FCPA Autumn Review 2024

International Alert

Introduction

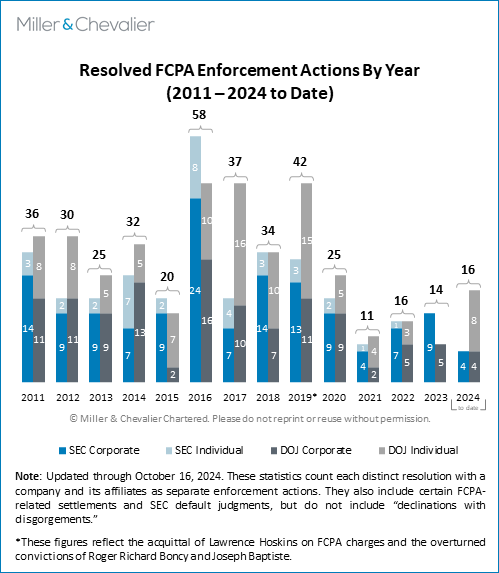

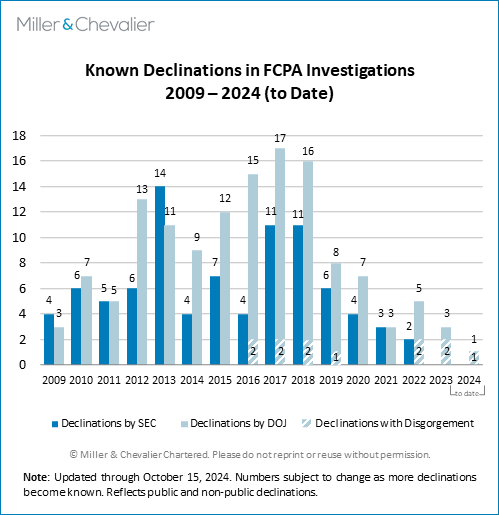

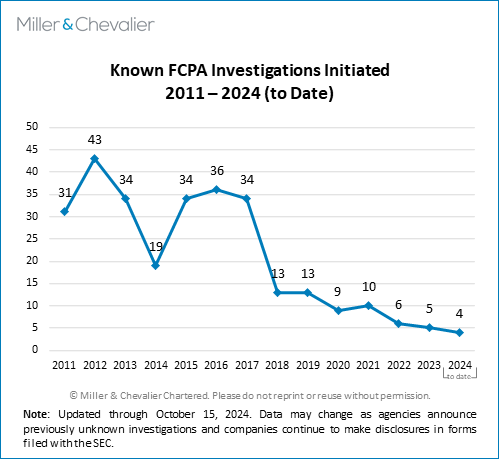

Following the second quarter's historic lack of corporate dispositions, the third quarter of 2024 included some corporate resolutions (one from the Department of Justice (DOJ) and one from the Securities and Exchange Commission (SEC)), two key jury convictions (one against a former corporate executive, the other against a former high-ranking government official from Mozambique extradited to the U.S.), and some important policy announcements (the Corporate Whistleblowers Award pilot program in August and the revisions to DOJ’s guidance on the Evaluation of Corporate Compliance Programs (ECCP) in September). The DOJ filed charges against individuals relating to a corporate corruption scheme targeting government contracts in the Philippines and announced guilty pleas in two cases related to a U.S.-based airline services company for improper payments in South Africa and Nepal, all of which suggests that related corporate resolutions may also be on the horizon. The DOJ also succeeded in extraditing a Goldman Sachs executive from the U.K. to face Foreign Corrupt Practices Act (FCPA) charges related to business in Ghana.

Meanwhile, both the DOJ and SEC have announced additional corporate resolutions in October, suggesting that the fourth quarter may push 2024 FCPA enforcement statistics in range with prior years not affected by the pandemic. And while some have been wondering if the DOJ and SEC have abandoned the use of monitorships, the DOJ and SEC required an Independent Compliance Monitor in the October resolutions with RTX Corp and its subsidiary Raytheon Company – the first monitorship in the FCPA space since Glencore's resolution with the DOJ in May 2022. Meanwhile, there have been important and noteworthy international developments – especially across Europe and Latin America – some of which demonstrate challenges to anti-corruption enforcement outside of the U.S. Congress revised the Foreign Extortion Prevention Act (FEPA) and the DOJ reports that it already has received nearly 200 whistleblower allegations in its pilot program. In other words, even if the DOJ and SEC have not been in the headlines for FCPA enforcement, we have a lot to cover for the third quarter and are preparing for a busy fourth quarter of 2024.

DOJ and SEC Public Remarks and Updates

DOJ and SEC officials discussed policy matters in public speeches at various events, including their views on how companies should respond to the incentives and expectations established by recent DOJ modifications to corporate enforcement policies.

The DOJ's new Corporate Whistleblower Awards Pilot Program, announced on August 1, 2024, and discussed in detail here, has been highlighted on several occasions by DOJ officials in public forums. On September 17, 2024, at the New York University School of Law's Program on Corporate Compliance and Enforcement, Principal Deputy Assistant Attorney General (PDAAG) Nicole M. Argentieri delivered a speech about the program. She noted that, in part, the program is "sending a message to company executives and leadership: invest in compliance and take internal reports of wrongdoing seriously, because we are using more tools than ever before to identify corporate misconduct." She also discussed how the new program extends beyond the SEC's existing program under the Dodd-Frank Act, asserting that "our cases involving bribery at international commodity trading companies, which resulted in six corporate resolutions, convictions of 20 individuals, and over $1.7 billion in financial penalties" would have been covered by the new program even though the companies at issue were not "covered by the SEC's program." PDAAG Argentieri concluded that "[t]ogether, our corporate voluntary self-disclosure policy, our whistleblower pilot program, and our individual voluntary self-disclosure pilot are mutually reinforcing" and designed to "encourage[] both companies and individuals to come forward with information about wrongdoing [and] increas[e] the incentives for corporations to improve compliance and internal reporting systems" to "ensur[e] that we get the information we need to hold criminal actors accountable."

At the same event, according to a report in Global Investigations Review (GIR), another senior DOJ Criminal Division official stated that the DOJ "has received well in excess of' 100 tips since its whistleblower pilot programme began accepting submissions at the beginning of August [2024]." The official noted further, "[a]s you might expect, with any time you're soliciting input from the public at large, you're going to get some input that's of interest and some that's not… [but] we're getting good tips." At a later GIR-sponsored event on September 27, 2024, the same official noted that "a lot of folks are making multiple submissions to different programmes" such as those administered by the SEC, Commodities Futures Trading Commission (CFTC) and other agencies, and that the DOJ "' expect[s] to have close connectivity with the folks in the other agencies with whistleblower programmes'" when reviewing allegations.

At the same GIR-sponsored event, DOJ Fraud Section head Glenn Leon asserted that "corporate enforcement cases brought by the fraud section will likely increase by around 30%" by the end of 2024. This figure likely covers the broader cross-section of cases handled by the Fraud Section beyond the FCPA. He also noted that FCPA prosecutors have begun looking at "public bidding data to generate leads for foreign bribery cases."

As we have noted, while these public statements do not necessarily reflect regulatory guidance, nor do they have binding effect on the agencies' actions, they provide insights into the DOJ's and SEC's expectations for responsible corporate behavior.

Finally, we note that turnover at both the DOJ and SEC continues as the U.S. election looms. On October 2, 2024, the SEC announced that Enforcement Division Director Gurbir S. Grewal "will depart the agency, effective Oct. 11, 2024" and that "[u]pon Mr. Grewal's departure, Sanjay Wadhwa, the Division's Deputy Director, will serve as Acting Director." The announcement specifically spotlighted Director Grewal's May 2024 speech regarding the "five pillars of cooperation" with SEC investigations.

Corporate Enforcement Actions

In the third quarter of 2024, the DOJ and SEC announced only two new corporate resolutions – a declination with disgorgement and an SEC Cease-and-Desist Order charging FCPA accounting violations related to improper payments – but the pace is already quickening in October. On October 11, the SEC announced an administrative Consent Order with Moog, and then on October 16, the DOJ announced two deferred prosecution agreements (DPAs) with Raytheon Company, one of which related to the FCPA and related export control violations (while the other related to defrauding the U.S. government). On the same day, the SEC announced an administrative consent order with RTX, Raytheon's parent company, for FCPA violations. Both the DOJ and SEC FCPA resolutions related to efforts to gain business in Qatar.

