FCPA Autumn Review 2021

International Alert

Introduction

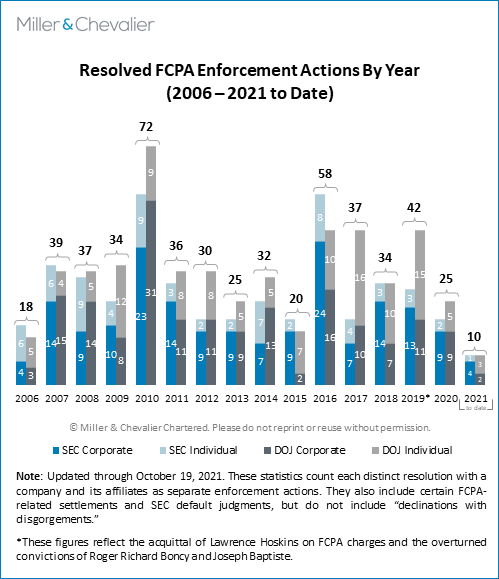

Continuing the COVID-19 era trend of few corporate enforcement actions, U.S. authorities announced only one corporate Foreign Corrupt Practices Act (FCPA) enforcement action this past quarter: in late September, the U.S. Securities and Exchange Commission (SEC) announced that it had entered into a Cease-and-Desist Order with London-based WPP plc (WPP) to settle alleged violations of the FCPA's anti-bribery, books and records, and internal accounting controls provisions. The U.S. Department of Justice (DOJ) did not announce any corporate enforcement actions, against WPP or otherwise, in the third quarter.

On October 19, 2021, the DOJ and SEC announced dispositions with Credit Suisse Group AG to resolve misconduct involving kickbacks to intermediaries in Mozambique, who allegedly then paid bribes to government officials in the country. In a global coordinated resolution with U.K. authorities, Credit Suisse agreed to pay approximately $475 million to the SEC, DOJ, and the U.K.'s Financial Conduct Authority (FCA) to resolve the misconduct. Only the SEC charged Credit Suisse with FCPA violations; according to the SEC's Cease-and-Desist Order, Credit Suisse "engaged in violations of the books and records and internal accounting controls provisions of the Exchange Act, including violations of the Foreign Corrupt Practices Act." We will cover this resolution in detail in our FCPA Winter Review 2021.

Individual criminal enforcement announcements saw an uptick in the third quarter, with three individuals pleading guilty to FCPA charges, and a fourth charged with and arrested for alleged FCPA violations. The DOJ also announced that a federal court had unsealed an indictment alleging FCPA violations against a fifth individual, originally charged in June 2020. In addition, three other individuals pleaded guilty to bribery-related money laundering charges, reflecting a continuation of the DOJ's emerging trend of charging individuals with money laundering violations predicated on bribery of foreign officials – without bringing actual FCPA charges.

Despite the low number of enforcement actions so far in 2021, public statements by DOJ and SEC officials indicate that we should expect more activity in the fourth quarter and in 2022. As reported by Global Investigations Review, in June, Acting Assistant Attorney General Nicholas McQuaid stated at an FCPA conference that 2021 will bring FCPA enforcement actions "on a par with, if not exceeding, the 'size, scope and significance' of previous years." Promising there was "more to come in 2021," McQuaid discouraged the audience "from drawing conclusions about [the DOJ's] pipeline of cases" based on enforcement this year to date. These statements echo other key enforcement officials' messaging throughout the year: although the COVID-19 pandemic has certainly impacted aspects (and potentially the pace) of investigations, the agencies have a strong pipeline of potential enforcement actions, are not waiting for companies to self-disclose, and are continuing to partner with other governments to investigate suspected misconduct.

Additionally, in a speech at the GIR Connect: New York conference on October 5, 2021, Principal Associate Deputy Attorney General John Carlin said that the DOJ has "started to redouble [its] commitment to white-collar enforcement," adding that "in the days and months to come [the DOJ is] building up to surge resources for corporate enforcement." Notably, Carlin also confirmed that one change resulting from this "surge" in resources is the designation of a full-time squad of FBI agents working with the DOJ's Fraud Section. He also noted – vaguely – that the DOJ will be implementing changes regarding its policies and practices on corporate resolutions, saying that the Department will "continue to assess [its] practices and make some changes regarding the prosecution of corporate crime." Carlin indicated that formal announcements by the DOJ regarding these changes were forthcoming.

Perhaps the most noteworthy FCPA-related comment from Carlin relates to the DOJ's scrutiny of companies that have already resolved FCPA matters. Carlin stated that the DOJ will "continue to use NPAs, DPAs and guilty pleas [but such a result] . . . is not the end of an obligation for a company, and to the contrary, it's just the start." Carlin continued, "particularly now with scrutiny on the use of those agreements, we'll need to make sure that those who get the benefit of such an arrangement comply with their responsibility." If companies do not comply with their cooperation commitments, they should "expect to see serious repercussions." These comments make clear that the DOJ will be closely scrutinizing the actions of companies with current ongoing cooperation commitments, as well as those considering entering into such arrangements to resolve FCPA violations in the future.

In an October 6, 2021 speech, SEC Director of Enforcement Gurbir Grewal highlighted that SEC enforcement activity will increase in accordance with a number of priorities. While the speech did not address any specific FCPA-related initiatives, Grewal emphasized that companies "need to think rigorously about how their specific business models and products interact with both emerging risks and Enforcement [Division] priorities, and tailor their compliance practices and policies accordingly." He also noted that the SEC will be looking closely at companies' cooperation with investigations, evaluating "whether the would-be cooperator took significant, tangible steps that enhanced the quality of our investigation, allowed us to conserve resources and bring charges more quickly, or helped us to identify additional conduct or other violators that contributed to the wrongdoing." Finally, Grewal pointed out that, in future cases:

[a]s we evaluate the relevant penalty factors, we will also be closely assessing whether prior penalties have been sufficient to generally deter the misconduct at issue. Where they have not been, you can expect to see us seek larger penalties, both in settlement negotiations and, if necessary, in litigation. Even if a firm or individual hasn't offended before, if they violate a law or rule for which the SEC has previously and publicly charged other actors in their industry, it may be appropriate for penalties or other remedies to be increased in response to the lack of deterrence.

This statement makes clear that the SEC expects companies to be aware of violations and risk patterns that arise in other enforcement actions and to proactively address similar issues if they arise in companies' own business activities.

New leaders have joined the DOJ and SEC or changed titles since the updates reported in our last Review. First, in August, seasoned FCPA Unit prosecutor David Last was appointed as permanent Chief of the DOJ's FCPA Unit, after having been named acting chief of the unit April 2021. Last has worked on numerous high-profile FCPA enforcement actions, including the corporate resolutions with Goldman Sachs, Cognizant Technology Solutions, Odebrecht, and Braskem, as well as the individual prosecutions of Ng Lap Seng and Patrick Ho.

Among other changes, in late September, Lisa Miller, formerly Chief of the DOJ's Market Integrity & Major Frauds Unit, was named as Acting Deputy Assistant Attorney General for the Criminal Division. The DOJ also announced the internal appointment of two new Fraud Section deputy chiefs: Brent Wible and Lorinda Laryea; before her new appointment (with responsibility across the Fraud Section), Laryea had been serving as the Assistant Chief of the FCPA Unit.

In August, the SEC named Sanjay Wadhwa as Deputy Director of the Division of Enforcement. Wadhwa's appointment is the first significant change in leadership within the Enforcement Division, following Gurbir Grewal's appointment to Director of the Division at the end of June. Wadhwa has been at the SEC since 2003, most recently serving as co-head of Enforcement in the SEC's New York office. Wadhwa's experience on FCPA matters includes the SEC settlements with Herbalife and Stryker.

The SEC's Dodd-Frank Act whistleblower program remains strong as ever, with the agency continuing to issue high-dollar value awards. In September, the agency issued a press release stating that the whistleblower program had paid more than $1 billion in awards since the program's inception in 2012. The program's fiscal year 2021 awards alone exceed $500 million. At least one award this quarter was related to a successful FCPA enforcement action: a $3.5 million award announced in August. Although the SEC (in keeping with practice) did not identify the individual or the company at issue, the recipient's attorneys publicly confirmed that the award related to the SEC's 2019 enforcement action against Juniper Networks. The attorneys' statement also noted that the recipient was a foreign national, and that he or she was not a company employee. This is the second SEC whistleblower award this year which has been publicly linked to an FCPA enforcement action.

