FCPA Summer Review 2024

International Alert

Introduction

While the relatively quiet second quarter of 2024 may add to perceptions that Foreign Corrupt Practices Act (FCPA) enforcement is declining, other data do not necessarily support such a conclusion. For example, there are numerous investigations disclosed over the last few years that have not yet been resolved. One example is RTX Corporation (which includes Raytheon, Pratt & Whitney, and Collins Aerospace), which announced a provision on July 25, 2024, for expected resolutions with the Department of Justice (DOJ) and Securities and Exchange Commission (SEC). RTX expects that in the second half of the year there will be "a deferred prosecution agreement with the [DOJ] and … an administrative order with the SEC to resolve the previously disclosed… investigations into improper payments made by Raytheon Company and its joint venture, Thales-Raytheon Systems, in connection with certain Middle East contracts since 2012." RTX also expects resolutions with the DOJ and Department of State for other issues, with a combined total provision greater than $1.2 billion for all resolutions.

Despite provisions and ongoing investigations, neither the DOJ nor the SEC entered into any public corporate resolutions of FCPA cases this quarter. The last few times this occurred was Q2 of 2017 (although the DOJ did announce some declinations with disgorgement in that quarter) and Q3 of 2013. More recently, although there were resolutions in both Q1 and Q2 2021, we note that there was a five-month stretch without any resolutions from January to June of 2021. Notably, in 2017, the SEC and DOJ still completed 17 corporate resolutions by the end of the year, so one quiet quarter certainly does not necessarily result in a quiet year.

In addition, while headlines in June and early July were dominated by domestic anti-corruption-related developments in the Supreme Court's decision in Snyder v. U.S. and the recent conviction of Senator Robert Menendez (D-NJ), the second quarter of 2024 did produce several significant developments in ongoing cases involving individuals, including further convictions and forfeiture actions involving former and current foreign officials accused of receiving bribes – a focus of the current administration as set out in the U.S. Strategy on Countering Corruption (SCC) that will likely also eventually see new prosecutions under the recently-enacted Foreign Extortion Prevention Act (FEPA) – which was amended without fanfare in July 2024, as noted below. Following a two-week trial, the DOJ secured a guilty verdict involving multiple money laundering and related charges against the former Comptroller General of Ecuador, Carlos Ramón Polit Faggioni (Polit). The DOJ accepted three other guilty pleas this quarter from individuals in cases involving official corruption. In July, the DOJ initiated the trial in U.S. federal court of former Mozambican Finance Minister Manuel Chang, who was extradited from South Africa in 2023 and who faces money laundering charges related to the so-called “Tuna Bonds” scandal that also led to DOJ and SEC resolutions with Credit Suisse (and SEC’s resolution with VTB Capital) in October 2021. In addition, in July the DOJ unsealed charges filed on June 11, 2024, against Julian Aires, alleging a conspiracy to violate the FCPA's anti-bribery provisions. We will cover this development in the next issue. The SEC did not enter any FCPA-related dispositions with individuals this quarter and has not done so since 2022.

The biggest headlines for the quarter, however, arise from the U.S. Supreme Court. In a major setback for the SEC, on June 27, 2024, the Supreme Court issued its decision in SEC v. Jarkesy, holding that the Seventh Amendment of the U.S. Constitution "entitles" defendants to jury trials in any case brought by the SEC for securities fraud that would result in civil monetary penalties. This ruling impacts the SEC's current practice, adopted under the Dodd-Frank Act in 2010, of imposing monetary penalties through its in-house administrative process. The decision is unlikely to affect the SEC's practice of negotiating settlements with corporations or individuals (with the defendants waiving their rights to jury trial as part of the settlement) in FCPA cases, though the decision will likely force any contested SEC enforcement actions into federal courts. The new framework may also convince more future defendants to refuse settlement and fight in court – especially in the case of individuals.

The other notable Supreme Court case related to corruption – Snyder v. U.S., issued on June 26, 2024 – has generated significant discussion regarding corruption enforcement in the U.S., but it likely will not have much impact on FCPA enforcement. In Snyder, the majority held that a federal statute aimed at bribery of U.S. state and local officials – 18 U.S.C. § 666 – does not reach gratuities and instead is limited to circumstances in which a thing of value is given or received pursuant to a quid pro quo agreement, which is a key element required for an offense under federal bribery statutes, including 18 U.S.C. § 201 and the FCPA. Thus, as discussed below, Snyder does not fundamentally alter the approach to FCPA enforcement by the DOJ and therefore does not require companies to change their approach to FCPA compliance. There are also facts in Snyder suggesting that if the same situation were to occur outside the U.S., the prosecutors would be able to consider FCPA charges – certainly under the accounting provisions applicable to public companies, but also potentially under the anti-bribery provisions if the company paying the government official ever sought further business from the relevant government entity.

In Snyder's wake, in-house legal and compliance professionals can expect various questions on the differences between bribery and gratuities, whether the Supreme Court legalized bribery in the U.S., and whether the FCPA prohibits gratuities. The short answers are that gratuities do not have any quid pro quo that is essential to the definition of bribery under U.S. law, that the Supreme Court did not legalize bribery but merely scaled back a specific law for state and local officials working under federal programs (consistent with prior decisions in the Courts of Appeals for the First and Fifth Circuits), and that while the FCPA does not prohibit gratuities, any significant gratuity like the one at issue in Snyder may nonetheless raise risks under the FCPA, as well as liabilities under a variety of laws.

The DOJ and SEC continued to issue public policy pronouncements this quarter, as discussed below, and the DOJ also issued a new pilot program related to potentially culpable individual whistleblowers. There were also several international developments, including new draft guidance from Australian authorities related to that country's "adequate procedures" defense under Australia's anti-corruption laws and various anti-corruption developments in the U.K., Vietnam, Russia and Ukraine.

DOJ and SEC Public Remarks and Updates

Officials from the DOJ and SEC continued to discuss policy matters in public speeches at various events, including their views on how companies should respond to the incentives and expectations established by recent DOJ modifications to corporate enforcement policies.

Most notably, SEC Division of Enforcement Director Gurbir Grewal delivered a May 23, 2024, speech that discussed the "five pillars" of "effective" cooperation that the SEC expects from companies under investigation for various securities law issues, including the FCPA. The speech added some new clarity on SEC expectations and provided commentary on the line between effective advocacy and actions that will create concern at the SEC. We discuss that speech and other SEC developments in the article below.

Per a report in Global Investigations Review, on May 9, 2024, DOJ Fraud Section Chief Glenn Leon highlighted the DOJ's ongoing efforts to use increasingly sophisticated data analytics tools to detect and drive investigations of potential international corruption, as well as other fraud. Leon noted that analytics "are generating leads in the FCPA space" and that DOJ has "dedicated data scientists, data analysts just working on FCPA work." He also referenced the use of artificial intelligence (AI) by the DOJ, though did not provide details. The DOJ's own use of data analytics runs parallel to the DOJ's expectations, as set out in the 2023 version of DOJ's guidance on the Evaluation of Corporate Compliance Programs, that companies employ data analytics tools and techniques to identify risks and monitor compliance program effectiveness.

As we have noted, while these public statements do not necessarily reflect regulatory guidance, nor do they have binding effect on the agencies' actions, they provide insights into the DOJ's and SEC's expectations for responsible corporate behavior.

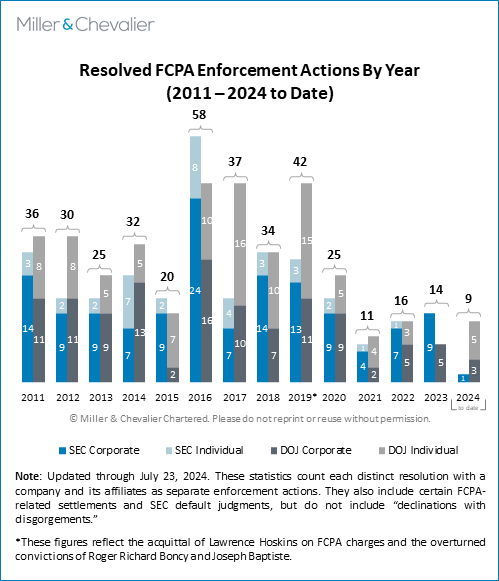

Corporate Enforcement Actions

With no change in Q2 2024, the year-to-date number of resolved enforcement actions has remained the same with seven resolutions – including both corporations and individuals – as of the end of the quarter. The pace for the year is on track to land somewhere between the numbers for the years 2021 and 2022, which saw a total of six and 12 corporate resolutions, respectively.

