FCPA Winter Review 2022

International Alert

Introduction

2021: Year in Review

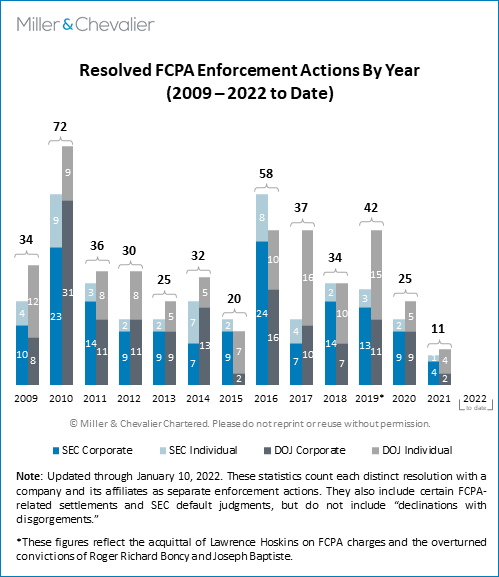

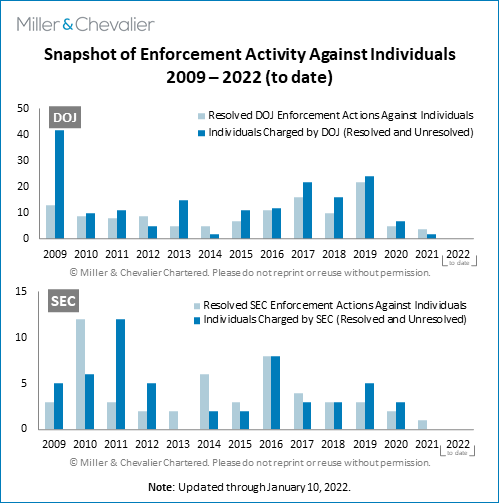

Calendar year 2021 saw the fewest number of announced enforcement actions related to the Foreign Corrupt Practices Act (FCPA) in at least 15 years. This end result is different from what U.S. Department of Justice (DOJ) officials had signaled mid-year, when some officials indicated that 2021 would be on par with previous years. Likely contributing to these figures were the continuing effects of the global COVID-19 pandemic (including the Delta and Omicron variant surges), the transition to a new policy team at the DOJ Criminal Division, some significant turnover at the Fraud Section, and (as always) the individual facts and dynamics of each matter under investigation. Given the changes in enforcement policies and other notable actions in the second half of 2021, the case closure rate for the year is likely not predictive of enforcement levels for 2022.

Enforcement Actions

Overall, the DOJ resolved three cases against companies (Deutsche Bank, Foster Wheeler, and Credit Suisse) and four actions against individuals in 2021, while the U.S. Securities and Exchange Commission (SEC) concluded four settlements with companies (the three noted above in conjunction with the DOJ, plus WPP) and one action related to an individual.

The year began with dispositions by the DOJ and SEC involving Deutsche Bank on January 8, 2021 – the financial institution's second round of FCPA-related settlements in 18 months. As is the case with roughly three quarters of past FCPA-related resolutions, the allegations centered on activities by and management of third parties – called "Business Development Consultants" by the bank. Presaging changes announced in the second half of 2021 and because of Deutsche Bank's prior history, the DOJ criminal fine – part of a total set of penalties worth $123 million – was nearly double what it could have been under typical criminal fine calculations in FCPA resolutions for first-time offenders. Perhaps contrary to changes in policy later in 2021, the agencies did not impose a monitorship, citing Deutsche Bank's remediation efforts, despite findings of significant controls and compliance issues and violations that implicated now-former members of the bank's senior management.

The next corporate action, and the first under the Biden administration, was announced in late June 2021 and involved U.K.-based construction engineering company Foster Wheeler. The latest of many cases involving corruption in Brazil centered on Petrobras, the matter also involved Unaoil, which was connected to an intermediary acting for Foster Wheeler. The intermediary had been rejected based on due diligence conducted by the company but continued to represent the company unofficially – including allegedly acting as a conduit for bribes paid to Petrobras officials to secure a $190 million contract with Petrobras to design a gas-to-chemicals complex. Foster Wheeler's June resolutions with the DOJ and SEC were part of an internationally coordinated resolution with the Brazil Controladoria-General da Uniᾶo (CGU)/Advocacia-Geral da Uniᾶo (AGU) and the Ministério Publico Federal (MPF), as well as the U.K. Serious Fraud Office (SFO). The combined settlements resulted in the assessment of $177 million total in compensation, disgorgement and prejudgment interest, fines, and penalties across the various regulators. Foster Wheeler's parent company, U.K.-based global engineering company John Wood Group plc (Wood) – which had its own anti-corruption resolution in March 2021 with Scottish authorities based on different conduct – was not named as a defendant in the proceedings but agreed to take on certain financial and reporting obligations in connection with the various settlements.

In September 2021, the SEC announced a settlement with WPP plc, a major international advertising group based in London and New York City, under which WPP agreed to pay over $19 million to settle charges related to allegations that various of its subsidiaries had engaged in bribery and other unlawful schemes in India, China, Brazil, and Peru. All the publicly described schemes giving rise to the FCPA charges in the settlement occurred in entities that WPP acquired through what the SEC termed an "aggressive acquisition strategy." The alleged facts show that WPP did not place effective compliance resources, "entity-level controls," and oversight mechanisms in place to counter the rapidly expanding heightened risks that the new affiliates the company acquired created for WPP's global operations. Thus, the SEC held WPP responsible for continuing pre-acquisition practices by held-over local management that went undetected or were not adequately remediated.

Finally, as discussed in detail below, in October 2021, the SEC and DOJ announced dispositions with Credit Suisse Group AG (Credit Suisse) to resolve alleged misconduct involving kickbacks paid to intermediaries, who in turn paid bribes to government officials in Mozambique. The U.S. dispositions were part of a coordinated resolution with U.K. authorities on FCPA and other charges and resulted in Credit Suisse agreeing to pay approximately $475 million – the highest disposition amount of 2021 – to the SEC, DOJ, and the U.K.'s Financial Conduct Authority (FCA). Of note, the DOJ charged Credit Suisse only with conspiracy to commit wire fraud rather than FCPA-related charges, possibly due to the jurisdictional issues highlighted in the DOJ's setback in the related case against Jean Boustani, also discussed below. Despite this case being the second FCPA-related action against Credit Suisse in four years, the U.S. authorities did not impose a monitor – though a related disposition with Swiss financial authorities did result in the appointment of an independent third party to monitor Credit Suisse's risk management and internal control systems. Notably, nine days after the Credit Suisse resolution was announced, the DOJ updated its guidance on FCPA corporate enforcement actions to emphasize that recidivism will impact future resolutions and to reassert that the DOJ will impose monitors whenever deemed appropriate.

Despite public statements reaffirming the commitment of both agencies to the pursuit of culpable individuals, the number of publicly announced resolutions against individuals was substantially below 2020 levels and levels for the last few years. That said, there were several notable enforcement actions involving individuals in 2021.

In March 2021, two former procurement officers with Citgo Petroleum Corporation's (Citgo) Special Projects Group pleaded guilty in connection with multi-year international money laundering and bribery schemes. Laymar Giosse Peña Torrealba (Peña) and Jose Luis De Jongh Atencio (De Jongh) both pleaded guilty to money laundering charges – De Jongh doing so on the eve of his scheduled trial after the DOJ noted plans to introduce new evidence (tax returns) that undermined his planned defense, which was in part a claim that he received the payments at issue with the consent of Citgo. In November 2021, Peña was sentenced to three years of probation. De Jongh is scheduled to be sentenced in February 2022. The cases involving De Jongh and Peña are one part of a larger ongoing U.S. government investigation into bribery and related criminal activity at Petróleos de Venezuela, S.A. (PDVSA).

In April 2021, Jose Carlos Grubisich, the former Chief Executive Officer (CEO) of the Brazilian petrochemical company Braskem S.A., pleaded guilty in a Brooklyn federal court to conspiring to violate the FCPA's anti-bribery provisions and to violate the FCPA's books and records provisions by failing to accurately certify Braskem's financial reports. Per the related public documents, from 2002 to 2014, Grubisich assembled a slush fund by diverting $250 million from Braskem for bribes of government officials, including executives from Petrobras. Grubisich and his co-conspirators used fake contracts and offshore shell companies to disguise the payment. Grubisich hid the slush fund within a notorious Odebrecht business unit nicknamed "The Department of Bribery." Braskem and its parent company, global construction conglomerate Odebrecht (now known as Novonor S.A.) pleaded guilty in December 2016 to U.S., Brazilian, and Swiss bribery charges and paid $2.6 billion in fines to the U.S., Brazilian, and Swiss governments. In October 2021, Grubisich was sentenced to 20 months in prison, and was ordered to pay $1 million in fines and to forfeit $2.2 million.

