Trade Compliance Flash: UFLPA Enforcement 2024 Year in Review

International Alert

As the Uyghur Forced Labor Prevention Act (UFLPA) entered its third year in effect, enforcement by Customs and Border Protection (CBP) and the Department of Homeland Security (DHS) increased significantly. Here are key statistics and enforcement trends from 2024 as well as topics that we will be watching closely in 2025.

Refresher on the UFLPA. The UFLPA requires CBP to apply a rebuttable presumption that imports of goods manufactured, wholly or partially, in the Xinjiang Uyghur Autonomous Region (XUAR) of the People's Republic of China (PRC), or by entities listed on the UFLPA Entity List, are made with forced labor and therefore not eligible for entry into the U.S. The presumption also applies to goods that include component inputs made in the XUAR. To comply with the UFLPA, CBP expects importers to conduct due diligence, implement effective supply chain tracing, and execute supply chain controls to ensure that goods entering into the U.S. are not prohibited under the UFLPA.

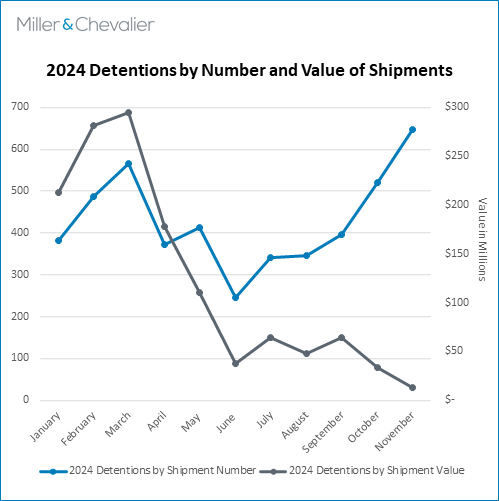

UFLPA Enforcement By the Numbers. CBP's UFLPA enforcement efforts increased over the course of the year. Overall, there was a 25 percent increase in the number of shipments detained between 2023 and 2024. On average, CBP detained 428 shipments per month in 2024, comparted to 342 shipments per month in 2023.

In the second half of 2024, the number of shipments detained steadily increased despite a decrease in the value of merchandise detained. November represented the lowest dollar value of detentions ($13 million) of any full month since the UFLPA took effect in 2022, but also the highest number of detentions in a single month (648 shipments). In total, CBP detained $1.34 billion in merchandise over the course of the year.

The dip in the value of the goods detained does not indicate relaxed enforcement by CBP. Rather, the decreased value demonstrates a shift in focus toward lower value goods or component parts, such as a microchip, that would be used in manufacturing a final product in the U.S. In the first two years of UFLPA enforcement, CBP detained a significant number of solar panels, which have a high dollar value attached to each shipment. As CBP's enforcement priorities diversified in 2024, it is unsurprising that the value of shipments detained has declined. If high-value products, such as finished automobiles, are detained in 2025, we would expect to see a significant increase in detention values again.

For the second year in a row, detentions by CBP's Electronics Center of Excellence and Expertise (CEE) generated the highest number of detentions in 2024, with 2,173 shipments detained between January and November 2024. However, the automotive and aerospace industry experienced the greatest growth over the course of 2024 with a nearly 1,600 percent increase in the number of shipments detained in 2024 compared to the same time frame in 2023. Most of this increase occurred in the last quarter of 2024, when we saw a 1,000 percent surge in the number of automotive/aerospace shipments detained with 523 detentions in November 2024 up from 45 detentions in August 2024. Reports indicate that automotive components and drones account for some of this recent increase.

Detentions by CBP's Apparel, Footwear, and Textiles CEE and Consumer Products and Mass Merchandising CEE reflected moderate growth in 2024 compared to 2023, consistent with the overall increase in UFLPA enforcement.

Meanwhile, CBP's enforcement in other industries dropped this year. Notably, detentions by the Industrial and Manufacturing Materials CEE and Machinery CEE fell significantly — over 70 percent — from 2023 to 2024.

| Number of Detentions by Industry* | 2023 | 2024 | % Change |

|---|---|---|---|

| Automotive and Aerospace | 59 | 991 | 1,579.7% |

| Electronics | 1,463 | 2,173 | 48.5% |

| Apparel, Footwear, and Textiles | 578 | 771 | 33.4% |

| Consumer Products and Mass Merchandising | 156 | 200 | 28.2% |

| Pharmaceuticals, Health, and Chemicals | 92 | 87 | -5.4% |

| Agriculture and Prepared Products | 230 | 217 | -5.6% |

| Base Metals | 230 | 162 | -29.6% |

| Industrial and Manufacturing Materials | 938 | 217 | -76.9% |

| Machinery | 156 | 32 | -79.5% |

*CBP's UFLPA enforcement statistics for December 2024 are not yet available. Therefore, we compare January 2023 to November 2023 with January 2024 to November 2024.