As we have discussed, there is evidence of numerous ongoing investigations based on past corporate disclosures. Also, as always, we note that many factors underlie the timing of case dispositions, and thus changes in quarterly levels of output should not be read as longer-term indicators.

Enforcement Actions Against Individuals

There were developments in several announced DOJ cases involving individuals this quarter, including, the aforementioned conviction at trial of former Ecuadorian Comptroller General Carlos Ramón Polit Faggioni and a guilty plea from Gary Oztemel in advance of the expected trial against him and his brother Glenn. Q2 2024 also saw two corruption-related sentencings – both involving persons tied to larger investigations. The DOJ unsealed charges in July 2024 against Julian Aires, alleging a conspiracy to violate the FCPA's anti-bribery provisions, which we will address in the upcoming Autumn Review. The SEC did not announce any FCPA-related actions against individuals this quarter, continuing a trend dating back to 2022.

While the SEC was quiet with regard to enforcement against individuals, the DOJ secured one conviction and three guilty pleas for corruption-related charges, involving two individuals extradited from Europe, a former Ecuadorian government official living in the U.S., and an American businessman.

- Former Ecuadorian Comptroller General Convicted in Two-Week Long Trial: On April 23, 2024, a federal jury in South Florida entered a guilty verdict against Polit for his involvement in a multi-million-dollar money laundering and bribery scheme related to Brazilian construction firm Odebrecht. The DOJ alleged that Polit received bribes exceeding $10 million in the Odebrecht scheme and also accepted bribes to assist other companies in doing business with the state-owned insurance company Seguros Sucre (various corporate resolutions related to Seguros Sucre are covered in our Winter 2024 Review). Polit had strong ties to Florida, allegedly using the proceeds to acquire and improve property there, and he was arrested at a condominium he owned in the Miami area in March 2022.

- Argentinian/Swiss Banker Pleads Guilty to Money Laundering in PDVSA Scheme: On May 14, 2024, Argentinian banker Luis Fernando Vuteff pleaded guilty to one count of conspiracy to commit money laundering and agreed to forfeit approximately $4 million in ill-gotten proceeds, after being extradited from Switzerland in 2022. Vuteff and a co-conspirator – both of whom worked at Swiss-based financial asset management firm Aquilla Swissinvest – were indicted in 2022 related to an alleged $1.2 billion bribery and money laundering scheme involving Venezuela's state-owned energy company Petróleos de Venezuela, S.A. (PDVSA).

- Swiss-Portuguese Banker Pleads Guilty to FCPA Conspiracy Charge After Extended Litigation and Is Sentenced to Time Served: On May 21, 2024, Swiss-Portuguese banker Paulo Jorge Da Costa Casqueiro Murta pleaded guilty to a conspiracy to violate the FCPA in connection with a Venezuela bribery scheme (a different scheme than Vuteff's). This plea resolves an extended effort by the DOJ that started with Murta's extradition from Portugal in 2021 and involved multiple appeals to the Fifth Circuit following district court dismissals. The district court judge sentenced Murta to time served (nine months in prison) and forfeiture of $105,000, although the DOJ sought a sentence of five years.

- Connecticut-Based Businessman Pleads Guilty to Money Laundering Prior to Trial on FCPA and Related Charges: Prior to an expected trial this fall, the DOJ announced that businessman Gary Oztemel pleaded guilty on June 24, 2024 to one money laundering count, resolving various FCPA and other charges. The charges related to transactions involving Brazilian state-owned oil enterprise, Petróleo Brasileiro SA (Petrobras) and Oztemel's brother, Glenn Oztemel, formerly a Connecticut-based oil trader at Freepoint Commodities LLC (Freepoint). After the DOJ secured the guilty plea of brother Gary, Glenn Oztemel is scheduled to stand trial later this year. We covered the DOJ's resolution with Freepoint in our Winter 2024 Review.

There were two other sentencings this quarter following guilty pleas entered several years ago. A former employee of a PDVSA subsidiary, Cesar David Rincon Godoy, was sentenced in May to time served and forfeiture of $1.2 million, after spending six months in custody and serving approximately six years of house arrest following his extradition from Spain and guilty plea in 2018. Luiz Eduardo Andrade, an intermediary involved in the payments covered by the 2020 corporate resolution by Sargeant Marine, Inc., was sentenced to one year of probation and forfeiture of $140,000. Andrade pleaded guilty to conspiracy to violate the FCPA in 2017.

Forfeiture Actions

Regarding other enforcement actions related to individuals, we also note that on June 26, 2024, the DOJ announced an agreement with Jho Low, the intermediary/agent involved in the Goldman Sachs FCPA resolution and the larger 1MDB scandal in Malaysia and elsewhere, which we summarized in our Winter 2021 Review. Low has evaded detention, and his exact location is currently unknown, although various press reports indicate that that the Malaysian government believes he is in Macau, China. The DOJ stated that the agreement included "Jho Low, members of his family, and trust entities Low established," and the agreement would see more than $100 million in assets returned to Malaysia. The assets – located in Switzerland, Hong Kong, Singapore, and an apartment in Paris – notably include paintings by Claude Monet and Andy Warhol. Under the agreement, the DOJ would permit more than $3 million to be released for legal fees and other costs related to the assets. Earlier in June, the DOJ announced that it was returning another $156 million to Malaysia following other forfeiture actions, stating that the DOJ had returned or assisted in the return of more than $1.4 billion to Malaysia, of the more than $4 billion in losses believed to have resulted from the scheme. Low continues to face charges in the U.S. and Malaysia.

In another forfeiture action, the DOJ sought to seize an apartment in Trump Tower in New York City, alleging that the apartment – purchased for $7.1 million in 2014 – was a vehicle for laundering proceeds from corrupt payments to the President of the Republic of Congo, Denis Sassou Nguesso. The complaint alleges that the Brazilian conglomerate Asperbras Group, owned in part by brothers Jose and Francisco Colnaghi, made corrupt payments via Portuguese businessman Jose Veiga, which enabled the purchase of the apartment. The complaint alleges that an Asperbras entity invoiced the Congolese government for more than $600 million for construction of 12 hospitals. Once the amount was received, Veiga established shell companies – ultimately owned by President Sassou Nguesso, according to the complaint – which in turned entered into contracts with entities controlled by the Colnaghi brothers. These offshore companies then allegedly received tens of millions from the Colnaghi brothers' entities. Subsequently, according to the DOJ, Veiga worked with a large U.S. law firm to establish a U.S. entity and purchase the apartment in Trump Tower using a portion of the proceeds in the various offshore entities controlled by Sassou Nguesso.

Notably, the complaint alleges that the application to the Trump International Management Corporation said the occupant would be Claudia Lemboumba (the full name of the president's daughter is Claudia Lemboumba Sassou Nguesso). According to Global Investigations Review, Veiga – through the firm Pryor Cushman – has challenged the complaint's allegations of corruption and asserted ownership to the apartment. Global Witness published an article on the apartment and concerns regarding Viega in 2019, indicating that Viega – formerly affiliated with soccer club S.L. Benfica – had been arrested by Portuguese authorities in a separate investigation, then released, but remained under investigation at that time, also related to corruption in the Republic of Congo.

Earlier in March 2024, the DOJ also announced that it was seeking to seize two other properties at the southern end of Central Park in New York City, alleging that the two properties were obtained by Mongolia's former Prime Minister Sukhbaatar Batbold through corrupt transactions. In particular, the DOJ alleges that while Batbold was prime minister, Mongolia awarded a $68 million mining contract to a company "he owned through trusted intermediaries," even though the company had no mining experience or operational history, and that funds were then diverted through shell companies to purchase real estate in New York for the use of Batbold and his family.

Other Indicia of Enforcement Trends, Including Investigation-Related Announcements

In the second quarter, there were no announcements of new FCPA investigations. BIT Mining Limited (formerly known as 500.com), a public company, announced in its annual report an accrual of $10 million of for potential penalties related to DOJ and SEC investigations into their operations in Japan. BIT Mining previously stated in SEC filings that it was negotiating a penalty that would take into account the company's financial position and its ability to pay.