In the only SEC individual FCPA-related matter settled in 2021, SEC settled civil FCPA charges with former Goldman Sachs executive Asante Berko for his role in an alleged scheme to bribe government officials in Ghana in 2015 and 2016. Berko consented to the entry of a final judgment ordering him to pay $275,000 in disgorgement and approximately $54,000 in prejudgment interest. It is noteworthy that the SEC's April 2020 press release announcing the charges against Berko stated that Goldman Sachs was not charged related to this conduct because "[t]he firm's compliance personnel took appropriate steps to prevent the firm from participating in the transaction[.]"

The low public tallies do not tell the whole story regarding the state of enforcement, especially as to likely enforcement trends in 2022 and beyond. Throughout 2021, we saw numerous, non-public signs of the DOJ's and SEC's continuing work on corporate and individual investigations, including precursors to enforcement positions and policies that have since been announced publicly. The agencies have continued to close various matters without further investigation in the traditional, non-public fashion.

And, as we note in our tracking statistics, the number of investigations that are in public view is an undercount of the actual tally of active investigations by the agencies – as most investigations take years to reach maturity and companies make individual decisions regarding whether and when to disclose such investigations publicly.

U.S. Policy and Legislative Developments

Perhaps the most noteworthy FCPA enforcement developments in 2021 were not cases but the various policy changes announced by U.S. authorities, which we have covered in detail in earlier Reviews and International Alerts. The Biden administration's December 2021 announcement of a new "Strategy on Countering Corruption" (SCC) received the most attention from the mainstream press, but the October 2021 memorandum issued by Deputy Attorney General Lisa Monaco announcing several key corporate enforcement policy changes will likely have the most significant impact on FCPA enforcement from a corporate point of view. The memorandum announces three significant policy changes that will affect all DOJ FCPA investigations:

- Consideration of a company's entire history of past misconduct when making decisions on charging and dispositions of investigations

- Requirements for corporations under investigation again to provide "all relevant facts relating to the individuals responsible for the misconduct" in order to gain full credit for cooperation (reinstating a requirement from the 2015 Yates Memorandum)

- Guidance that DOJ will impose independent compliance monitors in cases of "demonstrated need" and "clear benefits" for the company and enforcement goals

The U.S. government also initiated several new initiatives focusing on fighting corruption in Central America, including the formation of Joint Task Force Alpha and the issuance of the "Engel List" of individuals deemed responsible for corruption in the region who will be subject to various actions, including visa restrictions and targeted sanctions.

At the beginning of 2021, the National Defense Authorization Act (NDAA) included several elements relevant to the enforcement of the FCPA and related laws. The NDAA clarified that the federal courts now have statutory authority to order disgorgement – and other remedies based in equity – for violations of federal securities laws, including the FCPA, and in certain cases the courts can do so for a period of up to 10 years from the latest date of a violation. These statutory provisions were in part a response to past Supreme Court holdings in the Kokesh and Liu cases.

The NDAA also included the new Corporate Transparency Act, which requires U.S. registered entities to report to the Financial Crimes Enforcement Network (FinCEN) the identity and personal identifying information of each beneficial owner of any corporation, limited liability company, or similar entity created under the laws of a state or registered to do business in the United States. A beneficial owner is someone who exercises "substantial control" over the entity or owns more than 25 percent of the entity, with some exceptions. This law and the related proposed rule (issued on December 8, 2021 as part of the SCC) have brought the United States substantially closer to international anti-money laundering (AML) standards.

Finally, the NDAA contained two provisions geared towards incentivizing whistleblowing of AML violations. First, the Anti-Money Laundering Act of 2020 (AMLA) amended the Bank Secrecy Act (BSA) to both expand the U.S. Department of the Treasury's (Treasury) BSA whistleblower program and enhance anti-retaliation protections for whistleblowers who report potential AML violations. Second, NDAA's Kleptocracy Asset Recovery Rewards Act (KARRA) establishes a new Treasury whistleblower program specifically designed to reward whistleblowers who provide information leading to recovery of assets derived from foreign government corruption. A detailed discussion and analysis of the significance of the NDAA by Miller & Chevalier can be found here.

DOJ/SEC Staffing and Structure Updates

The Biden administration worked throughout 2021 to appoint or confirm key FCPA enforcement personnel. On the DOJ side, two former prosecutors were confirmed in top enforcement positions. Lisa Monaco was confirmed by the Senate in April as Deputy Attorney General and Kenneth Polite was confirmed in July to lead the DOJ's Criminal Division. In early December, Lisa Miller, formerly Chief of the DOJ's Market Integrity & Major Frauds Unit, was named as permanent Deputy Assistant Attorney General for the Criminal Division after being placed in that role in "acting" status in late September. Finally, in August, seasoned FCPA Unit prosecutor David Last was appointed as permanent Chief of the DOJ's FCPA Unit, after having been named Acting Chief of the unit in April.

In March, the DOJ hired Lauren Kootman, a lawyer from private practice with monitor experience, to serve as a compliance specialist, filling a role left vacant since 2017. In September, the DOJ posted a notice seeking to recruit a second compliance counsel or specialist to work alongside Ms. Kootman.

On the SEC side, new Director of Enforcement Gurbir Grewal (also a former prosecutor) was appointed in June, while Deputy Director Sanjay Wadhwa (a longtime SEC professional who has FCPA experience and who previously served as co-head of Enforcement in the SEC's New York office) was named to his position in August.

In October, the DOJ announced the formation of a specialized FBI team that will work full-time within the Fraud Section, focusing on FCPA, fraud and related matters as part of a "surge" in staff and resources to assist in corporate enforcement efforts.

U.S. Litigation Developments

U.S. courts issued several key FCPA-related rulings in 2021, with mixed results for U.S. authorities.

In August 2021, the U.S. Court of Appeals for the First Circuit affirmed a district court's March 2020 ruling granting a new trial to Joseph Baptiste, a retired U.S. Army colonel convicted in 2019 of conspiring to bribe Haitian officials. Both the 2019 and 2021 decisions found that Baptiste's lawyer had rendered ineffective assistance such that the jury verdicts against Baptiste and a co-defendant, Richard Boncy, could not stand. The government has yet to determine whether it will retry Baptiste and Boncy.

In November 2021, a U.S. district court in Houston, Texas dismissed multiple charges against Swiss wealth management company owner Daisy Rafoi-Bleuler for lack of jurisdiction. The court noted that Rafoi-Bleuler, as a foreign national, had no ties to the United States and as such, the DOJ's reliance on communications through interstate commerce did not establish that Rafoi-Bleuler was an agent of the relevant domestic concern involved in the case. Citing the August 2018 appellate ruling in U.S. v. Hoskins, the court held that "neither the FCPA nor the [Money Laundering Control Act] extends criminal liability to a foreign national located outside the United States, except in the specific circumstances where the agency relationship is established in the United States." The court further stated its view that "the term 'agent,' as a jurisdictional basis to prosecute a foreign national, is so vague that it denies a defendant the 'due process' that the federal Constitution mandates." The DOJ appealed this decision in December 2021.

Speaking of the long-running enforcement fight involving Lawrence Hoskins (a senior executive of Alstom, S.A. whose motion for acquittal and conditional motion for a new trial on FCPA charges was granted in February 2020 and also appealed by the DOJ a month later), the U.S. Court of Appeals for the Second Circuit heard the latest round of arguments in August 2021. The arguments centered on whether Hoskins, a citizen of the United Kingdom, was acting as an "agent" of a domestic concern when he undertook acts related to alleged payment schemes in Indonesia. During oral argument, the DOJ reiterated its view that the evidence of control was more than sufficient for a jury to find that the relevant domestic concern had the power to control Hoskins, thus establishing the agency relationship relevant to the jurisdictional and related questions under provisions of the FCPA. Hoskins argued against that conclusion and raised other issues regarding his past trial.

The ultimate court rulings in the Rafoi-Bleuler and Hoskins cases likely will significantly impact the interpretation of who might qualify as an "agent" of an issuer or domestic concern under the FCPA. Rulings that pare back the DOJ's assertive reading and application of this term could undermine the DOJ's ability to pursue foreign nationals using the FCPA's anti-bribery provisions.

International Enforcement and Policy Updates

International anti-corruption enforcement actions and multilateral cooperation efforts continued apace in 2021. Two of the four corporate FCPA-related cases announced in 2021 (Foster Wheeler and Credit Suisse) were coordinated with enforcement agencies from other countries.