Corporate Enforcement Actions

As noted above, WPP's settlement with the SEC was the only FCPA corporate enforcement action resolved during the third calendar quarter of 2021. The details and noteworthy aspects of the settlement are discussed below. The WPP resolution represents only the third corporate FCPA-related disposition this year (Credit Suisse is now the fourth).

On September 24, 2021, private advertising company WPP entered into a Cease-and-Desist Order with the SEC, agreeing to pay approximately $19.2 million in penalties, disgorgement, and prejudgment interest to resolve alleged violations of the FCPA's anti-bribery, books and records, and internal accounting controls provisions. WPP is headquartered in London and New York but operates its global business through a series of "Networks," or regional advertising agencies around the world. According to the SEC's Cease-and-Desist Order, WPP's majority-owned subsidiary in India paid as much as $1 million in bribes to Indian government officials through third-party intermediaries in order to obtain Indian government business, resulting in over $5 million in tainted profits. Additionally, WPP subsidiaries in China, Brazil, and Peru allegedly engaged in "other illicit schemes," with the subsidiaries in China and Brazil making improper payments to vendors and the subsidiary in Peru "funneling funds through other WPP entities" to hide the source of contributions to a Peruvian political campaign. The SEC found that WPP failed to devise and maintain a sufficient system of internal accounting controls, to make and keep accurate books and records, and to respond to red flags of corruption risks. As described in detail below, the enforcement action goes to risk arising from an aggressive mergers & acquisition (M&A) strategy without corresponding integration efforts to drive compliance program implementation.

Potentially of interest to in-house counsel, another bribery-related corporate enforcement action made headlines this quarter – though not for bribery of foreign officials. On July 22, 2021, the DOJ announced that Ohio-based public utility holding company FirstEnergy Corp. (FirstEnergy) had agreed to pay a $230 million penalty to resolve charges that the company conspired to commit honest services wire fraud (a charge which requires that the defendants conspired to "defraud the public of its right to the honest services of a public official through bribery or kickbacks"). According to the three-year DPA entered into between FirstEnergy and the DOJ, between 2017 and March 2020, FirstEnergy indirectly paid money to two Ohio public officials in order to gain their support for nuclear legislation or to take other official action that would benefit FirstEnergy. Specifically, FirstEnergy allegedly paid more than $59 million to a 501(c)(4) "which FirstEnergy Corp. knew was operated for the benefit of and controlled by" a member of the Ohio House of Representatives. The company allegedly also paid over $22 million to two companies owned by the Chairman of the Public Utilities Commission of Ohio, including by wiring $4,333,333 to one of the companies for the Chairman's benefit.

As we previously reported, FirstEnergy fired its CEO last year after two individuals, a political strategist for former Speaker of the Ohio House of Representatives Larry Householder and a lobbyist hired by an energy company to allegedly funnel money to Householder's enterprise, pleaded guilty for their roles in the alleged racketeering conspiracy. The FirstEnergy DPA demonstrates that companies should not overlook their U.S. operations when considering compliance risks.

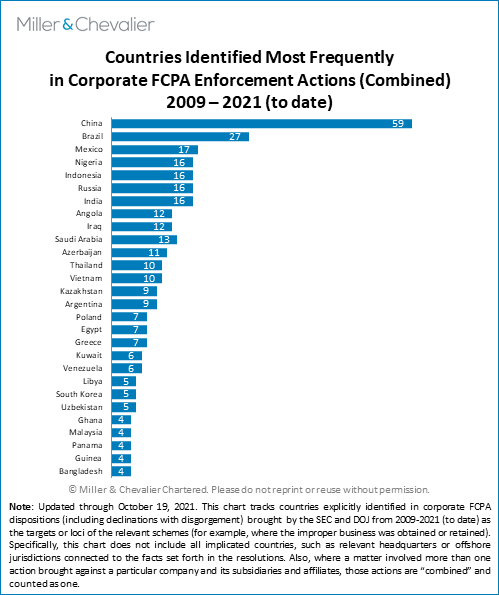

With regard to our regular updates assessing the countries implicated most frequently in corporate FCPA enforcement actions, China and Brazil remain at the top in the spotlight, with China implicated in 59 enforcement actions and Brazil in 27. Mexico is the third most frequently implicated country, with 17 enforcement actions related to misconduct in the country. These numbers have not significantly changed from the last time we reported on them, given the low number of corporate FCPA resolutions so far in 2021.

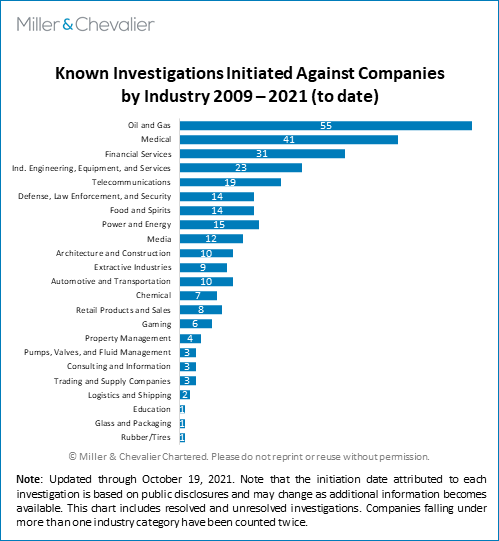

The following chart provides an update on known FCPA investigations initiated against companies by industry over the past 10 years. Certain industries have historically attracted and continue to attract FCPA enforcement attention, partly due to the inherent risks in sectors with heavy government regulation or nature of the transactions and partly due to the nature of the investigations, which often focus on multiple companies implicated in the same or similar conduct. The oil and gas, medical, and financial services sectors remain the top three industries which have attracted the scrutiny of U.S. regulators.

Corporate Investigations Closed without Enforcement Actions

Following our practice from past years, throughout the third quarter of 2021, Miller & Chevalier has tracked investigations closed without an enforcement action, i.e., known investigations that the DOJ and the SEC have initiated but closed without a DPA, Non-Prosecution Agreement (NPA), Cease-and-Desist Order, guilty plea, jury conviction, or other final enforcement procedure.1 During the third quarter of 2021, we tracked only one such investigation announced publicly as closed without enforcement action: in a 10-Q filed on August 5, 2021, food and beverage manufacturer Pactiv Evergreen (Pactiv) announced that the SEC had closed its investigation into the company, following the company's internal investigation into practices in the company's Shanghai business which "involve[d] acts potentially in violation of" the FCPA. As we reported in our FCPA Summer Review 2021, the company announced in May that the DOJ had ended its parallel investigation into the company following the company's voluntary disclosure of the potential issues to the DOJ and SEC in September 2020. According to its August filing, the company's internal investigation identified "the occasional giving of gift cards representing relatively minor monetary values to government regulators and employees of state-owned enterprise customers" in China, "over the course of several years." The filing also stated that "[t]he amounts involved were immaterial, individually and in the aggregate," and appear to have been given "for generalized goodwill purposes only" at the times of Chinese holidays. Pactiv said that it intends to fully cooperate with the SEC to conclude the matter, adding that it plans to "remediate" the gift-giving practices identified in its investigation, including by discontinuing the use of gift cards. The filing also noted that Pactiv's investigation identified "certain other gift, travel and entertainment practices" which violated company policies and provided "an opportunity for targeted, enhanced controls and additional training."

In addition to the above investigation closure, two companies' public securities filings indicate that additional FCPA-related resolutions or investigation closures may be forthcoming. In an August 6, 2021 U.S. securities filing, Stericycle, Inc. (Stericycle), an Illinois-based, NASDAQ-listed company specializing in medical waste disposal, disclosed that it had begun "preliminary" discussions with the DOJ and SEC regarding the potential resolution of FCPA compliance concerns related to "certain of the Company's operations in Latin America." Stericycle had disclosed in previous filings that the DOJ and SEC were investigating the company. Separately, Honeywell disclosed in a July 23, 2021 securities filing that it had begun discussions with the DOJ and SEC regarding potential resolution of FCPA compliance concerns connected to the company's business in Brazil "in relation to Petróleo Brasileiro S.A." (Petrobras), as well as its use of Monaco-based consultancy Unaoil in Algeria. As we have previously reported, both Petrobras and Unaoil have been connected to numerous FCPA enforcement actions in recent years.

