FCPA Summer Review 2020

International Alert

Introduction

The COVID-19 pandemic has continued to affect enforcement of the U.S. Foreign Corrupt Practices Act (FCPA) by the U.S. Department of Justice (DOJ) and the U.S. Securities and Exchange Commission (SEC) in the second quarter of this year (we discussed various aspects of this effect in more detail in our FCPA Spring Review 2020). The quarter featured only three corporate FCPA enforcement resolutions and three publicly announced corporate investigations closed without enforcement actions. Despite the pandemic's impact, these activity levels are consistent with recent previous second quarters. For example, there were only three announced corporate FCPA resolutions each in Q2 2019 and Q2 2018 (see our FCPA Spring Review 2019 and FCPA Spring Review 2018). There were only a few enforcement actions against individuals announced during the second quarter: two sentencings, both notably handled via videoconference as a result of the COVID-19 pandemic, and one announcement of SEC charges against a new defendant.

Several important policy and litigation developments occurred during the second quarter of 2020. We have covered two of these developments already in separate alerts: the June 1, 2020 update by the DOJ of its guidance on Evaluation of Corporate Compliance Programs (which had been last updated on April 30, 2019) and the publication by the DOJ and SEC on July 3, 2020 of a long-awaited update to the FCPA Resource Guide, which we previously analyzed upon its publication in November 2012. Another important development was the Liu v. SEC decision, in which the U.S. Supreme Court upheld—and limited—SEC's authority to seek the equitable remedy of disgorgement. Finally, the second quarter also witnessed some notable international developments, which we discuss below.

Although the COVID-19 pandemic has adversely affected – and continues to impact – all spheres of life, the DOJ and SEC have continued to message publicly that the agencies' commitment to FCPA enforcement has not subsided. As recently as May 2020, for example, the DOJ and SEC said during a webinar that the agencies' FCPA units were still focused on their missions and that they did not anticipate their staff would be reallocated to non-FCPA-related cases. In the words of Charles Cain, who oversees FCPA-related investigations at the SEC, the SEC is "not hitting the pause button on" those investigations. Daniel Kahn of the DOJ said at the same webinar that much of DOJ's FCPA-related work was "ploughing ahead because a lot of [the FCPA Unit's] work can be done remotely." Indeed, both agencies have taken steps to adapt to the new realities by focusing on the document collection and review sides of investigations (which can largely be performed remotely through technology platforms) and to focus on updating public guidance. As we have noted previously, however, other aspects remain challenging, such as the conduct of witness interviews and, in some cases, areas of multilateral cooperation. And, as we detail below, the numbers of announced FCPA resolutions for 2020 is lower than previous years' averages.

We summarize this quarter's corporate enforcement actions along with their noteworthy aspects, individual enforcement actions, and other policy, litigation, and international developments below.

Corporate Enforcement Actions

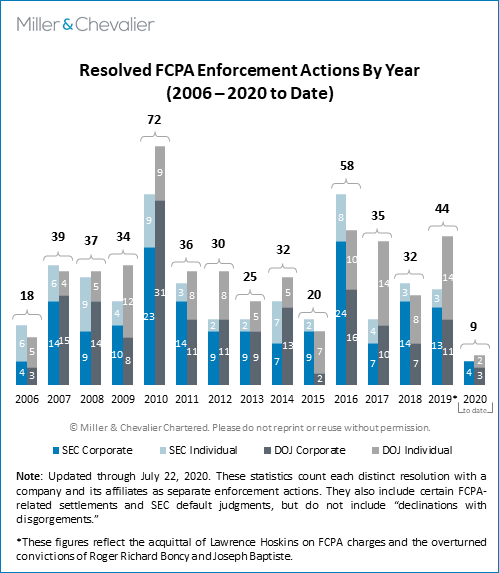

As mentioned above, in the second calendar quarter of 2020, the SEC and DOJ entered into four corporate resolutions under the FCPA with three companies.1 This followed a relatively slow first quarter, which similarly saw only two resolved corporate actions (see the relevant discussion in our FCPA Spring Review 2020). This brings the total number of resolved corporate enforcement actions to six in the first half of 2020 (and seven to date this year), a relatively low number considering we are halfway through 2020. As noted above, a likely key factor contributing to this slowdown has been the challenges the agencies have acknowledged that the COVID-19 pandemic is posing over their resources, ability to seek relief when courthouses are closed, and approaches to expiration of limitation periods, among others. As we have cautioned in the past, however, even without the unprecedented pandemic effects, it is difficult to make inferences about current enforcement levels, as the statistics for any given quarter are not necessarily indicative of larger trends and the pace of enforcement frequently picks up as the year goes on. For example, it is not unusual for a calendar year to end in a flurry of activity, with the fourth quarter accounting for a substantial number of the total number of resolved actions for the year.

As noted, the second quarter of 2020 saw the conclusions of the three corporate enforcement actions, all of which have notable compliance lessons. This total is somewhat below the norm we have seen in the past 10 to 12 years, as compared to an average of about five to six corporate enforcement actions resolved per calendar quarter since 2008 or approximately five concluded corporate enforcement actions during the second quarter of each year.

First, on April 17, 2020, the Italian oil company Eni S.p.A. (Eni) agreed to pay $24.5 million ($19.75 million in disgorgement and $4.75 million in prejudgment interest) to resolve FCPA charges brought by the SEC related to the use by Saipem, a minority-owned but controlled Eni affiliate, of a "wholly unequipped" intermediary to win government oil contracts in Algeria. According to the SEC's April 17, 2020 Cease-and-Desist Order (Order) charging Eni with violating the FCPA's books and records and internal accounting controls provisions, Saipem had paid $215 million to and had entered into four fictitious agreements with the intermediary to obtain contracts from Sonatrach, Algeria's state-owned oil company, all with the active participation of the then-CFO of Saipem, who later became a senior Eni manager. On October 1, 2019, Eni had announced in a press release that the company had received notice from the DOJ that the agency had concluded its investigation into Saipem's business in Algeria "without taking any action."

On June 25, 2020, global pharmaceutical and healthcare giant Novartis AG (Novartis) and its subsidiary in Greece, Novartis Hellas S.A.C.I., agreed to pay $337.8 million in penalties to settle charges by the SEC and the DOJ related to a bribery scheme at hospitals in Greece and improper record-keeping in Vietnam and other countries. On the same day, a former Novartis subsidiary, Alcon Pte Ltd., agreed to pay to a criminal fine of $8.9 million to resolve charges for similar conduct in Vietnam prior to Alcon Pte Ltd.'s spin-off from Novartis.

Novartis itself agreed to pay $112.8 million ($92.3 million in disgorgement and $20.5 million in prejudgment interest) to settle SEC's charges that Novartis had violated FCPA's books and records and internal accounting controls provisions. According to the SEC's Cease-and-Desist Order (Order), between 2012 and 2016, local subsidiaries or affiliates of Novartis or Alcon made improper payments or provided benefits to healthcare providers in South Korea, Vietnam, and Greece in exchange for prescribing or using Novartis or Alcon products; the Order also mentions conduct in China during the same period. In addition, Novartis Hellas S.A.C.I. and Alcon Pte. Ltd. entered into separate deferred prosecution agreements (here and here) with the DOJ and have agreed to pay $225 million and $8.9 million, respectively, in criminal fines for the alleged schemes. As part of the settlements with the SEC and DOJ, all three entities undertook three-year-long obligations to self-report back to the agencies once a year on the companies' progress in enhancing their compliance programs and internal controls.

This was Novartis' second FCPA-related resolution in the last five years, as it previously had agreed to pay $25 million to the SEC in order to resolve FCPA charges that two of its subsidiaries in China had bribed doctors and other healthcare professionals to prescribe Novartis drugs. As we discussed in more detail in our FCPA Spring Review 2016, Novartis improperly recorded the payments as travel and entertainment, lecture fees, marketing events, and medical studies, among others, in violation of the FCPA's books and records and internal accounting controls provisions.

We discuss the three corporate enforcement actions in more detail below.

