FCPA Summer Review 2021

International Alert

Introduction

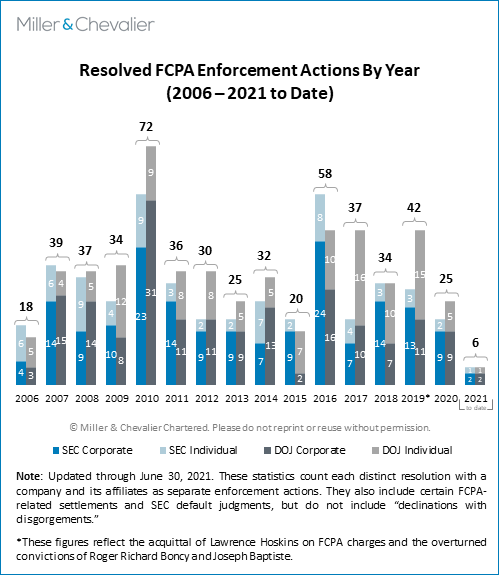

U.S. Foreign Corrupt Practices Act (FCPA)-related public enforcement activity through the second quarter of 2021 continued to be steady and relatively slow, likely due in part to the lingering effects of the COVID-19 pandemic. The U.S. Department of Justice (DOJ) and the U.S. Securities and Exchange Commission (SEC) each announced one corporate FCPA resolution, with U.K.-based construction engineering company Amec Foster Wheeler Energy Limited. However, as courts in the United States gradually reopen, the announcement of individual enforcement actions is catching up with recent years, with one individual pleading guilty to FCPA charges, one pleading guilty to conspiracy to commit money laundering in a bribery scandal, and 12 more individuals receiving sentencings in the past quarter. Additionally, the DOJ announced new charges against two former Bolivian government officials and three U.S. citizens and unsealed another indictment from 2019 against two former Chadian diplomats. The SEC also resolved one individual enforcement action, settling civil FCPA charges with former Goldman Sachs executive Asante K. Berko. The chart below shows the FCPA enforcement actions resolved with the DOJ and SEC by year, highlighting 2021's fall-off in numbers from prior years:

Enforcement activities will accelerate as pandemic-related restrictions are lifted, but other signs from the executive branch indicate that an increased pace of public enforcement dispositions and related efforts is likely on the horizon. In addition to the usual public statements by DOJ and SEC personnel (see below), the Biden administration has made clear that anti-corruption efforts are a centerpiece of its national security and foreign policy strategies. In June, the White House issued a National Security Study Memorandum (NSSM) on corruption, characterizing corruption as a "core" national security concern since it threatens not only key U.S. interests, but "democracy itself." The NSSM directs the federal government to complete an interagency review by the end of this year and send a report to President Biden with recommendations for enhancements to the U.S. government's abilities and resources for combatting corruption.

President Biden's latest nominations to fill to key enforcement positions also reflect these goals. In addition to Attorney General Merrick Garland, the administration has appointed three former prosecutors to top enforcement positions: Lisa Monaco, who was confirmed by the Senate in April as Deputy Attorney General; Kenneth Polite, who was confirmed by the Senate in July to lead the DOJ's Criminal Division; and Gurbir S. Grewal, who at the end of June became the SEC's Director of the Division of Enforcement. We discuss the new appointments and the NSSM in further detail below.

The DOJ has recently lost some personnel to private practice, but this has resulted in FCPA veterans occupying more senior positions in an acting capacity for now. For example, the Department recently promoted long-time FCPA enforcement official Daniel Kahn to be an acting Deputy Assistant Attorney General. Kahn, who had been the acting Fraud Section Chief since September 2020 and previously served as Chief of the FCPA Unit from 2016 to 2020. As discussed later in the Review, the FCPA Unit recently has made new hires and promoted existing attorneys to supervisory positions. With Kenneth Polite's recent confirmation, further appointments and hiring likely will take place, once he is able to organize his core team.

Tips on new potential investigations likely will be aided by an active whistleblower pipeline encouraged by several sizeable whistleblower awards in Q2 2021, at least one of which related to an FCPA enforcement action. In May, the SEC announced a $28 million dollar award to a whistleblower that provided information that led to the 2018 FCPA enforcement actions against Panasonic Avionics Corporation (PAC), a U.S. subsidiary of Japanese Panasonic Corporation (Panasonic). The award is one of the 10 largest ever handed out under the Dodd-Frank whistleblower program. Notably, the SEC granted the award despite the fact that "there [was] not a strong nexus" between the whistleblower's tip and the conduct at issue in the eventual enforcement actions. The number and size of recent whistleblower awards, coupled with the media coverage linking the $28 million award to an FCPA case and the new administration's dedication to combatting corruption, will likely lead to increased whistleblowing of potential FCPA violations.

We summarize this quarter's corporate enforcement actions and their noteworthy aspects, individual enforcement actions, and selected international developments below.

Corporate Enforcement Actions

One company reached resolutions with the DOJ and the SEC during the past quarter: Amec Foster Wheeler Energy Limited (Foster Wheeler). On June 25, 2021, the U.K.-based construction engineering company resolved criminal charges in the U.S., the U.K., and Brazil related to alleged bribery of officials at state-owned oil company Petróleo Brasileiro S.A. (Petrobras) and the corrupt use of agents to bribe officials in other jurisdictions. Foster Wheeler allegedly schemed to bribe officials in Brazil through multiple third-party agents, one of whom was engaged in an unofficial capacity after failing to clear the company's due diligence process, in order to win a $190 million contract to design a gas-to-chemicals complex. The settlement agreements across all three jurisdictions require Foster Wheeler to pay a total $177 million total in compensation, disgorgement, and prejudgment interest, fines, and penalties. Foster Wheeler agreed to pay more than $41 million total to resolve the U.S. offenses, settled via a deferred prosecution agreement (DPA) with the DOJ and a Cease-and-Desist Order with the SEC. The DOJ and SEC agreed to credit amounts to be paid to the Brazilian and U.K. authorities against the U.S. amounts owed, resulting in total payments to the DOJ and SEC of approximately $18 million. Notably, the U.K. DPA requires Foster Wheeler to pay approximately $143.3 million and relates to additional misconduct beyond that cited in the U.S. settlement documents. Foster Wheeler's parent company, U.K.-based global engineering company John Wood Group plc (Wood), was not named as a defendant in any of the proceedings, but agreed to take on certain financial and reporting obligations in connection with the various settlements. We discuss these resolutions in more detail below.

In addition, we note that in late May the DOJ reached a settlement with Swiss bank Julius Baer & Co. Ltd., which admitted to conspiring to launder over $36 million in bribes through the U.S. to officials in the Fédération Internationale de Football Association (FIFA) and other soccer federations for broadcasting rights to soccer matches. To resolve the investigation, the Swiss bank entered into a three-year DPA with the DOJ and agreed to pay a fine of $43,320,000 and forfeit $36,368,400.

Corporate Investigations Closed without Enforcement Actions

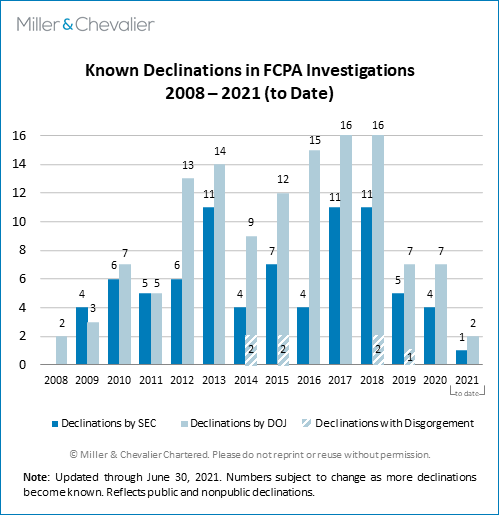

Following our practice from past years, throughout the first two quarters of 2021, Miller & Chevalier has tracked investigations publicly identified as closed without an enforcement action, i.e., known investigations that the DOJ and the SEC have initiated but closed without a DPA, Non-Prosecution Agreement (NPA), Cease-and-Desist Order, guilty plea, jury conviction, or other final enforcement procedure. We note that while in some instances the term "declination" is used to cover only those instances where an actual FCPA violation has been identified and the jurisdictional requirements have been satisfied (but the DOJ or SEC opt not to pursue the matter), we use the term more broadly to cover FCPA-related investigations open and closed, even if the investigations may have not identified FCPA violations that meet the statutory requirements. Since our last publication, we have noted the following developments:

- On May 6, 2021, via its Form 6-K, Brazilian food company BRF S.A. (BRF) announced that it had received a letter from the DOJ stating that it had concluded its investigation into the company for potential FCPA violations and did not intend to recommend an enforcement action against the company. The DOJ's letter follows a similar letter from the SEC in February 2021, also declining to recommend an enforcement action against the company. In 2017, BRF disclosed in U.S. securities filings that the DOJ and SEC had requested information from the company following a probe by Brazilian authorities into alleged bribery of food sanitation inspectors in Brazil (Brazilian Federal Police's Operations Carne Fraca and Trapaça).