Authorities in various countries continued to bring their own significant cases, many of which involved equivalents to U.S. deferred prosecution agreements (DPAs) (which the Organisation for Economic Cooperation and Development (OECD) terms as "non-trial resolutions"). Significant cases were announced in Brazil (Samsung Heavy Industries and Rolls-Royce – both using leniency agreements and both linked to the sprawling Lava Jato investigation); the U.K. (Airbus subsidiary GPT, two unidentified companies (marking the 11th and 12th DPAs issued by the SFO in corruption cases), Petrofac Limited, plus individuals in the SFO's ongoing Unaoil investigation); the Netherlands (SHV Holdings); France (Systra SA, using a judicial public interest agreement (CJIP)); and Peru (Aenza S.A.A. – also linked to Lava Jato).

As in the United States, courts in other countries issued rulings that set back enforcement authorities' efforts in specific cases. One of the most notable instances in 2021 was the March ruling issued by a Milan trial court acquitting oil and gas companies Royal Dutch Shell Plc (Shell), ENI SpA (ENI), and various current and former executives of both companies of criminal corruption charges brought by Italian prosecutors. The decision ended a three-year criminal trial during which the prosecution had alleged that Shell and ENI were involved in and had knowledge of corrupt activities (including benefits to a former Nigerian oil minister) related to a Nigerian oil and gas concession. In its written ruling issued in June, the trial court sharply criticized the conduct of the prosecution team in several areas, including an issue regarding disclosure of evidence. The Italian prosecutors and the Government of Nigeria (which has been classified in the proceedings as a victim) appealed the trial court ruling in July 2021.

On the international policy front, in November 2021, the OECD issued a long-awaited update of its Recommendation for Further Combating Bribery of Foreign Public Officials in International Business Transactions. The original Recommendation was published in 2009 and the document has been under review for several years. New sections or areas of discussion that might be of interest to corporate compliance personnel include: prosecution of the "demand-side" of bribery; international cooperation and mutual legal assistance in investigations; standards for protection of whistleblowers; the interplay and potential hurdles created by data protection laws; issues in public procurement, including enhanced scrutiny by governments of compliance risks presented by contractors; standards for the use of "non-trial resolutions" by OECD signatories; and incentivizing compliance.

Annex II of the updated OECD Recommendation, the Good Practice Guidance on Internal Controls, Ethics, and Compliance, features updates to one of the earlier international standards for corporate compliance programs. The Good Practice Guidance lists key elements of an effective corporate compliance program – and a review of the updated version shows the influence of the DOJ's and SEC's work on similar guidance (as well as efforts by other authorities, such as in the U.K. and France) in the intervening period since the OECD published the first version of the annex in 2010. New areas covered in the guidance include a section on mergers and acquisitions (M&A) due diligence and the importance of termination and audit rights in the management of compliance risk created by business partners.

The G-20 and the United Nations have been taking steps to enhance multilateral legal assistance in the corruption context for years. The latest effort was spurred by the October 2020 G-20 Anti-corruption Ministerial Meeting, which approved an initiative designed to supplement existing formal multilateral assistance mechanisms, such as those established by the OECD, Financial Action Task Force (FATF), and the UN Convention Against Corruption, as well as other cooperative efforts. After work in multiple spring 2021 meetings by various task forces and a panel of experts, the new Global Operational Network of Anti-Corruption Law Enforcement Authorities (GlobE Network) was launched in early June 2021. The United Nations Office on Drugs and Crime (UNODC) was designated to function as the network's permanent secretariat. The network's members conducted their first meeting in November 2021 and adopted a governing charter. The timing of the network's various initiatives remains unclear, but effective implementation of this initiative could enhance multilateral enforcement cooperation, and thus bears watching.

In July 2021, the World Bank's Office of Suspension and Debarment published its "first-ever" Global Suspension & Debarment Directory with a focus on "exclusion systems" – i.e., national and organization-specific mechanisms preventing select legal entities from accessing public funds.

Q4 2021

The fourth quarter of 2021 was a very quiet period for corporate enforcement dispositions, the quietest fourth quarter of any year since we began tracking cases in 2009. There was only one corporate disposition: Credit Suisse Group AG resolved its investigations with the SEC and DOJ in October 2021. VTB Capital plc of the U.K. resolved a related action with the SEC, but without involving any provisions of the FCPA.

It was a similarly quiet quarter for actions against individuals. Two individuals, Frederick Cushmore, Jr. and Debra Parris, pleaded guilty to charges.

In addition, this quarter we continued to see the DOJ pursue money laundering charges against individuals involved in bribery. In October, prosecutors indicted five individuals with money laundering offenses in connection with the bribery of Venezuelan officials to obtain contracts for distributing food and medicine between approximately 2015 and 2020. In December, Luis Enrique Martinelli Linares and Ricardo Alberto Martinelli Linares each pleaded guilty to a money laundering charge in connection with their roles as intermediaries for Odebrecht's payment of $28 million in bribes for the benefit of their father, Panama's former president.

There were several significant policy developments in the fourth quarter of 2021, including the release of DOJ Deputy Attorney General Lisa Monaco's memorandum on Corporate Crime Advisory Group and Initial Revisions to Corporate Criminal Enforcement Policies and the first ever United States Strategy on Countering Corruption. These are discussed in more detail above.

This quarter also included an important case out of the District Court of Southern Texas regarding jurisdictional limits of the FCPA as well as corporate leniency agreement for Rolls-Royce PLC in Brazil, as discussed below.

Corporate Enforcement Actions

Credit Suisse. On October 19, 2021, the SEC and DOJ announced dispositions with Credit Suisse to resolve misconduct involving kickbacks paid to intermediaries, who in turn paid bribes to government officials in Mozambique. In a global coordinated resolution with U.K. authorities, Credit Suisse agreed to pay approximately $475 million to the SEC, DOJ, and the U.K.'s FCA to resolve the misconduct. Only the SEC charged Credit Suisse with FCPA violations – according to the SEC's Cease-and-Desist Order, Credit Suisse "engaged in violations of the books and records and internal accounting controls provisions of the Exchange Act, including violations of the Foreign Corrupt Practices Act." The DOJ's three-year DPA with Credit Suisse resolves one charge of conspiracy to commit wire fraud. In addition, the Swiss Financial Market Supervisory Authority (FINMA) also resolved allegations with Credit Suisse based on the same underlying conduct. In a related matter, VTB Capital plc (VTB), a London-based subsidiary of the Russian bank VTB, settled charges with the SEC for its role in the exchange of EMATUM loan participation notes (LPNs) for sovereign bonds (discussed further below). The SEC's Cease-and-Desist Order (VTB Order) finds that VTB violated negligence-based anti-fraud provisions of the federal securities laws by misleading investors. To resolve the charges, VTB agreed to pay over $6 million, including a $4 million civil penalty, $2 million in disgorgement, and $429,883.94 in prejudgment interest.

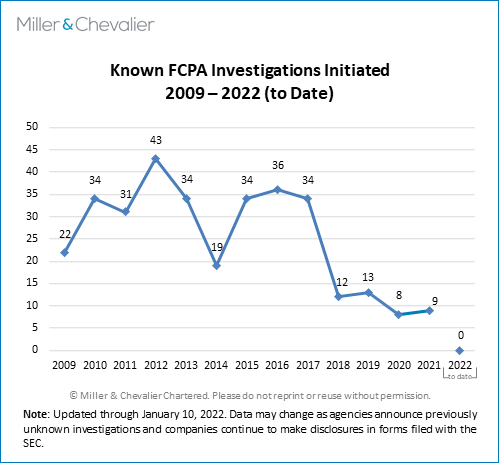

Known FCPA Investigations Initiated

The following chart provides an update on known FCPA investigations initiated against companies over the past 12 years. Nine companies disclosed new FCPA- related investigations in 2021. As previously reported, Cisco Systems Inc. (Cisco) and Toyota Motor Corporation (Toyota) disclosed DOJ and SEC investigations in the first quarter of 2021. In the second quarter of 2021, Tsakos Energy Navigation Limited and Ormat Technologies Inc. reported that the DOJ and SEC had opened FCPA investigations involving the companies, while Bombardier Inc. announced that the company was responding to information requests from the DOJ in connection with its business operations in Indonesia.

Three companies disclosed new FCPA-related investigations during the third quarter of 2021. Specifically, Edward Lifesciences Corporation (Edwards) and NewAge, Inc. (New Age) disclosed investigations of potential FCPA violations by the SEC and DOJ in July and August 2021, respectively. In addition, in August 2021, Pennsylvania-based coal producer Corsa Coal reported that it was cooperating with the DOJ and Royal Canadian Mounted Police (RCMP) following disclosure of an internal investigation into "whether any employees of the Company or any of its subsidiaries were aware of, or involved in" alleged misconduct by an "oversees third-party sales agent…in connection with allegedly unlawful benefits given to a representative of an overseas customers."