Several companies formally concluded their FCPA-related DPAs and related investigations during the quarter. On April 19, 2024, the DOJ formally moved to dismiss the indictment against Beam Suntory, Inc., following the expiration of the company's DPA in October 2023. On April 26, the DOJ filed a motion to dismiss the information related to the DPA involving Goldman Sachs, which expired by its terms on October 21, 2023. In a 10-Q filing released on May 1, 2024, Herbalife Ltd. stated that, "[o]n February 28, 2024, the DOJ determined that [Herbalife] has complied with its obligations under the DPA and filed a motion to dismiss the action" and that "[t]he Court subsequently dismissed the deferred charge with prejudice on February 29, 2024." Finally, on June 3, 2024, Swedish telecom Ericsson announced the "conclusion of the work and the term of the Independent Compliance Monitor," which was originally appointed in June 2020 following a December 2019 deferred prosecution agreement. The press release stated that the monitor had certified in March that Ericsson's compliance program was meeting the required elements and "functioning effectively," while also announcing that the plea agreement between Ericsson and the DOJ in March 2023 had also expired.

Policy and Legislative Developments

The DOJ's announcement on March 7-8, 2024, of a new pilot program that would establish rewards for whistleblowers who bring information on corporate misconduct implicating the FCPA and other laws suggested that the formal policy would be issued in early June, but it appears that there are complications that are delaying the public release. Media sources have quoted at least one DOJ official who noted the difficulties in balancing the DOJ's interest in incentivizing whistleblowers to come forward with new information with companies' interests in receiving such information from employees internally as part of an effective compliance program.

Meanwhile, Main Justice established a program for providing non-prosecution agreements (NPAs) for potentially culpable individuals who bring original information about FCPA violations (and other crimes) to the DOJ, formalizing the DOJ's existing informal practice. This program follows similar programs from the Southern District of New York (SDNY) and elsewhere, although those programs were not able to include FCPA violations in their scope, because Main Justice has priority for FCPA enforcement.

The U.S. government continues to designate foreign officials and related persons and companies as subject to economic sanctions and visa/immigration restrictions under the Global Magnitsky Human Rights Accountability Act and other statutory and regulatory authorities for acts of corruption. On June 11, 2024, the Department of the Treasury (Treasury) sanctioned several members of "one of Guyana's wealthiest families," companies owned by such persons, and a Guyanese official – including adding them to Treasury's Office of Foreign Assets Control's (OFAC) Specially-Designated Nationals (SDN) List – for "public corruption" and "abuse of Guyana's gold industry." The Treasury release stated that relevant persons "bribed customs officials to falsify import and export documents, as well as to facilitate illicit gold shipments" and provided money and gifts to various officials for favorable consideration or the award of government contracts and "to ensure favorable treatment in criminal or civil matters that would otherwise suggest their involvement in illegal criminal activity." Guyana's current Permanent Secretary of the Ministry of Labor was named and sanctioned for their involvement in these alleged schemes.

In July 2024, Congress quietly amended the recently enacted FEPA, which is designed to facilitate prosecution of foreign government officials for their roles in demanding or accepting bribes from companies or persons subject to the FCPA. While the amendments are categorized as technical, there are some significant changes to the scope of the law, including as to jurisdiction, the definition of a foreign official under the law, and how the key aspect of a quid pro quo is defined. In general, the changes bring FEPA's language closer to equivalent language and concepts in the FCPA.

Court Cases

The Jarkesy and Snyder Supreme Court decisions are the most notable court cases this quarter, but there were other litigation developments worth mentioning.

On April 22, 2024, a federal district court judge in New York approved a settlement between oilfield services provider Tenaris S.A. and plaintiffs in a securities-related action alleging various securities laws violations by the company and its former chief executive officer (CEO) and chief financial officer (CFO). The settlement involved a payout of $9.2 million to the class. The allegations made by the plaintiffs centered on disclosures related to an investigation of the former CEO by Argentine authorities that included allegations of fraud and corruption. We discuss the case in more detail below.

In other related U.S. litigation developments, on April 12, 2024, rapper Pras Michel lost his motion for judgment of acquittal under Federal Rule of Criminal Procedure 29; Michel had filed the motion following his conviction at trial in April 2023 on various criminal charges. Michel's case is an offshoot of the massive 1MDB corruption matter, which continues to spin out multiple issues and developments, including the forfeiture action related to Jho Low noted above.

International Developments

In late April 2024, as required by Australia's Combatting Foreign Bribery Act, the Office of the Attorney General of Australia published a "draft guidance on adequate procedures to prevent the commission of foreign bribery" to solicit comments from relevant stakeholders on the attorney general's views regarding what elements of an anti-corruption compliance program are critical for companies to invoke the adequate procedures defense. The draft lists five "main indicators" of an effective program and provides details and hypotheticals to illuminate the attorney general's positions. We discuss the draft guidance below.

On April 18, the U.K. Serious Fraud Office (SFO) announced its updated "strategy" for 2024-2029 – the first under new Director Nick Ephgrave. Among the commitments noted are a focus on improved use of technology by the SFO and its investigators, "[e]xplor[ing] incentivisation options for whistle blowers," "[c]ontinuing to push for a disclosure regime that is fit for today's challenges," and "[s]trengthen[ing] our operations through the deployment of new powers such as the new 'failure to prevent fraud' offence."

In other U.K. developments, the former chief of staff to Madagascar's president, Romy Andrianarisoa, was sentenced to more than three years in prison after her conviction earlier this year for soliciting bribes from Gemfields, as covered in our Spring 2024 Review. Her associate, French businessman Philippe Tabuteau, was sentenced to more than two years in prison after he pleaded guilty prior to trial. The SFO also indicated in public filings that it has sought approval to bring charges against various individuals related to Glencore's resolutions in the U.K. (as noted in our Winter 2023 Review), the U.S. (as reported in our Summer 2022 Review), and elsewhere. The U.K. also imposed sanctions on three high-ranking Ugandan officials, including the Speaker of Parliament, which are related to current protests in Uganda.

In Vietnam, businessperson (or real estate tycoon, according to the Washington Post) Truong My Lan was sentenced to death in April 2024 for charges relating to embezzlement and bribery, among others, for "siphoning" more than $12 billion from a bank and paying off regulators. This sentence was issued amid an anti-corruption wave in Vietnam referred to as "blazing furnace," which has seen both the president and the head of Vietnam's parliament resign in March and April this year.

While the Russian invasion of Ukraine continues, both governments have announced high-profile changes based on corruption issues. In Ukraine, Farm Minister Oleksandr Solskyi was arrested and charged with corruption in April 2024, then released on bail. He subsequently offered his resignation, which was accepted. In Russia, Defense Minister Sergei Shoigu was moved to another position in May, Deputy Defense Minister Timur Ivanov was detained on bribery charges in April, and another senior defense official, Lt. General Yury Kuznetzov, was arrested for bribery in May.

Finally, on June 19, 2024, the Organisation for Economic Cooperation and Development (OECD) Working Group on Bribery announced it had selected Canada's Director of Public Prosecutions, Kathleen Roussel, as its new Chair, commencing in October 2024.

Enforcement Against Individuals

Former Comptroller of Ecuador Found Guilty in Money Laundering and Bribery Scheme

On April 23, 2024, a federal jury in South Florida entered a guilty verdict against Carlos Ramón Polit Faggioni (Polit), the former Comptroller General of Ecuador, for his involvement in a multi-million-dollar money laundering and bribery scheme. The verdict came after a two-week trial.

According to the DOJ's press release, from 2010 to 2015, Polit, in his role as Comptroller General of Ecuador, "solicited and received over $10 million" in bribes from Brazilian construction company Odebrecht S.A. Odebrecht allegedly paid the bribes in exchange for fine exemptions on the company's projects in Ecuador. Odebrecht previously pleaded guilty in December 2016 to conspiracy to violate the FCPA after paying nearly $800 million in bribes to public officials in Ecuador and 11 other countries, including Brazil.