Lastly, although not technically in Q2 2020, we note here developments involving two pharmaceutical companies that warrant mention. The first one involves the Israeli-based drug manufacturer Teva Pharmaceutical Industries Ltd. (Teva), which was under a three-year deferred prosecution agreement (DPA) with the DOJ between December 2016 and January 2020 following resolution of allegations that the company had engaged in bribery in Russia, Ukraine, and Mexico. As part of the settlement with the SEC and DOJ to resolve the FCPA charges, Teva had agreed to pay $519 million and retain an independent compliance monitor (Monitor) for three years. We discussed the resolution in more detail in our FCPA Winter Review 2017. The DPA expired on January 31, 2020. On March 4, 2020, the DOJ moved to dismiss the charges filed against Teva in connection with the DPA. According to the motion, the DOJ had determined, based on its own assessment and that of the Monitor, that Teva had met all of its obligations under the DPA.

Second, on July 2, 2020, the SEC announced that the Boston-based pharmaceutical company Alexion Pharmaceuticals Inc. (Alexion) had agreed to pay more than $21 million to resolve charges that the company violated the books and records and internal accounting controls provisions of the FCPA. According to the SEC's Cease-and-Desist Order (Order), Alexion's subsidiaries in Turkey and Russia made improper payments to government officials in those countries to secure favorable treatment for the company's primary drug, Soliris. The Order found that the two subsidiaries "maintained false books and records of these improper payments, which Alexion's internal accounting controls were insufficient to detect and prevent." On May 6, 2020, Alexion had disclosed in its quarterly filing that the DOJ had closed its FCPA inquiry and that Alexion had reached an "agreement in principle" with the SEC to settle claims relating to its investigation into Alexion's FCPA compliance and grant-making activities. Because this resolution occurred in the first few days of the third quarter of 2020, we will discuss the case in more detail in our FCPA Autumn Review 2020.

Corporate Investigations Closed without Enforcement Actions

Following our practice from past years, Miller & Chevalier has tracked throughout the second quarter of 2020 public information on investigations closed without an enforcement action, i.e., known investigations that the DOJ and the SEC have initiated but closed without a DPA, non-prosecution agreement (NPA), Cease-and-Desist Order, guilty plea, jury conviction, or other final enforcement procedure.2

During the second quarter of 2020, Miller & Chevalier tracked three such investigations announced publicly as closed without enforcement action. First, on April 8, 2020, CHS Inc. (CHS), a publicly-traded secondary agricultural cooperative owned by farmers, ranchers, and co-ops across the U.S., announced in its 10-Q filing that it had received a letter from the DOJ on February 25, 2020 stating that the DOJ had closed its FCPA investigation without taking any action against the company. CHS had previously reported in its 10-K for the year ended August 31, 2019 that it had voluntarily disclosed to the DOJ and SEC in Q4 2018 the company's potential violations of the FCPA "in connection with a small number of reimbursements made to Mexican customs agents in the 2014-2015 time period for payments customs agents made to Mexican customs officials in connection with inspections of grain crossings the U.S.-Mexican border by railcar." An SEC inquiry into the matter remains ongoing, according to the company's April 2020 filing.

Second, on May 6, 2020, Alexion Pharmaceuticals, Inc. announced in a Form 10-Q filing that Alexion had received a request from the DOJ in October 2015 for the voluntary production of documents and other information pertaining to the company's compliance with the FCPA. According to the filing, the "DOJ recently informed [the company] that it has closed its inquiry into these matters." Of course, as noted above, the SEC investigation did result in an enforcement action for Alexion.

Lastly, on June 29, 2020, Usana Health Sciences Inc. (Usana) announced in its 8-K filing with the SEC that the SEC and the DOJ had closed their three-year FCPA-related investigations into the company's Chinese operation, BabyCare Ltd. (BabyCare) without further action. Usana announced in its 8-K that the SEC, in closing its investigation on June 24, 2020, had stated that the agency had reached this conclusion not to pursue further action based on several factors, including, but not limited to, "the Company's (i) prompt, voluntary self-disclosure of the matters underlying the investigation, (ii) thorough internal investigation, (iii) full cooperation with the SEC, and (iv) remediation of the matters underlying the investigation." The disclosure also stated that, in a letter sent to Usana on June 26, 2020, the DOJ informed the company that the DOJ had also closed its parallel investigation into the matter, noting Usana's "cooperation during the investigation."

Potential Future Corporate Resolutions

Lastly, we note three other recent developments involving the Scotland-based oilfield services company John Wood Group plc (the Wood Group), Herbalife Nutrition Ltd. (Herbalife), and World Acceptance Corporation. Specifically, as we noted in our FCPA Spring Review 2020, the Wood Group announced in its annual investor report in March 2020 that the company expected to reach a $46 million settlement with U.S., Brazilian, and Scottish authorities over bribery allegations related to the Monaco-based oil service firm Unaoil. As of the publication of this FCPA Review, however, a public announcement of this resolution from the agencies has not occurred, and it is unclear when such an announcement will be made.

On May 7, 2020, Herbalife announced in its 10-Q filing (Quarterly Report) with the SEC that it had "reached an understanding in principle" to pay $123 million to resolve foreign bribery investigations by the DOJ and SEC that were "mainly focused" on the company's operations in China. The company had previously set aside $40 million to resolve the allegations. The disclosure indicated, among other things, that the company would enter a three-year DPA with the DOJ and an administrative settlement with the SEC, and that the company would agree to three years of compliance self-reporting obligations. The final public resolution of this investigation had not been released as of the date of publication.

On the same day (i.e., May 7, 2020), World Acceptance Corporation, a South Carolina-based consumer lender, disclosed in a regulatory filing that it had set aside $21.7 million in anticipation to resolve an FCPA-related investigation by the SEC into certain consumer loan payments that the company had made in Mexico and how it had recorded them in its books and records. The company had first disclosed its internal investigation into the matter to the DOJ and SEC in June 2017. Back in February 2020, World Acceptance Corporation had reported that the company was in discussions with the SEC regarding resolution of the investigation into its Mexico operations. The company's discussions with the SEC regarding a possible resolution are ongoing, and it is unclear when a final resolution with the agency will be reached. Pursuant to the company's Annual Report filed with the SEC on May 29, 2020, World Acceptance Corporation had received no offer of settlement or resolution with the DOJ as of that time.

Known FCPA Investigations Initiated

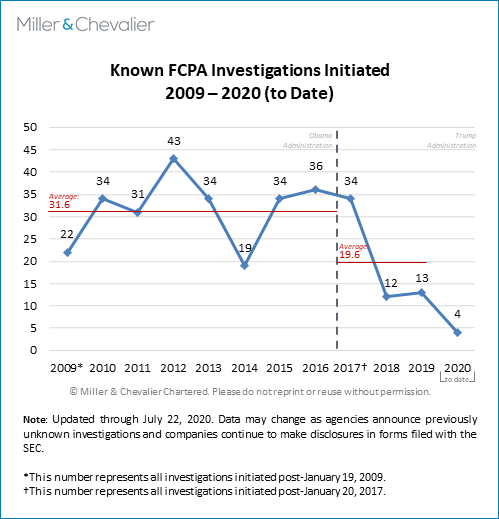

The chart of known FCPA investigations initiated since 2009 below shows that there were only four publicly-noted investigations that were opened during the first half of 2020 (with only three such investigations being opened during the first quarter of 2020 and only such one investigation (i.e., KT Corporation) initiated in the second quarter of 2020). Notably, as we most recently noted in our FCPA Spring Review 2020, the chart shows a general decline in new publicly known FCPA investigations since 2016-2017. While this trend may have longer-term implications for enforcement statistics over the coming months and years, it is also worth noting that most FCPA-related investigations remain active for years and that currently some trackers place the total number of currently active investigations at around 100 (though public sources make it virtually impossible to know an exact count). As we have done in the past, we also note here that this low number of initiated investigations in the second quarter of 2020 is almost certainly due to incomplete information. We are likely to learn of more investigations launched in 2019 and early 2020 in the coming weeks and months, as companies disclose such information in their public disclosure filings or journalists acquire relevant statistics through FOIA requests. Our investigation statistics are necessarily incomplete because neither the DOJ nor the SEC disclose official investigations statistics in real time and only some companies are likely to disclose such information through SEC filings or other means.