Finally, on October 18, 2021, Grab Holdings Limited disclosed what appears to be an FCPA investigation by the DOJ stemming from a voluntary disclosure by Grab following its own investigation "into potential violations of certain anti-corruption laws."

Individual Enforcement Actions

As mentioned above, the DOJ brought new FCPA-related money laundering charges against five individuals in the fourth quarter.

First, on October 21, 2021, federal prosecutors announced money laundering charges against five foreign nationals – two from Venezuela and three from Colombia – for their alleged roles in laundering the proceeds of an illegal bribery scheme that took place in Venezuela. The indictment alleges that Alvaro Pulido Vargas, Jose Gregorio Vielma-Mora, Emmanuel Enrique Rubio Gonzalez, Carlos Rolando Lizcano, and Ana Guillermo Luis conspired to bribe officials in Venezuela's state-owned food and medicine distribution program (Comité Local de Abastecimiento y Producción (CLAP)) to obtain "inflated contracts" to import and distribute food and medicine. The conspirators allegedly received approximately $1.6 billion in inflated contracts from 2015 to 2020, approximately $180 million of which they subsequently transferred to or through the United States. Each defendant faces up to 100 years in prison, if convicted.

The DOJ also brought an FCPA enforcement action against one individual: Frederick Cushmore Jr., former vice president and Head of International Sales of Pennsylvania-based metallurgical coal production company Corsa Coal. Cushmore pleaded guilty to conspiracy to violate the FCPA's anti-bribery provision on November 17, 2021. The DOJ alleged that, from 2016 to 2020, Cushmore and another unnamed Corsa Coal executive conspired to bribe Egyptian officials to secure approximately $143 million in coal contracts with Egyptian state-owned entity, Al Nasr Company for Coke and Chemicals (Al Nasr). Cushmore and his co-conspirator allegedly made the payments via an Egyptian sales agent, paying the agent over $4.8 million in commissions with the intent that a portion of those funds be used to bribe foreign officials. Corsa Coal, a public company, has stated in securities filings that they learned of the issue in 2020, after which they reported the matter to the DOJ and the RCMP (as Corsa Coal is incorporated in Canada). Both authorities have reportedly opened investigations; however, no charges have been filed against the company. Cushmore is set to be sentenced in March 2022.

Three individuals also pleaded guilty to existing FCPA or FCPA-related money laundering charges last quarter.

On November 17, Texas resident Debra Parris pleaded guilty to conspiracy to violate the FCPA for her role in a scheme to bribe Ugandan officials to procure adoptions of Ugandan children. The DOJ alleged that Parris and co-conspirator Dorah Mirembe, a Ugandan citizen, bribed numerous Ugandan officials, including social welfare officers and judges, to circumvent Ugandan law governing adoptions. Parris and Mirembe allegedly de-frauded U.S. adoptive parents, making $900,000 in profits by marking the bribes as court costs or foreign program fees on invoices to clients. They also allegedly defrauded U.S. and Polish authorities by making false statements in connection with visa applications for the adoptive children. Parris is scheduled to be sentenced on March 9, 2022. Mirembe, who faces the same charges, is still at large.

On December 2 and 14, 2021, respectively, Panamanian businessmen and brothers Luis Enrique Martinelli Linares (L. Linares) and Ricardo Alberto Martinelli Linares (R. Linares) each pleaded guilty to one count of conspiracy to commit money laundering for their roles in a money laundering and corruption scheme involving Brazilian construction conglomerate Odebrecht S.A. (Odebrecht). These agreements quickly followed their extradition from Guatemala to the United States this past quarter. As previously reported, in 2016, Odebrecht entered into settlements with authorities in Brazil, the U.S., and Switzerland for allegedly making more than $1 billion in bribe payments to win contracts in Brazil and other countries. The DOJ filed a criminal complaint against the Linares brothers in June 2020, alleging that they laundered over $28 million in bribe proceeds from Odebrecht through offshore shell bank accounts for the benefit of their father, Panama's former President Ricardo Martinelli Berrocal. The brothers are set to be sentenced in May 2022.

Finally, two individuals received sentencings for their roles in FCPA-related misconduct during the fourth quarter:

- In October, the United States District Court for the Eastern District of New York sentenced former Braskem CEO Jose Carlos Grubisich to 20 months in prison for conspiracy to violate the anti-bribery and books and records provisions of the FCPA. Grubisich, who pleaded guilty to the charges in April 2021, was also ordered to pay $1 million in fines and to forfeit $2.2 million.

- In November, the United States District Court for the Southern District of Texas sentenced Venezuelan citizen and Texas resident Laymar Giosse Peña Torrealba (Peña) to three years of probation for her role in an international bribery and money-laundering scheme. Peña, a procurement officer at Citgo (the U.S. subsidiary of Venezuelan state-owned oil company PDVSA), was charged with conspiracy to commit money laundering for allegedly accepting bribes worth $340,000 in exchange for helping a logistics company obtain business with Citgo. She pleaded guilty to the charge in 2019.

The SEC brought no individual enforcement actions in the fourth quarter.

Litigation Developments

An important court decision last quarter signaled potential limits to the DOJ's extraterritorial FCPA enforcement efforts: on November 12, 2021, the U.S. District Court for the Southern District of Texas dismissed FCPA and money laundering charges against Swiss national Daisy T. Rafoi-Bleuler for lack of jurisdiction. This decision was summarized above, and we provide more details below.

International Developments

Rolls-Royce PLC, the U.K.-based power systems, defense, and civil aerospace company, entered into a leniency agreement with two Brazilian authorities on October 25, 2021: the Office of the Comptroller General (CGU) and the Attorney General's Office (AGU). This agreement followed resolutions in 2017 with the DOJ, SFO, and Brazilian Federal Prosecutors Office (Ministério Público Federal) for related conduct. Specifically, the agreement relates to conduct in 2003-2005 and is part of Operation Car Wash (Operação Lava Jato). The agreement requires Rolls Royce to pay an additional $27 million. The company also agreed to improve its compliance program.

Corporate Enforcement Actions

Credit Suisse and VTB Settle Charges in Connection with Financing Provided to Mozambican State-Owned Entities

On October 19, 2021, the DOJ and SEC announced resolutions with Credit Suisse Group AG (Credit Suisse), an international investment bank based in Switzerland and listed on the New York Stock Exchange (NYSE). The resolution concerned a scheme that the agencies alleged fraudulently misled investors and violated the FCPA. The underlying conduct also involved several U.K. Credit Suisse entities, namely Credit Suisse Securities (Europe) Limited (CSSEL), Credit Suisse International, and Credit Suisse AG, London Branch. To resolve the charges, Credit Suisse will pay approximately $475 million to U.S. and U.K. authorities, as well as restitution in an amount to be determined by the court.

According to the SEC's Cease-and-Desist Order (SEC Order), Credit Suisse violated the internal accounting controls and books and records provisions of the FCPA and other anti-fraud provisions of federal securities laws. Credit Suisse will pay almost $100 million to the SEC to resolve the charges, including a $65 million civil penalty, $26,229,233 in disgorgement, and $7,822,639 in prejudgment interest. In reaching the settlement, the SEC noted that "Credit Suisse has engaged in a review and remediation of its internal controls and procedures relating to the integration of its compliance functions."

Simultaneously, the DOJ entered into a three-year DPA with Credit Suisse that resolves one charge of conspiracy to commit wire fraud, which is based on the EMATUM transaction (described below) and the subsequent exchange of LPNs for sovereign bonds. In addition, CSSEL pleaded guilty to one count of conspiracy to commit wire fraud. As part of the resolutions, the DOJ imposed a criminal penalty of $247,520,000 on Credit Suisse, $500,000 of which is to be paid by CSSEL, and disgorgement of $10,344,865. However, with Credit Suisse paying approximately $100 million to the SEC and $200 million to U.K. authorities, the DOJ agreed to credit approximately $82 million of the amounts paid under those resolutions. After crediting, Credit Suisse and CSSEL will pay a total of $175,568,000.

Both U.K. and Swiss authorities also resolved charges with Credit Suisse based on the same underlying conduct. The FCA announced that it reached an agreement with Credit Suisse, under which the company will pay a penalty of £147 million (approximately $200.3 million at the relevant exchange rate date established in the agreement) and forgive $200 million in debt by the Republic of Mozambique; the FCA indicated that, but for the agreed debt forgiveness, the fine would have been "significantly larger." With respect to the debt forgiveness remedy, the FCA's Final Notice explains that "the first $200m of any sums claims by Credit Suisse as due and payable to it from Mozambique shall not be payable…." The FCA indicated that the debt forgiveness is intended to ease the burden on the people of Mozambique caused by Mozambique's indebtedness.