While the pace of announced corporate actions through the first three quarters was slower than other, non-pandemic years, the timing of the announcements regarding the two October matters make it possible that Q4 will lead to a more average year overall.

On August 27, 2024, the DOJ announced that, pursuant to its Corporate Enforcement and Voluntary Self-Disclosure Policy (CEP), the agency was declining to prosecute Boston Consulting Group, Inc. (BCG) for alleged FCPA violations related to a bribery scheme in Angola funded by commissions to an agent. The DOJ cited multiple reasons for the declination, including "timely and voluntary self-disclosure," "full and proactive cooperation," assertive remediation (including clawbacks of partner profits), and "significant" compliance program improvements. As a condition of the declination, BCG will disgorge $14,424,000.

On September 10, 2024, global manufacturing company Deere & Company (Deere) settled an FCPA investigation by the SEC by agreeing to pay $9,930,355 in penalties, disgorgement, and interest to resolve charges that the company violated the FCPA's books and records and internal accounting controls provisions. The case involved alleged improper payments made by Deere's wholly owned Thai subsidiary, Wirtgen Thailand, which the SEC states aimed to gain business by influencing both foreign officials and employees of a private company in Thailand. The SEC settlement states that, to facilitate efforts to win the relevant contracts, Wirtgen personnel providing cash gifts, paid for entertainment (often at massage parlors), and sponsored "extravagant" factory visits to Germany, Switzerland, and elsewhere in Europe that mostly involved tourism activities. Wirtgen personnel also allocated funds for improper payments indirectly through sham consulting fees provided to a third-party agent in contravention of Wirtgen's and Deere's compliance policies. According to the SEC, Deere failed to "fully integrate Wirtgen Thailand into its existing internal control system" after acquiring Wirtgen, which "contributed to its failure to devise and maintain a sufficient system of internal accounting controls with respect to employee expense reimbursements, third party payments, and gifts, travel and entertainment."

On October 11, 2024, the SEC announced the resolution of a case involving aerospace and defense manufacturer Moog, Inc., in which the company agreed to pay a penalty of $1.1 million based on allegations "of bribes paid by its wholly owned Indian subsidiary." The SEC's press release states that employees of the Indian subsidiary "bribed a variety of Indian officials to win business… exclude competitors… and also used a variety of schemes to make the improper payments, including by funneling them through third-party agents and distributors." The company also agreed to disgorge and pay prejudgment interest totaling close to $600,000. We will cover the case in more detail in our next Review.

On October 16, 2024, the DOJ announced a three-year DPA with Raytheon Company, a subsidiary of U.S. defense company RTX, to resolve multiple DOJ investigations involving the FCPA and violations of the International Traffic in Arms Regulations (ITAR), including Part 130, which requires disclosures of certain payments to third parties and is designed in part to detect bribery. The DOJ release notes that "between approximately 2012 and 2016, Raytheon, through certain of its employees and agents, engaged in a scheme to bribe a high-level official at the Qatar Emiri Air Force (QEAF)…[who] was primarily responsible for the conduct of air warfare, in order to assist Raytheon in obtaining and retaining business from the QEAF" and other Qatari military forces. Under the terms of the DPA, "Raytheon will pay a criminal monetary penalty of $230.4 million, pay forfeiture of $36,696,068, and retain an independent compliance monitor for three years." This represents the first monitorship imposed in an FCPA case since the 2022 Glencore DPA. The DOJ press release also stated that Raytheon entered a second DPA with the DOJ in relation to "a major government fraud scheme involving defective pricing on certain government contracts." Overall, Raytheon agreed to pay "over $950 million" in penalties related to the two DPAs.

On the same day, the SEC also announced a settlement with RTX (a U.S. issuer and Raytheon's parent company) under which RTX "agreed to pay more than $124 million to resolve charges that it violated the [anti-bribery and accounting provisions of the FCPA] in connection with payments made to assist in obtaining contracts with the Qatari military." The public documents from the agencies detail credits and offsets that the company received in regard to the two sets of penalties. The SEC resolution also requires the retention of an Independent Compliance Monitor for three years. We will cover the Raytheon/RTX dispositions in detail in our next Review.

There is continuing evidence of several ongoing investigations based on past corporate disclosures that could result in further corporate dispositions before year's end, as discussed below. As always, we note that many factors underlie the timing of case dispositions and thus changes in quarterly levels of output should not be read as longer-term indicators.

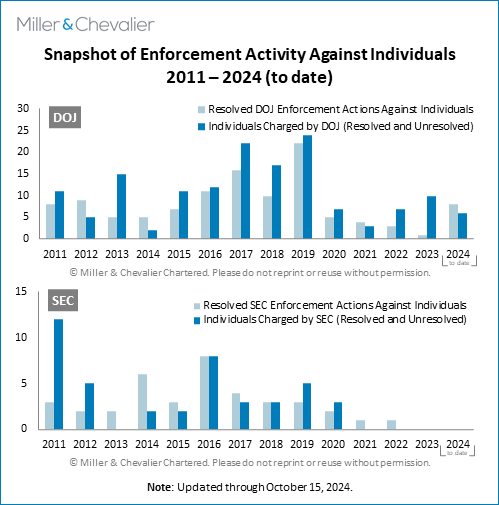

Enforcement Actions Against Individuals

Cases involving individuals in Q3 2024 added to the DOJ's recent successes in charging and convicting both givers and takers of corrupt payments, including through multiple guilty verdicts at trial as well as guilty pleas and forfeiture actions involving former and current foreign officials accused of receiving bribes. Most notably, the DOJ achieved guilty verdicts from juries in the trials of former Finance Minister of Mozambique Manuel Chang and former oil trader Glenn Oztemel. The DOJ also secured a plea agreement with former Vitol trader Javier Aguilar, ending a long-running prosecution that involved several twists and turns based on various court rulings. The quarter also saw the public release of plea agreements with two former airline service company executives amidst what appears to be an ongoing investigation of alleged corruption involving multiple state-owned airlines. And, on the first day of Q4 2024, a court sentenced Carlos Ramón Polit Faggioni, the former Comptroller General of Ecuador, to a decade in prison for taking bribes from Odebrecht and others, following his conviction earlier this year.

Meanwhile, the SEC did not announce any FCPA-related actions against individuals or related resolutions this quarter and, as noted above, has not done so since 2022 (when the federal court awarded a default judgment against a Chinese defendant). As shown below, the SEC has not initiated an FCPA action against an individual since 2020.

As noted, on August 8, 2024, the DOJ announced the conviction of Manuel Chang, the former Finance Minister of Mozambique, following a four-week trial. Chang was convicted for two counts – conspiracy to commit wire fraud; and conspiracy to commit money laundering – which arose from charges that he had been central to the so-called "tuna bond" scandal, a $2 billion scheme involving fraud, bribery, and money laundering in which he allegedly received $7 million in bribe payments in exchange for signing guarantees to secure $2 billion in funding for projects to be carried out by Mozambican state-owned companies. Chang faces up to 20 years in prison for each count.

On September 26, 2024, a federal jury found Glenn Oztemel, a former Freepoint Commodities executive, guilty on seven counts for his role in a Petrobras-related bribery and money laundering scheme. Oztemel was found guilty of having facilitated more than $1 million in bribes to Brazilian officials over nearly eight years using commissions or customer relationships to generate slush funds and pay bribes to obtain contracts for Freepoint and a previous employer. Oztemel faces a maximum penalty of five years on each FCPA and FCPA conspiracy count and 20 years apiece on the money laundering/conspiracy counts. Oztemel's brother Gary Oztemel, who pleaded guilty to money laundering in June, also awaits sentencing.

The Oztemel verdict represents the DOJ's second successful case against former trading company executives in 2024. The first – the long-running prosecution of former Vitol trader Javier Aguilar – came to an end in the third quarter of 2024, as well. Aguilar was convicted in a New York court in February 2024 for improper payments to officials at Petrobras, the Brazilian state-owned oil company. Facing a second trial in Texas for paying bribes to officials of Petroecuador, Ecuador's state-owned oil company, and to officials at PEMEX Procurement International (PPI), a subsidiary of Mexico's state-owned oil company PEMEX, Aguilar instead accepted a plea agreement under which he pleaded guilty to one count of conspiracy to violate the FCPA and one count of violating Texas' criminal anti-bribery provision. Aguilar now faces a maximum 40-year sentence under both the Texas-based counts and a New York jury verdict and he must forfeit over $7 million in criminal proceeds.