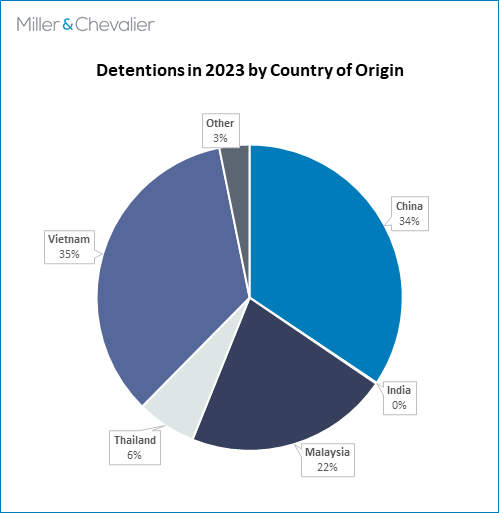

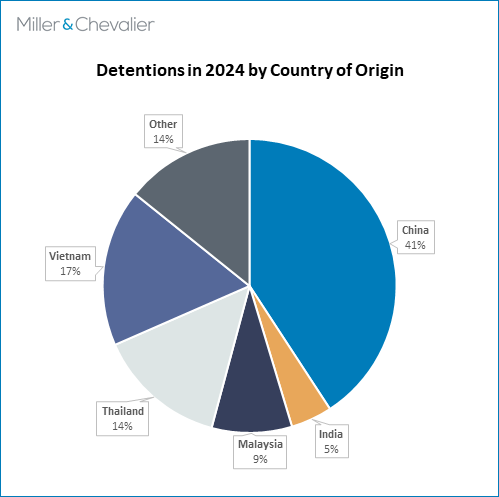

In addition to the shift in the industries that most frequently experienced detentions, 2024 also saw a clear shift in the origin profile of the shipments detained by CBP. While China remained the primary country of origin represented in 2024 detentions, the percentage of detentions increased to 41 percent, up from 34 percent in 2023. There was also a marked increase in the number of shipments detained with India or Thailand declared as the country of origin, while detentions where Vietnam and Malaysia were declared decreased. Of note is the significant rise in the "other" category. While CBP's public statistics do not identify the other countries of origin for detained shipments, we understand that many importers have moved their U.S.-bound operations to countries such as Singapore, which could account for the change in the profile of detentions this year.