FINMA also announced that it resolved charges against Credit Suisse in connection with this same underlying scheme. According to its press release, FINMA imposed remedial measures after concluding an enforcement proceeding against Credit Suisse. The remedial measures include the appointment of an independent third party to monitor Credit Suisse's risk management and internal control systems and review certain transactions involving "financially weak and corruption-prone states."

In addition to Credit Suisse, VTB Capital plc (VTB), a London-based subsidiary of the Russian bank VTB, separately settled charges with the SEC for its role in the exchange of EMATUM LPNs for sovereign bonds (described below). The SEC's Cease-and-Desist Order (VTB Order) finds that VTB violated negligence-based antifraud provisions of the federal securities laws by misleading investors. To resolve the charges, VTB agreed to pay over $6 million, including a $4 million civil penalty, $2 million in disgorgement, and $429,883.94 in prejudgment interest.

Summary of Relevant Transactions

The SEC charges against Credit Suisse stem from three transactions intended to raise funds for entities owned and controlled by Mozambique that occurred between 2013 and 2016. The transactions included a syndicated loan to ProIndicus S.A. (ProIndicus) and two bond offerings — one to finance debt for Empresa Mocambicana de Atum S.A. (EMATUM) with interest-bearing LPNs and another allowing the exchange of those LPNs for sovereign bonds issued by Mozambique. At the time, both ProIndicus and EMATUM were newly formed state-owned entities with no prior business operations. In contrast to the SEC, the DOJ charges relate only to the EMATUM transaction and the subsequent exchange of LPNs for sovereign bonds.

VTB also participated in financing the syndicated loan to ProIndicus, the initial EMATUM bond offering, and the subsequent exchange of EMATUM LPNs for sovereign bonds. In addition, in 2014, VTB financed another syndicated loan to a third state-owned entity, Mozambique Asset Management (MAM). The individual transactions are discussed in detail below.

As the SEC press release notes, the transactions "were used to perpetrate a hidden debt scheme, pay kickbacks to now-indicted former Credit Suisse investment bankers along with their intermediaries, and bribe corrupt Mozambique government officials." The SEC determined that the relevant improper payments, taken together, totaled approximately $200 million. Of that amount, approximately $50 million in kickbacks was paid to three former Credit Suisse bankers (collectively, CS Bankers), who facilitated and hid the scheme from other members of Credit Suisse management. The three CS Bankers are identified by the DOJ as Andrew Pearse, Surjan Singh, and Detelina Subeva. The SEC Order explains that the scheme was made possible by "deficiencies in Credit Suisse's internal accounting controls, unreasonable reliance on the CS Bankers to structure the deal, and inadequate appreciation of bribery risks that came to the attention of the bank's reputational risk, credit risk and compliance groups."

First Transaction – Loan Paid to Third Party Intermediary with Red Flags for Corruption

The first transaction was a syndicated loan offered to ProIndicus in 2013. The loan amount totaled $622 million and Credit Suisse contributed $504 million of that amount. VTB provided the other $118 million in financing. Officially, ProIndicus was supposed to "supply vessels and training to protect Mozambique's coastline and maritime interests," and the loan proceeds were intended to fund certain maritime projects.

Despite ProIndicus's official mandate, the SEC found that the entity was created to facilitate improper payments to government officials, intermediaries, and the CS Bankers. Prior to the arrangement of the loan, ProIndicus had entered into a contract with Privinvest Group (Privinvest), an intermediary from the United Arab Emirates. Under the contract, Privinvest agreed to provide equipment and services for ProIndicus's maritime projects. However, the SEC stated that Privinvest and its agents also facilitated the corrupt scheme, under which part of the loan was used for the designated maritime projects, while the remainder was used to pay kickbacks to an agent of Privinvest, Jean Boustani, and the CS Bankers, as well as bribes to Mozambican government officials. (The SEC papers do not use the names of the third parties, but the names are public information from other enforcement actions.)

After the syndicated loan closed, Credit Suisse transferred $547,463,200, including a portion arranged by VTB, to Privinvest's account in Abu Dhabi through U.S. correspondent banks. According to the SEC Order, the bank made the transfer even though Credit Suisse knew of allegations relating to Privinvest's corrupt activities. The SEC noted that over $80 million was transferred to Mozambican government officials' accounts. The SEC also found that "Credit Suisse's books and records did not record the fact that a substantial portion of the ProIndicus financing proceeds would be paid as improper payments to numerous senior-level government officials in Mozambique or as kickbacks to the CS Bankers."

The SEC Order also highlights Credit Suisse's internal accounting controls weaknesses. Specifically, the SEC notes that Credit Suisse's financial crime compliance group previously acquired a third-party due diligence report that identified Privinvest's principal (Privinvest Principal) as a "master of kickbacks" and raised other concerns about Privinvest's involvement in bribes, kickbacks, and corrupt business practices. While there was some contradictory evidence as well, the SEC found that "Credit Suisse, nonetheless, acted unreasonably in failing to properly consider the totality of bribery risks surrounding the transaction that came to its attention." With respect to VTB, however, the SEC determined that VTB lacked knowledge of the improper payment scheme underlying the ProIndicus transaction.

Later in 2014, ProIndicus and Credit Suisse agreed to extend the payment terms and increase ProIndicus' borrowing limit to $900 million. The SEC noted that, at that time, Credit Suisse knew of the risks and red flags related to the transaction, yet the bank still pressed forward with the extension agreement.

Second Transaction – EMATUM Bond Offering

In a second transaction in 2013, Credit Suisse underwrote and offered $500 million for a $850 million bond offering of LPNs to finance debt offered to EMATUM. The remaining $350 million was underwritten and offered by VTB. While this was initially intended to be a $250 million project, the SEC found that it quickly increased to $850 million. That final amount provided additional funds for improper payments and included financing to cover both ProIndicus and EMATUM's upcoming interest payments, which ProIndicus would have otherwise been unable to pay.

EMATUM was created as a tuna fishing company and, according to the SEC, the offering materials that Credit Suisse provided to investors touted that "the proceeds would be used 'towards the financing of the purchase of fishing infrastructure, comprising 27 vessels, an operation center and related training and for the general corporate purposes of the Borrower.'" Like the ProIndicus transaction, prior to the $850 million offering, EMATUM entered into a contract with an affiliate of Privinvest, supposedly to further the EMATUM project. Ultimately, however, the funds intended for the EMATUM project were used to pay kickbacks to the CS Bankers and make other improper payments to government officials.

The SEC noted that, by the time of the EMATUM transaction, Credit Suisse was already aware of the alleged corruption risks related to the Privinvest Principal and the Privinvest affiliate based on the prior ProIndicus due diligence. In addition, Credit Suisse had obtained information suggesting that "[Privinvest] and its related entities were not selected from a competitive bidding process, but rather, from 'high level connections' between [Privinvest] and the Mozambican government." While the bank's reputational risk, credit risk, and compliance groups were aware of the bribery risks, Credit Suisse nonetheless transferred the funds to Privinvest's account in Abu Dhabi, instead of providing the funds directly to EMATUM.

The SEC determined that "Credit Suisse did not perform sufficient due diligence concerning the [Privinvest]Principal or his entities in connection with the EMATUM transaction" and that the CS Bankers were able to perpetrate the scheme due to the bank's internal accounting controls weaknesses. In addition, the SEC found that certain statements made in connection with the EMATUM offering were false and misleading. In particular, Credit Suisse failed to disclose to investors the underlying corruption scheme, Credit Suisse's own conflict of interest due to its involvement in the ProIndicus transaction, and Mozambique's total indebtedness and creditworthiness. With respect to VTB, the SEC found that VTB again lacked knowledge of the improper payment scheme underlying the EMATUM transaction.

Third Transaction – Mozambique Asset Management Loan

In May 2014, VTB engaged in a third transaction. VTB arranged for a $535 million syndicated loan to state-owned entity MAM, for which VTB provided $435 million. As with the ProIndicus and EMATUM transactions, MAM contracted with Privinvest. In the VTB Order, the SEC highlights that at this point, "VTB understood Mozambique's total indebtedness included prior guaranteed debt from transactions with Credit Suisse." The combination of the ProIndicus, EMATUM, and MAM transactions contributed 13 percent of Mozambique's GDP.

