What You Need to Know About Reciprocal Tariffs [UPDATED]

International Alert

LAST UPDATED APRIL 15, 2025

On April 2, 2025, President Trump invoked his authority under the International Emergency Economic Powers Act (IEEPA) to implement "reciprocal" tariffs on U.S. trade partners via executive order (the Order). These tariffs (Reciprocal Tariffs) are designed to address trade deficits and trade barriers between the U.S. and other nations. Here is what you need to know:

Under what legal authority?

IEEPA authorizes the president to regulate imports as a way to "deal with any unusual and extraordinary threat, which has its source in whole or substantial part outside the United States, to the national security, foreign policy, or economy of the United States." 50 U.S.C. §§ 1701-1702. In this instance, President Trump declared a national emergency "arising from conditions reflected in large and persistent annual U.S. goods trade deficits" that is "driven by the absence of reciprocity in our trade relationships and other harmful policies." You can read the Order here. Some companies have argued that IEEPA gives the president power to imposed these tariffs – these challenges are pending.

What reasoning does the White House provide for implementing the Reciprocal Tariffs?

The White House cited the Foreign Trade Barriers report published by the Office of the United States Trade Representative (USTR) in the Order, explaining that the report "details a great number of non-tariff barriers to U.S. exports around the world on a trading-partner by trading-partner basis." You can access the report in the link above, which provides a country-by-country assessment of trade barriers.

What Reciprocal Tariff rate applies and when?

As of April 5, 2025, at 12:01 a.m. EDT, a baseline 10 percent tariff applies to imported products of all countries except Canada and Mexico.

On April 9, 2025, at 12:01 a.m. EDT, the 10 percent rate increased to a new rate for certain countries. The list of rates for each specified country can be found in Annex I of the Order. These individualized Reciprocal Tariffs purported to target countries with which the U.S. has the largest trade deficits. This was a tariff rate increase, not a tariff in addition, to the baseline 10 percent imposed April 5. The increased rates ranged from 11 percent to 50 percent.

Increases Paused for Most Countries: The increased Reciprocal Tariff rates stayed in place only for one day. On April 9, the White House announced via a new executive order that, with the exception of China, these country-specific rates would be suspended, effective April 10, 2025, at 12:01 a.m. EDT. A a result, all increased Reciprocal Tariff rates (except the rate imposed on China-origin products) returned to the original 10 percent baseline Reciprocal Tariff rate. The suspension on the increased Reciprocal Tariff rates will last for 90 days. Unless otherwise modified, the increased rates will automatically apply to the countries identified in Annex I on July 9, 2025, even without a further executive order.

China Subject to Increased Rates: In the same order, the White House announced that China's Reciprocal Tariff rate would be raised to 125 percent. This rate is in addition to other duties and tariffs.

In addition to Annex I, which identifies the countries potentially subject to higher Reciprocal Tariff rates, the April 2 order includes two other annexes: Annex II contains a list of products excepted from the Reciprocal Tariffs according to the product's Harmonized Tariff Schedule (HTS) code and Annex III contains the new Chapter 99 HTS codes that will be used to classify these products, their corresponding duty rates, and additional tariff exceptions. Annex III also includes language that was inserted into the HTS Notes as additional guidance on how to interpret and apply the Reciprocal Tariffs.

Do the Reciprocal Tariffs apply to the country of origin or the country of export?

Tariff exposure is based on the product's country of origin, not the country of export. Therefore, if a product's country of origin is China and it is exported from Mexico, the product will still be subject to the 125 percent Reciprocal Tariff on China, even though Mexico is currently excepted from the Reciprocal Tariffs.

What if my products are already in transit to the U.S.?

The Reciprocal Tariffs will not apply to goods loaded onto a vessel at the port of loading and in transit on the final mode of transit before 12:01 a.m. EDT on the effective date and entered for consumption or withdrawn from the warehouse for consumption after 12:01 a.m. EDT on the effective date and before 12:01 a.m. EDT on May 27 2025.

Do I have to pay the Reciprocal Tariffs on imported products made with U.S.-origin components?

If at least 20 percent of the value of the imported good is U.S.-originating, meaning the components are produced entirely in or substantially transformed in the U.S., then the Reciprocal Tariffs apply only to the value of the non-U.S.-origin content of the product.