- Also on May 6, 2021, food and beverage manufacturer Pactiv Evergreen announced in a Form 10-Q that the DOJ had closed its investigation into the company, following the company's internal investigation into practices in the company's Shanghai business which "involve[d] acts potentially in violation of" the FCPA. The company stated that its internal investigation into these practices had identified "occasional giving of gift cards representing relatively minor monetary values to government regulators and employees of state-owned enterprise customers in the People's Republic of China." According to its disclosure, the company voluntarily disclosed these potential issues to the DOJ and SEC in September 2020 and presented findings to both regulators in February 2021. The SEC's review remains ongoing.

Both declinations are reflected in the chart below.

Known FCPA Investigations Initiated

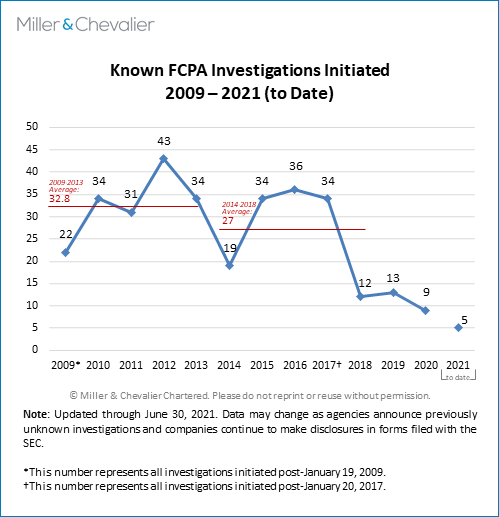

Since our last publication, three companies have publicly disclosed new FCPA-related investigations. In an April 16, 2021 U.S. securities filing, Tsakos Energy Navigation Limited reported that the DOJ and SEC had opened an FCPA investigation following charges from Brazilian authorities of improper conduct by certain company shipbrokers (see below). In a May 6, 2021 U.S. securities filing, Ormat Technologies, Inc. announced that the company was responding to information requests by the SEC and DOJ related to "certain claims made in a report published by a short seller regarding the Company's compliance with anti-corruption laws." The company's disclosure states that in March, its board of directors established a special committee of independent directors to investigate these claims. Finally, in a May 6, 2021 U.S. securities filing, Bombardier Inc. announced that that the Company was responding to information requests from the DOJ in connection with the company's business operations in Indonesia. The chart below reflects these investigations, as well as other investigations disclosed in Q1 2021.

As we have noted in the past, the numbers in this chart are subject to limitations on available public information, and because neither the DOJ nor the SEC disclose official investigations statistics in anything close to real time and only some companies are likely to disclose such information through SEC filings or other means, our investigation statistics are necessarily incomplete. We are likely to learn of more investigations launched in late 2020 and 2021 in the coming months, as companies disclose such information in their public disclosure filings.

We note that an SEC response to a Freedom of Information Act (FOIA) request by Global Investigations Review indicated that the agency had opened 15 new FCPA cases in 2020. The resulting article does not provide details of that SEC response beyond the numbers quoted and thus our chart above continues to reflect only the data that we are able to confirm from direct sources. Our chart and the article's count reflect the same trend line, however – both sets of numbers show that new cases initiated by the SEC have been on the decline since the Trump administration took office and that this past year saw the fewest new cases in over a decade. As we have noted elsewhere, the 2020 figures are likely in part a result of the impact of the coronavirus pandemic.

Individual Enforcement Actions

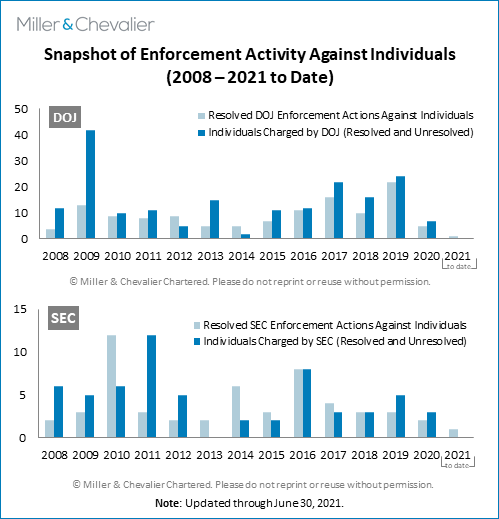

The chart below shows snapshots of FCPA enforcement activities against individuals by the DOJ and SEC, respectively. It is important to note that we track FCPA proceedings only, not other statutory violations where the FCPA is the predicate act (for example, violations of anti-money laundering statutes). There are many such cases resolving violations of other laws, that also involve alleged bribery. In the second quarter of 2021, the DOJ filed two criminal complaints against five individuals for conspiracy to commit money laundering, as well as unsealed one indictment from 2019 covering two individuals who have yet to face the charges. The second quarter also saw one SEC settlement, two guilty pleas, and 12 sentencings, among other developments.

Specifically, during the second quarter, the DOJ announced charges against two former Bolivian government officials and three U.S. citizens for conspiring to commit money laundering in an alleged international bribery and money laundering scheme connected to the award of a government contract to provide equipment to Bolivia's Ministry of Defense. In addition, a federal court in the District of Columbia unsealed an indictment filed in 2019 against two former Chadian diplomats to the United States, Mahamoud A. Bechir and Youssouf H. Takane, in connection with an alleged international bribery and money laundering scheme to obtain oil contracts from the government of Chad. While all the charges summarized above from Q2 are corruption related, these did not involve FCPA counts directly.

Meanwhile, the SEC settled civil FCPA charges with former Goldman Sachs executive Asante K. Berko, who was responsible for developing investment banking business for Goldman Sachs and its U.K. subsidiary, for his role in an alleged scheme to bribe Ghanaian government officials in order to help a client to win a contract to build and operate an electrical power plant in Ghana. Berko agreed to pay $275,000 in disgorgement and approximately $54,000 in prejudgment interest.

Two individuals pleaded guilty to FCPA-related charges. First, Jose Carlos Grubisich, the former CEO of Brazilian petrochemical company Braskem S.A., pleaded guilty to conspiring to violate the anti-bribery provisions and the books and records provisions of the FCPA. Grubisich is scheduled to be sentenced on August 5, 2021. Second, in the bribery scandal involving the joint ventures of Venezuelan state-owned and state-controlled oil company Petróleos de Venezuela S.A. (PDVSA), Carlos Enrique Urbano Fermin, a Venezuelan businessman, pleaded guilty to one count of conspiracy to commit money laundering.

Eight individuals were also sentenced this quarter in connection with PDVSA-related misconduct:

- Edoardo Orsoni (former general counsel at PDVSA): three years of probation

- Gustavo Adolfo Hernandez Frieri (investment adviser): 46 months in prison

- Abraham Edgardo Ortega (PDVSA executive): 28 months in prison

- Rafael Pinto-Franceschi (U.S. businessman): 24 months in prison

- Franz Muller-Huber (U.S. businessman): 20 months in prison

- Ivan Alexis Guedez (PDVSA procurement official): 18 months in in prison

- Jose Orlando Camacho (PDVSA procurement official): 12 months in prison

- Charles Quintard Beech III (oil contractor): 12 months in prison

Additional sentencings this quarter include:

- Ramiro Andres Luque Flores, founder of an Ecuadorian company specializing in the disposal of hazardous waste from oil and gas production, was sentenced to four years of probation in connection with a scheme to bribe employees of Ecuador's state-owned oil company Petroecuador.

- Donville Inniss, former member of the Parliament of Barbados, was sentenced to 24 months of imprisonment for laundering bribe payments through U.S. bank accounts. Inniss allegedly received the illicit payments from senior executives at an insurance agency in Barbados in exchange for leveraging his official position to assist the company in obtaining renewed insurance contracts with a government agency.

- Daren Condrey, former co-president of Maryland-based trucking company, was sentenced to 24 months of imprisonment for allegedly bribing a director of a subsidiary of Russia's State Atomic Energy Corporation in order to retain business.

- Deck Won Kang, owner of two New Jersey naval equipment and technology companies, was sentenced to three years of probation for bribing a South Korean official in exchange for assistance with securing contracts with an agency within the country's Ministry of National Defense (note, this sentence took into account that Kang already served two years in prison in South Korea).

We discuss these developments and individual enforcement actions in more detail below.