Fourth Transaction – Exchange of EMATUM LPNs for Sovereign Bonds

The fourth transaction was a bond offering by Mozambique "that allowed investors to exchange their [EMATUM] LPNs for new sovereign bonds issued directly by the government of Mozambique." By the end of 2014, EMATUM had incurred significant losses and the media had reported that EMATUM would potentially default on its payments. Therefore, Credit Suisse, VTB, and Mozambique decided to restructure the LPNs as a sovereign bond.

Prior to the exchange offer, two of the CS Bankers—Pearse and Subeva—had left Credit Suisse to work for Palomar, an entity owned and controlled by Privinvest Principal. In the exchange offer, these two CS Bankers represented Mozambique in discussions with Credit Suisse and VTB.

By this time, the EMATUM transaction had received significant negative press coverage, including being labeled "Mozambique's 'worst ever corruption scandal….'" The SEC Order also highlights that the media alleged "that equipment received had been 'overpriced and not fit for purpose… and that the overpricing profited government ministers.'" The negative media coverage prompted Credit Suisse to conduct additional due diligence. After an external appraiser conducted a valuation of the boats EMATUM had purchased, Credit Suisse identified a difference of between $265 million to $408 million between the proceeds of the EMATUM LPN transaction and the value of items purchased.

The exchange offer was eventually announced and approved by bondholders in March 2016. In connection to the EMATUM exchange offer, the SEC identified a number of material misrepresentations and omissions by Credit Suisse and VTB. The offering materials distributed by Credit Suisse and VTB failed to disclose the existence of the ProIndicus and MAM loans and the banks' conflicts of interest as creditors in the prior transactions. In addition, the offering materials did not accurately disclose Mozambique's total debt, risk of default, or the significant amount of missing funds that Credit Suisse had discovered in connection with the prior EMATUM transaction.

This fourth transaction — the exchange of EMATUM LPNs for sovereign bonds — is the basis for the SEC's charges against VTB. The SEC found that "VTB placed its interests as a creditor ahead of investors and protected its reputational risk at the costs of meeting its disclosure obligations to investors, including the failure to disclose the Proindicus and MAM transactions." The SEC determined that "[d]espite numerous and significant red flags and concerns that were presented regarding the accuracy of the debt disclosures, VTB unreasonably gave in to pressure from Mozambican officials and others and failed to prevent the debt from being disclosed in a misleading manner in the offering materials that VTB distributed." As a result, VTB was found to be negligent in failing to make accurate disclosures.

Later, in April 2016, Mozambique's government disclosed the country's additional debts. The previously undisclosed indebtedness was found to total $1.35 billion. As a result of this revelation, "the IMF and 14 other donor groups suspended lending and aid packages to Mozambique…," and Mozambique defaulted.

Boustani's Previous Acquittal and Current Status

Boustani previously faced individual charges for his role in the scheme. As described above, Boustani was alleged to have participated in diverting loan proceeds to make improper payments to Privinvest executives, the CS Bankers, and Mozambican government officials. However, as previously reported in our FCPA Winter Review 2020, Boustani was acquitted of wire fraud conspiracy, money laundering conspiracy, and securities fraud conspiracy charges by a jury in the Eastern District of New York in December 2019. The acquittal is tied to jurisdictional issues. After the trial, jurors explained that they did not understand how federal prosecutors in New York could prosecute crimes that occurred elsewhere.

Since then, Mozambique has initiated multiple proceedings in connection with this scheme. In September 2021, AllAfrica reported that Mozambique issued an international arrest warrant for Boustani. Separately, Boustani issued a statement saying: "I am willing and ready to appear in front of Honourable Judge Efigênio José Baptista as soon as possible…" to testify in the ongoing trial of other individuals involved in the scheme. However, in December 2021, a report in Africa Press stated that Boustani will not be testifying. While Boustani was scheduled to testify via video conference, it was "cancelled because Boustani is already an accused person in a second 'hidden debts' case in another section of the [Maputo] City Court." Baptista was not aware of the international arrest warrant that had previously been issued for Boustani. The Africa Press article stated, "[a]n accused person cannot be asked to testify in another case about the same facts."

Noteworthy Aspects

- No FCPA Charges from the DOJ: While the SEC charged Credit Suisse with violating the books and records and internal accounting controls provisions of the FCPA, the DOJ charged Credit Suisse only with conspiracy to commit wire fraud. This could be the result of a variety of factors. In particular, the difference in the burden of proof required for criminal and civil charges could have impacted the DOJ's decision because to proceed with charges under the FCPA, the DOJ would have to satisfy a higher burden of proof than what the SEC needs to prove for civil charges of violations of the FCPA's accounting provisions. In addition, jurisdictional issues could have been a consideration in the DOJ's charging decision – an issue highlighted by the DOJ's setback in the Boustani trial, as noted above. The resolutions with foreign authorities in the U.K and Switzerland may also have shaped the DOJ's investigation and charging decisions.

- No Monitor Imposed by U.S. Authorities Despite Being the Second FCPA Resolution: U.S. authorities determined that appointing a compliance monitor would not be necessary in this case, even though this is Credit Suisse's second resolution within the last four years involving FCPA charges. As we reported in our FCPA Autumn Review 2018, Credit Suisse settled FCPA charges with the SEC in July 2018 in connection with a different scheme. In that case, the SEC pursued charges under the FCPA's anti-bribery and internal accounting controls provisions. The DOJ also entered into a non-prosecution agreement (NPA) with Credit Suisse to resolve charges related to improper hiring practices. In the present case, the DOJ highlighted Credit Suisse's remediation and compliance program in reaching the decision not to impose a monitorship without focusing on the bank's prior violation.

Notably, however, under the Swiss resolution, FINMA appointed an independent third-party to review Credit Suisse's compliance program. The FINMA press release notes that the appointed third party will review Credit Suisse's recently implemented measures, which are intended "to improve the Group-wide risk management and internal control systems." In addition, an independent third party will review "Credit Suisse's existing credit transactions with financially weak and corruption-prone states or companies with guarantees from such states…." This appointment of an independent third-party by Swiss authorities was likely a factor in the U.S. authorities' decision not to appoint a monitor, though the DPA does not discuss that matter.

It is noteworthy that nine days after the Credit Suisse resolution was announced, the DOJ updated its guidance on corporate enforcement actions to emphasize that recidivism will impact future resolutions (previously reported here). According to a memorandum issued by Deputy Attorney General Lisa Monaco, "prosecutors are directed to consider misconduct by the corporation discovered during any prior domestic or foreign criminal, civil, or regulatory enforcement actions" in making charging decisions all and reaching resolutions. The Credit Suisse disposition might have looked different had this policy been fully in place at the time. In addition to the above-mentioned FCPA-related NPA in 2018, Credit Suisse also entered a large settlement with the DOJ in 2016 related to "false and irresponsible representations about residential mortgage-backed securities." In late 2020, Swiss authorities issued criminal charges against the bank for failing to prevent money laundering in transactions related to Bulgaria. While the revised DOJ guidance does not appear to have been applied to this case, it is likely the DOJ will take a stronger stance against recidivists in the future. - U.K. Debt Forgiveness Remedy: To resolve charges with the FCA, Credit Suisse agreed to forgive $200 million of Mozambique's debt. By agreeing to forgive a portion of Mozambique's outstanding debt, Credit Suisse received a lower penalty as a result. In its press release, the FCA specifically stated that it "would have imposed a significantly larger financial penalty" if Credit Suisse had not agreed to the debt forgiveness remedy. In discussing the sanction to be imposed, the FCA's Final Notice acknowledged that Credit Suisse's role in the scheme described above "contributed to a debt crisis, currency devaluation, and inflation in Mozambique, [which] has materially affected the people of Mozambique."

It is generally uncommon to see remedies that attempt to compensate the victims of corruption so directly. However, this is not the first time where a resolution attempted to compensate the victims of a corruption scheme. For example, as reported in our FCPA Autumn Review 2018, an FCPA settlement with Petrobras credited $683.6 million to penalties the company had paid to a Brazilian fund that was intended to support social and educational programs.

Individual Enforcement Actions

Former Braskem CEO Sentenced to 20 Months After Pleading Guilty to FCPA-Related Violations

On October 12, 2021, Jose Carlos Grubisich, the former CEO of publicly traded Brazilian petrochemical company Braskem S.A. (Braskem), was sentenced in a U.S. federal court in the Eastern District of New York (EDNY) to 20 months in prison and ordered to pay $1 million in fines and to forfeit $2.2 million. Grubisich pleaded guilty in April 2021 to conspiracy to violate the anti-bribery and books and records provisions of the FCPA.