Apart from the Odebrecht bribes, the DOJ press release states that Polit also accepted a bribe from an Ecuadorian businessman in 2015 to assist the businessman with obtaining contracts with Ecuador's state-owned and controlled insurance company, Seguros Sucre S.A. Though not explicitly stated in available documents, this aspect of the case may have been tied to evidence obtained by the DOJ in other matters involving the Ecuadoran insurer that have resulted in several corporate and individual dispositions, as discussed in our FCPA Winter Review 2024.

From 2010 to 2017, Polit directed one of his co-conspirators to hide the proceeds of their bribery scheme by using Florida companies registered under the names of friends and associates, frequently without their knowledge. The DOJ alleged that Polit and others used these funds "to purchase and renovate real estate in Florida." As reported by the Miami Herald, Polit was arrested in March 2022 in Florida, where he owned and resided in a condominium near the Miami River.

At trial, the jury convicted Polit on three counts of "money laundering involving concealing proceeds of specified unlawful activity," two counts of engaging in transactions in criminally derived property, and one count of conspiracy to commit money laundering. Polit faces a potential maximum penalty of several decades in prison and his sentencing hearing is currently set for September 4, 2024. In the meantime, Polit has filed motions both for acquittal and a new trial that are pending as of the date of publication.

Argentinian Financier Luis Fernando Vuteff Pleads Guilty to PDVSA Money Laundering Conspiracy

On May 14, 2024, Argentinian banker Luis Fernando Vuteff (Vuteff) pleaded guilty to one count of conspiracy to commit money laundering before the U.S. District Court for the Southern District of Florida. As previously reported, Vuteff was indicted in July 2022 — alongside alleged co-conspirator and Swiss national Ralph Steinmann — for his role in an alleged $1.2 billion bribery and money laundering scheme involving Venezuela's state-owned energy company PDVSA. Vuteff and Steinmann are both former managers of Swiss-based financial asset management firm Aquilla Swissinvest. As indicated in court records, Vuteff was extradited from Switzerland to the U.S. in 2022.

In a factual proffer accompanying the plea agreement, Vuteff stipulated facts describing his involvement in the PDVSA scheme. From approximately 2012 through 2018, Vuteff laundered proceeds of a foreign currency exchange scheme flowing from loan contracts with PDVSA obtained through bribes and kickbacks. In furtherance of the scheme, Vuteff and Steinmann created a Hong Kong shell company, Eaton Global Services Limited (Eaton), and opened several European bank accounts. Through one of the currency exchange loan schemes, Vuteff's co-conspirators were able to exploit the Venezuelan government's fixed foreign currency exchange rate, yielding the equivalent of $550 million in profits. Significant portions of these profits were paid as bribes to Venezuelan officials in exchange for enabling Eaton to obtain the loan contracts in question. The proffer noted that these officials included Carmelo Antonio Urdaneta Aqui (Urdaneta), "former Legal Counsel [to] the Venezuelan Ministry of Oil and Mines," and Alvaro Ledo Nass (Nass), "former PDVSA General Counsel."

To facilitate payments to Urdaneta and Nass, Vuteff and his co-conspirators took steps "specifically designed to" circumvent likely "Know Your Customer" scrutiny from banks, including the use of a Spanish commercial real estate company to conceal payments intended for Urdaneta. The proffer states that Vuteff also transferred more than $9.5 million to U.S. bank accounts, including accounts belonging to "an aircraft title services company in Oklahoma City" and a "yacht company in Miami."

Under the plea agreement, Vuteff agreed to forfeit the value of his ill-gotten gains, which amount to over $4 million. He could be sentenced to up to 10 years in prison and a maximum fine of $250,000, or twice the amount gained from the illicit transactions, whichever is greater. Vuteff's sentencing is set for August 1, 2024. Other individuals implicated in the scheme, including Urdaneta and Nass, have already been prosecuted and sentenced for their respective crimes. Steinmann's case, however, was designated with fugitive status in December 2023 and has not progressed any further.

Swiss-Portuguese Banker Paulo Jorge Da Costa Casqueiro Murta Pleads Guilty to FCPA Conspiracy Violation

On May 21, 2024, Swiss-Portuguese banker Paulo Jorge Da Costa Casqueiro Murta (Murta) pleaded guilty to a conspiracy to violate the FCPA in connection with a Venezuela bribery scheme. The plea agreement ends a years-long effort by the DOJ Fraud Section to prosecute Murta for FCPA-related crimes—an effort that has yielded multiple dismissals, appeals to the Fifth Circuit, and subsequent recusal and reassignment of district court judges. As noted in court documents, Murta was extradited to the U.S. from Portugal in 2021. Judge Kenneth Hoyt dismissed the charges against Murta on two separate occasions, each of which was remanded by the Fifth Circuit. The first dismissal was based on arguments first advanced by Daisy Rafoi-Bleuler (who was then and continues to be represented by Miller & Chevalier), which led to Judge Hoyt's dismissal of the charges against Ms. Rafoi-Bleuler in 2021.

According to the plea agreement, between 2011 and 2013, Murta served as General Manager of Swiss Company B, a Swiss wealth management company. Murta used his position and banking contacts to facilitate a scheme between officials from state-owned energy company PDVSA – including Rincon Godoy, whose sentencing is detailed below – and two U.S.-based businessmen, Abraham Jose Shiera Bastidas (Shiera) and Roberto Enrique Rincon Fernandez (Rincon), whose businesses provided services to PDVSA. The PDVSA management team solicited bribes and kickbacks from Rincon and Shiera in return for preferential treatment of their businesses, including payment priority and assistance winning PDVSA contract bids. For all payments Rincon and Shiera received from PDVSA, 10 percent was diverted to the PDVSA management team. In furtherance of this scheme, Murta and his co-conspirators set up an elaborate network of bank accounts and financial structures to facilitate the bribe payments. To disguise the payments, Murta and his co-conspirators transferred funds to a host of recipients including companies, intermediaries, relatives, friends, creditors, and close personal associates of the PDVSA officials. Murta traveled to Miami and Dubai to meet with his co-conspirators about the scheme and communicated with them via email and messaging services. The plea agreement stipulates that approximately $25.9 million in bribes was paid through the bank accounts that Murta set up.

Shortly after the plea agreement was entered, Judge Gray Miller of the U.S. District Court for the Southern District of Texas issued Murta's sentence. While prosecutors argued for a five-year sentence in their sentencing memorandum, Murta was ultimately sentenced to time served. According to Murta's sentencing memorandum, he had already spent nine months in custody and four months in home confinement, which exceeded the sentences issued to comparable defendants. Under the plea agreement and subsequent money judgment issued by the court, Murta is also required to forfeit $105,000.

Connecticut Businessman Gary Oztemel Pleads Guilty to Role in $30M Bribery Scheme Involving Petrobras

On June 24, 2024, Connecticut-based businessman Gary Oztemel pleaded guilty to one count of engaging in a monetary transaction involving criminally derived property. Originally, Oztemel was also charged with counts of conspiracy to violate the FCPA, money laundering conspiracy, and the concealment of money laundering, all of which were dismissed under the plea agreement. The transaction at issue was related to an alleged bribery arrangement involving Brazilian state-owned oil enterprise, Petrobras, and Oztemel's brother, Glenn Oztemel, a Connecticut-based oil trader at Freepoint Commodities LLC (Freepoint). Glenn Oztemel is expected to stand trial later this year. As we previously reported, Freepoint reached a three-year DPA with the DOJ in December 2023 for its alleged role in the bribery scheme—under which the company paid a nearly $50 million in criminal penalty and $30.5 million in administrative forfeiture. In August 2023, the Oztemel brothers and intermediary Eduardo Innecco were indicted as co-defendants in the U.S. District Court for the District of Connecticut, after an initial indictment in February 2023 included only Glenn Oztemel and Eduardo Innecco. The alleged bribe recipient, former Petrobras official Rodrigo Berkowitz, pleaded guilty to money laundering conspiracy before the Eastern District of New York in February 2019 (as discussed in Winter 2021 FCPA Review).

