Using the First Sale Rule to Reduce Tariffs

International and Tax Alert

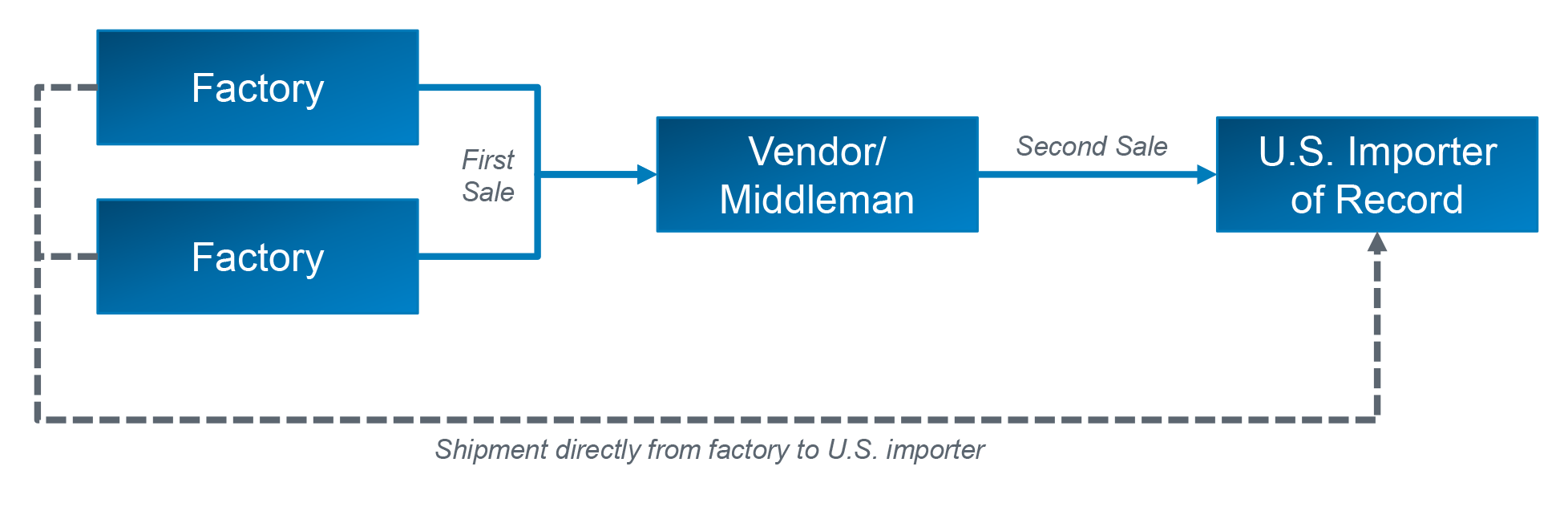

Over 30 years ago, the Federal Circuit in Nissho Iwai American Corp. v. United States, 982 F.2d 505 (Fed. Cir. 1992), accepted what is commonly known as the "First Sale Rule" for U.S. customs purposes. This rule is applicable when goods are imported in a multi-tiered transaction, such as when a foreign manufacturer (factory) sells goods to a foreign middleman that, in turn, sells the goods to a U.S. importer.

When the requirements of this rule are satisfied, the transaction value of the goods for U.S. customs purposes can be determined by the price paid or payable on the first sale (e.g., the sale from the foreign manufacturer to the foreign middleman). This rule is advantageous as the price paid or payable is often less on the first sale, thereby lowering the value on which tariffs are imposed. As tariffs become higher and more prevalent, companies engaging in multi-tiered transactions should consider these rules and evaluate whether they can support lower values and tariffs.

The First Sale Rule

| The First Sale Rule requires that the sales are:

|

The basis for the First Sale Rule is 19 U.S.C. § 1401a(b)(1), which provides that "[t]he transaction value of imported merchandise is the price actually paid or payable for the merchandise when sold for exportation to the United States..."1 It does not have to be the price paid or payable on the import itself, but, rather, can be the price paid or payable on an earlier sale when the goods are destined for export to the U.S. In addition to involving goods clearly destined for the U.S., the sales must also be bona fide and conducted at arm's length.