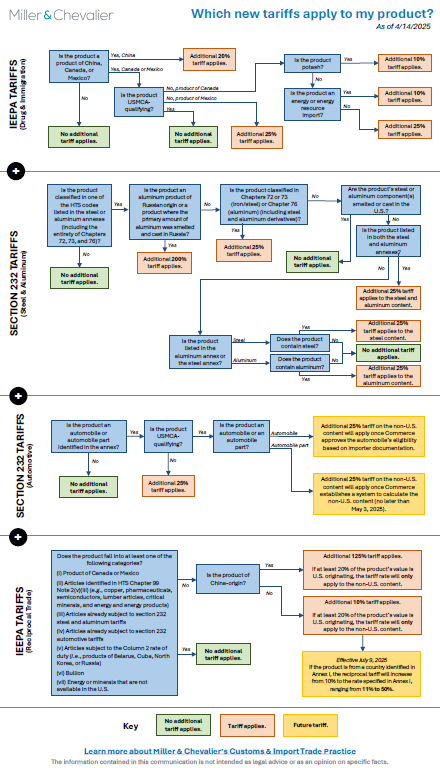

How do I know which new tariffs apply to my product?

The chart below tracks recent tariff developments, including the newest Reciprocal Tariffs, to help importers determine whether the president's new tariffs will apply to their products.

Click to view full size.

The information contained in this communication is not intended as legal advice or as an opinion on specific facts.

See full disclaimer information at the end of this alert.

Are there any exceptions to the Reciprocal Tariffs?

Yes. Some products will not be subject to the Reciprocal Tariffs. Excepted articles include:

- Articles subject to 50 USC § 1702(b) (i.e., personal communications, donations, personal luggage)

- Steel/aluminum articles and automobiles/auto parts already subject to section 232 tariffs

- Certain articles of copper and lumber, pharmaceuticals, and semiconductors listed in Annex II

- All articles that may become subject to future section 232 tariffs

- Articles subject to Column 2 rates of duty from countries with which the U.S. does not have normal trade relations (Belarus, Cuba, North Korea, and Russia)

- Bullion

- Energy and other certain minerals that are not available in the U.S.

- Other articles delineated in Annex II of the Order

On April 11, 2025, Trump issued a memorandum clarifying which semiconductor products were excluded from Reciprocal Tariffs. The memorandum explains that smartphones, automatic data processing machines, magnetic or optical readers, flat panel modules, electronic integrated circuits, and certain semiconductor devices and parts are included within the meaning of the semiconductors exemption and therefore exempted from Reciprocal Tariffs. The clarification extends back to April 5, 2025, allowing importers to retroactively claim this exemption if the semiconductors definition now applies to a product already imported.

What is the Reciprocal Tariff rate on China-origin products?

In response to a retaliatory tariff levied by China on U.S. goods, Trump signed a second executive order on April 8 that amends the Reciprocal Tariff on China, increasing the tariff rate from 34 percent to 84 percent. As mentioned above, this rate then was increased to 125 percent on April 9, via the third executive order. Effective 12:01 a.m. EDT on April 10, 2025, products of China are subject to a Reciprocal Tariff of 84 percent in addition to all other applicable tariffs.

How do the Reciprocal Tariffs stack with other tariffs, including the existing IEEPA and section 232 tariffs?

The Reciprocal Tariffs are in addition to pre-existing tariffs, including the product's general duty rate, section 301 tariffs on China-origin products, and IEEPA tariffs for Canada, Mexico, and China. These tariff rates are cumulative. If a hypothetical product is subject to a general duty rate of 6.5 percent, section 301 duties of 25 percent, a China IEEPA tariff of 20 percent, and the new Reciprocal Tariff of 125 percent, then the total tariff exposure for the product is 135.5 percent.

How does the Order impact existing IEEPA tariffs for Canada, Mexico, and China?

For Canada and Mexico, the existing IEEPA tariffs are unaffected by the Order. This means United States-Mexico-Canada Act (USMCA)-compliant goods will continue to be subject to a zero percent IEEPA tariff rate, non-USMCA-compliant goods will be subject to a 25 percent IEEPA tariff, and non-USMCA-compliant energy and potash will see a 10 percent IEEPA tariff. If the administration ended these IEEPA tariffs, USMCA-compliant goods would continue to receive preferential treatment, while non-USMCA-compliant goods would be subject to a 12 percent Reciprocal Tariff.