In the superseding indictment, the U.S. government alleged that between 2010 and 2018, Gary Oztemel used two of his U.S.-based businesses to funnel bribes to Petrobras officials in exchange for "confidential information related to Petrobras's business," including competitor price information. The indictment states that Gary Oztemel relayed this information to his brother who subsequently used it to gain "improper commercial advantage[s]" for and on behalf of Freepoint, which amounted to over $30 million in illicit gain. In order to conceal the scheme, the Oztemel brothers, Inecco, and their co-conspirators are alleged to have used encrypted messaging platforms and coded language. Moreover, they allegedly moved funds through offshore accounts and shell companies.

Proceedings against Glenn Oztemel and Innecco are ongoing. Glenn Oztemel is scheduled to stand trial in September 2024. Notably, counsel has not yet appeared in federal court on behalf of Innecco, who is reportedly challenging extradition from France, according to press reports and court filings. As for Gary Oztemel, his sentencing is currently scheduled for September 16, 2024. Gary Oztemel faces up to 10 years in prison, three years of supervised release, and a maximum fine of $250,000.

Former Venezuelan Official Sentenced to Time Served and Forfeiture for Receiving Bribes After Guilty Plea More Than Six Years Ago

On May 21, 2024, Cesar David Rincon Godoy (Rincon), the former general manager of Bariven, S.A., a subsidiary of PDVSA, was sentenced to time served and ordered to forfeit approximately $1.2 million from a bank account at a shell company he controlled. Rincon had previously pleaded guilty to a money laundering conspiracy charge in 2018. According to Global Investigations Review, the sentencing took into account the six months Rincon had already spent in custody and the six years he had spent in house arrest after he pleaded guilty to a money laundering conspiracy charge on April 19, 2018.

Although the court's sentencing memorandum is currently under seal, Rincon filed a sentencing memorandum on May 16, 2024, arguing for a non-custodial sentence, emphasizing that the "punishment in this case began years ago." The U.S. government also issued a redacted sentencing memorandum, filed on May 30, 2024, arguing for an increase in base offense level and an incarceration sentence. Although Rincon argued that he should not be considered a public official, the government disagreed, arguing that his role as the general manager of Bariven placed him "in a position of trust" and gave him "decision-making responsibility" in a "state-owned and state-controlled company." However, the U.S. government did credit Rincon with substantial assistance in the DOJ's investigations of PDVSA, although the details are redacted. That being said, we know from public records that the DOJ pursued convictions of several PDVSA officials in the same or similar schemes, in addition to Rincon. Judge Gray Miller in the District of Southern Texas ruled on the sentence for Rincon.

The DOJ originally reported the October 2017 arrest and extradition of Rincon from Spain to the U.S., and later detailed that he pleaded guilty to using his official capacity to solicit and receive bribes from U.S. energy company owners and laundering approximately $7 million in proceeds. The DOJ asserted that he received bribes from – among others – U.S.-based businessmen Roberto Enrique Rincon Fernandez (Roberto Rincon) and Abraham Jose Shiera Bastidas (Shiera), who previously pleaded guilty to FCPA charges.

Roberto Rincon was sentenced to 18 months in prison, minus time served, and one year of supervised release, while Shiera was sentenced to 12 months in prison, 12 months supervised release, and a fine of $6,269.

Intermediary Luiz Eduardo Andrade Sentenced for FCPA Conspiracy Guilty Plea from 2017

On May 23, 2024, U.S. Eastern District of New York Judge Eric Vitaliano sentenced Luiz Eduardo Andrade to one year of probation and ordered forfeiture of $140,000. Andrade was an intermediary working for Sargeant Marine, Inc. (SMI). According to the information filed against Andrade, Andrade engaged in several overt acts in a scheme in which SMI made payments to Petrobras officials, including sending more than $50,000 to a Marshall Islands entity and signing backdated documentation. The sentencing memorandum is currently under seal.

We previously reported that Luiz Eduardo Andrade pleaded guilty on September 22, 2017, to one count of conspiracy to violate the FCPA in connection to SMI's bribery scheme and that SMI pleaded guilty to violate the anti-bribery provisions of the FCPA and agreed to pay a fine of $16.6 million in September 2020. Andrade was one of multiple people who pleaded guilty in relation to the scheme, including SMI employees, Petrobras officials, and intermediaries such as Andrade.

Policy and Legislative Developments

SEC Enforcement Director Details "Effective Cooperation" in West Coast Speech

Following various recent DOJ enforcement policy updates and related discussions about what constitutes "full" or "extraordinary" cooperation under the DOJ programs, Gurbir Grewal, Director of the SEC's Division of Enforcement, provided some guidance on what the SEC considers to be "effective" cooperation in a speech during the Securities Enforcement Forum West conference on May 23, 2024. Grewal emphasized the importance of cooperation during SEC investigations as a mutually beneficial approach for the SEC and companies that want to address misconduct, promoting various benefits for companies that cooperate. He noted that the SEC "may recommend bringing reduced charges" or "reduced or even zero civil penalties," or the SEC "may decline to recommend charges altogether," for parties that cooperate with the SEC during investigations. Grewal also noted that in a situation that may otherwise reflect unfavorably on a company, SEC public statements regarding cooperation can offer an important reputational boost. Finally, Grewal stated that cooperating with an investigation leads to greater efficiency, allowing the SEC to resolve investigations more quickly, which ensures that the "cloud of investigation doesn't hang over an entity or an individual for longer than necessary."

"The Five Principles of Effective Cooperation"

Rather than introducing new policies, Grewal's speech – entitled the "Five Principles of Effective Cooperation in SEC Investigations" – built on and clarified SEC policies on cooperation that have been articulated for more than two decades, starting with the 2001 Seaboard Report, in which the SEC explained its decision not to bring civil charges against Seaboard and thereby established a framework for evaluating corporate behavior during an investigation. Versions of this guidance are also articulated in the SEC's Enforcement Manual and 2010 Policy Statement on cooperation by individuals. Grewal's articulation of five principles — (1) self-policing, (2) self-reporting, (3) remediation, (4) cooperation, or more specifically cooperation that is "above and beyond" what is legally required, and (5) collaboration — establish the basis for the SEC's assessment of whether an entity will receive cooperation credit. While the fifth principle, collaboration, is new – at least as a standalone item – the first four principles stem from the 2001 Seaboard Report.

Self-Policing. Director Grewal's speech emphasized that self-policing should occur "well before the SEC becomes involved" in an investigation. The speech includes several concepts within its "self-policing" framework, including the creation of a "culture of compliance" that is established by those at the top and recognized throughout the organization and "staying up-to-date on developments and risks." Grewal noted that having "appropriate safeguards in place" can help demonstrate to the SEC that any misconduct that did occur was a rogue incident rather than a reflection of an institutional problem.

Overall, "self-policing" as conceptualized in Grewal's speech in essence is an exhortation for companies to implement effective compliance programs – a recent focus of DOJ guidance. One noteworthy aspect of staying "up-to-date" emphasized by the speech is "keep[ing] pace with technological advances that affect your business" (including AI) and being ready to modify compliance policies and practices to address these advances as they occur. This emphasis on technological issues aligns with the DOJ's recent focus on data analytics and companies' management of business data on personal devices and third-party apps. For example, in March of 2023, DOJ updated its guidance on the Evaluation of Corporate Compliance Programs to reflect its expectation that businesses will not only have policies governing how work-related information must be used and stored on personal devices, but also ensure those policies are being consistently enforced.

Self-Reporting "Without Delay." Grewal called on public companies to report possible relevant misconduct to the SEC and to do so quickly, even if the companies do not yet "know all the facts" or are not yet certain whether a violation occurred. Such reporting, according to Grewal, indicates self-policing and "a culture of proactive compliance," whereas not reporting at all "raises questions about [a company's] supervisory systems and compliance function." Prior to Grewal's speech, Law360 published an interview with him in which he cited self-reporting as the "most important factor" considered by the SEC's enforcement staff when assessing cooperation and determining the imposition of penalties. In the interview, Grewal noted that voluntary self-disclosure has been a commonality across recent SEC cases that have been resolved with no penalties and that parties with self-reported misconduct have faced significantly lower penalties compared to parties whose misconduct was discovered during an SEC investigation.

That being said, Grewal acknowledged that SEC practices and rules make it "more difficult… to spell out what specific benefits corporations may receive for specific cooperative actions." Indeed, the SEC does not have clear public guidelines on how civil penalties and disgorgement are calculated, nor does the SEC publish specific guidance on how self-reporting may contribute to a reduction of fines.