Known FCPA Investigations Initiated

Two companies disclosed new FCPA-related investigations during the third quarter of 2021, and a third company disclosed what appears to be a DOJ FCPA investigation in mid-October. First, in an August 9, 2021 securities filing, Colorado-based health and organic products company NewAge, Inc. (NewAge) disclosed that it was investigating potential FCPA violations related to the "international business practices" of its subsidiary, international direct-selling company Ariix, LLC (Ariix). NewAge acquired Ariix in late 2020. According to the filing, NewAge engaged external counsel to conduct an investigation into Ariix's international business practices in December 2020; after the investigation identified conduct potentially in violation of the FCPA, NewAge voluntarily self-disclosed the potential issues and its investigation to the DOJ and SEC. NewAge's recent filing did not explicitly state that the DOJ and SEC had opened an investigation into the matter, but the company stated that its "reporting to the DOJ and SEC . . . is ongoing" and that it intends to fully cooperate with the agencies to resolve the matter.

Second, in its July 30, 2021 10-Q, California-based medical technology company Edwards Lifesciences Corporation (Edwards) disclosed that the company was investigating "whether the allocation of certain grants and other payments" by company employees in Japan had violated the FCPA. According to the filing, Edwards has engaged outside counsel to conduct an investigation and (apparently before that investigation has yielded any findings) has "voluntarily notified" the DOJ and SEC of the investigation.

Finally, in its October 18, 2021 Registration Statement, Singapore and Indonesia-based ride hailing and technology company Grab Holdings Limited (Grab) disclosed what appears to be an FCPA investigation by the DOJ. In the filing, Grab stated that its "audit and risk committee led an investigation into potential violations of certain anti-corruption laws related to its operations in one of the countries in which it operates," adding that the company had "voluntarily self-reported the potential violations to [the DOJ]." Grab previously noted its internal investigation and voluntary self-reporting to the DOJ in an April 2021 investor presentation. The company's latest filing indicates that the DOJ may now be investigating the issues disclosed, saying that "while no conclusion can be drawn as to the likely outcome of [the DOJ] matter, Grab is not aware of any other contemplated or pending investigations" (emphasis added) related to the potential violations.

We are likely to learn of more investigations launched in the last quarter in the coming weeks and months, as companies disclose such information in their public disclosure filings.

Individual Enforcement Actions

In the third quarter, the DOJ resolved or initiated FCPA enforcement actions against four individuals and unsealed a 2020 indictment against a fifth individual. First, in July, Anthony Stimler, a former trader at a subsidiary of British-Swiss multinational mining and commodity trading company Glencore plc (Glencore), pleaded guilty to one count of conspiracy to violate the anti-bribery provisions of the FCPA and one count of conspiracy to commit money laundering. Second, in August, Naman Wakil, a Syrian national and U.S. lawful permanent resident who owns both oil and food companies, was arrested and charged with two counts of violations of the FCPA (among other charges) for his role in a bribery scheme involving Venezuela's state-run oil company Petróleos de Venezuela S.A. (PDVSA) and a Venezuelan state-owned food corporation. In September, U.S. citizens Bryan Berkman and Philip Lichtenfeld – both of whom were charged in May with conspiracy to commit money laundering in connection with an international bribery scheme – pleaded guilty to conspiracy to violate the FCPA's anti-bribery provisions. Finally, also in September, the DOJ announced that a federal court had unsealed a June 2020 indictment charging Afework Bereket, a former employee of Ericsson Egypt Ltd., with conspiracy to violate the FCPA and to commit money laundering.

As we have reported in several of our Reviews, in recent years the DOJ has increasingly charged foreign officials – who, as the recipients of bribe payments, are typically not directly subject to the FCPA – with violations of U.S. anti-money laundering laws in connection with the DOJ's broader FCPA investigations. This emerging trend has continued throughout 2021. Three individuals pleaded guilty this quarter to money laundering charges in connection with bribery schemes that also formed the basis of corporate and/or individual FCPA enforcement actions. These individuals include two foreign officials and alleged bribe recipients, as well as one U.S. citizen who was accused of participating in an international bribery and money laundering scheme:

- In July, Carmelo Antonio Urdaneta Aqui (Urdaneta), former legal counsel to Venezuela's Ministry of Oil, pleaded guilty to conspiracy to commit money laundering in connection with the DOJ's long-running investigation into corruption involving PDVSA. Urdaneta is the latest of numerous individuals who have received sentences or pleaded guilty to charges in connection with PDVSA-related misconduct this year.

- In September, Sergio Rodrigo Mendez Mendizabal (Mendez), the former Chief of Staff of the Ministry of Government of Bolivia, pleaded guilty to conspiracy to commit money laundering in connection with the alleged international bribery scheme involving Bryan Berkman and Philip Lichtenfeld, referenced above, to win a Bolivian government contract on behalf of Berkman's Florida-based company. Mendez allegedly received bribes as part of the scheme. A second Bolivian official, former Minister of Government Arturo Carlos Murillo Prijic, is also alleged to have received bribes as part of the scheme; he has denied any wrongdoing and is scheduled to appear in court to face similar money-laundering charges.

- The third individual who pleaded guilty to bribery-related money laundering charges this quarter, Luis Berkman, also participated in the alleged bribery and money laundering scheme involving Mendez, B. Berkman, and Lichtenfeld. Luis Berkman is a U.S. citizen, but unlike B. Berkman and Lichtenfeld, pleaded guilty to a single count of conspiracy to commit money laundering, rather than FCPA charges. He faces a potentially longer prison sentence than B. Berkman and Lichtenfeld. It remains unclear why these three individuals, all U.S. citizens, were charged differently for what appears to be similar conduct.

In addition to these bribery-related money laundering enforcement developments, one individual was recently sentenced for a previously resolved FCPA actions. On October 12, a federal court sentenced former CEO of Braskem, S.A. (Braskem), Jose Grubisich, to 20 months in prison for his role in an alleged scheme to bribe public officials in Brazil. As reported in our FCPA Summer Review 2021, on April 15 of this year, Grubisich pleaded guilty to one count of conspiracy to violate the FCPA's anti-bribery provisions and one count of conspiracy to violate the books and records provisions. According to the DOJ, Grubisich and others diverted "hundreds of millions of dollars" from Braskem "to a secret slush fund," using the funds to pay bribes to government officials – including Petrobras executives – in order to obtain business for Braskem. As we previously reported, Braskem and its parent company, global construction conglomerate Odebrecht (now known as Novonor S.A.) pleaded guilty to U.S., Brazilian, and Swiss bribery charges in 2016. In addition to his prison sentence, Grubisich agreed to forfeit approximately $2.2 million as part of his plea agreement.

On the other hand, United States Court of Appeals for the First Circuit affirmed the lower court's ruling that granted a new trial to Joseph Baptiste, who was previously convicted of conspiracy to bribe Haitian officials in 2019; however, the United States District Court for the District of Massachusetts found that Baptiste's lawyer had rendered ineffective assistance such that the jury verdict could not stand.

Policy and Litigation Developments

There have been several noteworthy developments in FCPA-related litigation this quarter.

In September, a proposed class of Cognizant Technology Solutions Corporation (Cognizant) investors filed a motion seeking approval of a $95 million class action settlement to resolve securities claims based on Cognizant's alleged bribery of officials in India. Cognizant activities in India have come under scrutiny by enforcement authorities, as reported in our FCPA Spring Review 2019 and FCPA Autumn Review 2019, with top executives accused of approving approximately $2 million in bribes to public officials in India to secure necessary licenses. Cognizant investors sued the company following its disclosure of an internal investigation into its activities in India – after which company's stock price dropped significantly. Cognizant is the latest of numerous public companies to face private securities litigation following the disclosure of FCPA-related enforcement actions or internal investigations.

In August, the U.S. Court of Appeals for the Fifth Circuit reversed a federal district court's dismissal of Petrobras America, Inc.'s fraud and racketeering lawsuit against Samsung Heavy Industries (Samsung). The subject matter of the lawsuit relates to Samsung's 2019 settlements with Brazilian and U.S. authorities involving alleged bribery of Petrobras officials in exchange for a lucrative shipbuilding contract. The U.S. subsidiary of Petrobras has accused Samsung of violating the Racketeer Influenced and Corrupt Organizations (RICO) Act by bribing Petrobras executives in Brazil into awarding Samsung the contract for a drillship for which Petrobras had no commercial need. A federal court previously dismissed the claims on statute of limitations grounds, but the Fifth Circuit reversed, holding that Samsung had not shown that Petrobras was on notice in 2015, when Samsung argued the statute of limitations began to run.