Individual Enforcement Actions

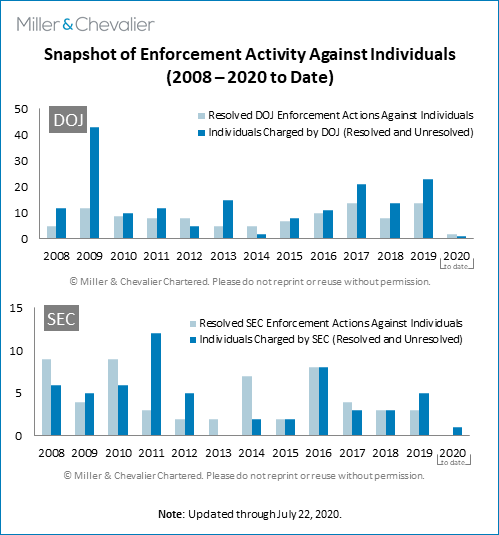

The chart below shows snapshots of enforcement activities against individuals by the DOJ and SEC. As can be seen from the chart, during the second quarter of 2020, the SEC did not resolve any FCPA enforcement actions against individuals but brought an enforcement action against one individual. During the second quarter of 2020, there were two sentencings, one of which (Eberhard Reichert, a former Siemens executive in Argentina) was related to the 2008 Siemens FCPA resolution. In addition, the SEC brought FCPA charges against Asante Berko, a former Goldman Sachs executive in London.

In addition, on July 6, 2020, a criminal complaint, filed on June 27, 2020, was unsealed charging Luis Enrique Martinelli Linares and Ricardo Alberto Martinelli Linares, who are sons of Panama's former President Ricardo Martinelli Berrocal, with money laundering. According to the allegations, the brothers served as intermediaries to set up bank accounts to receive and launder $28 million in bribe payments made by Odebrecht S.S. for the benefit of their father.

As mentioned above, during the second quarter of 2020, there were two sentencings, one of which stemmed from the 2008 FCPA settlement between Siemens AG and U.S. and German authorities. First, on April 17, 2020, Eberhard Reichert, a former Siemens executive, was sentenced via a telephone conference to time served (approximately 50 days in a Croatian jail prior to being extradited to the U.S. in December 2017, according to Reichert's sentencing submission statement) for his participation in a conspiracy to pay $100 million in bribes to government officials in Argentina to secure a contract to produce national identity cards. Following Siemens's FCPA settlement in 2008, Reichert had been charged in December 2011 and pleaded guilty in March 2018 to one count of conspiring to violate FCPA's anti-bribery, internal controls, and books and records provisions, and to commit wire fraud. Reichert had been initially scheduled to be sentenced on March 13, but his sentencing was rescheduled due to the ongoing COVID-19 pandemic.

The first quarter of 2020 witnessed a related development. Andres Truppel, a former Chief Financial Officer of Siemens Argentina and Reichert's co-defendant, also had pleaded guilty in September 2015 to one count of conspiring to violate the FCPA's anti-bribery, internal controls, and books and records provisions, and to commit wire fraud. In his sentencing submission statement, Truppel asked to receive no prison time and noted that he had "provided substantial assistance" to the DOJ throughout the investigation and had voluntarily submitted to U.S. jurisdiction despite having the options, as a dual Argentinian-German citizen, to either remain in Argentina "forever" or take refuge in Germany to avoid extradition. On March 13, 2020, Truppel was sentenced to time served in prison and was ordered to pay a mandatory assessment of $100.

Second, on April 24, 2020, Larry Puckett, a former Regional Sales Manager at Alstom Power Inc., Alstom S.A.'s subsidiary in Connecticut, was sentenced via videoconferencing due to the COVID-19 pandemic to time served (approximately 30 minutes, which was the time he was detained for following his arrest), 100 hours of community service, and a $5,000 fine. Puckett agreed in 2013 to plead guilty to conspiring with Lawrence Hoskins, a former Alstom executive, and others to bribe Indonesian government officials to secure a power plant project in Indonesia. At trial, Puckett testified against Hoskins, who was convicted in November 2019 and sentenced to imprisonment for 15 months in March 2020 for anti-money laundering (AML) violations.

Separately, as we discussed briefly in our FCPA Spring Review 2020, on April 13, 2020, the SEC brought charges against Asante Berko, a former Goldman Sachs executive in London, for allegedly violating federal securities laws and the anti-bribery provision of the FCPA. According to the Complaint, in 2015 and 2016, Berko, who currently resides in Ghana, bribed Ghanaian government officials to help one of Godman Sachs's clients, a Turkish energy company, secure a contract to build and operate a power plant in Ghana. The SEC notably did not charge Goldman Sachs with any misconduct, and the Complaint detailed how Berko had circumvented his employer's internal controls, including using personal email, lying to company legal and compliance personnel, and falsifying documents. According to the SEC's press release, Goldman Sachs's "compliance personnel took appropriate steps to prevent the firm from participating in the transaction and it is not being charged." A detailed discussion and analysis of the significance of the case by Paul Leder and FeiFei Ren, two Miller & Chevalier attorneys, can be found here.

Policy & Litigation Developments

We note here again three significant policy and litigation developments during the second quarter of 2020. First, on June 1, 2020, without any formal announcement, the DOJ updated its guidance on Evaluation of Corporate Compliance Programs, which was first published in February 2017 and had last been updated on April 30, 2019. The new version of the updated guidance makes several important changes to the language of the previous version, reflecting "additions based on [DOJ's] own experience and important feedback from the business and compliance communities," according to Brian Benczkowski, the Assistant Attorney General in charge of the DOJ's Criminal Division. For an in-depth analysis and further discussion of the key insights from DOJ's revised Corporate Compliance Guidance, see Miller & Chevalier Members Alejandra Montenegro Almonte's and Ann Sultan's article, which was originally published in Law360 on June 2, 2020.

Second, on June 22, 2020, in Liu et al. v. Securities and Exchange Commission, the U.S. Supreme Court (the Court) upheld the SEC's authority to seek disgorgement of ill-gotten gains as "equitable relief" in civil proceedings. Although the Court ruled in favor of the SEC's general authority, the decision limited the scope of such relief. Specifically, the Court held that a disgorgement award that (i) does not exceed a wrongdoer's net profits and (ii) is awarded to the victims of the wrongful conduct, is equitable relief permissible under 15 U.S.C. 78u(d)(5). The decision in Liu comes three years after Kokesh v. SEC, 137 S. Ct. 1635 (2017), in which the Court held that disgorgement was a "forfeiture" or "penalty," rather than a remedy for purposes of applying the relevant statute of limitations, and was therefore subject to the five-year limitations period established in 28 U.S.C. §2462. We analyze Liu in more detail below.

Lastly, on July 3, 2020, the DOJ and the SEC published the Second Edition of A Resource Guide to the U.S. Foreign Corrupt Practices Act (the Guide). The Guide was first published in November 2012 and provides key insights into the agencies' interpretation and enforcement of the FCPA as well as their priorities and expectations from companies when it comes to compliance with the statute. Among the noteworthy updates to the Second Edition of the Guide are those regarding the scope of the term "agent" for determining corporate liability, the mens rea requirement, and the statute of limitation for criminal violations of the FCPA's accounting provisions – all reflecting relevant court decisions. In addition, the Second Edition reflects updates and guidance resulting from almost eight years of other developments in FCPA enforcement, including significant FCPA resolutions, other case law, and international developments. A recent alert by Miller & Chevalier Member John E. Davis provides an in-depth discussion and analysis of the key updates to the Guide.

International Developments

There were several noteworthy international developments during the second quarter of 2020.

On March 18, 2020, the Tashkent City Criminal Court sentenced Gulnara Karimova, the elder daughter of the late Uzbek President Islam Karimov, to an additional 13 years and four months in prison after it found her guilty of organizing a criminal group, fraud, embezzlement, extortion, and money laundering, among others. The closed trial against Karimova and five of her associates began in Tashkent on January 8, 2020. Four of her associates were also given long prison sentences by the Court, ranging from 17 to 20 years.

On April 6, 2020, the Asian Development Bank's (ADB) Office of Anticorruption and Integrity (OAI) released its 2019 Annual Report. In 2019, according to the Report, ADB debarred 69 firms and 62 individuals and imposed temporary suspensions and other remedial actions for violations of its anti-corruption policy. In addition, the Report states that ADB cross-debarred 153 firms and 20 individuals in response to notices of debarment by other multilateral development banks. According to the Report, ADB's OAI also had adopted a new case management system and improved its efficiency in assessing complaints and investigative processes.

On April 24, 2020, following an investigation by the Office of Institutional Integrity of the Inter-American Development Bank (IDB), the IDB debarred the Brazilian construction company Andrade Gutierrez Engenharia S.A. (AG Engenharia) for three years and one month in connection with its engagement in prohibited practices committed in four IDB-financed projects in Brazil. According to the IDB's news release, the debarment is the result of a settlement between the IDB, the Inter-American Investment Corporation, and AG Engenharia. According to AG Engenharia's admissions in the settlement agreement, the company had agreed to make illicit kickback payments, potentially as high as $60 million, to Brazilian government officials in exchange for securing IDB-financed contracts.