For China, the existing 20 percent IEEPA tariff will remain in effect in addition to this new 125 percent Reciprocal Tariff for a total 145 percent IEEPA and Reciprocal Tariff rate.

If my product is subject to section 232 steel and aluminum tariffs and is of China-origin, do I still need to pay the previous 20 percent China IEEPA tariff for those products?

Yes, the previous 20 percent China IEEPA tariff will continue to apply, in addition to the section 232 steel and aluminum tariffs. However, products that are subject to section 232 steel and aluminum tariffs and the automobile tariffs are exempted from the Reciprocal Tariffs. In other words, only a 20 percent tariff will apply to China-origin steel and aluminum articles, instead of a 125 percent China-origin Reciprocal Tariff, but the section 232 steel and aluminum tariffs will still apply.

Is the de minimis exemption still available?

The de minimis exemption permits duty free importation of certain low-value shipments valued at under $800. For now, the de minimis exemption will remain available for all products that are subject to the Reciprocal Tariffs until the Secretary of Commerce announces adequate systems are in place to collect duty revenue on goods otherwise eligible for de minimis treatment. Upon that notification, the de minimis exemption will no longer be available.

However, in a separate executive order, the White House also announced that the de minimis exemption for products from China and Hong Kong will be terminated starting at 12:01 a.m. EDT on May 2, 2025. This executive order was further amended on April 8, and again on April 9, in response to retaliatory tariffs levied by China on U.S. goods. The following duties will now apply for those goods:

- For packages not coming through the mail that previously would qualify for de minimis: now subject to all applicable duties (Most Favored Nation, IEEPA, etc.).

- For packages coming through the mail that previously qualified for de minimis: subject to a 120 percent tariff if the carrier chooses to report product value, or a $100 charge per product if no value is reported. This charge will increase to $200 on June 1, 2025. The carrier can choose which will apply. At any time, CBP can decide that a formal entry process is required, instead of the tariff or charge above.

Currently, the de minimis tariffs do not apply to Macau, but the USTR is reviewing whether it should extend to Macau.

Is drawback (or duty refund) available for the Reciprocal Tariffs?

A drawback is a duty refund available for products imported into, but not used, in the U.S. and which are subsequently exported or destroyed. Trump's prior trade actions, including the earlier IEEPA and section 232 tariffs, specified whether the tariffs would be drawback-eligible, but the Order is silent on the issue. However, on April 4, 2025, CBP circulated additional guidance to importers that confirmed that importers will be able to claim drawback to recover up to 99 percent of the duties paid. Drawback eligibility should offer some relief to importers and potentially mitigate the impact of the Reciprocal Tariffs.

Is Chapter 98 subject to the Reciprocal Tariffs?

Chapter 98 includes special classification provisions based on the use or condition of a product. With some exceptions, the Reciprocal Tariffs are not imposed where a product is properly entered under Chapter 98 of the tariff schedule.

Despite the general rule, the Reciprocal Tariffs will still apply to certain products:

- The Reciprocal Tariffs apply to goods exported for repairs or alterations and then re-imported into the U.S. as well as metals manufactured in the U.S. that are exported for further processing and re-imported. However, the Reciprocal Tariffs are only applied to the value of the repairs, alterations, or processing performed in the foreign country. For example, if a product whose value is $5,000 is exported from the U.S. to a foreign country for repair, and the importer pays $1,000 for that repair, the Reciprocal Tariffs will only apply to the $1,000 repair.

- The Reciprocal Tariffs also still apply to goods assembled abroad using U.S. components. However, the Reciprocal Tariffs are only applied to the value of the assembled good after subtracting the value of the U.S. parts. For example, if a product whose value is $4,000 is imported into the U.S. following assembly in a country subject to the Reciprocal Tariffs and the product is composed of U.S. parts totaling $2,500, the Reciprocal Tariffs will only apply to the remaining value of $1,500.

What is the impact on Foreign Trade Zones (FTZs)?

The Reciprocal Tariffs will not apply to goods that are eligible for "domestic status" under 19 CFR 146.43, meaning U.S.-origin or previously imported goods. Goods which are admitted to FTZs on or after April 9, 2025, when the country-specific tariff increases take effect, must be admitted as "privileged foreign status" under 19 CFR 146.41, therefore fixing the duty rate. The Order's impact on products admitted under the "privileged foreign status" prior to April 5, when the 10 percent tariff rate on all countries takes effect, is unclear.