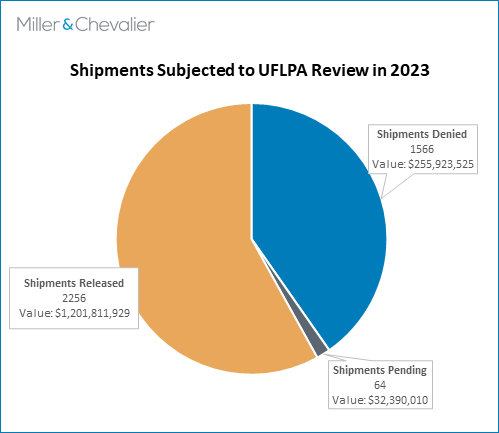

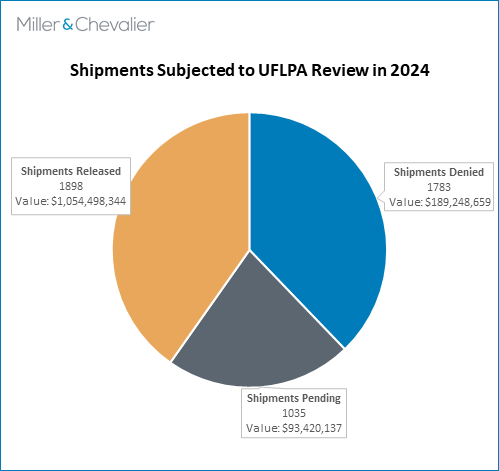

Once a shipment is detained, the importer has an opportunity to contest whether the UFLPA applies and argue that import of the specific shipment is not restricted. Thus far, approximately 48 percent of shipments detained in 2024 were ultimately denied, compared to 41 percent in 2023. There are nearly $100,000 worth of goods still pending review for 2024; however, we expect an increased rate of goods released in 2024 as importers become more familiar with their supply chains as well as CBP's standards and expectations. The upward trend in denials could indicate stricter scrutiny by CBP or more complex tracing required to admit detained products. For example, products such as motors, which have hundreds of component parts, have more complex supply chains requiring more complex tracing compared to simpler products, like a tee shirt or produce.

Given recent trends, we anticipate robust enforcement of the UFLPA in 2025 and a potential further increase in the number and scope of detentions.

Areas of Enforcement Focus. In July 2024, DHS issued its 2024 Updates to the Strategy to Prevent the Importation of Goods Mined, Produced, or Manufactured with Forced Labor in the People's Republic of China (2024 Strategy Update). The 2024 Strategy Update announced the addition of aluminum, polyvinyl chloride, and seafood to the growing list of high-priority sectors for UFLPA enforcement, which already included industries such as cotton, apparel, and other minerals. In practice, detentions for the year also reflect these areas of focus. The top industries detained in 2024 include electronics, automotive/aerospace, and apparel, footwear, and textiles. In addition, the increased focus on aluminum products and critical minerals, such as lithium and cobalt, which are key components in electric vehicle (EV) batteries, forecasts a likely increase in automotive detentions in 2025.

The Entity List Expanded Significantly. After infrequent additions in prior years, the UFLPA Entity List experienced rapid and unprecedented growth in 2024. The Forced Labor Enforcement Task Force (FLETF) announced additions to the UFLPA Entity List on May 17 (26), June 12 (3), August 9 (5), October 3 (2), November 1 (4), and November 25 (29). The UFLPA Entity List now contains 107 companies, more than double where it began the year.

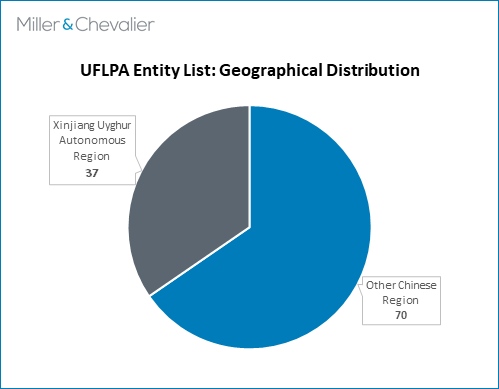

Of the 107 designated entities, 37 entities are based in the XUAR. As mentioned in the refresher above, the UFLPA's rebuttable presumption automatically applies to any entities based in the XUAR. While designation on the UFLPA Entity List is technically duplicative because goods from these entities are presumptively prohibited from import, designation on the Entity List allows importers to more easily and clearly identify potential risks in their supply chains. The remaining 70 entities are based in other regions of China, which reinforces the need for companies to closely examine upstream supply risks even if they do not source from the XUAR.

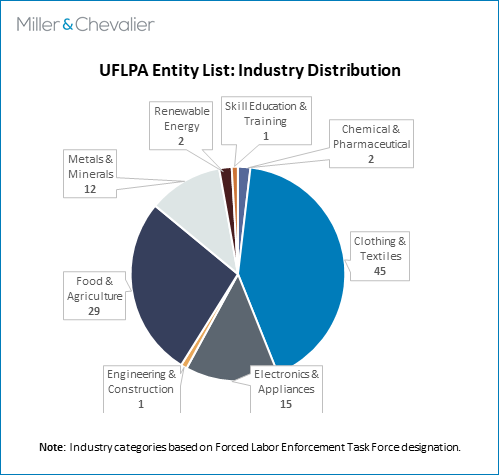

The entities designated on the UFLPA Entity List also reflect CBP's diverse enforcement priorities. The Entity List contains entities from a variety of industries. The top industries represented are clothing and textiles (45), food and agriculture (29), electronics and appliances (15), and metals and minerals (12), all of which are high-priority enforcement industries or contain components from high-priority enforcement industries.