International Developments

On the international front, the U.K. Serious Fraud Office (SFO) has been active, with multiple corporate enforcement actions this quarter for violations of the U.K. Bribery Act (UKBA) and other anti-corruption laws. In addition to leading the internationally coordinated enforcement action against Foster Wheeler, the SFO announced in April that an Airbus SE (Airbus) subsidiary, GPT Special Project Management Ltd. (GPT), had pleaded guilty to corruption in connection with a government contract in Saudi Arabia. The SFO had previously carved GPT out of its 2020 DPA with Airbus to resolve alleged UKBA violations in numerous jurisdictions, settled as part of the enforcement action with authorities in the U.K., the U.S., and France.

Another SFO investigation garnered significant attention this quarter, though not as a result of an enforcement resolution. In May, the long-awaited trial commenced between mining conglomerate Eurasian Natural Resources Corporation's (ENRC) and the SFO, Dechert, and former global co-head of the law firm's white collar practice Neil Gerrard. ENRC has brought breach of contract and fiduciary duty claims against Dechert and Gerrard, alleging that Gerrard intentionally leaked confidential and privileged information related to an anti-corruption matter to the SFO in order to prompt the agency to open an investigation into ENRC – and thereby increase the firm's fees. ENRC is also suing the SFO for misfeasance in public office and inducing a breach of fiduciary duty, claiming that the SFO encouraged the leak. The alleged misconduct dates as far back as 2010. ENRC fired Dechert in 2013 after paying legal fees of over $18 million, and the SFO opened a bribery investigation into ENRC shortly thereafter. Former SFO director Sir David Green testified at the trial in July regarding the alleged misconduct of his predecessor, former SFO director Richard Alderman. ENRC seeks £70 million ($97 million) in damages; the trial remains ongoing.

Other noteworthy developments from Europe include the Dutch Public Prosecution Service's (Openbaar Ministerie or the OM) April announcement of corporate resolutions totaling €41.6 million (approximately $57.3 million) with multiple subsidiaries of privately owned Dutch trading company, SHV Holdings. Two of the three separate settlements – one of which accounted for €40.1 million ($50.4 million) of the total settlement amount cited above – relate to commercial bribery by the companies, rather than bribery of public officials. An audit firm (reported by some media as likely to be PricewaterhouseCoopers (PwC) remains under investigation in connection with that matter. The third action settled allegations that Mammoet Salvage BV (Mammoet Salvage), the salvage arm of SHV's Mammoet Group, paid $130,000 in bribes to an Iraqi parliamentarian in exchange for access to the Iraqi Minister for Oil. The SHV enforcement actions are discussed in detail below.

In June, a Florida federal district court stymied Norway's efforts to advance another individual enforcement action, denying the U.S. government's request to extradite to the country a former corporate executive convicted of corruption. Kendrick Wallace, former Chief Legal Officer of fertilizer company Yara International ASA (Yara), was indicted in Norway in 2014 and convicted of two counts of gross corruption for allegedly bribing Indian and Libyan officials from 2007 to 2009 to help Yara secure joint ventures with state-owned enterprises in those markets. Wallace was arrested in Florida in April and the U.S. sought to extradite him under the extradition treaty between the U.S. and Norway. The treaty allows for extradition for offenses "relating to bribery, including soliciting, offering, and accepting bribes" – however, it requires dual criminality in both Norway and the U.S. The treaty further provides that extradition shall not be granted when prosecution for the offense is time-barred by either state. Because Wallace's alleged conduct fell outside the five-year statute of limitations for the FCPA offenses, the court denied the U.S. government's request to extradite Wallace to Norway.

Finally, as relates to Europe, the European Public Prosecutor's Office (EPPO) opened operations on June 1, 2021. The EPPO is an "independent and [decentralized] prosecution office of the European Union" tasked with investigating and prosecuting crimes against the EU budget, including corruption. The extent to which the EPPO's work will coincide with other jurisdictions' anti-corruption enforcement actions remains to be seen.

In South America, prosecutors continue to bring corporate and individual enforcement actions in connection with the years-long investigation into alleged corruption Petrobras. We provided a detailed update on Brazil's investigation into the alleged misconduct, Operation Car Wash, in our FCPA Winter Review 2021. Operation Car Wash continues to yield new enforcement actions, with Brazilian prosecutors announcing new criminal charges in June against three former executives of Braskem S.A. (Braskem). (Braskem and parent company Odebrecht entered into a multi-billion-dollar resolution with U.S., Brazilian, and Swiss authorities in 2016.) Prosecutors have alleged that former Braskem president Carlos José Fadigas de Souza Filho, in-house lawyer José Américo Spínola, and finance director Marcela Aparecida Drehmer Andrade coordinated the transfer of millions of dollars of funds to bribe politicians and employees of Petrobras in order to obtain business for Braskem. The individuals have yet to be tried.

In May, Peruvian authorities announced that they had reached an agreement to settle corruption charges with Aenza S.A.A. (formerly Graña y Montero S.A.A.) in a case also stemming from Operation Car Wash. According to Peruvian prosecutors, Aenza and two Graña y Montero subsidiaries engaged in corruption related to 16 major infrastructure projects. Aenza was also accused of anti-competitive conduct related to tenders for 48 additional projects. The company agreed to pay ~PEN 480 million (~$128 million ) in civil penalties to resolve the allegations.

In Canada, in April, infrastructure development company SNC-Lavalin Inc. (SNC-Lavalin) announced an early end to its World Bank debarment. The sanctions were originally imposed in 2013 following a World Bank investigation into allegations of bribery and misrepresentations by the company in connection with World Bank-funded projects in Bangladesh and Cambodia. The debarment was scheduled to remain in place until 2023; however, the company announced that the World Bank had determined to lift the sanctions after confirming that SNC-Lavalin had met all of the terms of its 2013 settlement with the World Bank, including improvements to the company's compliance program.

Corporate Enforcement Actions

First FCPA Corporate Resolution under the Biden Administration: Amec Foster Wheeler Energy Limited

On June 25, 2021, Foster Wheeler, a U.K.-based construction engineering company, resolved criminal charges in three jurisdictions stemming from a scheme to bribe Brazilian officials in exchange for an approximately $190 million contract with Petrobras to design a gas-to-chemicals complex. The company reached concurrent resolutions with the DOJ and SEC as part of an internationally-coordinated resolution with the Brazil Controladoria-General da Uniᾶo (CGU)/Advocacia-Geral da Uniᾶo (AGU) and the Ministério Publico Federal (MPF), and the SFO, resulting in the assessment of $177 million total in compensation, disgorgement and prejudgment interest, fines, and penalties across the various regulators. Foster Wheeler's parent company, U.K.-based global engineering company John Wood Group plc (Wood), was not named as a defendant in the proceedings, but agreed to take on certain financial and reporting obligations in connection with the various settlements.

Foster Wheeler agreed to pay more than $41 million to U.S. authorities – approximately $18.4 million to the DOJ and $22.8 million to the SEC – to settle criminal and civil charges related to the misconduct. The company entered into a three-year DPA with the DOJ, resolving a one-count criminal information charging the company with conspiracy to violate the FCPA's anti-bribery provisions. Foster Wheeler separately consented to an SEC Cease-and-Desist Order finding that the company had violated the FCPA's anti-bribery, books and records, and internal accounting controls provisions. The DOJ and SEC agreed to credit amounts to be paid under the company's resolutions with the CGU/AGU, MPF, and SFO against the $41 million, for total payments to the DOJ and SEC of approximately $18 million.

In summary, according to the settlement papers, between 2011 and 2014, Foster Wheeler schemed to pay bribes to Petrobras officials through a number of third-party agents in order to win a contract to design a Brazilian chemicals complex (the UFN-IV contract). Foster Wheeler paid the third-party agents – one of whom had failed the company's due diligence process but continued to unofficially work on the project – approximately $1.1 million in "commission" on the deal. A portion of this amount was allegedly used to bribe one or more Petrobras officials. Foster Wheeler won the Petrobras contract, generating millions in profits for the company (according to the SEC's order, Foster Wheeler "obtained a benefit of over $17.6 million"; the DPA states that the company "earned at least $12.9 million in profits from the corruptly obtained business").

At the time of the alleged misconduct, Foster Wheeler was incorporated in the U.K. as a wholly owned subsidiary of Foster Wheeler AG, a global provider of oil and gas technology and services. Foster Wheeler AG was a U.S. company that moved its headquarters to Switzerland in 2008 and had shares traded on NASDAQ, including after its headquarters relocation. In 2014, Foster Wheeler AG and Amec merged to form Amec Foster Wheeler, and this company was subsequently acquired by Wood in 2017.