The Hoskins case also continues, now in its second appeal on the question of whether Hoskins, a citizen of the United Kingdom, was acting as an agent of (and under the control of) U.S.-based Alstom Power Inc. (API) when he violated the FCPA. As previously covered in our FCPA Winter Review 2021 and FCPA Spring Review 2020, a jury convicted Lawrence Hoskins, former Senior Vice President of Alstom, S.A. (Alstom), of FCPA and other charges for his role in a scheme to secure a lucrative contract in Indonesia for API. A federal court granted Hoskins' motion for acquittal and conditional motion for a new trial on the FCPA charges in February 2020, and the DOJ appealed. We discuss the DOJ's agency theory, and Hoskins' argument in response, in detail below.

In September, the U.S. District Court for the Eastern District of New York denied ex-Goldman Sachs (Goldman) banker Roger Ng's motion to dismiss FCPA charges brought against him for his alleged role in the corruption scandal involving 1Malaysia Development Bhd. (1MDB). The 1MDB investigation has been the source of numerous FCPA enforcement actions, including the DOJ's and SEC's 2020 settlements with Goldman. As we have previously reported, the DOJ has alleged that Malaysian national Ng (along with others) misappropriated 1MDB funds and conspired to bribe foreign officials in Malaysia and Abu Dhabi. Ng faces charges of conspiring to violate both the FCPA's anti-bribery and internal controls provisions. He moved to dismiss the charges on numerous grounds, including that the government had failed to allege (1) that "he was an agent or employee of an actual issuer of U.S. securities," and (2) that he "conspired to circumvent a set of internal accounting controls cognizable under the FCPA."

With respect to the internal controls charge, Ng's motion centered on the argument that the FCPA's internal controls provision "applies only to the transactions and assets of an 'issuer.'" Ng argued that because the government's allegations related to "transactions and assets that belonged to non-issuer 1MDB at the time of the violations," and not to Goldman, the government had failed to allege an internal controls violation. The government argued that, despite Ng's argument that the "'bribes did not involve any of [the] Goldman [Sachs] Group's funds and therefore had nothing to do with [the Goldman Sachs Group's] internal accounting controls,'" "the relevant 'transaction' and use of 'assets'" were the 1MDB bond transactions underwritten by Goldman. The government alleged that Goldman would not have authorized the bond transactions if not for Ng's circumvention of internal controls by concealing the involvement of an individual (Jho Low) in the transactions. The Court found that the government had sufficiently alleged that Ng conspired to circumvent Goldman's internal controls, noting, "the plain language of the [FCPA does not] support Ng's assertion that internal accounting controls can only be implicated in transactions where an issuer uses its own assets to pay a bribe directly."

International Developments

Corporate anti-corruption enforcement continues apace in the U.K.; in the third quarter alone, the U.K.'s Serious Fraud Office (SFO) secured three corporate enforcement actions for alleged violations of the U.K. Bribery Act of 2010 (UKBA). In July, the SFO received judicial approval for two separate DPAs with unidentified U.K.-based companies for offenses under the UKBA. Under the two-year DPAs, which the SFO reported "shared a common Statement of Facts," the companies agreed to pay a total of £2,510,065 (approximately US $3.4 million) in profit disgorgement and penalties. The SFO did not identify the companies charged — stating only that "[r]eporting restrictions" currently prevent publication of the DPAs and related materials. There is some precedent for this approach – in 2016, the SFO entered into a DPA with an unnamed company dubbed "XYZ"; in 2019, the SFO identified the company as Sarclad, Ltd. following the acquittals of three individuals charged with related misconduct. The SFO said the original "reporting restrictions" had been put in place to protect the individuals' right to a fair trial.

In early October, U.K. oil company Petrofac Limited (Petrofac) pleaded guilty to seven counts of failing to prevent bribery in violation of Section 7 of the UKBA. A U.K. court ordered Petrofac to pay £77 million (approximately $105 million) in penalties, confiscation, and costs. Petrofac allegedly failed to prevent former senior executives of its subsidiaries from "using agents to systematically bribe officials, to win oil contracts in Iraq, Saudi Arabia and the United Arab Emirates" between 2012 and 2015. As we reported in our FCPA Spring Review 2019, in February 2019, former Petrofac employee David Lufkin pleaded guilty to eleven counts of bribery for his involvement in the misconduct.

The SFO also announced in August that it has brought charges against five individuals for their roles in an alleged bribery scheme relating to the award of (domestic) U.K. construction contracts. Two of the individuals, "former senior executives" Robb Simms Davies and Nigel Wilson, face charges of bribery and money laundering. The SFO has also brought charges against alleged bribe recipients Trevor Wright and Roger Dewhirst. A fifth individual, Dawn Dewhirst, also faces charges of money laundering. The trial is scheduled to occur in September of next year.

Elsewhere in Europe, in July, French public transport company Systra SA (Systra) entered into a judicial public interest agreement (CJIP) with France's National Financial Prosecutor's Office (PNF) to settle allegations that the company bribed officials in Uzbekistan and Azerbaijan in order to win transportation contracts. Systra has agreed to pay €7.5 million (approximately $8.7 million) in connection with the settlement.

In Brazil, a U.S. company has come under investigation in connection with the widely reported Petrobras corruption scheme that has resulted in numerous FCPA enforcement actions. In late September, Reuters reported that Brazilian authorities are investigating the potential involvement of JPMorgan Chase & Co. in the Petrobras bribery scheme. The conduct at issue reportedly dates back to 2011.

Also in September, the U.S. District Court for the Northern District of California ordered the extradition of former Peruvian president, Alejandro Toledo, to Peru to face criminal charges of collusion and money laundering. Peruvian prosecutors allege that Toledo, who fled the country in 2017 shortly before he was charged, negotiated to receive approximately $35 million in bribes from the Peruvian subsidiary of Brazilian construction company Odebrecht in exchange for helping the company win contracts to construct a large infrastructure project. U.S. prosecutors filed a criminal complaint and formal extradition request against Toledo in 2019. Toledo argued that he had not been "'charged' with a crime within the meaning of" the U.S.-Peru extradition treaty. The court disagreed, finding that the conduct subject to both the collusion and money laundering charges in Peru would be "punishable under U.S. law" and that there was probable cause that Toledo committed both offenses.

Finally, in July, the World Bank's Office of Suspension and Debarment (OSD), published a Global Suspension & Debarment Directory detailing suspension or debarment systems in 19 different jurisdictions, two U.N. institutions, and the World Trade Organization (WTO).

These developments are discussed in further detail below.

Corporate Enforcement Actions

WPP Settles FCPA Charges with the SEC

On September 24, 2021, the SEC announced that WPP plc (WPP), a major international advertising group, with headquarters in both London and New York City and traded on the New York Stock Exchange, will pay $19.2 million to settle charges under the anti-bribery, books and records, and internal accounting controls provisions of the FCPA. The $19.2 million settlement includes $10.1 million in disgorgement, $1.1 million in prejudgment interest, and an $8 million penalty. According to the SEC Cease-and-Desist Order, various WPP subsidiaries had engaged in bribery and other unlawful schemes in India, China, Brazil, and Peru.

According to the SEC, WPP employed an "aggressive acquisition strategy" by which "WPP acquired a controlling interest in small, localized agencies in high-risk markets, such as India, China, and South America that were previously majority-owned by the local agency's founder." Some transactions incorporated an "earn-out provision," under which part of the purchase price was not paid until the acquired entity achieved certain "financial goals." WPP also allowed the founders of the local agencies in India, China, and Peru to remain at the acquired entities as CEOs.

Once acquired, the local agencies were incorporated into a WPP "Network," though the SEC notes that "WPP centrally coordinated the group's financial matters, reporting, control, treasury, tax, mergers, acquisitions, investor relations, legal affairs and internal audit from its headquarters." WPP also "mandated that all companies follow WPP global policies and internal accounting control requirements." However, the CEOs of the subsidiaries still "exercised wide autonomy and outsized influence," and the SEC alleged that WPP lacked sufficient oversight into key aspects of its Network affiliates.

The SEC order details five schemes in four countries — India, China, Brazil, and Peru. Each instance involved a subsidiary that was acquired by WPP in the manner described above. The SEC alleged that "[d]espite the known corruption and fraud risks inherent in WPP's … acquisitions, WPP lacked sufficient internal accounting controls with respect to its expansive international network," "had no compliance department," and "lacked meaningful coordination between its legal and internal audit departments and Network management."

While the various schemes employed by WPP's subsidiaries were active, there were allegedly numerous red flags that could have signaled to WPP that unlawful conduct was occurring. In some cases, WPP failed to address these warning signs entirely. In other cases, WPP failed to address them effectively. These red flags, as well as the details of each scheme, are discussed below.