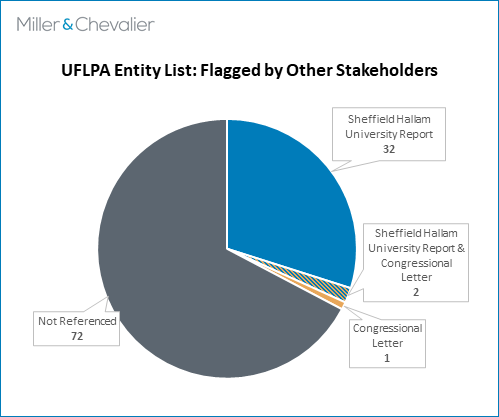

In addition to reflecting CBP's enforcement priorities, the Entity List also reflects UFLPA priorities identified by other stakeholders. Of the 107 entities, approximately 32 percent were identified by a report from Sheffield Hallam University (SHU) prior to its designation on the Entity List, suggesting that SHU reports carry considerable weight as the FLETF targets and investigates potential Entity List additions. At the end of 2023, Laura Murphy, a professor at SHU, joined DHS as a Senior Policy Advisor in the Office of Strategy, Policy, and Plans. One of her many responsibilities in this role is to lead research related to the UFLPA Entity List and to advise the Entity List Office and FLETF on process improvements. It is unsurprising to see such a strong SHU influence on Entity List additions as well as an overall increase in Entity List additions during Laura Murphy's tenure at DHS.

Based on these trends, we expect further expansion of the UFLPA Entity List in 2025.

Congressional Support in 2024. Congress continued to signal strong support for UFLPA enforcement efforts throughout 2024 both through congressional letters and legislation. Members of Congress issued letters in January, April, June, and October, all of which suggested significant additions to the UFLPA Entity List in various industries, including the apparel, battery, critical minerals, and pharmaceutical industries. A separate bipartisan letter sent to the U.S. Trade Representative (USTR) in September 2024 urged improved cooperation between the U.S., Canada, and Mexico to prevent circumvention of the UFLPA through the U.S.'s neighbors. In addition to support for increased enforcement and expansion of the UFLPA Entity List, congressional support also extended to proposed legislation in 2024. For instance, the bipartisan Critical Material Transparency and Reporting of Advanced Clean Energy (TRACE) Act called for development of a system to trace critical minerals in battery supply chains for environmental purposes as well as to address forced labor and human rights concerns. At the end of the year, the Senate Committee on Appropriations also released a proposal for increased funding for forced labor enforcement, including more than $9 million to DHS and $5 million to Homeland Security Investigations (HSI) for expenses and technology related to improved UFLPA enforcement. We expect to see support from the new administration as well as continued congressional support in the new year.

What to Look for in 2025

There are many open questions regarding the future of UFLPA enforcement as we enter a new year and a new administration. There are several key topics we will monitor throughout the year:

- Will UFLPA enforcement continue the upward trend of the last few years, or will enforcement stagnate in 2025? 2024 was a year of rapid expansion of UFLPA enforcement as the number of detentions increased significantly, enforcement priorities diversified, and the Entity List more than doubled. Despite these 2024 achievements, CBP officials recently indicated the need for continued forced-labor enforcement efforts, noting that "the fight is far from over... This challenge requires continuous, collective effort — from governments, industries, and consumers — to ensure a world where no one's humanity is traded for profit." In addition, the president-elect's cabinet nominees and advisors include long-time supporters of the UFLPA and advocates for increased scrutiny of Chinese trade practices, signaling likely support for ongoing enforcement efforts related to forced labor in China. Based on the government's 2024 enforcement trajectory and expected support, we would anticipate continued momentum in 2025. Nevertheless, enforcement trends can be unpredictable and we could instead see UFLPA enforcement plateau unexpectedly as new enforcement priorities take focus. We will watch CBP's public statistics to see how the UFLPA fares in 2025.