Grewal's emphasis on timeliness in self-reporting is consistent with the DOJ's recent emphasis on early self-reporting in their revised 2023 Corporate Enforcement and Voluntary Self-Disclosure Policy, discussed in this alert. In a further example highlighting some of the differences in the two agencies' approaches to the issue, a recent article in Global Investigations Review compared comments made by DOJ and SEC officials at a conference on self-disclosure in the context of mergers and acquisitions (M&A). The DOJ official provided details on the DOJ's October 2023 M&A Safe Harbor policy, which provides benefits to companies for self-reporting potential violations within six months of a transaction closing, along with taking other prescribed actions. The SEC official noted that the SEC expects disclosures to occur "as soon as possible" and weighs the timeliness of disclosures and remediation efforts in their decisions about whether or not to pursue enforcement actions – but did not give the same level of specificity as the DOJ.

Remediation. According to Grewal, to obtain favorable SEC credit, remediation efforts must follow a voluntary disclosure. He noted that "certain remedial measures… are applicable to any number of situations," including disciplining actors involved in misconduct, conducting trainings on the compliance issues implicated in potential misconduct, and "strengthening relevant internal controls and [compliance] policies and procedures." Paralleling similar public statements and policies from the DOJ, Grewal said that remediation must be "timely," "proactive," and "meaningful" to be credited as a sign of effective cooperation.

"Above and Beyond" Cooperation. While there is some confusion in treating cooperation as a pillar of effective cooperation, this stems from the Seaboard Report, which established a principle recognizing companies that "otherwise cooperate" in addition to self-policing, reporting, and remediating. Grewal emphasized that cooperation by companies under SEC investigation should "go above and beyond what's legally required – more than simply complying with subpoenas without undue delay or gamesmanship." Grewal offered examples of how companies can guide SEC investigators by providing guidance on potentially responsive documents and helping to formulate relevant discovery requests, which he noted "prevent[s] overly broad document requests on our end and document dumps on your end, thereby ensuring that our requests get us the information we need to complete our investigation." Grewal also cited providing witness-related information and assistance and offering findings from any internal investigations related to the conduct under investigation as additional examples. According to Grewal, these practices "have resulted in meaningful cooperation credit in recent Commission orders." These standards parallel DOJ expectations on cooperation during investigations.

Collaboration. Finally, Director Grewal encouraged "collaborat[ing] with Enforcement Staff early, often, and substantively" as a fifth principle of effective cooperation. He stated that collaboration is based on timely, frequent, and substantive communication between the SEC and the party being investigated, emphasizing that "[t]he frequency and format of these communications…may change over the lifespan of an investigation." Grewal further noted that such collaborative communication efforts may help companies to "establish credibility with the staff" related to the staff's efforts "to assess the reasonableness of a party's response" as the investigators receive information from multiple sources.

Other Statements

Near the end of his speech, Grewal acknowledged that effective cooperation does not preclude "zealous advocacy" or "good faith conversations" about the merits of a case. Grewal emphasized, however, his view that the SEC must feel that a company has a "shared goal" with the SEC, which is "to determine whether or not violations have occurred, and, if they have, to punish violative conduct and improve compliance." He asserted that there is no room for "dilatory tactics" or "gamesmanship" (his second use of this word in the speech, which he leaves otherwise undefined).

Overall, while many of Director Grewal's statements align with recent DOJ policy guidance, the speech and related SEC policies do not clearly define the benefits that companies can obtain by following his five principles. While "meaningful" cooperation credit is offered as a possibility, the specific conditions of cooperation and concrete benefits are left undefined; the SEC is not offering any presumptions of declining to pursue charges under certain conditions as the DOJ does in its current Corporate Enforcement Policy. Thus, the speech is unlikely to fundamentally reframe corporate discussions on the benefits and risks of disclosing potential misconduct to and cooperating with the SEC.

SEC Revises Internal Policies on Staff Use of Text Messaging and Third-Party Messaging Applications

We also note that in keeping with its heightened scrutiny of the use of mobile phones and third-party messaging platforms for work-related communications by employees and agents of public companies regulated by the SEC, the SEC recently blocked the use of third-party messaging applications, SMS, and iMessage by its own employees. Bloomberg reported that the SEC blocked third-party messaging applications on agency-issued phones in September of 2023, and in February 2024 disabled text messaging on most staff phones.

The SEC has reached settlements with financial firms that include fines totaling approximately $3 billion in the wake of allegations that the firms' use of mobile phone messaging applications, such as Signal and WhatsApp, caused inadequate record-keeping of work-related communications. The SEC and DOJ have both encouraged companies to assess risks and adopt appropriate policies that favor retention of corporate communications by company personnel using third-party messaging applications.

DOJ Corporate Whistleblower Pilot Program Still Not Finalized; DOJ Offers NPAs to Cooperating Culpable Witnesses Who Disclose New Information

At the end of the second quarter of 2024 (and as of the date of this publication), the DOJ had not yet publicly announced its finalized whistleblower rewards program for corporate personnel, which DOJ officials announced in early March. The March announcement initially targeted early June 2024 for the rollout of that program.

In the meantime, on April 15, 2024, the DOJ Criminal Division announced its Pilot Program on Voluntary Self-Disclosure for Individuals (Pilot Program). The focus of this program is on potentially culpable individuals (as opposed to non-culpable whistleblowers) who cooperate with DOJ investigations in return for "discretionary grants of immunity, and entry into non-prosecution agreements (NPAs)" among other benefits. According to the DOJ, the Pilot Program aims to "provide[e] transparency regarding the circumstances in which [the DOJ] will offer [NPAs] to individuals who voluntarily disclose original information about certain types of criminal conduct involving corporations," if the individuals also meet other criteria. The Pilot Program is groundbreaking with its formality, but not in its substance, as the DOJ makes clear: the program is a step to formalize the DOJ's longstanding practice to grant discretionary immunity and NPAs in exchange for witness cooperation in investigations and prosecutions. While the main aim of the NPA program is to gather more information to hold other wrongdoers (either corporations or other individuals) accountable, the DOJ also states that providing NPAs to individuals who report misconduct in the corporate context "may be a particularly important incentive for companies to create compliance programs that encourage robust internal reporting of complaints."

This Pilot Program is part of a broader effort by the Criminal Division and various U.S. Attorney's Offices to encourage potential whistleblowers to step forward, in part to increase pressure on companies to detect and self-disclose potential wrongdoing to the DOJ. As previously reported, on February 13, 2024, the SDNY launched its own whistleblower program offering discretionary NPAs in exchange for voluntary self-disclosure of certain criminal conduct relating to information not already known to the SDNY or DOJ component offices. One month later, on March 14, 2024, the Northern District of California launched its own program, offering NPAs in exchange for individual cooperation where similar conditions are met. Because the Fraud Section in Washington, DC has primary jurisdiction over FCPA investigations, however, these U.S. Attorney-directed programs specifically carve out whistleblowers with information regarding FCPA violations. The new Pilot Program is the Criminal Division's version of these burgeoning regional whistleblower programs, covering FCPA violations and other areas of law, as summarized below.

The DOJ establishes numerous criteria for individuals to qualify for an NPA under the Pilot Program, which is effective for any disclosures made on or after April 15, 2024. Of course, any disclosure must be original information, defined as "non-public information not previously known to the Criminal Division or to any component of the Department of Justice." Such information must involve one of the following issues:

- "Foreign corruption and bribery" including violations of the FCPA, FEPA, or related money laundering laws

- Bribes or kickbacks to U.S. public officials

- Money laundering or related fraud involving financial institutions

- "Violations related to integrity of financial markets"

- Health care fraud or kickbacks

- U.S. federal government contracting fraud

The disclosure must be voluntary, meaning before any inquiry has been made by the DOJ or other enforcement agency to the individual relating to the subject matter of the submission, absent a pending government investigation or threat of imminent disclosure to the public or government, and without any pre-existing obligation to report that information to a government entity. Also, the individual must disclose information truthfully and completely, including all information known about the individual's own participation in the misconduct, and the individual must agree to fully cooperate with and provide substantial assistance to the DOJ in connection with the prosecution of equally or more culpable individuals or entities. The individual also must agree to forfeit any profit from the criminal misconduct and pay restitution or victim compensation.