On April 30, 2020, the DOJ announced that Bank Hapoalim B.M. (BHBM), Israeli's largest bank with international operations, and its wholly-owned subsidiary, Hapoalim (Switzerland) Ltd. (BHS) entered into a three-year NPA with the DOJ. Under the NPA, BHBM and BHS agreed to forfeit close to $21 million and pay a fine of more than $9.3 million to resolve an investigation into their involvement in a money laundering conspiracy related to an international soccer bribery scheme. BHBM and BHS admitted that from December 2010 to February 2015, their personnel conspired with sports marketing executives to launder more than $20 million in bribes and kickbacks to soccer officials with Fédération Internationale de Football Association (FIFA) and other soccer federations in exchange for broadcasting rights for soccer matches and tournaments to the sports marketing executives and their companies. We discuss each of these international developments in more detail below.

Finally, on July 24, 2020, Goldman Sachs and the Government of Malaysia announced an "agreement in principle" to "resolve all the criminal and regulatory proceedings in Malaysia" against the firm related to the ongoing 1Malaysia Development Berhad (1MDB) scandal. The announcement states that agreement "would involve the payment to the Government of Malaysia of $2.5 billion and a guarantee that the Government of Malaysia receives at least $1.4 billion in proceeds from assets related to 1MDB seized by governmental authorities around the world." The announcement contains other details, as well, and notes that this development "does not resolve the other pending governmental and regulatory investigations involving the firm relating to 1MDB" including ongoing U.S. and other inquiries. We last covered various aspects of the 1MDB investigations in our FCPA Spring Review 2020 and we will monitor these developments and report further in our next review.

Corporate Enforcement Actions

Italian Energy Company Eni Settles Allegations of FCPA Accounting Requirements with SEC for $24.5 Million

On April 17, 2020, the SEC entered a Cease-and-Desist Order (Order) against Eni S.p.A. (Eni), an oil, gas, and electricity company headquartered in Italy, to resolve alleged violations of the books and records provisions and the internal accounting control provisions of the FCPA. Specifically, the SEC alleges that the company violated the FCPA when it: (a) consolidated the false records of its 43 percent-owned subsidiary, Saipem S.p.A. (Saipem), into its records and (b) failed to use good faith efforts to cause Saipem "to devise and maintain a system of internal accounting controls" in compliance with the FCPA.

Eni has issued American Depository Receipts (ADRs) traded on the New York Stock Exchange and it has been registered with the SEC since 1995, making it an "issuer" under the FCPA. Pursuant to the Order, Eni, without admitting or denying the SEC's findings, agreed to pay disgorgement of $19,750,000 and prejudgment interest of $4,750,000, for a total of $24.5 million. The SEC Order noted that this is Eni's second alleged FCPA violation, highlighting that in 2010, Eni and its subsidiary paid $365 million and agreed to a permanent injunction against future FCPA violations to resolve FCPA charges related to payments to officials in Nigeria.

In the current matter, the SEC alleges that, between 2007 and 2010, Eni's subsidiary, Saipem, entered into "four sham contracts with an intermediary" for the purpose of obtaining contracts with the state-owned oil company of Algeria. Saipem allegedly paid the intermediary approximately €198 million "and was awarded at least seven contracts with Algeria's state-owned oil company." Saipem also claimed tax benefits in Italy worth a total of $57 million for the payments to the intermediary, which the company characterized inaccurately as legitimate business expenses. The Order states that "approximately $19,750,000 of [that] unwarranted tax benefit obtained by Saipem also flowed to Eni as a result of its 43% interest in Saipem."

The Order alleges that the scheme with the intermediary began after Saipem was informed that Saipem would need to hire the intermediary to secure business in Algeria. During subsequent meetings with Saipem, the Algerian Energy Minister stated that the intermediary's owner was "his personal secretary" and like a "son" to him. The SEC Order states that, following these meetings, Saipem entered into the contracts at issue, which stated that the intermediary would provide certain services. The Order notes that those services were never rendered, and indeed that the intermediary could not have provided the services because the intermediary had no experience in the field, no offices or staff in Algeria, and "only a 'virtual office' in Geneva, Switzerland staffed by one individual." The Order states that the "intermediary directed at least a portion of the payments" to Algerian government officials or their designees, including the relevant Energy Minister. The payments to the intermediary were falsely recorded in Saipem's books and records as "brokerage fees." Saipem's books and records were eventually consolidated into Eni's books and records and, as a result, the SEC stated that Eni violated the books and records provisions of the FCPA.

The Order also alleges that Eni failed to meet the "good faith" standard in the FCPA's accounting provisions, which requires an issuer with a 50 percent or less stake in a company to undertake good faith efforts to cause the company "to devise and maintain a system of internal accounting controls" in compliance with the FCPA. This charge centers on the ineffectiveness of Saipem's internal accounting controls and the role of an executive in facilitating the sham contracts. The executive was Saipem's CFO from 1996 until 2008, after which he became Eni's CFO.

On a more general level, the Order alleges that Saipem's internal accounting controls were not adequately implemented or effective even though Eni (the "controlling minority shareholder") required Saipem to maintain a system of internal accounting controls, which included "adopting Eni's directives of transparency, traceability, and anti-bribery compliance." In particular, the SEC notes that Saipem did not conduct a "substantive review of the intermediary contracts" or any review of "the intermediary's business or reputation." And the internal audits conducted by Saipem on the contracts "were either inadequate or perfunctory, such as simply matching invoices to payment amounts."

The Order also alleges that the executive was directly involved in facilitating the sham contracts and payments through multiple actions both before and after he assumed the role of CFO at Eni. According to the Order, the executive took several actions to "circumvent or override" Saipem's internal accounting controls, including falsifying and backdating documents, and making a payment to the intermediary "without the approval of the appropriate senior officer until a year after the payment was made." After being hired as Eni's CFO in 2008, the executive continued to communicate with the intermediary and took other actions to deflect scrutiny of the contracts, all the while concealing the nature of the payments from "his colleagues at Eni." In 2012, Eni discovered the sham contracts with the intermediary, the lack of due diligence on the contracts, and the executive's continued involvement in facilitating the payments to the intermediary. At that point, Eni terminated the executive. The SEC determined that "[a]s the principal finance officer of Eni, [the executive] could not have been proceeding in good faith to cause Saipem to devise and maintain sufficient internal accounting controls while simultaneously being aware of, and participating in, conduct at Saipem that undermined those controls." Thus, Eni "could not rely" on the good faith provisions and thus did not implement effective internal accounting controls at Saipem.

The settlement was informed by cooperation and remedial actions immediately taken by Eni, which the SEC says included compiling financial data and analysis relating to the transaction at issue, making substantive presentations on key topics, and providing translations of key documents and foreign proceedings.

As noted previously, in October 2019, Eni disclosed that the DOJ had closed its investigation into possible FCPA violations in Nigeria and Algeria, including allegations that Saipem had paid bribes to Algerian officials to secure contracts.

In 2018, an Italian trial court acquitted Eni and some of the company's executives of bribery allegations for the actions in Algeria, while at the same time convicting Saipem and the executive involved in conducting the scheme in Algeria; the court ordered Saipem to forfeit €198 million and pay an additional €400,000 fine, while sentencing the executive to a prison sentence of 49 months. However, per the SEC Order, in January 2020, the Milan Court of Appeals "overruled the trial court and acquitted the remaining defendants, including Saipem and [the relevant executive], of all charges."

Noteworthy Aspects

- Enforcement of the "Good Faith" Standard Related to Minority-Owned Affiliates. This case is a rare instance involving the good faith standard in the FCPA's accounting provisions, Section 13(b)(6) (another case is the SEC's action against BellSouth in January 2002). The good faith standard provides that, when an issuer owns 50 percent or less of a domestic or foreign firm, the FCPA's internal accounting control provisions require "only that the issuer proceed in good faith to use its influence, to the extent reasonable under the issuer's circumstances, to cause such domestic or foreign firm to devise and maintain a system of internal accounting controls consistent with" the provisions. The statute states that companies should exercise "good faith" "to the extent reasonable under the issuer's circumstances" – and that "[s]uch circumstances include the relative degree of the issuer's ownership of the domestic or foreign firm and the laws and practices governing the business operations of the country in which such firm is located." The relevant legislative history (the conference report for the FCPA's 1988 amendments) confirms that "[w]hile the relative degree of ownership is obviously one factor, other factors may also be important in determining whether an issuer has demonstrated good-faith efforts to use its influence."