In July, guilty pleas related to two individuals linked to AAR Corp. (AAR), a U.S.-based aviation services company, were publicly revealed. They related to violations of the FCPA's anti-bribery provisions in South Africa and Nepal, five years after AAR disclosed possible FCPA violations. Julian Aires, the president of JM International, an aviation services company that served as a joint venture (JV) partner for AAR, pleaded guilty on January 15, 2024, to a count of conspiracy to violate the FCPA's anti-bribery provisions; the DOJ released this plea agreement on July 15, 2024. The charges centered in part on an alleged scheme by Aires and his co-conspirators to bribe South African officials in order to secure a five-year contract for JM Aviation South Africa, a JV between JM International and AAR. Later, on July 19, 2024, Deepak Sharma, a former AAR executive, pleaded guilty to conspiracy to violate the FCPA's anti-bribery provisions, based on allegations that Sharma was part of a conspiracy to bribe Nepali officials in order to secure a $216 million deal for Nepal Airlines, a state-owned airline, to acquire two jets. Sharma agreed to forfeit around $130,000. Both defendants have yet to be sentenced.

On October 1, 2024, a federal district judge in the Southern District of Florida sentenced former Ecuadoran official Carlos Ramón Polit Faggionito 10 years' imprisonment, followed by three years of supervised release. Polit was convicted in April 2024 of multiple money laundering and related counts based on his solicitation and receipt of over $10 million in bribes from Brazilian company Odebrecht and others and his actions to launder the resulting proceeds in Florida and elsewhere. The judge also ordered Polit to forfeit approximately $16.5 million in illicit proceeds. DOJ prosecutors had argued for a longer sentence, asserting that Polit "was one of the most powerful people in Ecuador" and had "abused his position over a nearly decade-long period to obtain massive bribes and to launder those bribes into South Florida with the help of his son and others." According to media reports, Polit's son, John Christopher Polit, was arrested by U.S. authorities in September 2024 and charged with similar crimes. The younger Polit is scheduled to go to trial in November 2024.

On August 8, 2024, a federal grand jury in Florida returned an indictment against three businessmen associated with voting machine company Smartmatic – Roger Alejandro Pinate Martinez (Pinate), Jorge Miguel Vasquez (Vasquez), and Elie Moreno— as well as a government official in the Philippines who is expected to be extradited to the U.S. The indictment claims that the businessmen undertook various actions to allegedly cause at least $1 million in bribes to be paid to the Philippine official in exchange for obtaining three contracts worth approximately $182 million related to the May 2016 election in the Philippines. The indictment also alleges that a Taiwanese-based vendor facilitated the payments through "over-invoicing" to create a funding source and assisted with transferring money to offshore accounts linked to the official.

Forfeiture actions related to the massive 1MDB scandal continued this quarter, following action in Q2. On July 23, 2024, the DOJ announced a deal with "Jasmine" Loo Ai Swan (Loo), the former general counsel of [1MDB] "to recover artwork by Pablo Picasso and a financial account in Switzerland traced to funds allegedly embezzled from 1MDB"; the total value was $1.8 million. In the same press release, the DOJ also stated that it "has obtained forfeiture orders on other assets allegedly purchased with 1MDB funds by Low Taek Jho, also known as Jho Low (Low), including diamond jewelry and artwork by Vincent Van Gogh, Claude Monet, Pablo Picasso, Jean-Michel Basquiat, and Diane Arbus." The value of these assets is stated in the release to be over $83 million. The release also noted that none of the new agreements "release[s] any entity or individual from filed or potential criminal charges."

In other developments involving individuals this quarter, on July 15, 2024, the U.K. extradited former Goldman Sachs banker Asante Berko to the U.S. The next day, Berko was arraigned in federal court in the Eastern District of New York (EDNY) and charged "with violations of the [FCPA] and money laundering for bribing Ghanaian government officials to secure a power plant deal and laundering the payments through the U.S. financial system." Berko had been arrested on November 9, 2022, "pursuant to an Interpol Diffusion Notice" based on an August 2020 indictment. While Goldman Sachs had its own corporate resolutions related to the 1MDB scandal, these charges against the former Goldman Sachs executive are not related to Malaysia.

The trial of former Cognizant executives Gordon Coburn and Steven Schwartz, which was originally to have commenced in September 2024, was pushed by an August 2, 2024 court order to March 3, 2025. The trial has already been delayed several times – the current reason cited by the court is continuing uncertainty regarding the availability of a key witness located in India. The DOJ has been pursuing the witness through a mutual legal assistance request to the Indian government, but that process has been slow and is ongoing. The court noted that the decision on adjournment of the trial to 2025 was "a close one" but, after consideration of various factors, the court approved the delay "to preserve the integrity of the truth-seeking process."

Earlier in the case against Coburn and Schwartz, on July 2, 2024, the trial judge denied a motion to quash discovery, including testimony, by an outside lawyer for Cognizant's alleged intermediary for some improper payments (i.e., Larsen & Toubro Construction), regarding aspects of his conduct of an internal investigation for the third party into the allegations of bribe payments in India. The judge's order relied "largely" on "the reasons outlined in Defendants' motion papers." The defendants' counsel had argued that the testimony was relevant due to the fact that the investigation "did not find evidence one would expect it to find if the government's allegations were true." The defendants also had asserted that their subpoena "seeks testimony that is limited to information already provided to the government, and therefore either was not privileged in the first instance or as to which privilege has been waived."

On August 30, 2024, rapper Prakazrel (Pras) Michel lost his motion for a new trial following his April 2023 conviction on various counts related to activities in the sprawling 1MDB corruption case. The district court's August 30 memorandum addresses in detail Michel's claims related to insufficient evidence and ineffective assistance of counsel at trial and concludes that the errors at trial – both purported and founded – did "not warrant the reversal of Michel's conviction and a new trial." The court denied Michel's "Rule 29" motion for acquittal in April 2024. Michel's lawyers have announced that they will appeal the August 30 decision.

Finally, we note two cases outside the FCPA and related areas that nonetheless are worth mention in the Review. First, as has been well-covered in the media, now former U.S. Senator Robert Menendez (D-NJ) was found guilty by a jury on July 16, 2024, of several counts, including bribery, conspiracy, and honest services fraud. Some of the charges related to alleged bribe payments to Menendez connected to his intervention in matters to the benefit of the government of Egypt and related to obtaining investment funds from a Qatari entity related to the royal family. Two other New Jersey businessmen were also found guilty, while a third entered a plea agreement and was a key witness for the DOJ at the trial. Menendez's wife has also been charged, though her trial has been delayed due to her health issues. Menendez resigned his Senate seat on August 20, 2024, and he currently is scheduled to be sentenced on October 29, 2024. Second, the DOJ filed charges against New York City mayor Eric Adams, alleging – among other charges – that he received lavish entertainment and travel from the Turkish government in a covert scheme to provide the Turkish government with preferential treatment (for example, approving the opening of a consular building in New York even though it would have failed inspection).

Also, regarding internal investigation practices and the attorney-client privilege, on August 5, 2024, Miller & Chevalier co-signed an amicus curiae brief along with 38 other law firms that was filed with the U.S. Court of Appeals for the Sixth Circuit in ongoing shareholder litigation involving fallout from the political scandal involving FirstEnergy in Ohio. The brief argues that the district court trying the case, among other issues, "applied the wrong legal standard" in ruling that documents related to two internal investigations conducted by outside counsel were not protected by either the attorney-client privilege or the work product doctrine. The amici firms noted that the standards used by the district court "if adopted, would threaten the success of countless internal investigations necessary to the good governance of companies in the United States" and "would also undermine the strength of the attorney-client relationship companies have with their counsel."

Other Indicia of Enforcement Trends, Including Investigation-Related Announcements

During the third quarter of 2024, one new corporate FCPA investigation was announced involving Steward Health Care, a private company based in Texas. Based on media reports, the investigation appears to relate to a 2018 contract that Steward Health Care was awarded by the Maltese government. Under the contract, Steward Health Care was supposed to renovate and operate three state-owned hospitals in Malta. However, as reported by a number of news outlets – including CBS News, Times of Malta, and the Organized Crime and Corruption Reporting Project – last year, a court in Malta determined that the contract at issue was "fraudulent" because it resulted from "collusion" between Steward Health Care and Maltese government officials. As a result, the court cancelled Steward Health Care's contract. Some Maltese officials have also been charged in connection with the scheme.

There were also updates to two ongoing investigations:

- The previously disclosed investigation involving RTX Corporation resulted in multiple resolutions, as noted above.