India

In India, there were two distinct alleged bribery schemes operating from 2015 to 2017 – both related to the activities of an Indian ad agency that WPP had acquired in 2011 (India Subsidiary) and involving the Departments of Information and Public Relations for the Indian states of Telangana and Andhra Pradesh (DIPR).

The SEC alleges that, in the first instance, the India Subsidiary created an off-the-books fund that was used to compensate DIPR officials and the CEO of the India Subsidiary. DIPR awarded the India Subsidiary an advertising contract and "paid a set publicly available fee" to the India Subsidiary for purchasing the necessary advertising space from relevant newspapers. At the same time, however, the CEO of the India Subsidiary negotiated a cheaper price for that same advertising space with the newspapers and arranged for the India Subsidiary to make those purchases through a third-party vendor. When the India Subsidiary received payments from DIPR at the "set publicly available fee," the India Subsidiary paid those funds to the third-party vendor, which in turn paid the negotiated lower rate for the advertising space to the newspapers. Thus, an off-the-books fund was created using the difference between DIPR's set fee and the negotiated lower rate. The CEO of the Indian Subsidiary then authorized transactions through which the off-books funds were used to make payments to DIPR officials, as well as payments to himself.

According to the SEC order, WPP received several complaints regarding aspects of this scheme. Upon receiving the first anonymous complaint in 2015, WPP retained an accounting firm to investigate the claims. The SEC found that during the investigation, the accounting firm "relied on information provided by [the India Subsidiary's CEO and CFO], did not contact third parties, and ultimately provided a report to WPP, which contained no conclusions related to the bribery allegations." The accounting firm only noted "red flags" related to the third-party vendor, such as the India Subsidiary's "failing to obtain comparative quotes from other vendors or properly vetting" the third-party vendor. Even with those findings, the India Subsidiary continued to use the third-party vendor for DIPR's media purchases.

When WPP received additional complaints in 2016, the same accounting firm was again retained to complete a compliance review. This time, the third-party vendor refused to provide the media invoices as requested by the accounting firm, and the Network India CFO terminated the India Subsidiary's relationship with the third-party vendor. However, WPP failed to take any further actions.

In the second scheme, the India Subsidiary "fabricat[ed] an entire advertising campaign in order to create an off-the-books fund at a third-party agency… that was used to compensate DIPR officials for awarding campaigns to the India Subsidiary and for the personal benefit of" the India Subsidiary's CEO. The SEC found that "the entire purpose of the fake campaign was to enrich DIPR officials [and the India Subsidiary CEO], and benefit India Subsidiary by cancelling out old receivable balances."

DIPR paid over $1.5 million to the India Subsidiary, and the funds were diverted to an off-the-books fund. The India Subsidiary paid "the bulk of the money it received from DIPR" to a third-party agency. In turn, the third-party agency paid over $1,000,000 of those funds to another intermediary, which then made payments to DIPR officials. The SEC found that the remaining funds were used to make cash payments to the India Subsidiary's CEO and to "pay overdue account receivables from clients unrelated to DIPR."

The SEC order states that WPP received anonymous complaints regarding the second scheme. Despite receiving such complaints, "WPP failed to uncover that the supposed June 2015 DIPR campaign was, in actuality, a mechanism for bribery." In August 2017, after continuing to receive complaints about both schemes, WPP's legal team started an investigation. At this point, WPP conducted due diligence and reviewed the email accounts of both the CEO and CFO of the India Subsidiary. The due diligence report found that the CEO had "a close relationship" with certain DIPR official, who was named in some of the anonymous complaints and "had a reputation for demanding kickbacks for contracts awarded under his supervision." The India Subsidiary's CEO eventually admitted that he was aware of the payments, and WPP terminated both the CEO and CFO.

China

In China, an entity acquired by WPP in 2014 (China Subsidiary) engaged in a tax avoidance scheme. According to the SEC, the China Subsidiary was able to avoid paying $3,261,437 in taxes in November 2018 to a Chinese tax authority by "making payments to a vendor identified by tax officials and providing $2,000 worth of gifts and entertainment to tax officials during the same time period." The SEC order also states that an employee of the China Subsidiary falsified documents to make it appear as though the vendor had performed legitimate services for a client of the China Subsidiary.

As in India, WPP was aware of several red flags related to the China Subsidiary and its CEO. These red flags included the findings of a 2017 internal audit, which uncovered the tax avoidance schemes and "other significant violations of WPP's internal accounting controls." In addition, the SEC noted that a China Subsidiary employee informed both the Network CFO and WPP's regional tax director that the China Subsidiary was "in the midst of a tax audit and [its] management could face criminal charges for its tax avoidance schemes." The China Subsidiary's CEO also made comments to the same Network CFO and regional tax director about "attempt[ing] to control the direction of the tax audit." Despite receiving these communications, WPP failed to investigate any potential indicated risks. WPP ultimately uncovered the scheme in 2019 during an unrelated review, and the China Subsidiary's CEO resigned subsequently.

Brazil

In Brazil, the SEC noted that a public relations agency acquired by WPP in 2016 (Brazil Subsidiary) "made improper payments to vendors in connection with securing government contracts," in violation of a WPP policy. The payments were "made in circumstances in which there was a high probability that a portion of the payments may have been passed to the government officials with the authority to award the contracts." The Brazil Subsidiary also falsified its books and records to disguise the payments.

Peru

Finally, in Peru, a creative services agency acquired by WPP in 1996 (Peru Subsidiary) acted as the intermediary for illicit political payments at the direction of its CEO. The scheme "involved a construction company funding the mayor of Lima's political campaigns in exchange for contract awards." As the intermediary, the Peru Subsidiary accepted payments from the construction company and transferred those funds to the mayor's campaign. The SEC order states that, before the funds reached the mayor's campaign, the Peru Subsidiary funneled the money through other WPP entities in Colombia and Chile to disguise the funds' origin and purpose. WPP only discovered the bribery scheme when "a Peruvian criminal proceeding highlighted the conduct in 2019."

The SEC noted that the agency considered WPP's cooperation and remediation when issuing the Cease-and-Desist Order. WPP cooperated with the SEC investigation by sharing information, translating documents, and ensuring employees were available for interviews. WPP also remediated the past improper activities by terminating the executives and employees involved in the conduct, developing more robust compliance and controls functions, and undertaking annual risk assessments.

Noteworthy Aspects

Failure to Investigate Significant Red Flags Effectively or at All: There were various red flags stemming from the schemes that WPP's subsidiaries conducted. For example, the SEC noted that WPP received a total of seven anonymous complaints ("with increasing specificity") related to the two schemes in India. Likewise, red flags arose in China when an internal audit and communications from a China Subsidiary employee both suggested that China Subsidiary was engaging in a tax avoidance scheme and potential improper payments to tax officials to support such actions. Despite receiving these warnings, WPP failed to adequately respond or investigate. In some cases, when red flags became apparent, WPP did take actions to investigate the allegations, but its actions did not discover enough to stop the various issues until they had occurred, in some cases, for years. For example, after receiving the complaints regarding the India schemes, WPP retained an accounting firm on two occasions to investigate the allegations. In the first instance, the investigation occurred at the direction of the regional finance director and discerned several red flags, but "WPP allowed India Subsidiary to continue routing DIPR's media purchases through" the investigated vendor. The accounting firm's second investigation resulted in the termination of the vendor, but the SEC noted that "WPP did nothing further with respect to the multiple allegations that [the Indian Subsidiary] CEO…was engaged in a bribe scheme with the [Indian Subsidiary's] significant client." It took a third investigation led by a corporate legal resource to discover the extent of the Indian issues, but only after, as the SEC notes, the company "was unjustly enriched by" $5.6 million over multiple years.

WPP Lacked Sufficient Oversight Mechanisms for its Rapid Expansion in Risky Business Environments: All of the schemes giving rise to the FCPA charges in the settlement occurred in entities that WPP acquired through its "aggressive acquisition strategy." The SEC further commented on the financial arrangements resulting from those acquisitions that left the bought-out owners/directors of the affiliates in effective control of most of the affiliates' activities, with additional incentives to continue to rapidly grow the business. While such financial arrangements are not necessarily themselves problematic, the case also shows that WPP did not place effective compliance resources, "entity-level controls," and oversight mechanisms in place to counter the rapidly expanding heightened risks that the new affiliates created for WPP's global operations. The subsidiaries were integrated into the WPP Networks and the issuer's financial statements, but the local heritage management appear to have continued pre-existing practices and approaches to doing business that were not identified in acquisition due diligence and post-acquisition integration, in part due to the "structural deficiencies" in WPP's compliance and audit functions identified by the SEC. The case is another reminder that acquisitions should account for the relevant compliance risks and corresponding mitigating resources to ensure that new operations do not present outsized risks for expanding companies.