As previously noted, Eni held a 43 percent share of Saipem. Despite this minority ownership interest, the SEC calls Eni the "controlling" shareholder (in BellSouth, the company was deemed to have "operational control"). In both cases, the SEC thus focused on "control" as the critical factor in evaluating whether the respective companies had fulfilled their "good faith" obligation to extend relevant internal accounting controls over their affiliates. The statutory language and the legislative history give room to the SEC to factor such "control" into the agency's assessment of the relevant "circumstances." The Eni decision therefore reinforces the need for companies to assess a number of factors related to whether they could be deemed as "controlling" a minority-owned company or joint venture; if such control exists, then the relevant governance arrangements should be aligned with the company's obligations to attempt to ensure that the company can accomplish the tasks needed to cause the affiliate or joint venture to adopt effective controls. - Disgorgement Tied Solely to Tax Benefit to Eni. Despite statements in the Order that Saipem paid close to €200 million to the intermediary and obtained four significant contracts from the Algerian state-owned company, the disgorgement amount paid by Eni appears to be based solely on the tax benefits that Eni received from the improper tax deductions claimed by Saipem. There is no discussion of any shares of Eni's revenues or profits that might have flowed to Eni as a result of the awarded contracts, which are often the basis for disgorgement amounts. The reasons for this are unclear in the public record. The settlement amount could have been influenced by a number of potential factors, including evidentiary issues (which may also have led to the DOJ's closing of its investigation without action), the impact of Italian investigations and court rulings (in which Eni was acquitted of the charges), the effect of remediation actions undertaken by Eni, the length of time that has passed since the actions at issue occurred (which could have involved statute of limitations challenges), or other issues.

Novartis AG and Subsidiaries, Both Current and Former, Settle DOJ and SEC Investigations for $346.7 Million

On June 25, 2020, Novartis AG (Novartis), a Switzerland-based pharmaceutical company, and certain current and former subsidiaries agreed to pay U.S. authorities a combined total of $346.7 million for committing various FCPA violations. Novartis and two subsidiaries (one of which is now spun off into a new stand-alone company) reached settlement agreements with both the DOJ and the SEC, which resolved all ongoing FCPA investigations. Under the agreements, Novartis and its Greek subsidiary agreed to pay $225 million to the DOJ and $112.8 million to the SEC, and a former Novartis subsidiary based in Singapore agreed to pay $8.9 million in a separate resolution with the DOJ for conduct that occurred while it was still controlled by Novartis.

The SEC resolution with Novartis centered around evidence that the companies had offered inappropriate economic benefits to healthcare professionals in Greece, Vietnam, and South Korea (and without internal controls for a program in China), while the DOJ resolutions with the subsidiaries involved the same conduct in Greece and Vietnam. The conduct under investigation spanned from 2009 to 2016. Ultimately, Novartis and the subsidiaries admitted to violating both the anti-bribery and books-and-records provisions of the FCPA. Each of the schemes are discussed in detail below.

Novartis, as well as all relevant current and former subsidiaries, cooperated with both the DOJ and SEC investigations. Novartis stated in its press release that it already implemented "appropriate remedial measures." The company notes it has enhanced its governance policies, reinforced its "speak-up culture," and combined its risk management and compliance functions for greater impact.

Corporate Structure and History

Novartis, a Swiss corporation, sells its pharmaceutical and healthcare products in approximately 155 countries around the world. The corporation's numerous subsidiaries facilitate its large global presence. Several such subsidiaries, both current and former, were involved in the problematic conduct that sparked the DOJ and SEC investigations. They are described below.

Prior to these investigations, Novartis reached a separate resolution with the SEC in 2016. Under the 2016 resolution, Novartis paid $25 million for violating the FCPA when its China-based subsidiaries implemented a pay-to-prescribe scheme. The 2016 Cease and Desist Order required Novartis to periodically report to the SEC regarding its remediation and compliance measures over a two-year term. In addition, during the two-year period, if Novartis "discover[ed] credible evidence, not already reported to the Commission staff, that questionable or corrupt payments or questionable or corrupt transfers of value may have been offered, promised, paid, or authorized . . . or that related false books and records have been maintained," Novartis was required to promptly report such conduct to the SEC.

Novartis Hellas S.A.C.I. (Novartis Hellas) and Novartis Korea Ltd. (Novartis Korea) are both indirect wholly-owned subsidiaries of Novartis. Novartis Hellas manages the sales and marketing activities for Novartis products throughout Greece. Novartis Korea conducts the same activities in South Korea.

Alcon, Inc. (Alcon), an eye care company headquartered in Texas and incorporated in Switzerland, is a former subsidiary of Novartis. During a portion of the period relevant to the DOJ and SEC investigations, Novartis was the sole owner of Alcon. The companies merged in 2011, but Novartis later spun off Alcon as a stand-alone public company in 2019. Alcon is currently the largest eye care company in the world and conducts business in over 140 countries. Alcon concluded its own DPA with the DOJ, using separate counsel than the counsel used by Novartis.

Finally, Alcon Pte Ltd. (Alcon Pte) is a former subsidiary of Novartis and a current subsidiary of Alcon. During the period under investigation by the DOJ and SEC, Alcon Pte provided management oversight at two Alcon offices in Vietnam (Alcon Vietnam).

DOJ Investigation

In a June 25, 2020 press release, the DOJ announced that both Novartis Hellas and Alcon Pte entered into separate three-year DPAs. The relevant parent companies—Novartis AG and Alcon Inc., respectively—also signed the relevant DPAs and assumed their own obligations under the agreements. Novartis Hellas agreed to pay $225 million in criminal penalties to resolve the DOJ's investigation. Separately, Alcon Pte will pay $8.9 million to settle the dispute. Both Novartis Hellas and Alcon Pte, as well as their parent companies, also agreed to continue cooperating with the U.S. government in any ongoing or future criminal investigations.

The DOJ determined that Novartis Hellas and Alcon Pte profited from the bribery of medical professionals, hospitals, and clinics and then falsified their books and records to conceal the improper conduct. Both entities entered DPAs with the DOJ that deferred prosecution but imposed continuing obligations on Novartis Hellas, Alcon Pte, and their parent corporations.

In a criminal information filed in the District of New Jersey, Novartis Hellas was charged with one count of conspiracy to violate the anti-bribery provision of the FCPA and one count of conspiracy to violate the books-and-records provision of the FCPA. As admitted in its DPA, between 2012 and 2015, Novartis Hellas conspired to bribe employees of state-owned and state-controlled hospitals and clinics in Greece in order to increase sales of Novartis pharmaceuticals. Under one scheme, Novartis Hellas paid for these healthcare providers to attend international medical congresses, including some in the United States. In addition, Novartis Hellas admitted to previously making improper payments to healthcare providers involved in an epidemiological study in 2009 and 2010.

In its separate DPA, Alcon Pte admitted to one count of conspiring to cause Novartis to maintain false books and records as a result of a scheme to bribe healthcare providers at state-owned and state-controlled hospitals and clinics in Vietnam between 2011 and 2014. The employees in Vietnam made improper payments through a distributor in order to increase sales of intraocular lenses. Alcon Pte subsequently reimbursed the distributor for these payments. The reimbursements were recorded as consulting expenses, marketing expenses, and human resources expenses.

For the three-year terms of the DPAs, if either entity learns of any evidence or allegation of conduct that may constitute an FCPA violation had it occurred within the jurisdiction of the United States, the company must also report the evidence or allegation to the DOJ. In addition, the companies agreed to strengthen their compliance programs and periodically report on their progress. Notably, no compliance monitor is required of Novartis Hellas, Alcon Pte, or either of the parent companies.

There were several factors involved in the DOJ's resolution of the investigations. Both Novartis Hellas and Alcon Pte failed to timely disclose the conduct at issue in the investigations. The DOJ found Novartis Hellas did not voluntarily self-disclose the conduct under investigation. In the case of Alcon Pte, however, it appeared that Alcon Pte may have disclosed the conduct, but the DOJ determined that Alcon Pte did not timely disclose the conduct because there was an imminent threat of disclosure and because Alcon Pte's former parent corporation, Novartis, was subject to reporting obligations under the 2016 SEC resolution.