Summary of the Allegations

According to the DPA and Cease-and-Desist Order, in 2011, Foster Wheeler AG was seeking to establish a business presence in Brazil. An Italian agent affiliated with a Monaco-based company that acted as an intermediary in the oil and gas industry (Monaco Intermediary Company – identified as Unaoil in Wood's public statements), learned from a Brazilian engineering services firm (the Brazil agent) that Petrobras planned to seek bids on the UFN-IV project. The Italian agent "arranged an introduction" to the outgoing Chairman of the Board of Foster Wheeler through the manager of a New York clothing store frequented by them both. The Italian agent provided information about the project that was ultimately forwarded to Foster Wheeler's Brazil country manager, who expressed a belief that Foster Wheeler should not use the Italian agent's services as it would "send a wrong message" in the Brazilian market.

Regardless, the Italian agent met with the Brazil country manager to discuss the project, representing that the Monaco Intermediary Company had passed Foster Wheeler AG's due diligence. The reality was in fact the opposite: the public case documents state that Foster Wheeler AG had decided not to retain the Monaco Intermediary Company due to compliance concerns. According to the Cease-and-Desist Order, in November 2011, a third-party consultant provided Foster Wheeler AG with a due diligence report that raised concerns about the Monaco Intermediary Company's "associations and business practices, including possible violations of U.S. and U.K. sanctions laws." Foster Wheeler AG's management, including its General Counsel, Chief Compliance Officer (CCO), acting Chief Executive Officer (CEO), and head of Global Sales and Marketing, were aware of the report. Foster Wheeler AG thus declined to use the Monaco Intermediary Company as its agent for the project.

However, in early 2012, the Italian agent continued to reach out to the Brazil country manager, who directed the emails to the head of Global Sales and Marketing as well as others located in Houston, Texas, the base for Foster Wheeler AG's American operations. The country manager again expressed hesitation and a belief that, if Foster Wheeler utilized the "path" offered by the Italian agent "'in 1 project . . . we will be bullied to do it in all projects by him and others.'" Nonetheless, in April 2012, Foster Wheeler AG's CEO and Chief Operating Officer (COO) confirmed a two percent commission offer for the Italian agent mere days before the UFN-IV bid was due. A day later, Foster Wheeler AG management, in-house counsel, and the Brazil country manager took part in a call in which it was noted that the ongoing (but not yet completed) due diligence on the Italian agent suggested that the agent had links to the Monaco Intermediary Company (which recently had failed Foster Wheeler AG's due diligence). However, Foster Wheeler continued to work with the Italian agent to secure the UFN-IV contract under an "interim" agency agreement, even though such interim agreements were contrary to company policy while due diligence on outside agents was pending. With diligence still pending, the Italian agent flew to Rio de Janeiro to meet with Petrobras on behalf of Foster Wheeler, which had at this point submitted its bid. Petrobras later announced that Foster Wheeler was the only bidder to qualify for the UFN-IV contract.

Days later, Foster Wheeler AG's completed due diligence on the Italian agent identified the agent's connections to the Monaco Intermediary Company. The third-party investigators also were unable to verify information in the Italian agent's CV. However, the case documents state that the Italian agent continued to work on the project "unofficially" throughout its duration, and the agent's interim agreement was never formally terminated. The Italian agent continued to communicate with the Brazil country manager using the manager's personal email address during this time.

The Italian agent introduced the Brazilian agent to the Brazil country manager to serve as the local agent on the contract. The Brazilian agent was subsequently approved by Foster Wheeler. At the instruction of the Director of Business Development, the Brazilian agent's association and its payment structure with the Italian agent were withheld from Foster Wheeler's due diligence materials. Both Foster Wheeler AG attorneys and managers were aware that Italian agent maintained a role in the project.

In August 2012, Foster Wheeler was awarded the UFN-IV contract. Around that time, a Foster Wheeler executive informed an in-house attorney that he believed the Italian agent had promised bribes to Petrobras officials and he wanted to ensure that an agency agreement was entered into with the Brazilian agent so as to avoid problems with the UFN-IV contract should bribes not be received. Then, in November 2012, Foster Wheeler entered into an agreement with the Brazilian agent for a two percent commission on the $190 million contract. The Cease-and-Desist Order states, "despite a specific direction from [an] in-house attorney to not pay [the] Italian agent for his work on the project, [the] Brazil country manager and certain other managers were aware that Italian agent would receive payment" from the Brazilian agent.

According to the Cease-and-Desist Order, the Italian agent and Brazilian agent paid bribes to Petrobras officials to obtain confidential information on Foster Wheeler's behalf in order to win the contract and negotiate favorable pricing and other project terms. Between February 2013 and July 2014, the Brazilian agent submitted quarterly reports to Foster Wheeler and invoices for payment, "none of which documented any meaningful work … to justify the 2% commission," per the Cease-and-Desist Order. However, between June 25, 2013, and October 19, 2014, Foster Wheeler made four payments to the Brazilian agent totaling approximately $1.1 million into a correspondent account at JPMorgan Chase Bank in New York. The payments were then credited to the Brazilian agent's bank account in Brazil. The Brazilian agent utilized offshore accounts and a Brazilian money launderer ("doleiro") to pay the Italian agent his portion of the commission, with the money launderer depositing the funds in a Swiss bank account designated by the Italian agent. The settlement papers do not explicitly state what portion of the $1.1 million was used to bribe Petrobras officials, but imply that the agents earmarked 20 percent of the commission for bribes. All of the improper payments were recorded as "commissions" in Foster Wheeler's books and records. On May 23, 2014, Petrobras terminated the UFN-IV contract due to financial and other difficulties.

The DPA requires that, for a three-year period, Foster Wheeler continue to cooperate with the U.S. government in any ongoing or future criminal investigations concerning it or its executives, employees, or agents. In addition, Foster Wheeler and its parent company, Wood, agreed to enhance their compliance programs and to report on the implementation of these enhanced programs. The DPA imposes a criminal penalty of $18,375,000. However, the DPA also provides for a credit against this penalty of up to 25 percent ($4,593,750) for payments made by Foster Wheeler to authorities in the U.K. pursuant to its resolution with U.K. authorities and a credit of up to 33 percent ($6,125,000) for payments made pursuant to resolutions with Brazilian authorities, for a net amount of $7,656,250 paid to the DOJ.

The SEC settlement requires Foster Wheeler to disgorge $17,656,302 and pay a prejudgment interest of $5,107,985, for a total amount owed of $22,764,287. The Order provides for a disgorgement offset up to $9,105,714.80 for any disgorgement paid to the Brazilian authorities and $3,531,260.40 for any disgorgement paid to the SFO, for a net amount of $10,127,311.80.

Noteworthy Aspects

- Full Cooperation Credit, but No Credit for Voluntary Disclosure. According to the DPA with the DOJ, Foster Wheeler did not receive credit for voluntary disclosure because "it did not voluntarily and timely self-disclose" the misconduct. However, the company received full cooperation credit for its cooperation and Wood's cooperation. Both the SEC and DOJ settlement papers note that both Foster Wheeler and Wood cooperated with the investigations, with the SEC Cease-and-Desist Order noting that that first Foster Wheeler, "and subsequently Wood, cooperated . . . by identifying and timely producing key documents identified in the course of its own internal investigation, providing the facts developed in its internal investigation, and making current or former employees available . . ." Therefore, despite the nature and seriousness of the offense – including that the misconduct spanned several years and involved a high-level Foster Wheeler executive – the criminal penalty reflected a 25 percent reduction off the applicable U.S. Sentencing Guidelines fine. It is unclear to what extent Wood's, in addition to Foster Wheeler's, cooperation in the investigations helped to secure the settlements, however, Wood's assurances as to continuing cooperation and remediation appear to be essential under the DPA, especially in avoiding a requirement for an independent compliance monitor (see below).

- No Compliance Monitor. The DOJ determined that no compliance monitor was necessary. Wood acquired Foster Wheeler after the misconduct took place and fully cooperated with the investigations. The DPA explains that no compliance monitor was necessary due to "[Foster Wheeler's] and Wood's remediation, the state of Wood's compliance program," and both companies' commitment to ongoing reporting to the DOJ. Both the DPA and the SEC's Cease-and-Desist Order note that Wood had made improvements to its compliance program, with the DPA stating that Wood "has enhanced and has committed to continuing to enhance" its compliance program and internal controls, which apply to all Wood companies (including Foster Wheeler). Likewise, the SEC's Cease-and-Desist Order says that Foster Wheeler "and subsequently Wood . . . strengthened [Foster Wheeler's] ethics and compliance organization; enhanced its code of conduct, policies and procedures regarding gifts and hospitality, and the use of third parties; created positions to address potential risks; and increased training of employees on anti-bribery issues." At the time of the settlements, Wood's compliance program was apparently sophisticated enough that – when considered in light of its lack of involvement in the misconduct and full cooperation with the investigations – the DOJ determined a monitor was unnecessary.