Individual Enforcement Actions

Former Trader of Glencore Subsidiary Pleads Guilty to FCPA and Money Laundering Conspiracy Counts in Nigerian Oil Bribery Scheme

On July 26, 2021, Anthony Stimler, a former trader on the Africa Desk at a subsidiary of British-Swiss multinational mining and commodity trading company Glencore, pleaded guilty to one count of conspiracy to violate the anti-bribery provisions of the FCPA and one count of conspiracy to commit money laundering for his role in a bribery scheme involving payments through intermediaries to foreign officials at a Nigerian state-owned oil company. According to the criminal information, from 2007 to 2018, Stimler, a U.K. citizen and resident, conspired with others to make "millions of U.S. dollars" in corrupt payments to foreign officials at Nigerian National Petroleum Corporation and elsewhere, to obtain and retain business for, and to direct business to Glencore, its subsidiaries, and others, including obtaining contracts as well as "more lucrative grades of oil on more favorable delivery terms."

As part of the scheme, Stimler and others paid "inflated and fraudulent invoices" from third-party intermediaries to "disguise the nature and purpose of bribe payments made to government officials." At least one alleged unlawful payment was transmitted from Switzerland to and through a bank in the U.S., and from the U.S. to an intermediary's account in Cyprus. According to the criminal information, Stimler, while in the U.S., received and sent emails related to the scheme. Stimler will remain in the U.K. on $500,000 bond while he is awaiting sentencing.

Stimler's guilty plea appears to stem from broader investigations of Glencore. As we have previously reported, Glencore is under investigation by U.S., U.K., and Brazilian authorities related to bribery allegations. With respect to DOJ's investigation, in 2018, Glencore announced that Glencore Ltd., a subsidiary of Glencore, had received a subpoena from the DOJ to produce documents and other records in connection with potential violations of the FCPA and U.S. anti-money laundering statutes that "relate to the Glencore Group's business in Nigeria, the Democratic Republic of Congo, and Venezuela."

Former Venezuelan Official Pleads Guilty to Money Laundering, Bribery in Connection with Money Laundering Scheme Involving PDVSA

On July 14, 2021, Carmelo Antonio Urdaneta Aqui (Urdaneta), a former legal counsel to Venezuela's Ministry of Oil, pleaded guilty to conspiracy to commit money laundering in a U.S. federal court in Florida. Urdaneta is one of several Venezuelan officials charged by U.S. authorities in connection with an estimated $1.2 billion corruption, money laundering, and currency exchange scheme involving Venezuela's state-run oil company Petróleos de Venezuela S.A. (PDVSA). See our FCPA Summer Review 2021 for a breakdown of individuals who recently received sentences or pleaded guilty to charges in connection with PDVSA-related misconduct.

According to Urdaneta's July 14, 2021 plea agreement reached with the DOJ and filed with the U.S. District Court for the Southern District of Florida, Urdaneta pleaded guilty to a charge of conspiracy to commit money laundering listed in the Second Superseding Information filed on July 12, 2021, with the "specified unlawful activities" identified as (i) "a felony violation of the" FCPA, and (ii) an offense against a foreign nation involving bribery of a public official, and the misappropriation, theft, and embezzlement of public funds by and for the benefit of a public official."

In connection with his plea agreement, Urdaneta agreed to forfeit to the U.S. government all property involved in the alleged money laundering, including a forfeiture money judgment of approximately $49.2 million, as well as three of Urdaneta's Florida real estate properties and "all assets on deposit" in a Swiss bank account in the name of Ville Flor Holding SA. This property is already subject to a parallel civil forfeiture action United States v. One 1999 135-Foot Baglietto Yacht, et al. In addition, Urdaneta agreed to not to contest the forfeiture of other property, including four real estate properties located in Panama. Urdaneta, who is currently awaiting sentencing, faces a sentence of up to 10 years in prison and a fine of up to $500,000.

Business Executive Arrested for Bribing Venezuelan Officials at Venezuelan State-Run Oil and Food Companies and Money Laundering

On August 4, 2021, Naman Wakil, a Syrian national and U.S. lawful permanent resident who owns both oil and food companies, was arrested for his role in a bribery scheme involving PDVSA and a Venezuelan state-owned food corporation, Corporación de Abastecimiento y Servicios Agrícola (CASA).

According to the DOJ press release announcing his arrest, beginning in 2010 and continuing through at least September 2017, Wakil conspired to "make bribe payments to CASA officials and officials at joint ventures between PDVSA and various foreign companies in the oil-rich Orinoco belt of Venezuela." The DOJ alleges that the purpose of the bribes was "to obtain at least $250 million in contracts to sell food to CASA and do business with the PDVSA's joint ventures, including obtaining highly inflated contracts (worth at least $30 million) to provide goods and services to the PDVSA joint ventures." The DOJ also claims Wakil laundered the funds obtained through the bribery scheme to and from bank accounts in South Florida; and purchased, among other things, 10 apartment units in south Florida, a $3.5-million plane and a $1.5-million yacht with the laundered funds; and paid portions of the funds to Venezuelan officials. Wakil reportedly had funds deposited in accounts held by his companies in the Cayman Islands and Switzerland and at times provided false invoices to these banks to conceal the sources of the funds.

The criminal complaint filed on July 29, 2021 with the U.S. District Court of the Southern District of Florida alleges two counts of violations of the FCPA, one count of conspiracy to commit money laundering, one count of international money laundering, and one count of engaging in transactions in criminally derived property. The complaint also indicates that the DOJ is seeking to have Wakil forfeit numerous properties owned by Wakil in Miami, Florida as well as various bank accounts that allegedly hold assets derived through the bribery and money laundering scheme.

First Circuit Agrees Attorney's Ineffective FCPA Defense Merits New Trial

On August 9, 2021, the U.S. Court of Appeals for the First Circuit (First Circuit) affirmed a federal district court's ruling granting a new trial to Joseph Baptiste, a retired U.S. Army colonel, who was convicted of conspiring to bribe Haitian officials in 2019. The First Circuit's decision follows a March 2020 ruling by U.S. District Judge Allison D. Burroughs of the District of Massachusetts, who found that Baptiste's lawyer, Donald LaRoche, had rendered ineffective assistance such that the jury verdict could not stand.

Baptiste was indicted in September 2017 along with Richard Boncy, a Haitian American lawyer, for violations of the FCPA and the Travel Act. Baptiste was also charged with conspiracy to commit money laundering. According to an FBI affidavit, Baptiste told undercover FBI agents, posing as investors, that he could obtain Haitian government support for an $84 million dollar port development project and offered to funnel bribes through a non-profit controlled by Baptiste. Baptiste allegedly then sent an agent a photo of him meeting with a foreign official following the receipt of a wire transfer to the non-profit's bank account.

Baptiste initially agreed to cooperate with federal authorities before ultimately deciding to plead not guilty. In June 2019, a jury found Baptiste and Boncy guilty of conspiring to violate the FCPA and the Travel Act. Baptiste was also found guilty of two separate Travel Act violations and conspiracy to launder money.

On March 11, 2020 Judge Burroughs granted Baptiste's motion for a new trial, finding that LaRoche, who was working in his first major criminal trial, failed to investigate all possible defenses, did not review all material produced by the government during discovery, and did not cross-examine witnesses at trial. Judge Burroughs held that failing to "meaningfully review discovery" until the eve of the trial was prejudicial to Baptiste. In sum, Judge Burroughs found that LaRoche's errors and omissions were sufficient to find with a reasonable probability that Baptiste was prejudiced by the deficiency. LaRoche's performance gave no opportunity for Judge Burroughs to determine whether the government had sufficient proof to convict Baptiste, leading Judge Burroughs to order a retrial for both Baptiste and Boncy.

On August 9, 2021, a panel of First Circuit judges agreed with Judge Burroughs, holding that the government's evidence went essentially unchallenged at trial due to LaRoche's performance. The panel held that the fundamental fairness of the proceedings must always be the focus of an ineffective assistance of counsel claim, regardless of the strength of the government's evidence. The panel also determined that the district court had indeed considered the totality of evidence presented at Baptiste's trial and that the government had offered no persuasive evidence that the court had not considered.