However, both companies received credit for their cooperation with the investigations. The companies also engaged in remedial measures, such as terminating the individuals who orchestrated the misconduct, adopting heightened controls and compliance mechanisms, and devoting increased resources to these issues.

Novartis Hellas and Alcon Pte ultimately received different treatment in implementing the criminal monetary penalties. While Novartis Hellas received full cooperation and remediation credit, the penalty was based on a point near the top of the relevant Sentencing Guidelines fine range. In part, this was based on Novartis's prior offense in 2016, which resulted in a resolution with the SEC. In contrast, Alcon Pte's penalty was calculated using the bottom of the fine range.

SEC Investigation

In a June 25, 2020 press release, the SEC announced that Novartis agreed to pay $92.3 million in disgorgement and $20.5 million in prejudgment interest ($112.8 million total) to settle charges that it violated the books-and-records and internal accounting provisions of the FCPA. The SEC's Cease and Desist Order found that local subsidiaries engaged in bribery schemes in Greece, Vietnam, and South Korea, and there were internal accounting control violations in China. These entities made improper payments and provided benefits to both public and private healthcare providers in exchange for using or proscribing Novartis and Alcon products. Details of these schemes are provided below.

Moving forward, Novartis also agreed to periodically self-report on the status of its remediation and implementation of compliance measures for a three-year period. In particular, the SEC's Cease and Desist order states that Novartis will need to report on its "due diligence on prospective and existing third-party consultants and vendors, FCPA training and the testing of relevant controls including the collection and analysis of compliance data." If Novartis "discover[s] credible evidence . . . that questionable or corrupt payments or questionable or corrupt transfers of value may have been offered, promised, paid, or authorized . . . or that related false books and records have been maintained," Novartis must report such conduct to the SEC. Additionally, Novartis must complete an initial review and submit an initial report and conduct and prepare two separate follow-up reviews and reports.

Country-Specific Conduct

Novartis and its subsidiaries engaged in the conduct at issue in four countries: Greece, Vietnam, South Korea, and China.

- Greece

In Greece, Novartis Hellas provided improper benefits and things of value to healthcare providers, including employees of state-owned and state-controlled hospitals and medical clinics. There were two different schemes in operation. Both schemes focused on increasing sales of Novartis products. While ongoing, the payments related to both schemes were recorded as legitimate advertising and promotion or marketing and sales expenses. The SEC emphasized that while they were "seemingly legitimate educational and scientific activities," the funds were actually misused for improper purposes.

The DOJ and SEC determined that between 2012 and 2015, Novartis Hellas engaged in a scheme intended to increase sales of Lucentis, a Novartis drug used to treat neovascular age-related macular degeneration. The Novartis Hellas Ophthalmology franchise provided international congress scholarships to encourage healthcare providers to write prescriptions for Lucentis. This included paying healthcare providers' costs to attend the congresses, which often exceeded $6,000 per person. Specifically, these costs included airfare, hotel accommodations, and congress registration fees.

Novartis Hellas intentionally targeted Greek healthcare providers determined to be "Key Opinion Leaders." Healthcare providers were ranked based on their prescribing practices and were given improper "investments" based on their likelihood to prescribe Novartis products. Internally, this practice was described as a "return on investment." If healthcare providers failed to meet their return on investment, the investment activities were reduced or eliminated entirely.

The DOJ and SEC determined that the misuse of educational and scientific activities was known and approved by managers at various levels. Written minutes from internal meetings show that Novartis Hellas intended congress sponsorship to lead to increased sales, with one employee noting that Greek healthcare providers "must understand that their participation in [specific congresses in the United States and Europe] will be cancelled if sales performance is not improved significantly."

Additionally, the SEC determined that, between 2009 and 2012, Novartis Hellas conducted Phase IV and epidemiological studies—research studies related to Novartis-branded prescription drugs—with the intention of promoting sales of Novartis products in Greece. The studies allowed Novartis Hellas to make improper payments to healthcare providers in exchange for writing additional prescriptions. Novartis Hellas employees recognized that many healthcare providers believed they were being paid to write prescriptions and not to provide data in the studies.

Based on a Novartis Internal Audit review in 2012, it was determined that the process and control design failed to ensure the Phase IV and epidemiological studies were of a non-promotional nature. The identified control deficiencies included (1) unsupported rationale to perform the studies; (2) indications that the studies were promotional; and (3) weaknesses in the collection of data and subsequent publication of the results. Another internal audit in 2013 showed that Novartis Hellas addressed many of the deficiencies identified in the previous audits. In response to the internal audit reviews, Novartis Hellas also agreed to improve internal controls over grant approval and governance processes.

- Vietnam

Between 2007 and 2014, Alcon Vietnam, in cooperation with a local Vietnamese distributor, made improper payments to healthcare providers to increase the sale of Alcon's intraocular lenses. The targeted healthcare providers included those employed at state-owned and state-controlled hospitals and medical clinics.

Alcon Vietnam's distributor paid bribes to healthcare providers through a "consultancy program" in exchange for recommending Alcon products to patients. The distributor made the payments to the healthcare providers, but Alcon Vietnam managers and employees approved of the scheme. Alcon Vietnam would periodically reimburse the distributor for up to fifty percent of the costs using credit notes.

Novartis failed to ensure Alcon Vietnam's improper payments stopped following their merger. After the 2011 merger with Novartis, the "consultancy program" was renamed but the payments continued. Alcon Vietnam appears to have continued reimbursing the distributor for payments made to healthcare providers up until June 2014.

These payments were later falsely recorded as legitimate consultant payments and consolidated in the books and records of Novartis. The SEC also emphasized that an Alcon Pte executive signed two false Sarbanes-Oxley sub-certifications, without disclosing the improper payments.

- South Korea

Between 2011 and 2016, Novartis Korea similarly made payments to healthcare providers in an effort to increase the prescription and sales of Novartis products. There were several different schemes operating in South Korea.

Under one scheme, employees of Novartis Korea made the payments through third-party medical journals that subsequently forwarded the payments to healthcare providers. The payments to medical journals were recorded as advertising fees.

In another scheme, employees of Novartis Korea arranged the sponsorship of healthcare providers to international medical conferences in order to incentivize those healthcare providers to prescribe Novartis products. Between 2011 and 2016, the SEC found Novartis Korea funded the expenses of 2,032 healthcare providers at 381 international conferences—including 112 in the United States—at a total cost of approximately $7 million. Novartis Korea recorded these costs on its books and records as advertising and promotional fees.

In a third scheme, Novartis Korea employees designed a clinical study with select healthcare providers in order to improve relationships with those healthcare providers. The study was organized through a local medical journal and Novartis Korea provided $100,000 in funding. Novartis Korea failed to have the study reviewed and approved as required by the company's internal procedures.

In South Korea, the local law prohibits pharmaceutical companies from making payments to healthcare providers to promote sales. As a result, Novartis Korea has faced civil penalties imposed by South Korean authorities as well.

- China

From 2013 to 2015, Alcon placed surgical equipment at hospitals and clinics in China for little or no cost up front. In exchange, the hospitals and clinics executed contracts that obligated them to pay for the equipment, either directly or over several years, by purchasing Alcon's intraocular lenses and other consumables. Starting in 2013, Alcon referred to these agreements as "equipment financing arrangements" (EFAs). This business model was used both before and after Alcon's merger with Novartis.

The SEC found that Novartis lacked adequate internal accounting controls to ensure the EFAs were recorded appropriately by the accounting department. Most importantly, Novartis's internal accounting controls failed to ensure that (1) the EFAs reflected the terms negotiated with the hospital or clinic; (2) the agreements were signed; and (3) the agreements stated the price to be paid. Other controls issues also existed, including inadequate credit assessments of hospitals and clinics, allowances for bad debt, and insufficient proof of delivery or installation.

Alcon's sales personnel executed EFAs with customers without adequate profitability safeguards. Some hospitals and clinics maintained poor compliance rates with their EFA contractual obligations. Despite this, Alcon continued to execute EFAs that did not satisfy certain revenue recognition criteria or that inaccurately projected future purchases. In some cases, the EFA documents were even falsified.

In a 2015 review, Alcon found that of the 1348 pieces of equipment placed with customers, approximately 844 pieces of equipment were placed pursuant to faulty EFAs. About half of these faulty contracts lacked formal signatures but had still been validated by the hospital or clinic. The remaining pieces of equipment either could not be located, had been moved to another hospital, or the EFAs were forged or unverified.