- Rare Use of 15 USC § 78dd-3: The anti-bribery provision of the FCPA under which Foster Wheeler incurred criminal liability, 78dd-3, applies to any person "while in the territory of the United States," other than an "issuer" (i.e., a U.S. or non-U.S. person that issues securities in the United States under 15 USC § 78dd-1) or a "domestic concern" (i.e., a U.S. citizen, national, or resident and any entity based in or organized under the laws of the United States under 15 USC § 78dd-2). Though rarely used when other bases of jurisdiction are available, 15 USC § 78dd-3 remains an important tool for the DOJ, especially given the agency's long-standing focus on bringing enforcement actions against both U.S. and non-U.S. companies to "level the playing field" in international business. Foster Wheeler and Wood are U.K. companies and much of the alleged misconduct took place in Brazil or in other jurisdictions outside the U.S. However, the alleged involvement of Foster Wheeler employees in the U.S. constituted a U.S. connection sufficient for the DOJ to assert jurisdiction over the conduct at issue. Somewhat surprisingly, although parent company Foster Wheeler AG was listed on NASDAQ during the time period of the misconduct, the DOJ did not charge Foster Wheeler as an agent of an issuer.

- Functional Successor Liability for Parent Company Wood: Wood was not named as a defendant in the U.S., Brazil, or U.K. actions, despite U.S. enforcement authorities' statements in the FCPA Guide and elsewhere that acquiring companies may incur successor liability for a subsidiary's pre-acquisition misconduct. Here, Wood acquired Foster Wheeler in 2017, after the U.S. and U.K authorities began investigating Foster Wheeler. Foster Wheeler's pre-acquisition parent company, Amec Foster Wheeler Plc, disclosed in a December 2016 securities filing that it had received voluntary requests for information from the DOJ and SEC regarding its historical use of agents and had made a disclosure to the SFO regarding the same. And according to Wood's public statements, Wood disclosed in a May 2017 circular to shareholders that the SFO may investigate Foster Wheeler (which the SFO subsequently confirmed in July 2017). Wood apparently determined to proceed with the acquisition despite the open investigations, and, as noted, escaped criminal liability based on its cooperation with the investigations, remedial efforts, and commitment to continued enhancement of its compliance program and internal controls – all of which the agencies have cited as factors that can help acquiring companies avoid liability in similar situations.

Wood did not escape financial liability, though. Despite not being "involved in the indicted conduct, and [cooperating] fully with the SFO's investigation," Wood accepted responsibility for payment of the penalty imposed by the SFO and for ongoing cooperation with the SFO. (Note also that earlier this year, Wood reached a separate resolution with the Scottish Crown Office and Procurator Fiscal Service (Crown Office) for violations of the UKBA related to misconduct by a different subsidiary, PSNA Limited (PSNA) – also involving consultancy Unaoil – to secure contracts in Kazakhstan.) In the U.S., Foster Wheeler has primary liability for the DOJ and SEC settlements; however, in the statement of facts accompanying the DPA, Wood agreed to pay the criminal penalty owed by Foster Wheeler if Foster Wheeler failed to pay within the specified time period. The DPA also contemplates potential prosecution of Wood if Foster Wheeler or Wood fail to fulfill their obligations under the agreement.

With respect to the Brazilian actions, identical press releases on the CGU and AGU websites note that the conduct occurred well before the Wood acquired the subsidiaries, and that the Brazilian authorities gave the parent company credit for the company's cooperation with the investigation. The language of the CGU and AGU press releases do not explicitly say that Wood is one of the "companies" responsible for payment, but the releases indicate that Wood agreed to take on other obligations in connection with the settlements – including improvements to its compliance program. By contrast, the MPF press release does not mention the parent company. - Continued Coordination Among U.S. and International Enforcement Agencies. As is increasingly common, Foster Wheeler's settlement went beyond resolving investigations with the DOJ and SEC. In related proceedings, the company received provisional court approval for a settlement with the SFO and settled with Brazilian authorities. As noted, the total settlement with all three countries amounts to $177 million. Both the SEC and DOJ provided for credits against disgorgement and the criminal monetary penalty, respectively, based on the international settlements. The DOJ touts the resolution as further demonstration of the U.S. government's "dedication to work with [] international partners" in the global effort to combat corruption.

- Different Conduct Cited in SFO Resolution. Under the DPA with the SFO, which was approved by a U.K. court on July 1, Foster Wheeler agreed to pay £103 million (~$143.3 million) to U.K. authorities – one of the largest payouts obtained to date in a U.K.-led corruption case. Notably, the U.K. settlement relates to a broader fact pattern, with the misconduct occurring from 1996 to 2014 in Brazil and multiple other countries, including Nigeria, Saudi Arabia, Malaysia, and India. The judge who approved the DPA also chastised Foster Wheeler for not responding appropriately to notices of potential improper conduct within those countries. Specifically, the judge noted that in 2007, the Board of Directors of Foster Wheeler's ultimate parent company, Foster Wheeler Limited, "received and discussed" a report prepared by outside counsel that apparently included information regarding "serious" misconduct in Saudi Arabia. The "serious and . . . [offensive]" conduct nonetheless continued, despite the Board's discovery. The judge said that but for "the two takeovers of [Foster Wheeler] that have occurred since, and because of the co-operation by Wood since the second of those takeovers," he would not have approved the DPA. The judge further noted that the "widespread and high-level culture of criminality" which existed at Foster Wheeler did not "taint" Wood, noting that the DPA was in fact only appropriate because of the "change in ownership and management."

Finally, the U.K. settlement also includes a £210,610 (~$292,800) compensation payment to the people of Nigeria. In addition to agreeing to pay the settlement sum on behalf of Foster Wheeler, Wood agreed to ongoing cooperation with the SFO and to report annually on the state of the company's compliance program.

Individual Enforcement Actions

Two Former Bolivian Officials and Three Others Charged with Conspiracy to Commit Money Laundering

On May 26, 2021, the DOJ announced that it had charged two former Bolivian government officials and three U.S. citizens with conspiracy to commit money laundering for their roles in an alleged international bribery scheme connected to the award of a Bolivian government contract. According to the DOJ, Bolivia's former Minister of Government, Arturo Carlos Murillo Prijic, and former Chief of Staff of the Ministry of Government, Sergio Rodrigo Mendez Mendizabal, accepted $602,000 in bribes from U.S. citizens Bryan Berkman, Luis Berkman, and Philip Lichtenfeld and from Bryan Berkman's Florida-based company, Bravo Technical Solutions (according to press reports). The bribes were allegedly paid to assist the company with acquiring a $5.6 million contract to provide equipment to Bolivia's Ministry of Defense.

The case proceeded under a notably swift timeline – the last bribe payment was in April 2020 and the parties were charged within one year. According to the complaints, in or around November 2019, Bryan and Luis Berkman sought to win a government contract to serve as an "intermediary" to provide the Bolivian Ministry of Defense with defense weaponry and equipment. Bryan Berkman allegedly asked Mendez to ban competitors from bidding on the contract and Berkman's company was awarded the contract. Berkman's company made a 40 percent profit on the resale of the equipment from the original Brazilian vendor to the Ministry of Defense. The Berkmans and Lichtenfeld allegedly laundered the bribe payments through banks in both Florida and Bolivia, ultimately arranging for a payment of $582,000 in cash to Murillo and Mendez. The complaints also state that the Berkmans and Lichtenfeld paid $20,000 to a third (unnamed) official in the Bolivian Ministry of Defense.

The complaints allege that the scheme may have violated the FCPA, as well as Bolivian anti-bribery laws, and all five individuals were charged with "intent to promote an FCPA violation," but the DOJ did not file charges under the FCPA itself against any of the defendants (including the three defendants who allegedly paid the bribes and would be candidates for such charges). The defendants each face a maximum of 20 years of imprisonment. In a late May 2021 press conference, the Bolivian interior Minister Eduardo del Castillo announced that Bolivia is seeking the extradition of both Mendez and Murillo to hold them accountable in Bolivia.

Indictment Against Former Chadian Diplomats Unsealed

On May 20, 2021, the U.S. District Court for the District of Columbia unsealed a 2019 indictment against two former Chadian diplomats to the U.S., Mahamoud A. Bechir and Youssouf H. Takane , in connection with an alleged international bribery and money laundering scheme which took place from 2009 to 2014. Bechir served as Chad's Ambassador to the United States and Canada from 2004 to 2012, and Takane was Chad's Deputy Chief of Mission for the United States and Canada from 2007 to 2012. Canadian businessman Naeem Riaz Tyab and Bechir's wife, Nourachem Bechir Niam , were also indicted. Niam led a company that was the intermediary for the payment of bribes by Tyab and Niam to Bechir and Takane. The DOJ charged Tyab and Bechir with conspiracy to violate the anti-bribery provisions of the FCPA and all four defendants were charged with conspiracy to commit money laundering. According to the indictment, Tyab — co-founder and director of a Canadian start-up energy company — and Niam conspired to pay bribes to Chadian officials, including Bechir and Takane, "in order to obtain lucrative oil contracts…from the government of Chad" and "increase[] the value of their respective holdings and property interests" in the company.