Next, the panel rejected the government's contention that Baptiste had benefitted from Boncy's counsel's complementary defense. Despite the fact that Boncy's counsel had argued that no conspiracy ever existed, which had the result of exonerating Baptiste as well from the conspiracy charge, the panel affirmed the district court's holding that neither Baptiste nor Boncy coordinated their defense strategies. The panel noted that Boncy's counsel had elicited several damaging pieces of evidence against Baptiste and had attempted to paint Baptiste as the real culprit and as the mastermind of a scheme with other unindicted coconspirators. Finally, the panel concluded that the judge was correct to aggregate the individual errors of LaRoche when determining whether his actions constituted prejudice against Baptiste. The government has yet to determine whether it will retry Baptiste and Boncy.

Former Ericsson Employee Charged over Bribery Scheme

On September 8, 2021, the DOJ announced that the U.S. District Court for the Southern District of New York had unsealed an indictment against Afework "Affe" Bereket, a former employee of Ericsson Egypt Ltd. (Ericsson Egypt), a majority-owned subsidiary of Swedish telecommunications company Telefonaktiebolaget LM Ericsson (Ericsson) and Ericsson's operating entity in Egypt. The indictment charges him with one count of conspiracy to violate the FCPA's anti-bribery provision and one count of conspiracy to commit money laundering. According to the DOJ's press release, Bereket's charges stem from his alleged role in a scheme to pay more than $2 million in bribes to government officials in Djibouti in order to win business with a state-owned telecommunications company.

According to the indictment, which was filed with the U.S. District Court for the Southern District of New York on June 3, 2020, Bereket was on a long-term assignment in Africa between November 2010 and July 2013, where he was the account manager for a region that included Djibouti. Bereket allegedly engaged in the bribery scheme from in or about 2010 through at least the end of January 2014. During that period, he allegedly helped arrange approximately $2.1 million in bribes to at least two high-level government officials and one high-level executive at Djibouti's state-owned telecommunications company in order to help Ericsson secure a contract with it worth approximately $24 million.

In furtherance of the scheme, Bereket and his co-conspirators allegedly arranged for an Ericsson subsidiary in Ethiopia to enter into a sham agreement with a consulting company. They further caused Ericsson to approve fake invoices from the consulting company for services purportedly performed pursuant to the agreement in order to conceal the bribe payments. In addition, in carrying out the bribery scheme, Bereket and his co-conspirators drafted a "due diligence report that failed to disclose the spousal relationship between the owner of the consulting company and one of the high-ranking government officials who was bribed." The DOJ alleges that Bereket and his conspirators caused Ericsson to transfer the funds used for the bribes to and through bank accounts in the United States, from which the funds were then wired to the consulting company's bank account in Djibouti.

As we reported in detail in our FCPA Winter Review 2020, on December 6, 2019, Ericsson entered into a DPA with the DOJ to settle SEC and DOJ FCPA corruption charges over the company's activities in several countries, including Djibouti. The company agreed to pay approximately $1.06 billion in criminal penalty and disgorgement and prejudgment interest. As part of the resolution, Ericsson Egypt pleaded guilty on the same day to a related bribery conspiracy charge.

Three U.S. Citizens Pleaded Guilty to Bribery and Money Laundering Charges in Bolivian Bribery Scheme

On September 29, 2021, three U.S. citizens pleaded guilty to charges relating to their roles in an international bribery scheme connected to the award of a Bolivian government contract. As we reported in the FCPA Summer Review 2021, the DOJ announced conspiracy to commit money laundering charges against these individuals in May 2021. The government alleged that Bryan Berkman (B. Berkman), Luis Berkman (L. Berkman), and Philip Lichtenfeld (Lichtenfeld) paid approximately $700,000 in bribes to Bolivian government officials to secure a $5.6 million contract for B. Berkman's company, Bravo Tactical Solutions LLC, to supply tear gas and other non-lethal equipment to the Bolivian Ministry of Defense.

While B. Berkman and Lichtenfeld initially faced only conspiracy to commit money laundering charges, the DOJ filed an Information in each case on September 7, 2021, charging them each with only one count of conspiracy to violate the FCPA instead, to which B. Berkman and Lichtenfeld pleaded guilty. The third individual, L. Berkman, who is B. Berkman's father, pleaded guilty to a single count of conspiracy to commit money laundering. Each individual agreed to forfeit their respective corrupt proceeds: B. Berkman agreed to forfeit $121,751.58; Lichtenfeld agreed to forfeit $500,000; and L. Berkman agreed to forfeit $875,000. According to their respective plea agreements, L. Berkman faces up to 10 years in prison, while B. Berkman and Lichtenfeld each face up to five years in prison. Lichtenfeld and L. Berkman's sentencings are set for December 13, 2021, while B. Berkman's remains to be set.

On September 28, 2021, Sergio Rodrigo Mendez Mendizabal, the former Chief of Staff of the Ministry of Government of Bolivia who received bribes as part of the scheme, pleaded guilty before the United States District Court for the Southern District of Florida to conspiracy to commit money laundering. Arturo Carlos Murillo Prijic, Bolivia's former Minister of Government, who is also facing charges for conspiracy to commit money laundering for allegedly receiving bribes as part of the same scheme, has denied wrongdoing. His arraignment before the same court is scheduled for November 8, 2021.

Policy and Litigation Developments

Fifth Circuit Reverses Statute of Limitations Dismissal of Bribery-Related Racketeering Suit Against Samsung Heavy Industries

On August 11, 2021, a unanimous panel of the U.S. Federal Appeals Court for the Fifth Circuit reversed a federal district court's dismissal of Petrobras America, Inc.'s fraud and racketeering lawsuit against Samsung Heavy Industries. The panel ordered the case remanded to federal district court for further proceedings.

The U.S. subsidiary of the Brazilian state-owned oil and gas company Petrobras had accused the South Korean engineering and construction company of violating the Racketeer Influenced and Corrupt Organizations (RICO) Act by bribing Petrobras executives in Brazil in relation to the awarding of a shipbuilding contract to Samsung for a drillship for which Petrobras had no commercial need. Although on June 19, 2020 a Houston federal court had dismissed Petrobras America's claims for being filed after the statute of limitations had passed, the Fifth Circuit panel disagreed, holding that Petrobras discovered the fraud in a subsequent audit of the contract in 2015, and not when separate Samsung-Petrobras bribery was revealed a year earlier during "Operation Car Wash" in 2014.

According to Petrobras America, in 2007, seeking to obtain a lucrative shipbuilding contract with Pride Global Limited (a Petrobras contractor), Samsung paid $20 million in commissions to a Brazilian intermediary and Petrobras executives to induce Petrobras to enter into a contract to charter an offshore petrol drillship with Pride. As noted by the Fifth Circuit panel, the complaint alleged that Petrobras issued the call for a ship despite the lack of need for such a vessel. After receiving the completed vessel "DS-5" in 2011, Petrobras was forced to scramble and assign two new drilling contracts with other companies to recover some value from the DS-5. Petrobras put the DS-5 on "permanent standby" in 2015. That same year, Petrobras auditors uncovered the origination of the DS-5 contract and referred the matter to prosecutors. In November 2019, Samsung reached a settlement through a DPA with Brazilian and U.S. authorities related to the award of the DS-5 contract in which it paid $75 million in penalties.

In March 2019, Petrobras America brought RICO claims in a Texas state court, alleging that Samsung had procured the DS-5 contract from Petrobras through fraud. Samsung successfully removed the lawsuit to federal court, where a federal district court judge accepted Samsung's argument that Petrobras should have been on notice of the fraud in 2007 when Petrobras executives received the bribes and in 2014 with the revelations of other Samsung bribery schemes through Operation Car Wash. Because the statute of limitations for RICO claims is four years, the district court dismissed the RICO claims. Petrobras America appealed that decision.

The Fifth Circuit held that the knowledge of the Petrobras executives who accepted the bribes could not be imputed to the company, as the executives were acting adverse to Petrobras and in their own interests in shepherding the unneeded drillship contract. The appellate panel also held that even though Petrobras arguably was aware of the DS-5's lack of commercial value in 2007, it was an open issue of fact as to whether Petrobras was aware that the contract had been procured through fraud at that time, given the nature of the scheme as a fraud perpetrated by unfaithful Petrobras executives. And the court stated that because the DS-5 contract appeared on the surface to be between only Petrobras and Pride, 2014 news articles about Samsung's own bribery schemes would not have necessarily placed Petrobras on notice that a transaction with Pride was potentially suspect. The court concluded, therefore, that as a matter of law it could not be said that "a reasonably diligent investigation at the time, without the benefit of a full audit or the details of [a Petrobras executive's] plea agreement would have uncovered the basis for Petrobras's fraud claim."