Finally, some individuals are categorically excluded based on their own conduct or their positions within their companies. Most relevant to corporate counsel, the Pilot Program is not available to CEOs and CFOs of companies (or their equivalents), "elected or appointed foreign government official[s]," or domestic officials "at any level." Also, someone cannot benefit from the Pilot Program if they have engaged in criminal conduct involving "violence, use of force, threats, substantial patient harm, any sex offense involving fraud, force, or coercion, or relating to a minor, or any offense involving terrorism." The individual cannot have a prior felony conviction or "a conviction of any kind for conduct involving fraud or dishonesty;" or in other words, the potential witness must be reliable. Moreover, from an FCPA and FEPA angle, there are questions as to whether the limitation to "elected or appointed" foreign officials means that relatives and close associates of officials, who are defined as officials under the FEPA, are eligible. Similarly, that language suggests that employees of state-owned enterprises could be eligible, even though they can be defined as officials under the FCPA and FEPA under certain circumstances.

Finally, the program document notes that even if the criteria above are not fulfilled, the DOJ retains its longstanding discretion to award NPAs to individuals in appropriate circumstances in accordance with other DOJ policies.

Court Cases

SEC v. Jarkesy: Uncertain Impacts on FCPA Civil Enforcement

On June 27, 2024, the Supreme Court published its ruling in SEC v. Jarkesy, a case contesting the SEC's use of in-house administrative proceedings for civil fraud actions. The Court held that, under the Seventh Amendment of the U.S. Constitution, civil fraud actions in which the SEC seeks monetary penalties must be brought in federal court rather than as an administrative proceeding. The Court determined that since SEC civil fraud actions generally resemble common law fraud claims and seek remedies that are "legal in nature," defendants are entitled to a jury trial under the Seventh Amendment.

With respect to the FCPA, the SEC has discretion to file enforcement actions in federal court or as an administrative proceeding. In either case, the sanctions available pre-Jarkesy included civil monetary penalties for violations of the FCPA's anti-bribery, books and records, and internal accounting controls provisions. The 2010 Dodd-Frank Act authorized the SEC to impose civil penalties in an administrative action, as long as they accompanied a cease-and-desist order; prior to that time, the SEC could only seek penalties in federal court. Since the passage of Dodd-Frank, the SEC has brought a high percentage of its FCPA cases as administrative proceedings, and mostly as settled matters. By bringing these settled cases as administrative proceedings, the SEC can secure remedies that a district court judge might question, such as disgorgement (as previously discussed with respect to the Court's 2020 Liu v. SEC decision). Nonetheless, the SEC has already started using the federal courts again when pursuing individuals or companies in contested actions for issues other than the FCPA, in response to the threat of Jarkesy and the effects of other recent cases on its administrative proceedings.

At this juncture, it remains to be seen to what extent the Jarkesy ruling will affect SEC enforcement actions outside of the general fraud context — including, for example, civil enforcement of the FCPA's accounting provisions. The Jarkesy majority stated that civil monetary penalties are "a type of remedy at common law that could only be enforced in courts of law," suggesting that the nature of the penalty rather than the type of action was "all but dispositive" on the issue of whether the Seventh Amendment considerations apply. That said, we expect the SEC will likely prefer to continue using administrative proceedings for negotiated resolutions under the FCPA (as it did earlier this year with SAP). Regardless of Jarkesy, the SEC will still be able to impose non-financial remedies, such as cease-and-desist orders, remediation requirements, and – for now – disgorgement in the administrative context. Moreover, we expect that Jarkesy will not affect the ability of a party to waive the right to a jury trial and proceed with a civil monetary penalty in a settled administrative proceeding. Most companies threatened with an SEC FCPA matter that have not been able to convince the SEC not to file suit have chosen to settle and will likely continue to do so absent other significant changes. For those companies, it is likely that the SEC will continue to offer to settle as administrative proceedings, particularly if it is seeking disgorgement, and Jarkesy should not be an impediment to doing so.

Snyder v. U.S.: Ruling on Gratuities to State and Local Officials Unlikely to Affect FCPA Enforcement

On June 26, 2024, the Supreme Court issued an opinion in Snyder v. U.S., which arose out of the conviction of the former mayor of an Indiana town for accepting a $13,000 check from a truck company soon after that company had received contracts for more than $1 million for new trash trucks for the city. According to the factual summary, the mayor asked for a payment only after the contracts had been awarded, at which point the company agreed to pay. The mayor, James Snyder, was charged under 18 U.S.C. § 666, which bars state and local government officials from "corruptly" accepting "anything of value of any person, intending to be influenced or rewarded" for an official act. The question presented to the Court was whether section 666 criminalized a gratuity (a thing of value given or received "for or because of" an official act that has already taken place) as well as a bribe (a thing of value given or received in exchange for an official act). In a 6-3 ruling, the Court held that section 666 does not reach gratuities, and instead was limited to instances in which the thing of value was given or received pursuant to the quid pro quo agreement that is the hallmark of federal bribery statutes, including 18 U.S.C § 201 and – although never mentioned in any of the Supreme Court opinions – the FCPA.

Section 666 took a winding path to the Supreme Court's door in Snyder, and that history loomed large in the majority opinion. In 1962, Congress passed 18 U.S.C § 201, which prohibits both bribes and gratuities to federal officials or officials "acting for or on behalf of the United States." Because Courts of Appeal were divided about whether section 201 also applied to state and local officials in some instances, Congress in 1984 passed section 666, which, in its original form, criminalized both bribery and gratuities. Two years later, Congress amended section 666 and conformed its language to the bribery section of section 201, rather than the gratuities section, with one important deviation – it included the word "rewarded" – which led to the current difference of opinion between the majority and dissent (and various courts of appeal). The legislative history suggests that Congress did so, in part, to avoid application of the law to "acceptable commercial and business practices." And Congress set the maximum penalty for a violation of section 666 at 10 years imprisonment, significantly closer to section 201's maximum penalty for bribery (15 years) than gratuities (two years).

Writing for the majority, Justice Kavanaugh reasoned that it would be "strange to interpret" section 666 "to mean the same thing now that it meant back in 1984, before the 1986 amendment," and "highly unusual, if not unique" for Congress to draft a law that applies (and assigns the same penalty) to both bribery and gratuities, which are separate crimes with distinct elements and vastly different penalties. Justice Kavanaugh also noted that state and local governments regulate the acceptance of gratuities by their officials, and federal law could not supplement those laws without implicating federalism and fair notice considerations.

In dissent, Justice Jackson noted the statute's inclusion of the word "rewarded" alongside "influenced" and contended that this word "easily covers the concept of gratuities paid to corrupt officials after the fact — no upfront agreement necessary." She cited Justice Scalia's previous description of § 666 as a "clear rul[e]" that criminalizes "bribes and gratuities to public officials," and questioned the majority's application of legislative history in the face of the plain meaning of the relevant text. Justice Jackson also dismissed the majority's concerns regarding potential criminalization of several innocuous hypothetical examples and argued that the majority opinion left in doubt prosecutors' ability to reach "exactly the type of palm greasing that the statute plainly covers and that one might reasonably expect Congress to care about when targeting graft in state, local, and tribal governments."

Ultimately, Snyder may have limited impact outside of the subset of federal prosecutions of state and local officials under section 666, and it is not expected to have any meaningful direct impact for enforcement efforts under the FCPA. It is the latest example of the Court rejecting the government's argument that what the Court considers to be vague statutory language should survive because federal prosecutors would use the law responsibly, following the Court's decisions in other corruption cases, including McDonnell (narrowly defining "official act" under section 201) and Skilling (limiting the reach of the federal honest services wire fraud statute). But the Court did not disturb section 201(c)'s prohibition on gratuities or cast doubt on the validity of state and local laws criminalizing gratuities – indeed, the Court cited the myriad regulations as reason to avoid over-expanding the scope of a federal statute. The Court declined Snyder's invitation to alter the definition of "corruptly" by requiring prosecutors to prove specific intent to violate a specific law, thus leaving undisturbed the core element of all federal bribery statutes, including the FCPA or the recently enacted FEPA.