- Will current industry enforcement priorities continue, or will the incoming administration shift its focus to new areas in 2025? Since the UFLPA took effect in 2022, CBP and DHS have highlighted several high-priority sectors, including polysilicon, aluminum, apparel, cotton, seafood, and other critical minerals. Consistent with these priorities, industry experts have forecasted a likely uptick in supply-chain enforcement in the automotive industry, particularly related to EV batteries, since the industry relies heavily on minerals such as aluminum, lithium, and cobalt. Furthermore, China, including the XUAR, mines and processes key minerals in the EV battery supply chain, making battery products ripe for UFLPA enforcement. While we have yet to see large-scale automotive or battery detentions, automotive enforcement more broadly is on the rise and government agencies have laid the groundwork for future battery detentions. For instance, as we reported in December, FLETF added two upstream suppliers of Chinese EV battery companies, Contemporary Amperex Technology Co., Ltd. (CATL) and Gotion High-tech Co., Ltd. (Gotion), to the UFLPA Entity List. In addition, CBP officials have suggested that they are meeting with companies and trade associations to better understand battery supply chains, which was a key step undertaken in coordination extensive solar panel detentions. We will follow the new administration's policy announcements as well as FLETF's Entity List additions closely to see whether 2025 is the year CBP cracks down on automotive imports or whether the new administration steers enforcement in a different direction.

- Will companies on the UFLPA Entity List be able to successfully challenge designation, or will they remain on the Entity List? To date, no entity designated on the UFLPA Entity List has secured its removal. Ninestar Corporation, a Chinese laser printer manufacturer, and seven of its subsidiaries (collectively, Ninestar) were placed on the UFLPA Entity List in June 2023. Ninestar filed suit in the Court of International Trade (CIT), challenging the designation, including demanding that FLETF provide additional information regarding the reason(s) for the designation. The suit, which was ongoing throughout 2024 and is currently stayed while the FLETF considers Ninestar's delisting petition, is the first of its kind and could have far-reaching impacts on the process of adding companies to the UFLPA Entity List as well as the level of explanation provided to importers whose goods have been detained pursuant to the UFLPA. We will continue to watch how the litigation and delisting petition unfold and the ultimate impact on enforcement of the UFLPA.

- Will importers receive more context and detailed explanations in the event of a detention, or will CBP continue to limit the information given to importers of detained goods? In our experience, CBP often provides minimal information regarding why a particular shipment was detained pursuant to the UFLPA and is generally tight-lipped when explaining the reason(s) that an admissibility petition is unsuccessful (i.e., why CBP reviewers determined that an importer's supply chain tracing was insufficient to ensure UFLPA compliance). This opaque practice can cause significant frustration with importers, particular importers who would like to cooperate with CBP and resolve any outstanding issues regarding their supply chain to secure release of the detained goods. Many have advocated for greater transparency in CBP's targeting and review processes, making similar due process arguments as the Ninestar litigation. We will keep track of shifts both in policy and in practice related to CBP's level of transparency with importers as well as continue to encourage more open dialogue to resolve UFLPA detentions.

- Will we see continued congressional support for UFLPA enforcement, or a move to new legislative priorities in 2025? The Select Committee on the Chinese Communist Party was quite active last year and several new bills aimed at forced labor enforcement that were introduced in 2024 could be heard this year. It is difficult to predict whether this level of congressional support will continue or wane with the new Congress. Senator Marco Rubio (R-FL), who was a key sponsor of the UFLPA, has been nominated to be the next Secretary of State. Departing Secretary of Homeland Security Alejandro Mayorkas said that Rubio was a "champion" of forced labor enforcement and that he expects to see its continued prioritization. We will monitor whether Rubio's departure results in a shift to new legislative priorities or whether other lawmakers continue to drive the issue forward.

While there are open questions as to how the UFLPA will be enforced in 2025, we can say with certainty that 2024 was a growth year for enforcement as the UFLPA entered its third year in effect and the law moved beyond its early struggles to get enforcement off the ground. In 2024, CBP's enforcement efforts increased both in the number of shipments detained as well as the scope of industries subject to review. Furthermore, the FLETF dramatically expanded the size of the UFLPA Entity List, adding nearly 70 entities in 2024, and Congress continued to push for further anti-forced labor measures. As a result, 2024 was defined by robust and growing enforcement of the UFLPA.

Miller & Chevalier has deep experience in both proactive UFLPA compliance strategies to mitigate the risk of detentions and interfacing with CBP to secure the release of detained goods. Our team is led by a former CBP attorney and includes attorneys with extensive knowledge of U.S. anti-forced labor laws and priority sectors, and Mandarin language skills.

For more information, please contact:

Richard A. Mojica, rmojica@milchev.com, 202-626-1571

Daniel A. Solomon, dsolomon@milchev.com, 202-626-5982

Brittany Huamani, bhuamani@milchev.com, 202-626-5911

Aditi Patil, apatil@milchev.com, 202-626-1485

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.