Tyab pleaded guilty to one count of conspiracy to violate the FCPA in 2019. In a proffer entered with his guilty plea, Tyab admitted that he promised to illegally pay a consulting company $2,000,000 for the purpose of paying Bechir and Takane, in exchange for which Bechir and Takane agreed to "misuse their official positions and use their influence with the government of Chad to assist…in obtaining oil rights in Chad."

According to Tyab's proffer, the energy company entered into a contract for consulting services knowing that consulting services "were not going to be performed, and that the money to be paid pursuant to the contract was intended as a bribe." The consulting company was held by Bechir's wife, Niam. Tyab's proffer explains that after entering into the contract in 2009, Tyab met with Bechir and "other high-level Chadian government officials…regarding [the energy company's] efforts to secure oil rights in Chad," and this meeting was "in furtherance of the corrupt offer, payment, and promise to pay Bechir and Takane." The proffer further details that in 2011, after the 2009 consulting agreement expired, Tyab signed another contract "promising to pay $2 million" to Bechir and Takane. The additional $2 million dollars was paid so that Bechir and Takan allegedly would continue to misuse their government positions and assist Tyab with obtaining oil rights in Chad. When making the bribery payments, Tyab and his co-conspirators caused wire transfers to be sent to U.S. bank accounts held by Bechir and Takane. The indictment also alleges that, as part of the bribe, in mid-2009, the Canadian energy company issued founders' shares to Niam upon the award of certain oil rights in Chad. In June of 2014, Niam allegedly tendered her 3,200 shares in the energy company back to the stock transfer company in 2014, profiting $30 million. At the time that the shares were tendered back, they were worth £5.50 per share.

Global Investigations Review reported that during the April 2019 hearing related to Tyab's plea agreement, Judge Leon raised concerns about the prosecutors agreeing to cap Tyab's potential prison sentence at five years by accepting a guilty plea, while the original indictment had a sentencing range between 17 and 20 years, saying that in his 17 years on the bench, he had "never seen a case like this." With the questions to prosecutors, Judge Leon explained that he wanted to be "comfortable and satisfied that any decision" that he made "was in the interests of justice."

In its May press release, the DOJ explained that as part of his 2019 guilty plea, Tyab "agreed to forfeit criminal proceeds of approximately $27 million." Tyab is still waiting to be sentenced, while Bechir, Takane, and Niam remain at large.

Former Employee of Goldman Sachs' U.K. Subsidiary Reaches Settlement with the SEC Arising Out of a Ghanaian Bribery Scheme

On June 23, 2021, the SEC settled civil FCPA charges with former Goldman Sachs executive Asante K. Berko for his role in an alleged scheme to bribe government officials in Ghana in 2015 and 2016. Berko, a dual U.S. and Ghanaian citizen, was responsible for the development of the investment banking business of both Goldman Sachs (Goldman) and its U.K. subsidiary (Goldman U.K.). As we previously reported, the SEC filed a complaint against Berko in April 2020, charging him with orchestrating a scheme to bribe Ghanaian government officials to help a Goldman U.K. client — a Turkish energy company — win a contract to build and operate an electrical power plant in the country and sell power to the Ghanaian government. (Goldman was not named in the complaint, but Berko's history at the company has been widely reported.)

According to the SEC's complaint, from approximately 2015 through at least 2016, Berko arranged for the (unnamed) Turkish energy company to funnel between $3 and $4.5 million in bribes to various Ghanaian government officials in exchange for approval of the power plant project. Berko allegedly schemed for the energy company to transfer the bribe payments through a Ghanaian intermediary company, which then passed the funds to Ghanaian officials in charge of approving the project. The complaint alleges that of the total planned bribe amounts, the energy company actually transferred $2.5 million to the intermediary company — "all or most of which was used to bribe" officials. According to the SEC, Berko also personally paid bribes to members of Ghanaian Parliament and other government officials. The complaint alleges that, unbeknownst to Goldman, Berko received $2 million from the Turkish energy company for successfully executing the scheme.

Berko allegedly concealed his misconduct from Goldman through calculated use of personal email and by purposefully submitting documentation to compliance officers falsely stating that the energy company had not compensated any third-party intermediaries in connection with the project. Goldman nonetheless conducted additional diligence on the project, discovered the use of the intermediary company (in part by reviewing Berko's emails), and investigated the intermediary's role in the transaction. The complaint noted that the energy company's executives failed to cooperate with Goldman's investigation by refusing to provide information, and Goldman terminated its involvement in the project in 2016. Berko resigned from Goldman effective in 2017 and worked as a consultant for the energy company.

The complaint accuses Berko of "circumvent[ing] . . . legal and compliance controls" of both Goldman and Goldman U.K., including deliberately misleading compliance personnel about the role of the intermediary company. The complaint notes that Berko "assisted the [energy company] CEO by drafting false and misleading responses to the questions posed by the [Goldman] compliance personnel."

The SEC charged Berko (an "agent and/or employee" of Goldman) with violating the anti-bribery provisions of the FCPA and aiding and abetting the holding company's (i.e., Goldman's) violations of those anti-bribery provisions.

Without admitting or denying the allegations in the complaint, Berko consented to the entry of a final judgment ordering him to pay $275,000 in disgorgement of "alleged net profits gained as a result of the conduct alleged in the Complaint" and approximately $54,000 in prejudgment interest. According to the SEC's April 2020 press release announcing the charges against Berko, Goldman was not charged related to this conduct because "[t]he firm's compliance personnel took appropriate steps to prevent the firm from participating in the transaction[.]"

Former Braskem CEO Pleads Guilty to FCPA Anti-Bribery and Books and Records Provisions

On April 15, 2021, Jose Carlos Grubisich, the former CEO of the publicly traded Brazilian petrochemical company Braskem S.A., pleaded guilty in a Brooklyn federal court to conspiring to violate the anti-bribery provisions of the FCPA and to violate the books and records provisions of the FCPA by failing to accurately certify Braskem's financial reports. In December 2016, Braskem and its parent company, global construction conglomerate Odebrecht (now known as Novonor S.A.) pleaded guilty to U.S., Brazilian, and Swiss bribery charges. Odebrecht pleaded guilty to one count of conspiracy to violate the anti-bribery provisions of the FCPA and a Brooklyn federal court sentenced the company to pay $2.6 billion in fines to the U.S., Brazilian, and Swiss governments.

According to the public case documents, from 2002 to 2014, Grubisich assembled a slush fund by diverting $250 million from Braskem for bribes for government officials, including Petrobras executives. Grubisich and his co-conspirators used fake contracts and offshore shell companies to disguise the payment. Grubisich hid the slush fund within a notorious Odebrecht business unit nicknamed "The Department of Bribery." The public papers state that, to conceal the bribes, Grubisich falsified Braskem's books and records by causing Braskem to record the payments to offshore shell companies as payments for legitimate services. Grubisich also allegedly pocketed $2.6 million for himself from the scheme. Though Grubisich left Braskem in 2008, he left co-conspirators in charge of the slush fund and through them continued to receive bribes into 2014.

At his sentencing scheduled for August 5, 2021, Grubisich faces up to 10 years in prison on two counts of conspiracy. He has also agreed to forfeit approximately $2.2 million. Additionally, Grubisich may be subject to criminal fines imposed by the sentencing judge for his violations of the FCPA.

Venezuelan Businessman Pleads Guilty to Money Laundering Charge

On April 19, 2021, Carlos Enrique Urbano Fermin (Urbano), a Venezuelan businessman, pleaded guilty in the U.S. District Court for the Southern District of Florida to one count of conspiracy to commit money laundering. According to the criminal information, Urbano owned and controlled certain companies that supplied goods or services to entities that entered into joint ventures with PDVSA. From at least 2012 to 2016, Urbano's companies obtained numerous large contracts with joint venture subsidiaries of PDVSA. The Venezuelan government began investigating corruption related to the awarding and paying of contracts from the PDVSA joint ventures. Urbano allegedly funneled bribes through an intermediary to a high-ranking prosecutor in Venezuela to prevent his companies from being prosecuted for corruption in connection with this investigation.

According to the factual proffer, Urbano wired $1 million from the United States to pay bribes, including $100,000 from an account in Urbano's name in the United States, to an account at a Florida bank that belonged to a lawyer who had a close relationship with the high-ranking prosecutor. Urbano admitted that he knew the lawyer had an improper arrangement with the prosecutor. The Venezuelan government did not bring charges against Urbano's companies after the payments were made. Urbano is scheduled to be sentenced on September 3, 2021.