- Also in September, according to a press release from Ericsson, the SEC concluded an investigation into potential misconduct by the company in Iraq and determined that the agency "does not intend to recommend an enforcement action by the SEC against Ericsson."

In other news, on July 5, 2024, a federal court dismissed the FCPA-related case against Deutsche Bank after the DOJ filed a motion on July 3 noting the expiration of the company's DPA on January 7, 2024. The motion noted that the bank had undertaken all required commitments under the DPA, including "full cooperation with the Government, implementation of an enhanced compliance program and procedures, and satisfaction of the terms of the provisions regarding self-reporting."

Policy and Legislative Developments

Near the end of Q3, the DOJ announced an update of its ECCP guidance in the wake of a September 23, 2024, speech by PDAAG Argentieri. We discussed the various specific updates in this separate client alert, also providing a redline of the changes. The DOJ's substantive revisions for this round of ECCP updates focused primarily on companies' managing potential risks created by the spread of generative artificial intelligence (AI) across business functions, using data and technology related to various compliance program elements, integrating and adapting to lessons learned from other companies, measuring the success and value from compliance investments, and reporting.

As we discussed in detail in this alert, on August 1, 2024, the DOJ formally rolled out its new Corporate Whistleblower Awards Pilot Program and related documentation, including a related temporary update to the Criminal Division's Corporate Enforcement and Voluntary Self-Disclosure Policy (CEP). In summary, the new pilot program potentially will reward "individuals... [who] provide the [DOJ] with original information in writing [under certain conditions] that... leads to criminal or civil forfeiture exceeding $1,000,000 in net proceeds forfeited in connection with a successful prosecution, corporate criminal resolution, or civil forfeiture action related to corporate criminal conduct in" one of the enforcement priority areas established by the guidance: foreign corruption, domestic bribery, crimes involving financial institutions, and healthcare fraud related to private insurance. The DOJ originally announced the new pilot program on March 7 and 8, 2024.

On July 22, 2024, Congress passed amendments to FEPA that addressed several issues; we discuss those in detail below.

The SEC issued four significant whistleblower awards in July and August, with one amounting to $82 million. While these awards were not necessarily tied to FCPA cases, their frequency and size serve as a reminder that the whistleblower award program is a powerful information-gathering tool for the SEC that can trigger FCPA-related inquiries.

The U.S. government continues to designate foreign officials and others as subject to economic sanctions and visa/immigration restrictions under the Global Magnitsky Human Rights Accountability Act and other statutory and regulatory authorities for acts of corruption. On August 6, 2024, the Department of the Treasury (Treasury) sanctioned "Paraguayan tobacco company Tabacalera del Este S.A. (Tabesa) for providing financial support to Paraguay's former president, Horacio Manuel Cartes Jara," who was himself sanctioned along with others in January 2023 for "involvement in the rampant corruption that undermines democratic institutions in Paraguay." Though not directly related to corruption, Treasury and Department of State also issued Global Magnitsky sanctions in Q3 2024 against persons in Cambodia, Georgia, and Haiti related to human rights violations, cyber-currency scams, and human trafficking activities, many of which are likely supported through corrupt activities.

International Developments

There were several international developments of note in Q3 2024, including new final guidance from Australian authorities related to that country's "adequate procedures" defense under Australia's anti-corruption laws, the indictment of former Glencore executives by the U.K.'s Serious Fraud Office (SFO), and enforcement cases against companies and individuals in France, Switzerland, and Brazil.

On July 8, 2024, the Paris Prosecutor's Office entered into a disposition with SOTEC, a Gabonese construction and services company, in relation to allegations that SOTEC and another Gabonese company facilitated corrupt payments to Gabonese government officials to help a French company secure a military clothing contract. The president of the Paris Tribunal validated SOTEC's Judicial Convention of Public Interest (CJIP), on July 10, 2024, with SOTEC agreeing to pay €520,000 in penalties. As discussed below, some media reports suggest that the authorities are planning further actions against other parties related to these issues, including a potential prosecution of French company Marck et Balsan.

In another case, on July 12, 2024, the French Criminal Tribunal of Marseille sentenced seven current or former executives of French offshore services company Bourbon, including current Bourbon CEO Gaël Bodénès, to suspended prison sentences, fines, and bars to holding future corporate executive positions, based on actions the executives took while employed by Bourbon more than 10 years ago. The company itself could have faced liability, but according to press reports and the best information available, it was liquidated in 2020, with various banks acquiring the company's assets (including the Bourbon brand) and carrying on operations following a restructuring. Three of the seven defendants received the most severe sentences, as the court deemed them to be the most serious offenders. Bodénès has stated that he will appeal and he remains CEO of Bourbon based on current information on Bourbon's website.

In Brazil, the Office of the Comptroller General (CGU) on August 29, 2024, issued a new ordinance creating a new alternative to leniency agreements, called "term of commitment" or "settlement agreement" (termo de compromisso in Portuguese). Unlike a prior settlement mechanism ("early judgment"), this new option does not require a conviction for a company under the Brazil Clean Company Act (BCCA). Instead, the settlement agreement is an "administrative negotiation instrument" through which the company acknowledges its responsibility for the acts under investigation, and thereafter, the corresponding fine is imposed, considering applicable mitigating factors, without resulting in a conviction. A company must also forfeit improperly obtained profits and may be required to implement or enhance a corporate compliance program.

Also in Brazil, the fallout from a September 6, 2023, ruling in which a judge of the Brazilian Federal Supreme Court (STF) held that any evidence originating from the leniency agreement signed by Odebrecht in December 2016 is tainted and thus inadmissible in other cases continues. Lawyers in Brazil for Peter Weinzierl, ex-CEO of Meinl Bank, who has been charged by U.S. authorities and is under an extradition request, challenged aspects of the case in front of the same STF judge, who ruled significantly in their favor. This ruling raises significant questions as to whether the U.S. extradition request for Weinzierl can be granted under current circumstances.

In a similar development in Panama, a court ruled that much of the evidence used to bring money laundering charges against law firm Mossack Fonseca partners and more than 20 others was not gathered "in line with due process" and ordered all charges to be dropped, after a lengthy trial. The evidence at issue was obtained through the Panama Papers leak in 2016 that contributed to numerous protests and enforcement actions around the world. The law firm Mossack Fonseca had said the leak was the result of a hack. The court also dismissed similar charges involving allegations relating to payments through Panama connected to Odebrecht and Operation Car Wash; Odebrecht had its own FCPA and anti-corruption resolutions in the U.S., Brazil, and Switzerland in 2016.

On August 28, 2024, the attorney general in Australia published the final version of the "Guidance on adequate procedures to prevent the commission of foreign bribery." As noted previously, the draft version of the guidance was issued in late April 2024 in response to the February 2024 passage of Australia's Combatting Foreign Bribery Act. The Act creates an "adequate procedures" defense for companies in relation to the Act's defined offense of "failure to prevent" foreign bribery, and the guidance is intended to clarify what prosecutors expect in a compliance program in order to qualify for that defense. The Attorney General opened a public consultation process for the draft that lasted through early June and that informed the final version.

The final version of the guidance establishes six key principles related to adequate procedures, quoted here:

- Fostering a control environment to prevent foreign bribery

- Responsibilities of top-level management

- Risk assessment

- Communication and training

- Reporting foreign bribery

- Monitoring and review

The final guidance also retains other important concepts such as the "principle of proportionality," under which "[t]he controls a corporation implements to prevent foreign bribery should be proportionate to the corporation's operational circumstances, including its foreign bribery risks and the nature of its activities." The "5 main indicators of an effective anti-bribery compliance program" are also unchanged from the earlier draft. As with similar guidance issued by the U.S. authorities, the Australian guidance contains case studies and examples, but these "are illustrative only and are not intended to constitute legal advice."

There were two significant developments in Switzerland during Q3 2024. First, on August 5, 2024, the Swiss Office of the Attorney General (OAG) announced that it had concluded its four-year investigation of Glencore by "impos[ing] a summary penalty order on the grounds of corporate responsibility for Glencore's failure to take all necessary and reasonable organizational measures with regard to the bribery of foreign public officials by a business partner in connection with the latter's acquisition of minority stakes in two mining companies in the Democratic Republic of Congo (DRC) in 2011." Under that order, Glencore paid "a fine of CHF 2 million and a compensation claim amounting to USD 150 million." The announcement noted that the OAG had issued an "abandonment order" related to other issues under investigation and stated that "[t]hese rulings conclude the OAG's criminal investigation against Glencore" related to the relevant issues.