A sale is simply the transfer of goods in exchange for consideration and there is no one factor that establishes whether a sale is bona fide. Instead, U.S. Customs and Border Protection (CBP) looks to the entirety of the circumstances. While possession of the goods supports ownership, it is not dispositive and it is common that the goods are shipped directly from the factory to the importer, with the middleman never taking physical possession. Payment for the goods and assumption of the risk of loss with respect to the goods support ownership (and, therefore, the bona fide nature of the sale) and evidence in the form of contracts, purchase orders, invoices, bills of lading, packing lists, cargo manifests, and proof of payment can establish whether these factors exist. When the middleman does not bear the risk of loss, such as when there is simultaneous passage of title from the manufacturer to the middleman and from the middleman to the importer, the bona fide nature of the sale is strongly undermined.

Many of the documents that can demonstrate whether a sale is bona fide can also demonstrate whether the goods were destined for the U.S. The evidence must establish that at the time the middleman purchases the goods, the only possible destination is the U.S. It is insufficient to simply show that the goods actually went to the U.S. Back-to-back agreements whereby the middleman contracts to sell the goods to a U.S. importer and then contracts with a foreign manufacturer to make the goods to the customer's particular specifications is helpful. Likewise, the use of unique stock numbers or bar codes to track goods coupled with a contractual obligation on the middleman to sell those specific goods to a U.S. importer can provide strong support that the destined-for-the-U.S. requirement is satisfied. Of course, direct shipment by the manufacturer to the importer also eliminates the possibility of the goods being diverted by the middleman.

The final requirement is that the sale is conducted at arm's length. Transactions between unrelated parties are considered to be at arm's length. When a transaction is between related parties, the arm's length nature must be demonstrated. As with other customs analyses, this can be satisfied when 1) the circumstances of the sale indicates that the relationship of the parties did not influence the amount paid or payable or 2) when the transaction value closely approximates a test value. The circumstances of a sales test is similar to a transfer pricing analysis commonly performed for federal income tax purposes, but requires a closer examination of the products and industry, whereas transfer pricing analyses often place more emphasis on functions performed, risks assumed, and assets used as opposed to the particular products or industry.

It is important to remember that in a multi-tiered transaction, the presumption is that transaction value will be determined by the price paid or payable by the importer. To the extent that the importer seeks to use an earlier sale, such as the price paid or payable by the middleman, the burden is on the importer to prove that the First Sale Rule is satisfied. Additionally, failure by the importer to provide sufficient information to enable CBP to determine which sale in a multi-tiered transaction establishes the customs value can have significant adverse consequences including possible penalties or other enforcement compliance actions.

Our Approach

Miller & Chevalier works closely with importers in multi-tiered transactions to assess whether the first or an earlier sale can be used to establish the transaction value. We engage with the parties to collect the necessary documents and evaluate the sufficiency of such documentation to substantiate each prong of the First Sale Rule. When the arm's length nature of the transaction must be demonstrated, we engage and direct the work of a transfer pricing consultant when necessary. In this regard, we also study the transfer pricing analyses that have been prepared for federal income tax purposes and evaluate whether portions of such analyses can be utilized in conducting the customs analysis. Our Customs & Import Trade and Transfer Pricing practices work together seamlessly to maximize efficiencies.

When the First Sale Rule is satisfied, we assist importers in presenting the results to CBP and responding to any feedback from CBP in advance of implementing the First Sale price. Finally, we assist in preparing the First Sale entry packets.

Because our Customs & Import Trade and Transfer Pricing practices work together, we are also available to advise on the federal income tax consequences of tariffs and customs valuation methods. This is especially important when the First Sale Rule is used as the value for U.S. customs purposes will be different (and, likely, lower) than the actual transfer price paid by the importer.

For more information please contact:

Richard A. Mojica, rmojica@milchev.com, 202-626-1571

Brian S. Gleicher, bgleicher@milchev.com, 202-626-1589

--------------

1There are certain amounts added to the amount paid or payable, such as packing costs, commissions, assists and other amounts. A discussion of these additional amounts is outside the scope of this writing.

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.