Just two days later, Edoardo Orsoni, a former general counsel at PDVSA, was sentenced to three years of probation, which is discussed below.

PDVSA General Counsel Sentenced to Probation in Bribery-Related Money Laundering Case

On April 21, 2021, Judge Marcia G. Cooke of the United States District Court for the Southern District of Florida sentenced Edoardo Orsoni, a former general counsel at PDVSA to three years of probation. The sentence comes after Orsoni's August 2020 guilty plea to one count of conspiracy to commit money laundering in relation to a PDVSA joint venture bribery scheme.

Orsoni was charged in March 2020 with conspiracy to commit money laundering, with the specified unlawful activities being: (1) a felony violation of the FCPA and (2) offenses against a foreign nation involving bribery of a public official. Orsoni was accused of using his position to steer contracts from Petrocedeño S.A, a joint venture between PDVSA and two European oil companies, to specific contractors, which yielded benefits to senior PDVSA officials. According to federal prosecutors, in exchange for directing Petrocedeño's business to selected contractors, Orsoni received wire transfers totaling over $1,000,000 to corporate bank accounts he controlled in Portugal and Florida. Orsoni then used the funds for personal transactions, including the purchase of two properties in Miami.

The day before the sentencing hearing, the U.S. government filed a Motion for Reduction of Sentence on behalf of Orsoni because of his "substantial assistance to the government in the investigation and prosecution of others who have committed crimes against the United States." Orsoni is the latest defendant to be sentenced into the U.S. government's investigation into PDVSA, in which 22 individuals have pleaded guilty to various bribery-related offenses. As discussed above, Urbano pleaded guilty to one count of conspiracy to commit money laundering in the same court two days before.

American Businessmen and Venezuelan Officials of State-Run Oil Giant Sentenced in Connection with Bribery and Money Laundering Scheme; Judge Denies PDVSA's Restitution Bid

On April 30, 2021, Judge Kathleen M. Williams of the United States Federal District Court for the Southern District of Florida sentenced Gustavo Adolfo Hernandez Frieri (Hernandez Frieri), a former investment adviser for the Miami-based firms Global Securities Advisors and Global Strategic Investments, to 46 months in prison and ordered him to pay a $50,000 fine for his role in a $1.2 billion scheme involving bribery, money laundering, and currency exchange manipulations in transactions related to PDVSA. The sentence and fine stem from a plea agreement that Hernandez Frieri reached with the DOJ in November 2019.

Under his plea agreement, Hernandez Frieri pleaded guilty to one count of conspiracy to commit money laundering, with the specified unlawful activities identified in the indictment as (1) a felony violation of the FCPA and (2) an offense against a foreign nation involving bribery of a public official, including the misappropriation, theft, and embezzlement of public funds by and for the benefit of a public official.

According to the criminal complaint, beginning in December 2014, Hernandez Frieri's co-conspirators set up a sophisticated scheme to initially embezzle $600 million from PDVSA and launder a portion of the proceeds of that scheme. The embezzled amounts doubled to $1.2 billion by May 2015. The complaint describes a sophisticated criminal conspiracy involving fraudulent loan and assignment documents, false investment schemes, and bribes paid to officials at PDVSA. At the time, as Venezuela's supply of foreign currency was dwindling, PDVSA was the primary source of income and foreign currency in Venezuela. The conspiracy's scheme relied in part on the Venezuelan currency exchange system, under which the local currency's exchange rate with the U.S. dollar was pegged far below the true economic rate.

According to the DOJ's criminal complaint, participants in the conspiracy included officials at PDVSA, other members of Venezuela's elite (the boliburgués), along with nationals of Germany, Portugal, and Uruguay, some of whom the DOJ's complaint refers to as "professional money launderers." Hernandez Frieri's role in the conspiracy became prominent in 2016, when, according to a factual proffer, Hernandez Frieri helped launder approximately $12 million in bribes paid to a PDVSA official through the U.S. financial system using his Miami-based financial firms Global Security Advisors and Global Strategic Investments to create fraudulent investment schemes and contracts to conceal the bribe payments. The Miami office of Homeland Security Investigations, the principal investigative arm of the U.S. Department of Homeland Security (DHS), uncovered the scheme through an undercover investigation.

In a related case, on May 5, 2021, Abraham Edgardo Ortega, one of the PDVSA executives involved in the bribery and money laundering scheme, was sentenced by Judge Williams of the Southern District of Florida to 28 months for his role in the scheme. Federal prosecutors involved in Ortega's prosecution recommended a sentence below the low end of the federal sentencing guidelines, noting the substantial assistance that Ortega provided to the DOJ in the investigation.

A day later, Rafael Pinto-Franceschi and Franz Muller-Huber, two U.S. businessmen also involved in the misconduct, were sentenced in the U.S. District Court for the Southern District of Texas. According the DOJ's indictment, Pinto and Muller were each charged with one count of conspiracy to violate the FCPA, one count of conspiracy to commit wire fraud, two counts of wire fraud, and one count of conspiracy to launder money. Pinto, a sales representative for a U.S. industrial equipment supplier, pleaded guilty on July 31, 2019. He was sentenced to 24 months' imprisonment. Muller, Pinto's boss, who pleaded guilty on August 21, 2019, was sentenced to 20 months.

On the same day, the two PDVSA procurement officials who received bribe payments from Pinto and Muller were also sentenced in District Court for the Southern District of Texas. Both officials were charged with conspiracy to commit money laundering. José Orlando Camacho, who pleaded guilty in September 2018, was sentenced to 12 months while Ivan Alexis Guedez, who pleaded guilty in October 2018, was sentenced to 18 months.

In a ruling issued on June 18, 2021 in connection with Ortega's prosecution, Judge Williams denied PDVSA status as a "victim" under the Mandatory Victims Restitution Act (MVRA). PDVSA, through lawyers for the country's interim government led by Juan Guaidó, had submitted a filing to the court seeking to obtain status as a victim of the bribery and money laundering scheme, which, if granted, would have permitted the company to claw back up to $560 million that was funneled out of the country. In her ruling, Judge Williams rejected this bid, stating that PDVSA is not entitled to restitution because it was "in various ways, complicit in" the bribery and money laundering schemes. Judge Williams also rejected arguments made by PDVSA that the company had been "cleansed" through Guaidó's control, holding that what mattered was whether PDVSA met the qualifications for "victim" status under applicable U.S. law, and that PDVSA's involvement in the scheme meant the entity could not qualify as a victim.

On July 8, 2021, Charles Quintard Beech III, a former oil contractor, was sentenced in the U.S. District Court for the Southern District of Texas to 12 months in prison and was ordered to pay a $10,000 fine for his role in the bribery and money laundering scheme. According to the DOJ's criminal information document, Beech was charged with one count of conspiracy to violate the FCPA. Beech pleaded guilty in 2017 at the same time another businessman, Juan Jose Hernandez-Comerma, pleaded guilty to the same charges. Hernandez-Comerma and Beech admitted to separately paying bribes to the same PDVSA official in order to secure business.

Business Executive Luque Flores Sentenced in Petroecuador Bribery Scheme

On April 16, 2021, Judge Carol Bagley Amon of the United States District Court for the Eastern District of New York sentenced Ramiro Andres Luque Flores to four years of probation with six months of home confinement in connection with a scheme to bribe employees of Petroecuador, Ecuador's state-owned oil company. Luque Flores was also ordered to pay a $30,000 fine.

Luque Flores is the founder of Galileo Energy S.A., an Ecuadorian company specializing in the disposal of hazardous waste from oil and gas production. The U.S. government alleged that Luque Flores and his co-conspirators paid more than $3.2 million in bribes to Petroecuador officials in exchange for at least five hazardous waste disposal services contracts worth over $30 million.

According to statements by an attorney for the DOJ's Money Laundering and Asset Recovery Section at the sentencing hearing, Luque Flores was "first in the door" to cooperate with the DOJ, and the Court stated that Luque Flores' cooperation helped him to avoid a prison sentence. Specifically, Luque Flores cooperated quickly and extensively in the government's investigation, including going undercover and wearing a wire to record conversations with other targets, which led to the prosecution of five others and a noticeable decline in corruption in Ecuador. The DOJ also filed a "5K" motion to seek leniency on Luque Flores' behalf because of the substantial assistance provided by him.