After receiving various internal audit reports, the local Alcon management in China became aware of the internal controls-related deficiencies. Following a 2016 internal audit, Novartis management also became aware of the EFA issues. Ultimately, the EFA business model was abandoned in late 2016. At that point, however, the lack of adequate internal accounting controls led Novartis and Alcon to provision over $50 million in bad debt from the use of EFAs in China.

Noteworthy Aspects

- DOJ and SEC Investigations Overlap with 2016 SEC Resolution. In 2016, Novartis settled with the SEC over conduct related to a pay-to-prescribe scheme implemented by its China-based subsidiaries. The SEC found that between 2009 and 2013, employees of the subsidiaries offered money, gifts, and other items of value to healthcare professionals. This ultimately led to several million dollars in sales of pharmaceutical products to China's state-owned health institutions. Interestingly, much of the conduct covered by the SEC and DOJ's June 25, 2020 resolutions occurred during some of the same time period. In particular, the schemes at issue in Greece, Vietnam, and South Korea were all underway prior to 2013. It is unclear why the conduct covered by the SEC and DOJ's recent investigations was not addressed in the 2016 resolution.

- No Compliance Monitors Required. In resolving the criminal investigation into the conduct of Novartis Hellas in Greece, the DOJ determined that an independent compliance monitor would not be necessary, notwithstanding Novartis' multiple resolutions. The Novartis Hellas DPA explains that this determination was based on Novartis and Novartis Hellas' remediation efforts, implementation of stronger compliance programs, and ongoing commitment to report on developments. The Alcon Pte DPA also found an independent compliance monitor would not be necessary for similar reasons. All of the relevant resolutions, however, included three-year self-reporting requirements.

- Novartis Hellas' DOJ Criminal Fine is Especially High, Relative to Profit. According to the DPA, Novartis Hellas had profits of $71.5 million from its improper payments. The criminal fine of $225 million was therefore more than three times as large as its profits, which is particularly high for corporate FCPA resolutions at the DOJ. For example, recent DOJ resolutions with Ericsson and Samsung Heavy Industries included fines that were approximately 1.2 to 1.3 times larger than related profit, whereas Novartis Hellas' fine was 3.2 times larger than the profits. There were several factors at play here. First, Novartis Hellas' criminal monetary penalty imposed by the DOJ is based on a point far above the midpoint of the U.S. Sentencing Guidelines range. Specifically, within the range of $180 million to $360 million, the criminal penalty was based on an $300 million fine. Typically, the DOJ will use the lower end of the Sentencing Guideline range (as it did for Alcon Pte), but here it selected a fine near the upper limit of the range, citing the fact that Novartis (the parent) had previously concluded an FCPA resolution – not with the DOJ, but with the SEC. Second, in large corporate resolutions, a company's illicit profits typically exceed the base fine calculated under the Sentencing Guidelines. In this case, however, based on the Sentencing Guidelines, Novartis had a base fine that was calculated to be $150,000,000, even though its profits from the improper payments were less than half that amount (and even the disgorgement paid to the SEC for several countries was also lower, at $92 million).

- Enforcement in South Korea. As described above, Novartis' South Korean subsidiary was subjected to various regulatory actions in Korea for its improper payments, false books and records, and lack of internal controls. Notably, while the DOJ brought enforcement actions against Novartis subsidiaries in Greece and Singapore (for the conduct in Vietnam), there was no enforcement action against Novartis Korea itself, perhaps due in part to the local enforcement that already occurred.

Individual Enforcement Actions

Former Alstom Executive Video Sentenced to Time Served

On April 13, 2020, former Alstom executive Larry Puckett, who was regional sales manager at Alstom's Connecticut subsidiary Alstom Power Inc., was sentenced to time served and two years of supervised release for his role in the Alstom bribery scheme. Puckett was also ordered to pay a $5,000 fine and complete 100 hours of community service. Puckett, who is 70, appeared in the U.S. District Court for the District of Connecticut via Zoom video chat from a conference room with his attorney. The judge and prosecutors connected from separate locations, and reporters and the public were able to join the call, as well. In 2019, Puckett pled guilty to conspiring to violate the FCPA. Puckett testified against former Alstom executive Lawrence Hoskins at Hoskins's trial, leading to Hoskins's conviction on money laundering charges and a 15-month prison sentence. Puckett has reportedly been cooperating with the government since 2012.

Ex-Siemens Executives Sentenced to Time Served with No Fine for Roles in Argentine Bribery Scheme

On September 30, 2015, the former CFO of Siemens Argentina, Andres Truppel, pleaded guilty to one count of conspiracy to violate the FCPA for his involvement with activities related to approximately $100 million in bribes to secure a $1 billion contract for Siemens. Nearly three years later, fellow conspirator Eberhard Reichert, the former Technical Manager of Siemens Business Services GmbH & Co. OGH (SBS) also pleaded guilty for his role in the conspiracy. Now, on April 17, 2020, nearly twenty years after the scheme ended in 2001, Judge Denise Cote of the Southern District of New York sentenced both men to no additional jail time.

The scheme to which the Siemens executives pleaded guilty involved a contract to produce national identity cards (the DNI Project) for the Argentine government in 1994. To win the $1 billion contract over other bidders, Reichert and Truppel took part in a conspiracy that directed $100 million in payments to Argentine officials and politicians. In particular, Reichert's and Truppel's roles involved concealing the payments by using various shell companies and fraudulent bank wire transfers. Reichert ultimately agreed to cooperate with prosecutors in their investigation of the company and other Siemens executives.

The court noted Reichert's cooperation and acceptance of responsibility. Despite the seriousness of the crime, Judge Cote reportedly acknowledged that the crimes were committed "many, many years ago" and that Reichert was "not the most culpable" conspirator. During the sentencing hearing, Reichert's lawyer stated that her client was grateful for the court's willingness to carry out the hearing telephonically in light of his age and the COVID-19 pandemic. The guilty pleas and sentencings of Reichert and Truppel are the latest developments in an investigation where Siemens and its Argentine subsidiary also pleaded guilty to FCPA violations in 2008. Currently, six other charged executives involved in the bribery plot have yet to appear in U.S. court.

Policy and Litigation Developments

Supreme Court Confirms SEC's Disgorgement Authority While Simultaneously Limiting the Practice of Disgorgement

On June 22, 2020, the U.S. Supreme Court issued an opinion in Liu et al. v. Securities and Exchange Commission, holding 8-1 that the SEC has the authority under 15 U.S.C. § 78u(d)(5) to collect disgorgement as a form of equitable relief, though the holding established certain conditions for allowing that practice.

In 2017, a district court in California found that Charles Liu and his wife, Xin Wang, had defrauded foreign national investors in violation of U.S. securities laws. Under the EB-5 Immigrant Investor Program, noncitizens can apply for permanent residence in the U.S. after investing in approved enterprises. Liu and Wang used the allure of the Immigrant Investor Program to collect nearly $27 million, promising investors that their contributions would be put toward the construction of a proton-therapy cancer treatment center in California. Instead, the court found that Liu and Wang improperly diverted nearly $20 million of the investment funds to personal funds and "ostensible marketing expenses and salaries."

In its judgment against Liu and Wang, the district court ordered the couple to disgorge almost $27 million, the full amount collected from the defrauded investors. The Ninth Circuit affirmed the lower court's decision. Relying on the U.S. Supreme Court's 2017 decision in Kokesh v. Securities and Exchange Commission, Liu and Wang challenged this ruling and contested the SEC's authority to collect a disgorgement award before the Supreme Court. As described in our FCPA Summer Review 2017, the Court in Kokesh held that the disgorgement was a penalty rather than an equitable remedy for statute of limitations purposes. However, the Court in Kokesh specifically declined to comment on whether courts have the authority to award disgorgement in SEC enforcement proceedings under § 78u(d)(5), which limits the relief sought to equitable remedies rather than punitive sanctions.

In Liu, the Court explicitly took up this lingering question and found that the SEC can seek disgorgement as an equitable remedy under § 78u(d)(5) if the award meets certain characteristics, which the Court stated were derived from historical equity practice. Per the Court, a disgorgement award must be: distributed to the defrauded parties, based on a theory of individual liability, and limited to only the net profits of the fraudulent scheme. The Court remanded the case to the district court to evaluate whether the disgorgement award in Liu met the stated criteria, though it offered some general guidance on each point.