Glencore pleaded guilty to an FCPA conspiracy violation in May 2022, and at the time the company had disclosed the existence of Swiss and Dutch investigations into its activities. The August 5 OAG announcement noted specifically that "the OAG and the [Dutch authorities] had been working closely together, coordinating their investigations." On the same day, the Dutch Public Prosecutor's Office (DPPO) issued its own announcement that stated, "[s]ince Glencore…is a Swiss company, the conclusion of the criminal investigation in Switzerland is preferred, according to both countries" and thus "[b]ecause of the summary penalty order in Switzerland, the DPPO decided to dismiss the case against Glencore…in the Netherlands." Glencore itself issued a press release on both investigations, which noted that the conclusion of both cases "resolves the last of the previously disclosed government investigations into historical misconduct."

On August 28, 2024, the Swiss Criminal Chamber of the Federal Criminal Court announced that it had found two former Swiss-based managers of Petrosaudi – Patrick Mahony and Tarek Obaid – "guilty of fraud," "aggravated money laundering," and other offenses related to actions undertaken in concert with Jho Low in the massive 1MDB scandal. The official announcement did not name the defendants, but a separate release issued on the same day by the current Board of 1MDB did name them. Per the 1MDB release, Obaid received a sentence of seven years in prison and Mahony was given a six-year sentence. The same release also stated that "[t]he court ordered that their assets, including real estate in Switzerland and the U.K., and amounts held in numerous bank accounts, totalling more than $240 million, be confiscated and restored to 1MDB." The release also noted that the two defendants "are set to face further civil and criminal prosecution in Malaysia over charges of embezzlement and dishonest assistance."

In the U.K., the SFO announced charges on August 1, 2024 against five former executives of Glencore, including the ex-head of oil trading Alex Beard, related to "the awarding of a range of oil contracts variously spanning Cameroon, Nigeria and the Ivory Coast from 2007 to 2014." Two of the five also face charges for "the falsification of invoices to Glencore's London office marked as service fees to a Nigerian oil consultancy from 2007 to 2011." The SFO followed up with a court filing on August 9 stating that they were preparing charges against at least two other individuals who were understood to be outside of the U.K. at the time. On September 10, six of the defendants appeared at court and were granted bail. On October 9, 2024, the London court issued a trial schedule for the case that would begin in June 2027 – yes, 2027 – and last several months.

As noted above in relation to the Swiss action, Glencore pleaded guilty to an FCPA conspiracy violation in May 2022; that plea agreement contained provisions to address the effects of a future action by the SFO. A U.K. subsidiary of Glencore pleaded guilty to seven counts of bribery in June 2022 and was sentenced in November 2022 to pay over £281 million in penalties. The SFO has been considering pursuing charges against individuals since that time and the 2027 trial date ensures that this saga will continue for the next few years.

A report in Global Investigations Review noted that Romy Andrianarisoa, the former Chief of Staff to the president of Madagascar who was convicted under the U.K. Bribery Act (UKBA) in February 2024 of one count of requesting/accepting a bribe from U.K.-based mining company Gemfields and sentenced to more than three years in prison, was released and deported in July 2024. The article notes that she had been in detained since August 2023 and that U.K. authorities confirmed that she had been deported as part on an official "early removal scheme" designed "to save the taxpayer money."

Finally with regard to U.K. developments, on July 29, 2024, the High Court of England and Wales ruled that Government of Mozambique is entitled to close to $2.3 billion in payments and indemnities from Lebanese shipbuilder Privinvest in connection with alleged bribes authorized or paid by Privinvest to Manuel Chang as part of the tuna bond scandal. Mozambique had sued other companies involved in the improper payments, including Credit Suisse, but most of the other parties settled, according to the judgment. Privinvest has requested permission to appeal the judgment.

Actions Against Corporations

Boston Consulting Group Receives Declination from DOJ, Pays Disgorgement

On August 27, 2024, the DOJ announced it was declining to prosecute BCG for FCPA violations in line with the CEP. The DOJ issued the declination despite finding that BCG, in coordination with an agent, had engaged in a bribery scheme in Angola. As a condition of the declination, BCG will disgorge $14,424,000.

The DOJ found that between 2011 and 2017, BCG's office in Lisbon, Portugal, paid approximately $4.3 million in commissions to an agent. According to the DOJ, "[c]ertain BCG employees in Portugal" knew the agent had government connections in Angola and retained the agent to help BCG secure contracts with Angolan government agencies. Under the alleged arrangement, BCG paid the agent "20 to 35 percent of the value of any government contracts procured" via "the agent's three different offshore entities." the DOJ asserted that the agent would then provide "a portion of the commissions in Angolan currency to Angolan government officials associated with [the Angolan Ministry of Economy] in connection with obtaining the BCG contracts." The agent ultimately helped BCG obtain 11 contracts with the Angolan Ministry of Economy and one with the National Bank of Angola. These contracts produced approximately $22,500,000 in revenue and $14,424,000 in profits for BCG (more than 60 percent in profits). The DOJ's declination letter also noted that when "internal questions arose," some BCG personnel in Portugal "backdat[ed] contracts and falsif[ied] the agent's purported work product" to hide the nature of the relationship.

The DOJ cited multiple factors in deciding to issue a declination:

- Timely and Voluntary Self-Disclosure: BCG disclosed the misconduct to the DOJ after identifying a 2014 email evidencing a possible FCPA violation. The declination, however, does not state when BCG personnel identified the 2014 email and when the company disclosed the investigation to the DOJ, so there is little context for the public to understand the basis for the DOJ asserting that the disclosure was timely.

- Full and Proactive Cooperation: The DOJ noted that BCG provided "all known relevant facts about the misconduct, including information about the individuals involved" and agreed to continue cooperating with any related investigations or prosecutions.

- Nature and Seriousness of the Offense: The DOJ did not elaborate on this factor, but based on the result of this enforcement action, it appears the agency did not believe the offense warranted a more serious form of resolution under the exceptions to the CEP.

- Timely and Appropriate Remediation: BCG terminated the personnel who were involved in the misconduct and engaged in a variety of compensation-related actions, which included "requiring implicated BCG partners in Portugal to give up their equity in [BCG], denying access to financial transition normally accorded to BCG employees leaving the firm, and withholding bonuses."

- "Significant" Compliance Program and Internal Control Improvements: The DOJ credited BCG with implementing "significant" compliance program and "internal control" improvements, including by "formalizing employee training and vendor/client screening protocols, establishing local and global risk committees that meet regularly, and developing guidelines for opening offices in new and emerging markets."

- Lack of Aggravating Circumstances: The DOJ also observed that there was an absence of otherwise aggravating circumstances, "such as involvement by executive management, significant profit from the misconduct, egregiousness or pervasiveness of the misconduct, or criminal recidivism." The specific comment about a lack of "significant profit from the misconduct" is noteworthy, given the apparent profit margin for the contracts, although the DOJ is presumably comparing this instance to other schemes in which corporate profits exceeded $100 million or the profit was a substantial portion of the company's overall bottom line.

- Disgorgement: As noted above, BCG agreed to disgorge its "ill-gotten gains," which amounted to $14,424,000.

Key Takeaways

- Use of Compensation-Related Penalties Against Responsible Personnel. As noted above, BCG was credited with taking several strong compensation-related actions against the individuals who were involved in the misconduct. BCG required implicated personnel to forfeit their equity in the firm, denied standard financial transition benefits, and withheld bonuses. Moreover, BCG itself disgorged all profits from the transaction, which – in a professional services firm – would include profits for all partners, including the partners involved in the wrongdoing. In recent years, DOJ has emphasized the importance of compensation incentives and clawbacks. These actions by BCG are in line with the spirit of those expectations and contributed to BCG's ability to resolve this matter as a declination with disgorgement, as opposed to some other form of resolution. The declination letter does not provide any details as to the processes that BCG had to follow under relevant Portuguese laws, or the costs and risks of undertaking these steps. Having partnership and employee agreements and supporting policies that have been conformed to local law requirements in place prior to any serious compliance issues arising can help manage any such risks effectively.