At the same time, the Court evaluated Petroecuador's request for millions of dollars in restitution to recoup the bribes based on these corrupt contracts and the value of the deprivation of the officials of Petroecuador's honest services under the Crime Victims' Rights Act (CVRA) and the MVRA. Petroecuador argued that their corrupt employees acted outside of the scope of their official duties. In a written memorandum and order issued on May 14, 2021, Judge Bagley Amon denied the request as to the corrupt contracts theory because Petroecuador had failed to show that it was a victim as defined under the MVRA ("a person directly and proximately harmed as a result of the commission of an offense for which restitution may be ordered . . . ."), and Petroecuador's employees, including "numerous officials at the company's highest levels," were complicit in Luque Flores' misconduct, acting to benefit their company by obtaining large government contracts. Judge Bagley Amon also noted that even if Petroecuador had properly shown the company was a victim, she would have denied relief for Petroecuador's failure to prove its losses and failure to prove that it suffered the losses it claimed. As to the loss of honest services theory, Judge Bagley Amon found that Petroecuador had failed to prove a reasonable approximation of the loss amount (20 percent of the full value of the employees' salaries which Petroecuador paid during the time of the corruption).

Lastly, Judge Bagley Amon noted that she declined to grant restitution because "resolving the numerous complex issues of fact implicated by Petroecuador's theory of damages would impose an undue burden on the sentencing process," highlighted by the fact that Petroecuador itself had difficulty sufficiently estimating its losses. Further, Judge Bagley Amon noted that her ruling accords with two panels of the Eleventh Circuit that had also considered and rejected Petroecuador's restitution requests under the CVRA and MVRA. In both of these cases, the Eleventh Circuit pointed to the fact that at least four Petroecuador employees, including those at a high level, were involved in the bribery scheme, acted within the scope of their employment, and acted, at least in part, for the benefit of Petroecuador. Additionally, both Eleventh Circuit panels found that Petroecuador could not prove that it had been harmed by the bribes because it could not show that the contract prices had been inflated because of the bribes.

Former Barbados Public Official Sentenced to Two Years Imprisonment for Money Laundering

On April 27, 2021, Judge Kiyo Matsumoto of the United States District Court for the Eastern District of New York sentenced Donville Inniss, a former elected member of the Parliament of Barbados, to a two-year prison term for laundering a total of $36,000 in bribe payments through U.S. bank accounts. Inniss was also ordered to forfeit $36,536.73. Inniss filed a Notice of Appeal of his conviction and sentence on May 6, 2021, and that appeal is still pending.

As we reported in the FCPA Spring 2020 Review, Inniss, a U.S. permanent resident, was convicted by a jury in the Eastern District of New York on January 16, 2020 of two counts of money laundering and one count of conspiracy to commit money laundering. On July 24, 2020, the Court denied Inniss' motion for a judgement of acquittal of all three accounts of conviction, in which he challenged the sufficiency of evidence to sustain a conviction.

According to the Second Superseding Indictment, from August 2015 to April 2016, Inniss received two distinct bribe payments totaling $36,000 in violation of Barbados law from senior executives at the Insurance Corporation of Barbados Limited (ICBL). The payments were made in exchange for his leveraging his position as the "Minister of Industry, International Business, Commerce and Small Business Development" to assist ICBL in obtaining renewed insurance contracts with the government agency Barbados Investment and Development Corporation (BIDC), over which Inniss exercised authority. Inness twice caused BIDC to renew an insurance contract with ICBL, and in return, Inniss received payments that generally represented percentages of the premium that BIDC was to pay ICBL under its renewed contract to insure over $100 million worth of government property.

Inniss sought to conceal the bribes by directing the ICBL executives to make the payments to a U.S. bank account belonging to the dental business of a friend/associate. Under the scheme, ICBL made the payments through BF&M Ltd. (BF&M), its parent company in Bermuda, by using fake invoices from the dental business to ICBL for purported consultancy services and submitting the fake invoices to BF&M for processing payments. Both Inniss and an ICBL executive created fake invoices from the dental business to ICBL. Almost all of the money BF&M sent to the dental business's U.S. bank account was subsequently deposited into Inniss' own U.S. bank accounts.

Inniss faced a statutory maximum sentence of 20 years in prison for each count. Inness argued for a probationary sentence on various grounds, including by citing his age and concerns about COVID-19, as well as several cases that involved "significantly higher" amounts of money in which the defendants received sentences "substantially less" than the advisory guideline range. In the sentencing memo, the prosecution recommended the Court to impose a sentence within the applicable range of 78 to 97 months' imprisonment, arguing that it is "necessary to deter other corrupt government officials and individuals who, like the defendant, would seek to use the instrumentalities of the United States financial system in furtherance of foreign bribery and to inform the public that committing such conduct will be punished." The Court's sentencing order does not explain the reasons for its downward variance to two years' imprisonment (on each count, to be served concurrently).

As discussed in our FCPA Reviews for Spring 2020 and Autumn 2018, while the DOJ issued a declination to ICBL, noting as a contributing factor ICBL's cooperation and provision of information allowing the DOJ to identify and charge the culpable individuals, the two ICBL senior executives allegedly involved in the bribery scheme have been charged. Those charges are still pending.

Former Executive Daren Condrey Sentenced to Two Years for Role in a Nuclear Energy Bribery Scheme

On April 30, 2021, Daren Condrey, a former co-president of Maryland-based trucking company Transport Logistics International (TLI), was sentenced to 24 months' imprisonment by the U.S. District Court of the District of Maryland for his role in a bribery scheme. Following release from his two-year sentence, Condrey will be on supervised release for an additional three years. Condrey previously pleaded guilty in June 2015 to one count of conspiracy to violate the FCPA and to commit wire fraud.

Condrey and others allegedly made bribe payments on behalf of TLI to Vadim Mikerin, Russian foreign official and president of TENAM Corporation (a Maryland-based wholly owned subsidiary of Tenex) in order to retain business with Tenex, which "supplied uranium and uranium enrichment services to nuclear power companies throughout the world on behalf of the government of the Russian Federation." Tenex is a subsidiary of Russia's State Atomic Energy Corporation.

The plea agreement states that Condrey and other co-conspirators "obtained the money used to pay the bribes by inflating the prices" TLI charged Tenex for services and that they communicated regarding these payments via email, using code words such as "lucky figure" and "cake" to describe the bribes. Payments were made from U.S. bank accounts to offshore bank accounts located in Cyprus, Latvia, and Switzerland. In one instance, TLI acted as an intermediary for a payment made by another U.S. corporation for the benefit of the Tenex Director. From 2004 through 2014, Condrey and other conspirators allegedly caused TLI to pay bribes totaling more than $1,000,000 to benefit of Mikerin in connection with the bribery scheme involving TLI.

As previously reported, Condrey pleaded guilty in June 2015 alongside his co-conspirator, Boris Rubizhevsky, to a combination of FCPA, wire fraud, and money laundering charges. In November 2019, a jury in Maryland convicted Mark Lambert, president of TLI, of four counts of violating the FCPA, two counts of wire fraud, and one count of conspiracy to violate the FCPA and commit wire fraud in connection with the scheme. Condrey testified at Lambert's 2019 trial as a government witness, which presumably contributed favorably during his sentencing. Mikerin also pleaded guilty to one count of conspiracy to commit money laundering in connection with the scheme.

New Jersey Businessman Sentenced for $100,000 Bribery of South Korean Official

On May 19, 2021, Judge Claire Cecchi of the United States District Court for the District of New Jersey sentenced Deck Won Kang, a U.S. citizen, to three years of probation and ordered Kang to forfeit $1.5 million as a result of Kang's pleading guilty to one count of violating the anti-bribery provisions of the FCPA. Kang admitted in December 2020 that he had violated the FCPA by paying $100,000 in bribes to a South Korean official in exchange for assistance in securing contracts with the Defense Acquisition Program Administration (DAPA) of the South Korean Ministry of National Defense.

As discussed in our FCPA Winter Review 2021, Kang owned two New Jersey companies that provided naval equipment and technology services. In 2009, DAPA, a state-owned and controlled agency, solicited contract bids for an initiative to update the Korean Navy's fleet of ships. The DOJ alleged that Kang promised to provide a high-ranking Korean Navy official involved with procurement at DAPA with "something of value" in exchange for the official's assistance in securing the contract. In May 2010, the official allegedly provided Kang with non-public information to assist Kang in obtaining the DAPA contracts. The case documents state that from 2012 to 2013, Kang paid the official bribes in eight installments, totaling $100,000.

According to Kang's counsel, Kang had already spent two years in South Korean prison for the same bribery scheme; thus, all parties agreed that no further U.S. prison time was necessary. Kang's defense counsel had asked for two years of probation, but the DOJ asked for three years of probation, a sentence that Judge Clair Cecchi imposed, pointing out that she considered the violation to be a "serious offence."

Policy and Litigation Developments

Biden Administration Continues Efforts to Appoint and Confirm Key FCPA Enforcement Personnel