We reported in our FCPA Spring Review 2021 that the DOJ indicted Grubisich in 2019, charging him with conspiracy to violate the books and records provision of the FCPA, conspiracy to violate the anti-bribery provision of the FCPA, and conspiracy to commit money laundering. According to court records, from 2002 to 2014, Grubisich assembled a secret slush fund into which he and other co-conspirators diverted approximately $250 million of Braskem's funds for bribes to Brazilian officials to obtain and retain business. As discussed in our FCPA Summer Review 2021, the conspirators disguised the payments with fake contracts, offshore shell companies, and a "notorious Odebrecht business unit" called "The Department of Bribery." Case documents state that, as the CEO of Braskem, Grubisich recorded the bribes as payments for legitimate services. In 2008, after pocketing $2.6 million from the scheme for himself, Grubisich left Braskem, but he continued to receive bribes until 2014 from his co-conspirators who took over managing the slush fund after his departure.

Counsel for Grubisich requested that the court judge Mr. Grubisich's life "as a whole" and sentence him to time served or four months. The U.S. government, on the other hand, recommended the court sentence him to 60 months, stating that Grubisich "submitted more than 100 letters heralding his ethical and moral standards and devotion to humanity, but failed to grapple with his ethical and moral failings with respect to the criminal conduct at issue in this case or the real-world impact of the bribery and fraud schemes in which he participated."

Five Individuals Indicted for Laundering Proceeds of Venezuelan Food and Medicine Bribery Scheme

On October 21, 2021, Southern District of Florida prosecutors unsealed an October 7, 2021 indictment charging five people – Alvaro Pulido Vargas, Jose Gregorio Vielma-Mora, Emmanuel Enrique Rubio Gonzalez, Carlos Rolando Lizcano, and Ana Guillermo Luis – with money laundering. Specifically, the prosecutors alleged that the five defendants conspired (1) to use bribes to obtain contracts from the Venezuelan Comité Local de Abastecimiento y Producción (CLAP) for distributing food and medicine and (2) to launder the bribes and proceeds through banks in several countries, including the United States. Each defendant was charged with one count of conspiracy to commit money laundering and four counts of money laundering.

According to the indictment, from July 2015 through at least 2020, the five Columbian and Venezuelan nationals conspired to bribe Venezuelan officials, including Vielma-Mora, then-governor of the state of Tachira, into granting and retaining contracts to import and distribute boxes of food and medicine to the Venezuelan people under the CLAP program. To both pay the bribes and unjustly enrich themselves, the conspirators allegedly inflated the costs of the distribution contracts. The proceeds were then laundered through banks in Antigua, the United Arab Emirates, the United States, and elsewhere. Altogether, the conspirators allegedly received approximately $1.6 billion from the Venezuelan government through the inflated contracts, with approximately $180 million being transferred to or through the United States.

Pulido Vargas was sanctioned and indicted by the U.S. Treasury in 2019 in connection with a different alleged money-laundering scheme. Rubio Gonzalez is Pulido Vargas's son. If convicted, each defendant faces a maximum penalty of up to 100 years imprisonment.

U.S District Court Dismisses FCPA And MLCA Charges Against Swiss National Citing Jurisdictional Limits; DOJ Appeals

On November 12, 2021, the U.S. District Court of Southern Texas, Houston Division, entered a memorandum opinion and order dismissing three counts of a pending superseding indictment against Daisy T. Rafoi-Bleuler, a Swiss citizen and owner of a Swiss wealth management company, for lack of jurisdiction, signaling the court's view of the limits to its jurisdictional reach over foreign nationals under both the FCPA and the Money Laundering Control Act of 1986 (MLCA).

Previously, Italian authorities had arrested Rafoi-Bleuler in April 2019 based on an Interpol Red Notice. Following her arrest, the Court of Appeals of Milan released her from custody on condition that she not leave Italy. Upon her release, Rafoi-Bleuler returned to Switzerland and appealed her extradition. On June 18, 2020, the Italian Supreme Court of Cassation entered judgment dismissing the extradition order and declaring it null and void.

In the indictment against Rafoi-Bleuler, the U.S government alleged that PDVSA and its subsidiaries, including its Houston-based affiliate (PDVSA-US) had solicited bribes from PDVSA vendors in exchange for kickbacks in violation of the FCPA and the MLCA. The principal charge against Rafoi-Bleuler alleged that, in her capacity as a partner in the Swiss wealth management firm, she had communicated with the co-defendants and others, regarding the opening of named bank accounts at a Swiss bank and the disbursement of funds among certain of those Swiss bank accounts in order to conceal illegal proceeds derived from the alleged bribery scheme. Though the indictment did not allege an agency relationship between Rafoi-Bleuler and PDVSA or that Rafoi-Bleuler had opened the bank accounts at issue herself or executed any transfers of funds, the U.S government alleged that by communicating with PDVSA and its affiliates in connection with the accounts, Rafoi-Bleuler was effectively an agent for PDVSA-US and was therefore also subject to the provisions of the FCPA and the MLCA. Accordingly, the indictment charged Rafoi-Bleuler, with conspiracy to violate the MLCA, conspiracy to violate the FCPA, and the substantive offense of money laundering.

In response to Rafoi-Bleuler's motion to dismiss the first three counts of the Indictment against her, the U.S government continued to maintain that Rafoi-Bleuler had "engaged in a bribery and money laundering scheme" and invoked the Fugitive Disentitlement Doctrine as part of its argument that the Court should not entertain Rafoi-Bleuler's motion to dismiss because Rafoi-Bleuler allegedly had defied the extradition order and was thus a fugitive.

In its decision, the Court first rejected the government's arguments under the Fugitive Disentitlement Doctrine, finding that while Rafoi-Bleuler may be considered a "fugitive" by virtue of her returning to Switzerland from Italy, where she had been temporarily ordered to remain, the Court must nevertheless first address her claim of lack of jurisdiction. Ultimately, the Court disagreed with the government's position on the extent of jurisdiction under the FCPA and MLCA in this case, citing insufficient facts to establish that Rafoi-Bleuler was an agent of PDVSA-US. The Court noted that Rafoi-Bleuler, as a foreign national, had no ties to the United States and that the government's reliance on communications through interstate commerce did not establish that Rafoi-Bleuler was an agent of a "domestic concern." The Court also stated that any transfer of the illegal proceeds at issue was not attributable to Rafoi-Bleuler, but rather occurred between PDVSA, its affiliates, and the relevant financial institutions or banks. Furthermore, the illegal acts the government ascribed to Rafoi-Bleuler were instead specifically related to her co-defendants' conduct in the United States or Venezuela and did not point to any act by Rafoi-Bleuler in either country. Thus, the Court ruled, that it lacked jurisdiction over Rafoi-Bleuler as a foreign national.

The U.S government filed a notice of appeal of the Court's decision on December 7, 2021. Nevertheless, the Court's decision provides for arguments against the expansive jurisdictional claims that are often made by the DOJ in FCPA and MLCA cases.

Former Citgo Official Receives Sentence for Money Laundering Charge

On November 15, 2021, the United States District Court in the Southern District of Texas sentenced Laymar Giosse Peña Torrealba (Peña), a former procurement officer at Houston-based Citgo Petroleum Corporation (Citgo), to three years of probation for her role in an international bribery and money-laundering scheme. Peña, a Venezuelan citizen and resident of Texas, previously served as a buyer and a supervisor in the Special Projects Group at Citgo, a Houston-based, wholly owned U.S. subsidiary of PDVSA. As reported in our FCPA Review Spring 2021, DOJ charged Peña with one count of conspiracy to launder money, alleging that Peña accepted over $340,000 in monetary bribes and reimbursed travel from Jose Manuel Gonzalez Testino (Gonzalez) and his associates in exchange for inside information and other acts intended to help Gonzalez's logistics company obtain and retain business with Citgo.

In March 2021, the DOJ unsealed a 2019 plea agreement with Peña, in which Peña pleaded guilty to the money laundering charge and agreed to forfeit at least $332,308.47 in laundered funds and to fully cooperate with the U.S. government's investigation into Venezuelan corruption. DOJ separately charged Gonzales with conspiracy to violate the FCPA, to which Gonzalez pleaded guilty in 2019.

Peña's cooperation appears to have been instrumental to DOJ securing a guilty plea from another Citgo procurement officer, Jose Luis De Jongh Atencio (De Jongh). In June 2020, the DOJ charged De Jongh with one count of conspiracy to launder money and five counts of money laundering. On March 22, 2021, the eve of his trial, De Jongh pleaded guilty to a single count of conspiracy to launder money, admitting to receiving more than $7 million in bribes from third parties (including Gonzales), funneling bribery proceeds via shell company bank accounts in Panama and Switzerland, and laundering bribery proceeds through U.S. and global banks for the eventual purchase of real estate assets in Houston. De Jongh also agreed to forfeit over $3 million seized from his bank accounts and 15 properties he allegedly purchased with the illicit proceeds. Global Investigations Review reported at the time that Peña's case was unsealed because she was due to testify at De Jongh's trial. Peña faced up to five years' imprisonment and fine of up to $250,000 or twice the gross gain from the offense. Her sentence – three years' probation and no criminal fine (forfeiture only) – likely reflects the value of her cooperation in this respect. De Jongh is scheduled to be sentenced in February 2022.