One of the ways in which DOJ has encouraged companies to take stronger compensation-related measures is through the Compensation Incentives and Clawbacks Pilot Program (Pilot Program). Under this Pilot Program, companies may receive reduced fines in return for clawing back compensation from responsible personnel. The Pilot Program did not apply in this case because the matter was resolved as a declination with disgorgement, which, in contrast to a fine, is not subject to a reduction under the Pilot Program. Previously, however, Albemarle Corporation and SAP SE both benefitted from the Pilot Program in reaching their resolutions with the DOJ, as discussed in the FCPA Autumn Review 2023 and the FCPA Spring Review 2024, respectively. - Compliance Program Initiatives. Among the program improvements noted by the declination letter were new "guidelines for opening offices in new and emerging markets" and the implementation of "local and global risk committees that meet regularly" across the organization. These initiatives appear to react to specific identified risks faced by BCG and to tie them to the company's existing organizational chart. As indicated by its regular updating of its guidance on compliance program evaluation, the DOJ has brought increasing sophistication to its internal expertise in corporate programs, which allows companies – as perhaps BCG did in this case – to convince the DOJ that program innovations tailored to the company's actual risks and existing business structures are effective improvements that can make a difference in enforcement outcomes.

- Ambiguity Around "Timely" Self-Disclosure. The DOJ's declination letter indicates that BCG made a "timely" self-disclosure of the misconduct, but it does not specify the exact timeline of events that led to the disclosure. The letter notes only that BCG disclosed the misconduct after discovering a 2014 email that provided evidence of a possible scheme. DOJ does not state when this email was discovered relative to when it was sent or how long after discovering it BCG disclosed it to the DOJ. Given that the scheme was found to continue until 2017, it is possible BCG did not discover the relevant email until years after it was sent. In contrast to the last FCPA declination letter that DOJ issued under the CEP – in which Lifecore Biomedical, Inc., made a self-disclosure within three months of discovering potential misconduct and within hours after the internal investigation confirmed it, as discussed in the FCPA Winter Review 2024 – the BCG declination was notably silent on the details of what was considered "timely" in this case.

Deere & Company Settles with SEC for FCPA Accounting Provisions Violations for Transactions in Thailand After M&A Transaction

On September 10, 2024, global manufacturing company Deere agreed to pay $9,930,355 in penalties, disgorgement, and interest to resolve charges that the company violated the books and records and internal accounting controls provisions of the FCPA as a result of improper payments made by its wholly-owned Thai subsidiary, Wirtgen Thailand, which allegedly aimed to gain business by influencing both foreign officials and employees of a private company in Thailand.

In the first half of 2017, Deere announced its acquisition of Wirtgen Group of Germany, with the deal closing in December 2017. While Deere is known for tractors, the Wirtgen Group is known for equipment used in road construction (and other industries). According to the SEC's Cease-and-Desist Order (Order), from late 2017 to 2020, Wirtgen's Managing Director for Thailand and Wirtgen's Managing Director for Southeast Asia, among others, took actions related to making or approving improper payments to foreign officials at government entities in Thailand to win government tenders. The recipients of the payments worked at the Royal Thai Air Force (RTAF), the Department of Highways (DOH), and the Department of Rural Roads (DRR). The Order also states that personnel at Wirtgen's Thai affiliate engaged in "commercial bribery" of a "private company [referred to as "Company A]" that handles construction, project management, and design of large-scale infrastructure projects in Thailand."

The Order states that Wirtgen Thailand personnel made many of the improper payments themselves, by providing cash or paying for entertainment (often at massage parlors) or "extravagant" factory visits to Germany, Switzerland, and elsewhere in Europe. Wirtgen Thailand personnel also allocated funds for improper payments indirectly through sham consulting fees provided to a third-party agent (Agent) in contravention of Wirtgen's and Deere's compliance policies. Moreover, the relevant documentation supporting the various expenses had several inaccuracies, triggering the books-and-records provision. According to the SEC, expense reports associated with some of these payments "contained round number denominations and lacked specificity" and in some cases were altered to make them appear more reasonable. For example, when submitting expenses for visits to massage parlors, involved personnel would list Wirtgen Thailand employees who were in fact not present to make the expenses look smaller per person. Other expense reports explicitly listed "high-ranking" foreign officials with direct responsibility for reviewing and awarding tenders to Wirtgen Thailand, showing that government officials did benefit contrary to Deere policies. As a result, the SEC alleges that Deere failed to "fully integrate Wirtgen Thailand into its existing internal control system," which "contributed to its failure to devise and maintain a sufficient system of internal accounting controls with respect to employee expense reimbursements, third party payments, and gifts, travel and entertainment."

Bribery of Thai Government Officials Through Improper Entertainment in Local Massage Parlors

According to the SEC, from late 2017-2020, Wirtgen Thailand "regularly entertained foreign officials from RTAF, DOH, and DRR at several massage parlors in Thailand" to improperly influence these officials while bidding on tenders. Specifically, the SEC details expense reports showing expenses incurred at massage parlors from November 2019 through March 2020 in which senior RTAF officials participated, including a "high level RTAF officer in charge of drafting and awarding tenders." The Order states that Wirtgen Thailand entertained RTAF officials "in exchange for obtaining information about the tender process and specific bidding requirements for tenders they were actively bidding on," and was subsequently awarded "two RTAF tenders in March and April 2020 for approximately $665,000."

The Order asserts that, in December 2019, Wirtgen Thailand also aimed to influence a DRR tender and provided "improper benefits at massage parlors" to "two of the four DRR signatories" of a March 2020 tender award. According to the Order, Wirtgen Thailand ultimately won the contract, worth approximately $1.3 million. Highlighting the intent underlying these benefits, the Order noted communications from Wirtgen Thailand's Manager Director who stated that "after a few months fighting to get this deal done, I did whatever channel and opportunities to turn back the tender result, we finally got the judgment to agree with DRR decision."

Similarly, between 2017 and 2020, the SEC alleges that Wirtgen Thailand incurred massage parlor expenses to "host representatives from DOH tender committees," including a March 2017 expense for a "[g]roup of 15 persons from the DOH Committee," a July 2018 expense report noting "entertainment" of DOH, and September and December 2018 expenses recorded as "'entertainment' in round numbers." Similar to the massage parlor visits provided to RTAF and DRR officials, the SEC states that Wirtgen Thailand provided this entertainment to DOH officials to improperly influence the tender process. In this respect, the Order points to specific communications from Wirtgen Thailand's Managing Director in August 2018 commenting "[f]inally, we have 1st succeed to step in this tender since 3 years tried to add qualification to the DOH tender." Wirtgen was subsequently awarded multiple tenders from the DOH, including in December 2018 for approximately $2.3 million, in October 2019 for $498,567, and in November 2019 for approximately $1.5 million.

According to the SEC, these expenses were "submitted for approval by Wirtgen Thailand's Managing Director and his sales team" and were "routinely approved by Wirtgen's Managing Director for Southeast Asia or its Managing Director in Thailand." Moreover, the Order states that these expenses were in violation of Wirtgen's Code of Business Conduct, which prohibited "giving 'absolutely anything' to improperly influence a government official" as well as Deere's policies and procedures "relating to entertainment of government officials," did not follow "proper approval processes," and were "all improperly booked as legitimate business expenses."

Bribery Through Factory Tours That Were Actually "Sightseeing Spree[s]"

The Order also alleges that Wirtgen Thailand paid for four DOH officials, "including a member of the DOH procurement committee, and two of their spouses" to attend a "factory visit" of its German facilities for "the [purported] purpose of learning more about the company's equipment." Although supporting documentation accompanying trip expenses described the trip's purpose as being "to visit factory," the trip's itinerary "indicated that no factory visit took place." Instead, according to the SEC, the eight-day trip, which totaled $47,500, "solely consisted of sightseeing in Switzerland" and included "travel to Interlaken, Zermatt, and Lake Lucerne, as well as shopping and touring in the Alps, with stays in luxury hotels at each stop." The Order calls the trip a "sightseeing spree" and states that Deere incurred these expenses "to win lucrative tenders" from DOH, noting that during the trip, Wirtgen Thailand "submitted a bid on a DOH tender." Then, shortly after the trip had ended, on October 16, 2019, Wirtgen Thailand won a DOH tender for approximately $498,567 and won a second tender for approximately $1.5 million on November 20, 2019.

According to the SEC, Wirtgen Thailand's Managing Director for Southeast Asia "knowingly approved and justified" the trip's expenses on the basis that the company needed to "gain information and build rapport" with public customers. The Order states that the trip violated Deere's policies "governing visits by non-U.S. government officials to its factories and facilities" which required detailed information regarding the "purpose of each visit, an agenda, names of government officials in attendance, whether any gifts or entertainment would be provided, and information about overall accommodations and cost."