First, the Court explained that the purpose of a disgorgement award is to restore value to the defrauded parties, rather than simply to "deny [wrongdoers] the fruits of their ill-gotten gains." For that reason, the Court noted that returning the disgorged funds to identifiable victims should be the SEC's primary purpose in collecting disgorgement. Second, the Court held that an equitable disgorgement award must be awarded not based on joint-and-several liability but rather based on individual liability. Referring to its 1894 ruling in Belknap v. Schild, the Court noted that individual liability requires that defendants be "liable to account for such profits only as have accrued to themselves . . . and not those which have accrued to another, and in which they have no participation." Consistent with this equitable principle, the Court reasoned that a joint-and-several award could potentially cause the award to transform into a penalty for those defendants not directly responsible for the fraud. In the facts related to Liu itself, the Court indicated that Liu and Wang were so intertwined in the fraud and enjoyment of the profits so as to make them equally culpable, meaning the imposition of joint-and-several liability in their case could still be an equitable remedy. Third, a disgorgement award must be limited only to the net profits of the fraudulent scheme to ensure that the award remains an equitable remedy. Thus, in calculating disgorgement, any "legitimate business expenses"—such as the costs of cancer treatment equipment purchased by Liu and Wang—must be deducted from the total profits of the fraud. After Liu, a disgorgement award likely will be considered equitable (rather than punitive) only if these three criteria are met.

Beyond the Court's elaboration of these three principles, there are several remaining questions about how this ruling will impact SEC enforcement proceedings moving forward. For instance, the Court offered limited guidance on how to determine what costs should be considered as "legitimate expenses" to be deducted during the net profit calculation. This net profit limitation will be crucial in FCPA anti-bribery cases in which disgorgement awards can be substantial—sometimes far exceeding civil penalties. For example, of the three SEC enforcement proceedings resolved in 2020 alone, a grand total of $117,450,000 was awarded in disgorgement compared to only $2,500,000 in civil penalties (though criminal penalties accompanied some of these civil resolutions). Thus, the Supreme Court's ruling in Liu could significantly transform the role—and threat—of disgorgement in future FCPA dispositions by the SEC.

Similarly, the requirement that disgorged funds be returned to the victims of the fraud is more complicated in the FCPA context. In Liu, the identity of the defrauded investors was clear, making it far easier to direct the collected funds back to the victims. Conversely, identifying the victims of an FCPA violation is less straightforward. Some have argued (including as part of shareholder derivative claims) that the victims are investors who purchase corporate shares without knowledge of activities that are found to violate the FCPA and who then lose money when the violation is uncovered. However, the history of such claims and the inconsistent performance of shares of companies that disclose FCPA-related issues or investigations show that it can be difficult to determine whether investors lost money as a consequence of the circumstances surrounding the potential violation or the related disclosure. The FCPA also has larger public legal and policy goals, including fighting foreign corruption because (as the SEC and DOJ state in the updated edition of the FCPA Guide) such corruption "undermines democratic values and public accountability and weakens the rule of law" and "impedes U.S. efforts to promote freedom and democracy, end poverty, and combat crime and terrorism across the globe." In Liu, the Court left open the question of whether disgorged funds can be deposited into the U.S. Treasury when it is infeasible to return the money to identifiable victims. Going forward, lower courts will have to grapple with this unanswered question as the SEC likely will continue to argue that it remains appropriate to deposit disgorged funds into the U.S. Treasury in such circumstances.

Recent Supreme Court Ruling May Force Changes to IRS Proposed Rules on Tax Deductions for Disgorgement Awards

In May 2020, the Internal Revenue Service (IRS) issued proposed regulations to implement section 162(f) of the Internal Revenue Code, which disallows tax deductions for any amount paid to a government for a violation or potential violation of a law, including the FCPA. Under the proposed regulations, disgorgement awards (which are commonly part of FCPA-related dispositions with the SEC) would not qualify for an exception under section 162(f)(2), which allows deductions for amounts paid as "restitution." However, the Supreme Court's decision in Liu, issued on June 22, 2020, establishes principles related to disgorgement awards that may well require changes to the IRS's proposed regulations before the agency issues the final versions.

In its explanation of the proposed regulations, the IRS points to the Supreme Court's 2017 Kokesh decision as support for its treatment of disgorgement. In Kokesh, the Court held that, for purposes of the relevant statute of limitations, disgorgement awards were to be treated as a penalty because "[t]he primary purpose of disgorgement orders is to deter violations of the securities laws by depriving violators of their ill-gotten gains." Relying on that decision, the IRS reasoned that, because disgorgement awards are intended to punish a violator rather than to restore a victim, they did not fit within its proposed regulatory definition of restitution: "[a]n amount … paid or incurred … that … restores, in whole or in part, the person, … the government; the governmental entity; or property harmed by the violation or potential violation of a law."

However, in Kokesh, the Court explicitly cabined its classification of disgorgement awards as penalties to the narrow statute of limitations question at issue, stating "[n]othing in this opinion should be interpreted as an opinion on whether courts possess authority to order disgorgement in SEC enforcement proceedings or on whether courts have properly applied disgorgement principles in this context." The Court took the opportunity to address the broader question of whether disgorgement awards are a form of equitable relief in the more recent Liu decision. In Liu, Charles Liu and Xin Wang were ordered to disgorge $27 million for defrauding national investors. Liu and Wang contested the authority of the SEC to seek disgorgement as an equitable remedy on the basis that the Court had characterized disgorgement awards as penalties in Kokesh. The Court rejected that argument and held that the SEC can collect disgorgement awards as long as the SEC abides by restrictions traditionally imposed by equity courts to avoid "transforming a profits award into a penalty." Specifically, the Court stated that disgorgement awards are not intended simply to "deny [wrongdoers] the fruits of their ill-gotten gain" but to restore victims, and therefore the SEC should return disgorged funds to the defrauded victims.

The Liu decision presents an issue for the IRS's conception of disgorgement which hinged on the Court's previous language. Because Liu now requires that the SEC distribute disgorgement awards to the defrauded victims, it appears that awards that meet the Liu standards for disgorgement fall squarely within the IRS's proposed definition of restitution as an amount paid to restore the victims of the violation. If that is the case, as with other forms of restitution, taxpayers would be allowed to take tax deductions for the relevant disgorgement awards.

Liu poses an additional wrinkle in the context of FCPA violations. Unfortunately, the Court's Liu decision does not provide clarity on whether FCPA-related disgorgement awards, which are generally deposited with the U.S. Treasury because specific victims are difficult to identify, qualify as "disgorgement" under the revised standards – the Court stated that this remains an "open question."

As a result of the Court's decision in Liu, the IRS will likely need to reconsider both whether disgorgement awards generally fall within its proposed definition of restitution, and whether disgorgement awards with difficult-to-identify victims are an exception within the exception.

International Developments

Supreme Court of Uzbekistan Announces Another Verdict against Gulnara Karimova

On March 18, 2020, the Supreme Court of Uzbekistan announced its decision, made in closed proceedings, in relation to the daughter of the former President of Uzbekistan, Gulnara Karimova (Karimova), and affiliated individuals, finding her guilty in yet another set of allegations including forming an organized crime group, tax evasion, embezzlement, and extortion. Karimova was sentenced to 13 years and four months in prison. This sentence reflects her prior convictions related to her alleged siphoning of $3.9 billion from Uzbekistan.

In February 2020, Karimova presented an open letter to current President of Uzbekistan Shavkat Mirziyoyev emphasizing her readiness to withdraw her claims for her family funds in the sum of $686 million frozen on her Swiss accounts. In addition, she cited her poor health and her willingness to save her family. In her open letter, Karimova also cited numerous procedural violations by the courts and law enforcement authorities in the context of multiple criminal cases against her since February 2014.

On December 6, 2019, the General Prosecutor's Office of Uzbekistan announced that it cooperated with the U.S., Switzerland, France, Russia, and Latvia in relation to the recovery of assets in the sum exceeding $1.5 billion illegally obtained by Karimova.

On March 7, 2019, the U.S. authorities announced their indictment against Karimova related to money laundering offences in connection with her dealings with telecommunications companies, including VimpelCom, Telia Company, and MTS, that settled bribery related allegations with the U.S. and foreign authorities for the total amount of $2.6 billion.

Asian Development Bank Issues Annual Report on Anti-corruption and Integrity