The Peña and De Jongh plea agreements state unequivocally, and without providing underlying analysis, that PDVSA and its subsidiaries constitute state instrumentalities of the Venezuelan government under the FCPA. While the issue does not appear to have been raised in the context of the Peña case, records of the De Jongh case indicate that De Jongh challenged the DOJ's characterization of Citgo as an "instrumentality" of Venezuela – arguing that the Venezuelan government's "indirect" ownership stake in the company does not warrant Citgo's classification as a state instrumentality.

DOJ responded to De Jongh's argument by citing the 11th Circuit's decision in Esquenazi, in which the court held that, for purposes of determining state instrumentality under the FCPA, "what constitutes control and what constitutes a function the government treats as its own are fact-bound questions." DOJ noted that the 11th Circuit set forth "a non-exhaustive list" of "some factors that may be relevant to deciding the issue," including "whether the government has a majority interest in the entity." DOJ asserted that because Citgo is a wholly owned subsidiary of PDVSA, in which the Venezuelan government holds a majority interest, Citgo was an instrumentality of the Venezuelan government. The court ultimately did not rule on whether Citgo was a state instrumentality, as De Jongh pleaded guilty to his charges on the eve of his trial.

Former Coal Executive Pleads Guilty in Case Involving Bribes in Egypt

On November 17, 2021, Frederick Cushmore, Jr., a U.S. citizen and former vice president and Head of International Sales for Corsa Coal Corporation, a public Pennsylvania-based metallurgical coal production company, pleaded guilty to one count of conspiracy to violate the FCPA's anti-bribery provision. According to the charging document filed by the DOJ in the U.S. District Court for the Western District of Pennsylvania, the charge stemmed from Cushmore's participation in efforts to bribe Egyptian officials to secure coal sales contracts and other business advantages.

As part of the November plea agreement, Cushmore stipulated to the factual basis for the guilty plea. According to the agreement, Cushmore conspired with an unnamed executive (Executive A) from Corsa Coal to pay bribes to Egyptian officials through an unnamed intermediary (Agent A), an Egyptian national who served as a third-party sales agent. Corsa Coal contracted with Al Nasr Company for Coke and Chemicals (Al Nasr), "an Egyptian state-owned and state-controlled entity," to sell Al Nasr coal between 2016-2020. Cushmore and Executive A had Corsa Coal pay over $4.8 million in commissions to Agent A, intending that a portion of those funds would be used to bribe foreign officials, in order to obtain coal contracts, long-term sales contracts, and inside information about competitors' bids. A second unnamed Corsa Coal executive is alleged to have participated in communications about the bribes. The charging document and plea agreement noted communications about the bribes and inside information, as well as efforts to conceal the conspiracy by use of encrypted messaging services such as WhatsApp and personal email accounts. The facts also include tracking of in- person meetings between Cushmore, Agent A, and sometimes Al Nasr officials.

In its Q3 2020 financial results and corporate update (and repeated in its annual report for 2020), Corsa Coal explained that in September 2020 it "learned that an overseas third-party sales agent had been charged in an overseas jurisdiction in connection with allegedly unlawful benefits given to a representative of an overseas customer in relation to the sale of coal from operations of U.S. subsidiaries of the Company." The company indicated that it had created a special committee of the Board of Directors and engaged outside legal counsel to conduct an independent investigation "as to whether any employees of the Company or any of its subsidiaries were aware of, or involved in, the alleged conduct and whether any such knowledge or involvement may have given rise to a violation of anti-corruption laws by the Company or any of its subsidiaries." The findings from the investigation led the company to take "corrective action to minimize risk," and to report the matter to the DOJ and the RCMP. To date, no charges have been filed against the Corsa Coal.

Cushmore's sentencing has been set for March 24, 2022 before Judge Robert J. Colville. The DOJ has not publicly announced whether any of Cushmore's alleged co-conspirators will also be charged.

U.S. Citizen Pleads Guilty to Conspiracy and Fraud Charges in Ugandan and Polish Adoption Scheme

On November 17, 2021, a Texas woman, Debra Parris, pleaded guilty to charges relating to her role in a bribery and fraud scheme connected to an international adoption agency in Ohio. According to the original indictment filed with the U.S. District Court for the Northern District of Ohio, Parris, along with two co-conspirators, procured the adoption of Ugandan children by widespread bribery of Ugandan officials and defrauded Polish and American authorities to conceal improper international adoption practices.

Although the adoption agency was not named in the original indictment or any of the DOJ's press releases, local reporting identified it as European Adoption Consultants (EAC), an entity that was temporarily disbarred by the U.S. Department of State from providing intercountry adoption services from December 2016 to December 2019. According to the original disbarment notice, EAC was not compliant with accreditation regulations and there was "evidence of a pattern of serious, willful, or negligent failure to comply with the [accreditation] standards."

According to the indictment and the DOJ's press release, for the scheme in Uganda, Parris and co-conspirator and Ugandan citizen Dorah Mirembe bribed probation and social welfare officers, magistrate and High Court judges, and court registrars to circumvent required Ugandan law assessments that adoption was in a child's best interest or that a child was eligible for adoption, or to get cases assigned to "adoption-friendly" judges. Parris and Mirembe hid this information from the U.S. adoptive parents and submitted false documents to the U.S. Department of State related to visa applications for the Ugandan children. Between 2013 and 2016, Parris and Mirembe allegedly made $900,000 in profits by marking the bribes as court costs or foreign program fees on invoices to adoption agency clients. For the Ugandan scheme, Parris pleaded guilty to conspiracy to violate the FCPA and commit visa fraud. Mirembe, who faces the same charges, is still at large.

According to the indictment, for the scheme in Poland, Parris and the executive director of the adoption agency, Margaret Cole, allegedly placed a child that clients of the adoption agency determined they could not take care of with Parris's relatives in Texas, who were ineligible for intercountry adoption. While in the relatives' care, the child sustained "significant injuries" and required hospitalization. Parris and Cole hid their actions from the Council on Accreditation, the accrediting entity for U.S. intercountry adoption agencies, the U.S. Department of State, and the Polish Central Authority. For the Poland scheme, Parris pleaded guilty to conspiracy to defraud the United States. Cole pleaded guilty to defrauding U.S. and Polish authorities, on February 4, 2022, days before her trial was set to begin.

Earlier, on August 29, 2019, a fourth conspirator, Robin Longoria, pleaded guilty in the Northern District of Ohio "to one count of conspiracy to violate the FCPA, commit wire fraud, and commit visa fraud." According to the DOJ's press release, Longoria admitted that she and co-conspirators disguised bribes as fees to court registrars and Ugandan High Court judges to get cases in front of "adoption-friendly" judges and submitted false visa application information to the U.S. Department of State. Parris is scheduled to be sentenced on March 9, 2022.

Panamanian Businessmen and Brothers Plead Guilty to Money Laundering After Being Extradited to United States

On December 2, 2021, Luis Enrique Martinelli Linares (L. Linares) pleaded guilty to one count of conspiracy to commit money laundering and agreed to a forfeiture of approximately $18.9 million for his role in a money laundering and corruption scheme involving Brazilian construction conglomerate Odebrecht S.A. (Odebrecht). On December 14, 2021, L. Linares's brother and co-defendant, Ricardo Alberto Martinelli Linares (R. Linares), also pleaded guilty to one count of conspiracy to commit money laundering for his role in the scheme.

As we reported in our FCPA Summer Review 2020, in June 2020, the DOJ filed a criminal complaint against L. Linares and R. Linares, alleging that the brothers engaged in money laundering by serving as intermediaries for Odebrecht's payment of $28 million in bribes for the benefit of their father, Panama's former President Ricardo Martinelli Berrocal. The Linares brothers were arrested in Guatemala in July 2020, as they attempted to leave for Panama on a private plane. L. Linares and R. Linares were extradited from Guatemala to the United States – on November 15, 2021, and December 10, 2021, respectively – on a February 4, 2021 indictment in which the DOJ charged them each with one count of conspiracy to commit money laundering and two counts of concealment of money laundering. The DOJ had also charged L. Linares with two additional counts of engaging in transactions in criminally derived property for his role in two wire transfers from a bank in Switzerland to a bank in New Jersey and a bank in Florida, totaling $916,500.