The Order also highlights the use of extravagant travel as a form of commercial bribery, stating that Wirtgen Thailand spent "hundreds and thousands of dollars on 'factory visit' trips" in which Wirtgen "hosted representatives from Customer A" and on occasion "representatives from other companies and government agencies, ostensibly for the purpose of visiting its factory in Germany." However, in practice, the Order alleges that Wirtgen Thailand had a "practice of improperly rewarding foreign officials and employees of commercial customers that purchased spare parts at certain benchmarks with 'factory visits' that included substantial sightseeing elements." For example, according to the Order, Wirtgen Thailand treated two Customer A employees, one of whom had been a previous recipient of a cash bribe in 2018, to "an eight-day sightseeing trip in Germany and Switzerland." Then, this same individual and "three of his family members" allegedly received a second sightseeing trip in Germany and France. Wirtgen Thailand also treated a parts manager to on an eight-day trip through various European countries in October 2018. Supporting documentation for the October 2018 trip allegedly referenced Customer A's recent purchases, noting "we still have potential for next project will [be] coming soon."

The Order alleges that Wirtgen Thailand continued these practices in 2019, including by paying an employee of Customer A approximately $2,000 for "touring cost[s]" in connection to an "upcoming trip" and promising to facilitate future touring costs. Later in the year, Wirtgen Thailand also provided two Customer A representatives a nine-day European tour, again "ostensibly as part of a 'factory visit' trip." The Order states that as a result of these payments, Wirtgen "made profits of approximately $1.5 million on $5.3 million in gross sales of machines and spare parts from Customer A from 2018-2023."

Bribery of Thai Government Officials Through Cash Payments and Agent

The SEC also alleges that between 2018-2020 Wirtgen Thailand bribed DOH, DRR, and RTAF officials through direct cash payments by Wirtgen Thailand personnel as well as through the Agent. and these payments were made and approved by the Managing Director in Thailand and Wirtgen Thailand's Finance Manager. For example, regarding cash payments, the Order alleges that in April 2019, Wirtgen Thailand's Managing Director texted the Finance Manager to arrange the payments stating that he would have "candy money" ready in the amount of THB 100,000 and instructed the Finance Manager in the following way: "Liase with DOH…[p]repare 5 envelopes. And withdraw cash." The Order includes other examples. According to the SEC, Wirtgen Thailand's Managing Director and the Managing Director for Southeast Asia also approved cash payments to Customer A employees totaling approximately $35,000. Wirtgen Thailand recorded the payments in its books and records as "brokerage payments" and "sales commissions."

The Order states that Wirtgen Thailand also used an unidentified Agent to "assist in paying bribes" to DOH and DRR officials "in order to secure four lucrative tenders for machine sales worth approximately $4.67 million." According to the SEC, Wirtgen Thailand entered into three "sham commission agreement[s]" with the Agent for each tender, which "provided no legitimate services and [were] simply a conduit for paying bribes" amounting to $285,129 to Thai government officials. These agreements were signed by the Wirtgen Thailand's Managing Director and Finance Manager.

According to the SEC, Wirtgen Thailand's Managing Director and its Finance Manager referred to the Agent's bribe payments in communications with each other. For example, in connection with a 2020 DRR tender specifically, they referred to "cash bribes to the new director of DOH, the former director of DOH, and a set of golf clubs given to the deputy director of DRR." The Order also alleges that based on bank account information in Wirtgen Thailand's commission agreement with the Agent, the recipient of the payment was a "senior official of DOH, who along with his wife" had also attended the "factory trip" in October 2019 and that this official also received entertainment at a massage parlor in December 2018. The Order also says that Wirtgen Thailand made payments to the Agent for assistance in avoiding a tender process and obtaining sales of nearly $1 million to SKT – an entity that operated as a dealer in the sale of machinery to DOH.

Overall, as a result of these payments, the SEC states that Wirtgen Thailand "obtained illicit profits of approximately $2.7 million on sales of machinery to SKT, DOH, and DRR."

Resolution and Remediation

As a result of the conduct described above, the SEC imposed a total fine of $9,930,355 on Deere, which included $4,343,401 disgorgement, $1,086,954 in prejudgment interest, and a civil penalty of $4,500,000. However, the SEC also recognized Deere's cooperation and remediation, with the Order noting that Deere's cooperation included translation of relevant documents, making employees available to Commission staff, and "timely providing the details of facts developed during its internal investigation."

According to the Order, Deere also took the following remedial actions: "termination of employees responsible for the misconduct and initiating significant improvements to its internal audit and compliance program." With respect to the latter, the Order notes that the Deere "revised its Code of Business Conduct, including its anti-bribery and corruption and travel policies… introduced new compliance initiatives, including the circulation of a companywide bi-monthly compliance newsletter and a new podcast dedicated to a discussion of compliance issues…and increased training on anti-bribery issues." (emphasis added) Furthermore, the Order also acknowledges the Company's "analysis of its compliance program" and continued improvements such as "anti-corruption risk assessments, internal audits, and enhanced internal accounting related to third party management."

Key Takeaways

- Inadequate Integration Efforts Following Acquisition. Although merger and acquisition (M&A) issues are not the focal point of the Order, Deere's resolution highlights the importance of integrating an acquired entity within a reasonable time period following acquisition. The Order states that Deere acquired Wirtgen in December 2017 but identified improper expenses dating back to March 2017 and states that the misconduct "occurred during a period in which Deere failed to complete the full integration of this acquired subsidiary into its compliance program and controls environment." Charles E. Cain, Chief of the SEC Enforcement Division's FCPA Unit, also underscored post-acquisition integration in the SEC's press release for the resolution in which Cain stated: "[a]fter acquiring Wirtgen Thailand in 2017, Deere failed to timely integrate it into its existing compliance and controls environment, resulting in these bribery schemes going unchecked for several years." Further, Cain cautioned that the Deere resolution is a "reminder for corporations to promptly ensure newly acquired subsidiaries have all the necessary internal accounting control processes in place." Other recent resolutions that followed M&A acquisitions include Flutter Entertainment's March 2023 resolution with the SEC, Stericycle's April 2022 resolution with the DOJ and SEC, WPP's September 2021 resolution with the SEC, and the DOJ's declination with disgorgement for Lifecore Medical in 2023. Although Deere publicly stated in response to a media inquiry that it "conducted a thorough internal investigation and fully cooperated with the SEC" upon discovering the misconduct, the Order does not reference a voluntary disclosure to the SEC by Deere, and the company has not made other public statements regarding whether there is any expected resolution with the DOJ, either under the M&A Safe Harbor Policy or otherwise.

- Spotlight on Commercial Bribery. The SEC has not historically addressed commercial bribery in FCPA resolutions in great detail, so its broad coverage of commercial bribery in the Order is therefore noteworthy and illustrates the broader set of compliance risks facing public companies with respect to improper gift, travel, and entertainment practices. As noted in the Order, payments further to Wirtgen's alleged bribery scheme were improperly recorded as legitimate business expenses in violation of the books and records provisions of the FCPA. The Order also serves as a reminder of the broad scope of the books and records and internal accounting controls provision of the FCPA, which extends beyond international bribery of public officials. Other corporate resolutions involving commercial bribery include Microsoft Corporation's June 2019 resolution with the DOJ and SEC and Johnson Control's July 2016 resolution with the SEC.

The SEC has used the FCPA's provisions to take actions against public companies for domestic bribery, including in the noteworthy resolution with United Airlines. The SEC has also employed the books and records and internal accounting controls provisions of the FCPA to penalize companies for potential violations of U.S. sanctions laws (in addition to improper payments), as was the case in its September 2019 resolution with Quad/Graphics. The DOJ has similarly pursued individuals for commercial bribery violations under U.S. domestic bribery statues such as the Travel Act. For example, in December 2020, the DOJ a grand jury issued a 10-count superseding indictment against Jose Luis De Jongh Atencio, former manager of Citgo's Special Projects Group, which included one count of conspiracy to violate the Travel Act in connection with an international money laundering and bribery scheme involving Venezuela's state-owned oil company Petróleos de Venezuela, S.A. (PDVSA). The most recent DOJ corporate resolutions to include the Travel Act, however, are the Nexus Technologies Inc. guilty plea in 2010 and the Control Components Inc. guilty plea in 2009. - Evidence of Problematic "Tone from the Middle" – Involvement by Senior Country and Regional Management. The SEC highlights the role of country and regional management in initiating and approving many of the improper payments described throughout the Order. Specifically, the Order repeatedly notes the active participation of Wirtgen Thailand's Managing Director and Wirtgen's Director for Southeast Asia in initiating, reviewing, and approving the improper payments. The Order also states that expenses incurred to provide massage parlor services to Thai officials did not "follow proper approval processes for such interactions," suggesting that additional approvals were needed, perhaps by individuals in gatekeeper functions.The fact that country and regional leadership are attending massage parlors as corporate entertainment also reflects a deviation from broadly acceptable forms of entertainment.