The FCPA's anti-bribery provision criminalizes payments intended to "influence the [] official in his or her official capacity" "inducing such … official to do or omit to do any act in violation of a lawful duty," or "secure an improper advantage" for the payer. Unlike section 666, the FCPA does not use the word "reward." Thus, even before Snyder, it appears the FCPA did not criminalize a gratuity – i.e., the giving of a thing of value after the completion of an act and without an agreement to influence that act. Indeed, the majority opinion states, "[t]he Government identifies no other provision in the US Code that prohibits bribes and gratuities in the same provisions," furthering its point that that bribery and gratuities are two different crimes with different elements.

Snyder makes clear that bribery is not limited to situations involving a payment preceding an official act. The majority rejected the argument advanced by the government and the dissent that the word "reward" could only refer to a gratuity and not a bribe and explained that a thing of value given after an official act satisfies the bribery statutes so long as the agreement precedes the payment. Prior circuit decisions, undisturbed by Snyder, establish that a quid pro quo agreement need not be express or explicit, and need not be tied to a specific official act. Rather, the requisite corrupt agreement can be inferred from a course of conduct establishing a stream of benefits juxtaposed against a stream of official acts. Thus, the giving of gifts over time to a government employee taking official acts that benefit the giver can suffice to prove bribery, even if there is no evidence of a formal agreement and even if the government cannot establish a precise sequencing of the gifts and the official's conduct.

We do not see Snyder as a sea-change for FCPA enforcement or compliance programs. While the Snyder decision may raise questions of whether some payments are now legal under the FCPA if they meet the definition of gratuities (for example, transposing the Snyder fact pattern to a contract with a foreign official), our view is that it does not reshape the contours of the FCPA or its enforcement. For example, the fact pattern in Snyder would still be a books and records violation under the FCPA's accounting provisions for public companies, because the truck company admitted that the paperwork for a consulting arrangement was inaccurate. Moreover, if the truck company pursued any further business with the local government, a prosecutor could allege that the initial payment was intended as the start of a stream of gifts in exchange for continuing contract awards. Moreover, even if payment in Snyder does not violate section 666, it could violate state or local law, as the majority recognizes. Similarly, internationally, even if some payments may in theory be gratuities that are not covered by the FCPA, such payments may still violate domestic corruption laws. Consequently, we do not anticipate any significant changes for international compliance programs.

The remaining question after Snyder is whether Congress will amend section 666 to explicitly prohibit the giving and taking of gratuities to and by state and local officials. The majority ends its opinion noting that Congress could do so if it wished, but that it has not since 1986, "presumably because Congress understands that state and local governments may and often do regulate gratuities to state and local officials." Whether Congress does so or not, however, Snyder does not fundamentally alter the ground rules of the federal bribery statutes or necessitate a sea-change in how companies approach FCPA compliance program design and execution.

Energy Supplier Tenaris Agrees to $9.5 Million Settlement of Securities Class Action Related to Disclosures on Corruption Issues

On April 24, 2024, Luxembourg-based steel pipe manufacturer and supplier Tenaris S.A. (Tenaris) and investors reached a settlement to conclude a four-year federal securities class action case filed in the Eastern District of New York (EDNY), after the class of investors had alleged that Tenaris caused damage to investors by omitting adverse facts in its public disclosures. Many FCPA corporate resolutions involving public companies have generated civil shareholder actions that rely on the public facts made available through disclosures and public resolutions with a regulator or prosecutor; the Tenaris case is a somewhat rare instance in which the claims survived a motion to dismiss and thus resulted in a settlement. Tenaris is also not the typical public company: it is a Luxembourg entity listed (via American Depositary Receipts (ADRs)) on the New York Stock Exchange (NYSE), and it is controlled by the holding company San Faustin, which in turn is controlled by the Rocca family (namely, Paolo and Gian Felice Rocca).

Tenaris and its owners have been involved in a slew of corruption-related investigations, trials, and resolutions in recent years. We previously reported on Tenaris's SEC resolution in June 2022 related to the FCPA's antibribery and accounting provisions. In its resolution with the SEC, Tenaris agreed to pay $78 million in penalties for improper payments to Petrobras officials in Brazil through shell companies, some of which were affiliated with Tenaris's controlling shareholder (San Faustin). At the same time, Tenaris announced that the DOJ had closed a parallel inquiry without taking action. Just prior to the SEC resolution, Paolo and Gian Felice Rocca – along with San Faustin and another San Faustin executive – were acquitted in Italy of related charges on jurisdictional grounds, after an 18-month trial. Previously, in 2021, Tenaris Chairman and CEO Paolo Rocca had been acquitted of charges related to improper payments in Argentina related to the Notebook scandal, which we covered in 2018. Tenaris also had a prior resolution with the SEC in 2011 for FCPA violations (notably, the SEC's first DPA) and a related NPA with the DOJ, related to Uzbekistan, as summarized here.

The recently resolved shareholder suit was filed shortly after Paolo Rocca was indicted in Argentina, and well before the company's SEC resolution. According to the initial class action complaint, in November 2018, Paolo Rocca was charged in Argentina for his role in a graft scheme. When news of Rocca's alleged involvement in the scheme became public, Tenaris stock fell by nearly 10 percent, or $2.64 per share. In December 2018, Charles Atanasio, a Tenaris investor who purchased the company's securities during the relevant time period, brought a federal securities class action on behalf of the people and entities that acquired publicly traded securities in Tenaris from May 1, 2014, through November 27, 2018. In his complaint, Atanasio asserted that investors had been damaged as a result of Rocca's actions and Tenaris' omission of adverse facts from the company's public disclosures.

As detailed in the class action complaint, the plaintiffs alleged that Tenaris failed to disclose material adverse facts in 20-F forms that Tenaris filed with the SEC from 2013 through 2017. Specifically, the complaint alleged that Paolo Rocca and Tenaris "made false and/or misleading statements and/or failed to disclose that" Rocca knew that a Tenaris executive paid government officials from 2009 to 2012 to "speed up compensation payments" related to a company transaction. Atanasio asserted that Rocca and the company were aware that Rocca's knowledge and conduct would lead to him being charged and would subject Tenaris and its affiliates to "heightened government scrutiny" and potential negative financial consequences. Atanasio also alleged that, as a result, Tenaris' statements in its 20-F forms "were materially false and/or misleading at all relevant times." Atanasio's complaint stated the Defendants' actions caused the stock price to fall, therefore damaging investors.

The class action complaint noted that Tenaris' 20-F filings from 2013 through 2017 each stated that the company was "committed to conducting business in a legal and ethical manner" and referenced the company's Code of Ethics and Code of Conduct, which stated that it applies to the company's "principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions." Additionally, each 20-F filing contained Sarbanes-Oxley (SOX) certifications that Rocca signed as CEO. On behalf of the plaintiff class, Atanasio alleged that these statements on the 20-F fillings were inaccurate because they did not include adverse facts relating to Rocca's involvement in and knowledge of the graft scheme.

In the October 2020 ruling on the defendants' motion to dismiss, the trial judge stated that the Argentine charges against Rocca were dropped in April 2019 due to insufficient evidence. Despite this development, the judge allowed the class action suit to move forward in part, with particular focus on the Argentine issues. In particular, the judge ruled that certain claims against Tenaris and Rocca survived the motion to dismiss because the plaintiffs' complaint sufficiently alleged that Rocca knew of facts that suggested that Tenaris' public statements were inaccurate. The judge also held that, under the facts as alleged by the plaintiffs, Rocca's alleged knowledge and intent (or "scienter") could be imputed to Tenaris because the plaintiffs sufficiently pled that Rocca (as CEO) had "adequate control" over Tenaris' statements.

With regard to certain specific claims, the judge held that the SOX certifications were not actionable due to the plaintiffs' failure to plead sufficiently as to why they were misleading. The judge also followed "consistent precedent" in holding that Tenaris' statements regarding its Code of Ethics – which he characterized as "generalized" and "aspirational," also were "not actionable." However, the judge ruled that specific statements regarding the company's separate Code of Conduct, which contained specific anti-corruption language to which Tenaris directors and officers certified their compliance annually, were actionable under the specific facts and circumstances. The court noted that "reasonable investors likely knew about the [2011] SEC DPA" with Tenaris. The judge stated that the 20-F form statements regarding the Code of Conduct could have been "material" since