When will the Reciprocal Tariffs be lifted?

According to the Order, the Reciprocal Tariffs will remain in effect until Trump determines that the threat posed by the trade deficit and underlying nonreciprocal treatment is "satisfied, resolved, or mitigated."

How were the Reciprocal Tariff rates calculated?

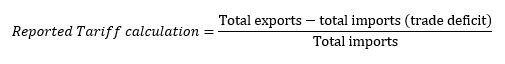

The country-specific Reciprocal Tariff rates were calculated based on the tariffs that each country imposes on the U.S. Reports have indicated that the tariff rates imposed on the U.S. were calculated via the following formula: trade deficit with country X divided by total imports from country X. Another way to view this formula is the following:

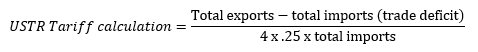

The USTR published a longer calculation on its website, using the formula below, which reaches the same outcome.

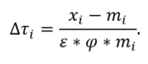

The USTR explained that:

- ε = price elasticity of import demand (set at 4)

- φ = elasticity of import prices with respect to tariffs (set at .25)

- ε and φ cancel each other out, since 4 x .25 = 1

- Xi = total exports to country X

- mi = total imports from country X

In other words, another way to view this formula is the following:

This formula is the same as that indicated in the reports above. The calculation of the tariffs that each country imposes on the U.S. is divided by two to reach the Reciprocal Tariff rate.

Can trading partners effectuate any changes to their existing tariff rate?

The Order also contains modification authority, allowing Trump to increase the tariff if trading partners retaliate or decrease the tariffs if trading partners take significant steps to remedy non-reciprocal trade arrangements and align with the U.S. on economic and national security matters.

How have countries since retaliated?

As of the date of this publication, countries have announced the following retaliatory measures:

- China announced that it would impose an equivalent 34 percent tariff on all products imported from the U.S. on April 10, 2025, the day after the 34 percent Reciprocal Tariff on China began. Following China's announcement, Trump amended the Reciprocal Tariffs to increase the tariff rate on China-origin goods from 34 percent to 84 percent. This action prompted China to similarly increase its own tariff on U.S. goods to 84 percent. On April 11, China raised its tariff rate to 125 percent in response to the U.S.'s 125 percent rate. These steps are in addition to previously imposed retaliatory trade measures.

- In addition to retaliatory trade measures, China requested a dispute consultation with the U.S. through the World Trade Organization (WTO) regarding the imposition of the Reciprocal Tariffs. This is the third WTO dispute consultation initiated regarding the administration's recent tariff actions.

- Although Canada was not included on the Reciprocal Tariff list, Canada is still subject to 25 percent automotive tariffs. Effective April 9, 2025, Canada imposed a 25 percent tariff on U.S.-origin imported autos, in addition to previously imposed retaliatory measures.

- On April 9, 2025, the EU voted to approve the first phase of its response to increasing U.S. tariffs, enacting tariffs up to 25 percent on a variety of U.S. goods in response to the section 232 steel and aluminum tariffs levied earlier this year. These tariffs were set to take effect April 15. However, on April 10, acknowledging the pause on country-specific Reciprocal Tariffs, the EU announced a 90-day pause to its response to the steel and aluminum tariffs.

- The U.K.'s trade secretary announced that they would work with the U.S. to negotiate an exemption to the tariffs. On April 4, 2025, the U.K. government published a list of hundreds of U.S. products, requesting input from businesses on what the government's response to the tariffs should be.

The tariff landscape is rapidly shifting. It is imperative for companies to review the tariff classification, country of origin, and value of U.S. imports, and consider making supply chain adjustments, as appropriate, to limit tariff exposure. Should you have any questions about these strategies or the content of the tariffs themselves, reach out to our Customs team.

For more information, please contact:

Richard A. Mojica, rmojica@milchev.com, 202-626-1571

Julia M. Herring, jherring@milchev.com, 202-626-1486

Brittany Huamani, bhuamani@milchev.com, 202-626-5911

Franco Jofré, fjofre@milchev.com, 202-626-1585

Peter Kentz, pkentz@milchev.com, 202-626-5891

Aditi Patil, apatil@milchev.com, 202-626-1485

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.