Actions Against Individuals

Former Mozambique Finance Minister Found Guilty of Fraud and Money Laundering Relating to Tuna Bonds Bribery Scheme

On August 8, 2024, the DOJ announced the conviction of Manuel Chang, the former Finance Minister of Mozambique, following a four-week trial arising from charges that Chang had engaged in a $2 billion scheme involving fraud, bribery, and money laundering. According to a DOJ press release announcing the guilty verdict, Chang obtained $7 million in bribe payments in exchange for signing guarantees to secure $2 billion in funding for projects to be carried out by Mozambican state-owned companies, hundreds of millions of dollars of which Chang along with co-conspirators diverted for other purposes. Chang was convicted for two counts – conspiracy to commit wire fraud and conspiracy to commit money laundering – after a third charge of securities fraud previously brought against Chang was dropped in the government's third superseding indictment filed on June 4, 2024. For jurisdiction, the DOJ pointed to various payments for the loans and alleged kickbacks that were made via bank accounts in the U.S. (and New York in particular), and the fact that the bonds were marketed to investors in the U.S. According to the DOJ, Chang's misrepresentations regarding how the funds would be used, the amount and maturity dates of debt owed by Mozambique, and statements that the funds would not be used to pay bribes and kickbacks to government officials, ultimately defrauded banks and investors.

As shown at trial, between 2013 and 2015, Chang, as Minister of Finance, arranged for $2 billion in financing from Credit Suisse AG, through its subsidiary in the U.K., Credit Suisse Securities (Europe) Limited (CSSEL), and another foreign investment bank. The financing was secured with Chang's assistance ostensibly to fund a fleet of tuna fishing vessels and other maritime-related projects in Mozambique and the related fallout is known as the "Tuna Bonds" scandal. According to the DOJ, Chang – together with executives of Privinvest Group, a United Arab Emirates-based shipbuilding company – diverted $200 million of the loan to pay various bribes and kickbacks. Specifically, Privinvest used $150 million to pay bribes to both Chang and other Mozambican government officials in exchange for ensuring that state-owned Mozambican companies, including Proindicus S.A. (Proindicus), Empresa Moçambicana de Atum, S.A. (EMATUM), and Mozambique Asset Management (MAM) would receive the loans for these projects and that the loans would be guaranteed by the Mozambican government. Subsequently, the loans were sold to investors, including in the U.S., who suffered substantial losses when Proindicus, EMATUM, and MAM defaulted and failed to pay $700 million in loan payments.

Chang was arrested in South Africa in December 2018 and was extradited to the EDNY in July 2023 after a lengthy extradition battle. Based on the charges for which Chang was convicted, he faces up to 20 years in prison for each count.

Other parties that have faced penalties in connection with this scheme include Credit Suisse AG and CSSEL, which, as reported in our 2021 FCPA Autumn Review, agreed to pay approximately $475 million to the SEC, DOJ, a Swiss prosecutor, and the U.K.'s Financial Conduct Authority (FCA) in a globally coordinated resolution of various charges, including conspiracy to commit wire fraud by the DOJ and violations of the internal accounting controls and books and records provisions of the FCPA and other anti-fraud provisions of federal securities laws.

DOJ has indicted the following other individuals in connection with the Tuna Bonds scandal:

- Jean Boustani, an executive Privinvest Group

- Najib Allam, a Lebanese national and Chief Financial Officer of Privinvest

- Antonio De Rosario, an official with Mozambique's governmental state intelligence and security service, Servico de Informacoes e Seguranca do Estado (SISE)

- Teofilo Nhangumele, a Mozambican government official

- Andrew Pearse, a citizen of New Zealand and managing director of CSSEL

- Surjan Singh, a citizen of the U.K. who previously served as a managing director of CSSEL

- Detelina Subeva, a citizen of Bulgaria who previously served as vice president of CSSEL and who pleaded guilty to conspiracy to commit money laundering

As reported in our 2020 FCPA Winter Review, Boustani was acquitted by a jury in New York of wire fraud conspiracy, money laundering conspiracy, and securities fraud conspiracy charges brought in connection with the Tuna Bonds scandal in December 2019, with press reports indicating at the time that jurors found the venue in New York to be ill-fitting for international crimes. As noted in our 2023 FCPA Autumn Review, Pearse pleaded guilty to one count of wire fraud conspiracy and Singh and Subeva each pleaded guilty to one count of money laundering conspiracy. The remaining defendants appear to remain outside of U.S. custody, however, press reports indicate that De Rosario, Nhangumele, and nine others have been convicted and sentenced to prison in Mozambique for related issues.

In July 2024, Mozambique won a lawsuit it brought in connection with the Tuna Bonds scandal against, among others, Privinvest, Chang, Credit Suisse, three former Credit Suisse's employees, and Privinvest's owner Iskandar Safa in the U.K., where a court ruled "substantially in favor" of Mozambique. The ruling entitled Mozambique to payments of over $825 million from Safa and companies in the Privinvest group. Additionally, Mozambique is entitled to an indemnity from Safa and the Privinvest group companies in relation to $1.5 billion they are liable to pay lenders and bondholders.

Glenn Oztemel Convicted in Relation to Petrobras Scheme

On September 26, 2024, a Connecticut jury found Glenn Oztemel, a former Freepoint executive, guilty on seven counts for his role in a Petrobras-related bribery and money laundering scheme. After a trial that took most of September, the jury convicted Oztemel of conspiracy to violate the FCPA, conspiracy to commit money laundering, three counts of violating the FCPA, and two counts of money laundering. Oztemel faces a maximum penalty of five years on each FCPA and FCPA conspiracy count and 20 years apiece on the money laundering/conspiracy counts. The DOJ now has two successful jury convictions of trading company executives in 2024, after a jury convicted Javier Aguilar (a former Vitol trader) earlier this year.

Oztemel was found guilty of having facilitated more than $1 million in bribes to Brazilian officials over nearly eight years. We have covered the scheme and different enforcement actions in depth, including in Spring 2023 (the original indictment against Glenn Oztemel and Eduardo Innecco), Autumn 2023 (the superseding indictments that included Glenn's brother Gary Oztemel), Winter 2024 (Freepoint's DPA with the DOJ), and Summer 2024 (Gary Oztemel's guilty plea). The scheme involved using commissions or customer relationships to generate slush funds and pay bribes to obtain contracts for Freepoint and Arcadia Fuels (Oztemel's employer prior to Freepoint), as well as laundering proceeds through many shell companies globally.

The trial included an interesting mix of witnesses and a unique jury request. According to press reports, the prosecution's witnesses at trial included an Arcadia Fuels executive (to testify about what they learned after Glenn Oztemel left the company) and Rodrigo Berkowitz (a former Petrobras official who testified that he received bribes from Oztemel and Innecco and who already pleaded guilty to money laundering charges for receiving bribes from different companies). The defense called former Freepoint executive Robert Peck to testify on Oztemel's behalf. Peck has not been named in DOJ press releases, but earlier press reports initially named him as someone who may have been involved in the plot during the early stages of the investigation. Interestingly, MLex also reports that a "compliance chief" testified about approving the payments to Eduardo Innecco's intermediary companies. There is no mention of compliance approvals in Freepoint's DPA, but any such approval would almost certainly have been based on incomplete information, because there are also press reports that testimony centered on Glenn Oztemel's use of burner phones for conducting business as well as using personal email accounts and code names for sensitive communications. According to Law360, the jury requested a complete read-back of the closing arguments, but the judge denied this request.

Glenn Oztemel's sentencing date has not yet been announced. Oztemel's brother Gary, who pleaded guilty to money laundering in June, still awaits sentencing, as does Berkowitz. Co-defendant Eduardo Innecco, who allegedly facilitated the scheme by controlling shell companies that held the laundered funds, remains in France following his arrest in May 2023 as the DOJ continues to pursue extradition efforts.

Former Vitol Trader Javier Aguilar Pleads Guilty to Second Set of Charges for Violating FCPA