While the Fifth Circuit held that Samsung had not shown that Petrobras was on notice before 2015 at the motion to dismiss stage, the panel noted that a factual question remained as to whether in 2007 Petrobras knew that the DS-5 had no utility to its projected operations at the time, thus placing Petrobras on potential notice of fraud issues. It is possible that Samsung may raise statute of limitations arguments again in a future motion for summary judgment at the district court, if enough evidence in discovery suggests that Petrobras was fully aware of how little value the DS-5 offered the company.

Second Circuit Hears Argument in DOJ Hoskins Appeal

As previously covered in our FCPA Winter Review 2021 and FCPA Spring Review 2020, a jury convicted Lawrence Hoskins, former Senior Vice President of Alstom, S.A. (Alstom), of conspiracy and money laundering and FCPA charges for his role in a scheme to secure a $118 million contract in Indonesia for Alstom Power Inc. of Connecticut (API) and its consortium partner. On February 26, 2020, Judge Janet Bond Arterton of the U.S. District Court for the District of Connecticut granted Hoskins' motion for acquittal and conditional motion for a new trial on the FCPA charges. In March 2020, the DOJ appealed this decision. This is the second time Hoskins' case has come before the U.S. Court of Appeals for the Second Circuit (Second Circuit). In a previous appeal, the Second Circuit held that Hoskins could not be liable under the FCPA as a co-conspirator or under an aiding and abetting theory.

Most recently, on August 17, 2021, the Second Circuit heard arguments on the question of whether Hoskins, a citizen of the United Kingdom, was acting as an "agent" of (and under the control of) API (a domestic concern) when he undertook acts related to the payment schemes. In its brief on appeal, the DOJ argued that there was sufficient evidence of control based on "(1) evidence of API's instructions to and authority over Hoskins; (2) evidence of API's control over the [the Indonesian project] and the hiring of consultants; and (3) documentary evidence of Hoskin's role at Alstom, from which a jury could reasonably have gleaned API's power to give him interim instructions in connection with his efforts on [the Indonesian project]."

During oral argument, the DOJ reiterated that the evidence of control was more than sufficient for a jury to find that API had the power to control Hoskins, thus establishing the agency relationship relevant to the FCPA. In response, Hoskins argued that there was no employee/employer relationship between Hoskins and API, including the fact that API could not fire Hoskins. In addition, Hoskins brought his own cross appeal, arguing various deficiencies below including violations of the Speedy Trial Act, Sixth Amendment, a faulty jury instruction, and lack of venue.

Cognizant Technology Settles Class Action Securities Suit Related to FCPA Allegations for $95 Million

On September 7, 2021, a proposed class of Cognizant Technology Solutions Corporation (Cognizant) investors (Investors) filed a motion that sought approval of a $95 million class action settlement to resolve securities claims that Cognizant officials bribed officials in India. The settlement resolves one of a series of civil and criminal lawsuits stemming from Cognizant's activities in India. As covered in more detail in our FCPA Spring Review 2019 and FCPA Autumn Review 2019, the DOJ and SEC investigated Cognizant and former top executives at the company – including Cognizant's former Chief Executive Officer Gordon Coburn, Chief Operating Officer Sridhar Thiruvengadam, and General Counsel Steven Schwartz – related to approximately $2 million in bribes to public officials in India to secure necessary licenses. The company resolved the investigations in February 2019 through an SEC cease-and-desist order and a DOJ declination with disgorgement. The DOJ and SEC have also pursued actions against various former Cognizant executives.

On September 30, 2016, when Cognizant disclosed it was conducting an internal investigation into its activities in India, the company's stock price dropped by more than 13 percent or $7.29 per share. Contending that Cognizant overstated its earnings and touted the benefits of its licenses, while failing to disclose the bribery scheme, the Investors brought a class action against Cognizant under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934.

According to the settlement motion, the Investors and Cognizant participated in a full-day mediation session in February 2020 but were unable to reach an agreement. Lengthy settlement negotiations continued and on August 6, 2021, the mediator, former United States District Court Judge Layn R. Phillips, issued a mediator's recommendation that the action be settled for $95 million in cash. That recommendation was accepted on August 10 and the Investors and Cognizant executed a formal Stipulation and Agreement of Settlement on September 2, 2021.

While the FCPA does not include a private right of action, Cognizant's settlement highlights the risk of follow-on litigation against companies following FCPA-related disclosures. In past issues, we have covered similar class action suits brought against InVision, Inc. (FCPA Winter Review 2009), SciClone Pharmaceuticals, Inc. (FCPA Autumn Review 2010, FCPA Winter Review 2012), Johnson & Johnson (FCPA Summer Review 2011), Wal-Mart Stores, Inc. (FCPA Summer Review 2014, FCPA Autumn Review 2014, FCPA Autumn Review 2016, FCPA Winter Review 2019), Avon Products, Inc. (FCPA Autumn Review 2014), and Petroleo Brasileiro SA (FCPA Winter Review 2015). Such suits have a mixed track record of success. The suit against Avon, for example, was dismissed for failure to state a claim; but the suit against Wal-Mart survived a motion to dismiss and was settled for $160 million. These cases present another consideration for companies considering potential FCPA-related disclosures, as such cases, even if not ultimately successful, can create additional adverse publicity and legal costs.

International Developments

French Public Transport Company Settles with France's National Financial Prosecutor's Office for €7.5 Million

On July 12, 2021, French public transport company Systra SA (Systra) entered into a judicial public interest agreement (CJIP) with France's National Financial Prosecutor's Office (PNF) in connection with allegations that the company bribed government officials in Uzbekistan and Azerbaijan in exchange for transportation contracts between 2009-2014.

Uzbekistan

The settlement documents allege two distinct bribery schemes. In Uzbekistan, Systra allegedly used an intermediary company, Kirkliston Development, to make payments to a public official at Uzbekistan's national railway company, UTY, in exchange for the award of a contract to enhance the Karshi-Termez railway line. Specifically, according to the CJIP, between January and December 2013, Systra paid approximately $575,000 into a Latvian bank account belonging to Kirkliston Development, which was owned by the head of UTY's public procurement department. The allegations came to light following a report from an employee of Japan Transportation Consultants Inc. (JTC), whose company also allegedly benefitted, alongside Systra, from the arrangement with the UTY official.

In addition, the CJIP alleges that Kirkliston Development leased apartments owned by procurement committee officials at UTY to Systra and JTC construction workers and expatriates at inflated prices, jointly hiring a consultant and former employee of UTY to facilitate the transaction. Systra allegedly achieved a turnover of more than €3 million as a result of its contract with UTY.

According to the CJIP, the scheme came to light in 2015, when the company's new regional director learned of suspicious facts in connection to Uzbekistan that had been concealed by the local management team. The company immediately terminated the contracts in question and implemented an audit of the payments. The PNF commenced its investigation in 2017 after receiving reports of corrupt behavior by Systra from Japanese authorities.

Azerbaijan

In Azerbaijan, Systra allegedly engaged in the bribery of a foreign official at Baku Metro – a state owned company – in connection with the award of a 2009 engineering contract. According to the CJIP, Systra established a consortium at the request of Baku Metro in 2008 through the creation of a local branch, Systra AZ. The consortium consisted of two foreign partners from the Czech Republic and Korea. Moreover, the PNF's investigation identified alleged commissions paid by the foreign consortia members and Systra through subcontractors to a commercial agent who served as an assistant project manager to the contracting authority for Baku Metro. The CJIP states that the agent had connections to the Azeri Minister of the Economy. Moreover, between 2009-2014 the consortium allegedly paid commissions to subcontractors in exchange for the contract.

The payment arrangements came to light following a change of management within Baku Metro, resulting in the termination of the consortium's contracts with the subcontractor recipients. According to the CJIP, Systra's contract with Baku Metro represented more than €44 million (approximately $51.3 million) in turnover for the company.

Fine

As noted above, Systra must pay a €7.5 million (approximately $8.7 million) fine as part of its settlement with the PNF. Specifically, under as 41-1-2 of the French Code of Criminal Procedure the public interest fine is calculated proportionate to the benefits Systra derived as a result of its alleged misconduct, but no greater than 30 percent of the company's average annual turnover over the past three years. Importantly, the CJIP noted Systra's existing compliance program, which has continued to be enhanced since the investigation commenced, as a mitigating factor. In addition, the CJIP pointed to Systra's cooperation and implementation of new management when considering the amount of the fine.

SFO Enters into Two DPAs with U.K. Companies for Bribery Act 2010 Violations